没有合适的资源?快使用搜索试试~ 我知道了~

美国农业部-美股-农业行业-美国牲畜、乳制品和家禽展望:大多数红肉和家禽的出口预测将更高-0617-27页.pdf

需积分: 0 0 下载量 142 浏览量

2023-07-26

14:25:00

上传

评论

收藏 1.4MB PDF 举报

温馨提示

美国农业部-美股-农业行业-美国牲畜、乳制品和家禽展望:大多数红肉和家禽的出口预测将更高-0617-27页.pdf

资源推荐

资源详情

资源评论

Approved by USDA’s World Agricultural Outlook Board

Livestock, Dairy, and Poultry Outlook

2020 Exports for Most Red Meats and Poultry Forecast Higher

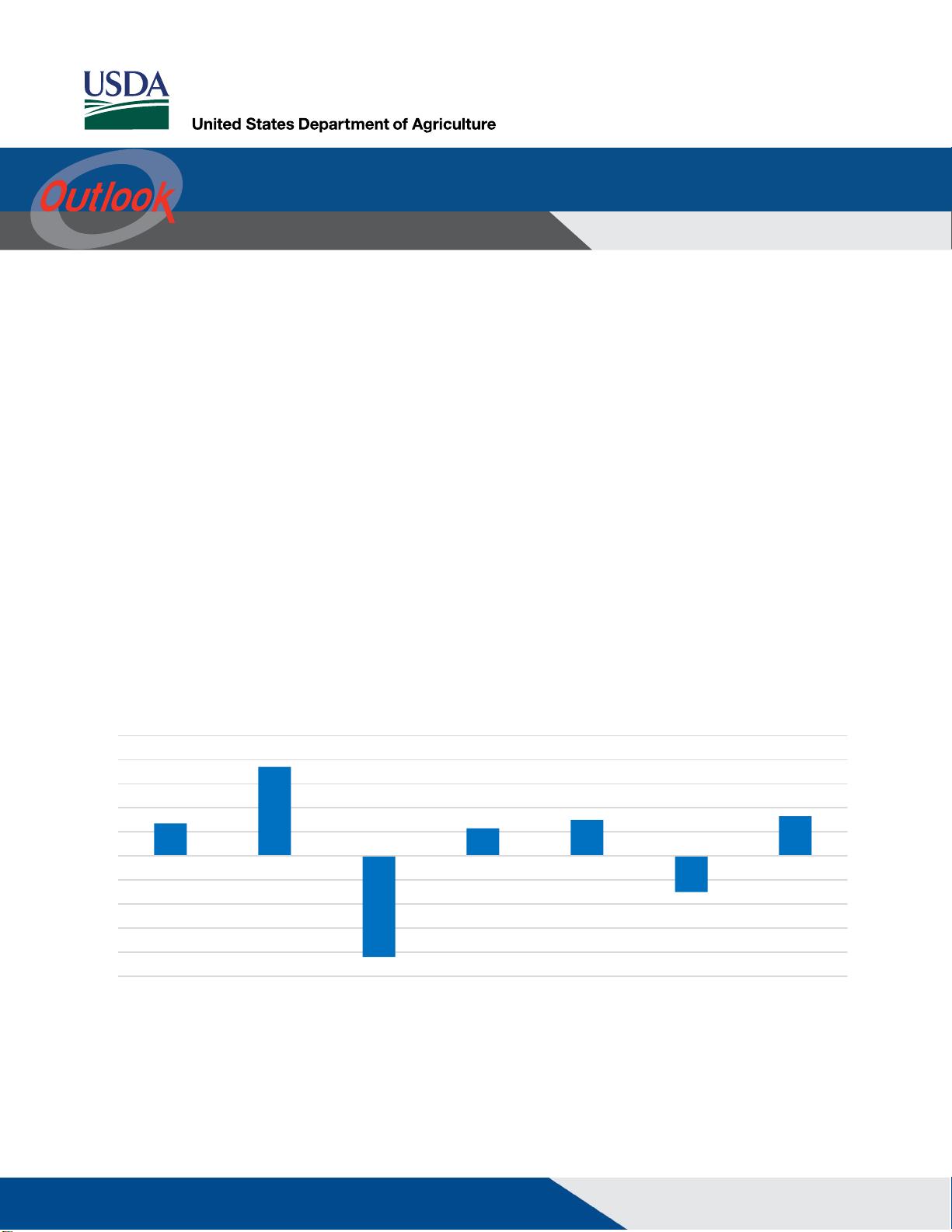

U.S. exports of red meat and poultry are expected to increase by more than 4 percent in 2020. Beef

exports are forecast to increase 2.7 percent, largely due to lower anticipated competition in Asian

markets, as beef supplies in Oceania will reflect weather-related herd reduction this year. Pork exports

are expected to increase more than 7 percent next year as Mexican demand for U.S. pork is re-

established following the removal of tariffs in mid-May, 2019. Broiler export growth is forecast at 2.3

percent based on expectations of increased demand in low- and middle-income countries, particularly

as the global meat and poultry market is pressured by shifting Chinese demand. Growth of 3 percent is

anticipated for turkey exports next year, supported by strength in shipments to Mexico—the largest

buyer of U.S. turkey meat—with continued low turkey prices expected to draw additional international

buying interest. Lamb and mutton exports are likely to fall as U.S. production trends lower. Export

volumes for eggs and egg products are forecast to decrease by 3 percent, based on expectations of

continued softness in foreign demand. Dairy exports are expected to grow 3.3 percent next year as

global demand for dairy products grows.

2.7

7.4

-8.4

2.3

3.0

-3

3.3

-10

-8

-6

-4

-2

0

2

4

6

8

10

Beef

Pork

Lamb & Mutton

Broilers

Eggs

%

Percent change in exports (2020/2019)

Dairy*

Source: USDA, Economic Research Service.

*Dairy exports are reflected on a skim-solids milk-equivalent basis.

Turkey

Economic Research Service | Situation and Outlook Report

Next release is July 17, 2019

LDP-M-300 | June 17, 2019

2

Livestock, Dairy, and Poultry Outlook, LDP-M-300, June 17, 2019

USDA, Economic Research Service

Beef/Cattle: The cost of feeding cattle is expected to rise this year, likely slowing the pace of

placements in feedlots and reducing anticipated marketings. This prompted forecasts for beef

production in 2019 and 2020 to be reduced slightly on lower expected fed cattle slaughter. Cattle price

forecasts were lowered to reflect current price weakness. Beef imports continue to exceed year-earlier

levels, but exports lag behind in early 2019.

Dairy: Due to recent declines in milk cow numbers, relatively high slaughter levels, and higher

expected feed prices, milk production forecasts have been lowered for 2019 and 2020. Dairy exports

were relatively weak in April, and export forecasts have been lowered for both 2019 and 2020. The all-

milk price forecast for 2019 is $18.00 per cwt, 5 cents lower than last month’s forecast. The all-milk

price forecast for 2020 is $18.90 per cwt, 10 cents higher than last month’s forecast.

Pork/Hogs: Estimated gross processing margins have been consistently year-over-year lower since

early April. While second-quarter prices of both hogs and wholesale pork cuts have been year-over-

year higher, hog prices have increased relatively faster, and processor margins have been squeezed

as a result. The rescission of Mexican tariffs on U.S. pork largely prompted upward revisions in U.S.

pork export forecasts for both 2019 and 2020.

Poultry/Eggs: Second-quarter broiler forecast was revised up based on higher average weights, while

the 2020 production forecast was lowered on expectations for higher feed costs. The 2019 and 2020

broiler price forecasts were lowered based on weak domestic demand and higher-than-anticipated cold

storage inventories. The 2019 second-quarter export forecast was revised down on slower-than-

expected global demand. The 2020 egg production forecast was decreased based on expectations for

tightening producer margins. The egg price forecast was decreased for both 2019 and 2020 on the

anticipation that supply will continue to outpace demand. The 2019 second-quarter egg and egg

product export forecast was revised up based on increasing shipments of shell eggs. Turkey production

is revised downward by 5 million pounds in 2019 and 40 million pounds in 2020 due to anticipated

increased feed costs. If the forecast is realized, production growth would be virtually flat between 2018

and 2020.

3

Livestock, Dairy, and Poultry Outlook, LDP-M-300, June 17, 2019

USDA, Economic Research Service

Beef/Cattle

Russell Knight and Lekhnath Chalise

2019 and 2020 Beef Production Marginally Lower from Last Month

The 2019 beef production forecast was reduced marginally from last month to 27.2 billion pounds, as

expected fourth-quarter production more than offsets a slight increase in expected second-quarter

production. Production in second-quarter 2019 was raised based on greater expected fed cattle

slaughter (i.e., steers and heifers) that was partially offset by lower expected carcass weights. Fourth-

quarter 2019 production was lowered on anticipated reduced fed cattle slaughter due to fewer expected

placements in second-quarter 2019. The forecast for 2020 beef production was lowered marginally

from last month’s forecast to 27.4 billion pounds, also based on anticipation of fewer fed cattle

slaughtered.

Feed Prices To Slow Feedlot Placements in Second-Half 2019

According to the May Cattle on Feed report,

1

the May 1 cattle-on-feed number increased more than 2

percent from the previous year to 11.8 million head, the largest number of cattle on feed for the month

of May since reporting began in 1996. Nearly 7 percent more fed cattle were marketed in April than at

the same time last year. When adjusted for the additional weekday of slaughter available compared to

April 2018, marketings were only about 2 percent higher in April 2019.

Also based on the report, the number of net placements (total placements minus disappearance) of

cattle in feedlots was 1.8 million head, which was about 9 percent above the previous year’s level. The

report showed that placements of feeder cattle 800 pounds or heavier in April 2019 as a percentage of

total net placements was close to year-earlier levels, which is expected at a time when cattle held on

winter pasture in the first quarter would likely be coming off pasture and placed in feedlots. Based on

the weekly USDA Agricultural Marketing Service National Feeder & Stocker Cattle Summary reports for

the month of May, there were about 25 percent fewer sales receipts compared to the same time last

year.

Anticipated placements of steers and heifers in feedlots in late 2019 were reduced. Softening fed cattle

prices in 2019 and the prospect of higher feed input costs could delay steers and heifers from entering

feedlots. This could incentivize keeping lightweight cattle on pasture longer to add weight, which may

lead to a more gradual pace of heavier cattle placed on feed so that feedlots will spend less time

feeding them to the appropriate finishing weights. The slower pace of placement will likely be reflected

in fewer fed cattle to be marketed for slaughter in early 2020.

Cattle Prices Decline on Higher Input Prices

Since the spring peak, weekly average fed steer prices in the 5-area marketing region have fallen to

$113.76 per hundredweight (cwt) for the week ending June 09, 2019, about an 11-percent decrease.

Based on recent price data and expectations of higher steer and heifer marketings, the price forecast

for second-quarter 2019 was lowered $3 to $118 per cwt. Historically, prices drop about 15 percent

1

Of feedlots with capacity of 1,000 or more head.

4

Livestock, Dairy, and Poultry Outlook, LDP-M-300, June 17, 2019

USDA, Economic Research Service

from the seasonal peak, which would suggest that prices will continue to decline into the fall. With

expectations of seasonally declining beef prices, the third-quarter 2019 price forecast was lowered $3

to $110 per cwt. As a result, the 2019 annual price is forecast at $117 per cwt, $1.50 lower than last

month and just below 2018 price levels. The forecast for the 2020 annual price was lowered by $2 to

$119 per cwt.

Lower fed cattle prices have turned feedlot margins negative, and higher forecast feed-input prices

could make feedlots less willing to bid up prices for feeder cattle for the rest of 2019. Based on recent

price data, the second-quarter 2019 feeder steer price was lowered by $3 to $142 per cwt. Faced with

continued poor operating margins, the 2019 third- and fourth-quarter price forecasts were each lowered

$5 from the prior month to $145 and $142 per cwt, respectively. As a result, this month’s annual price

forecast for 2019 was $4 lower at $142 per cwt. The 2020 annual price forecast was reduced $5 from

last month’s forecast to $145 per cwt as higher forecast feed costs and a lower forecast for fed cattle

prices weigh on feedlot margins.

Domestic Demand Lifts Import Forecast

U.S. beef imports in April 2019 were up 16 percent from year-earlier levels at 273 million pounds.

Among major suppliers, higher imports were from Mexico, Australia, New Zealand, Uruguay, and

Nicaragua, while imports from Canada and Brazil were lower. The price for imported beef (90-percent

lean) in the United States was also higher year-over-year in April 2019, suggesting stronger demand for

lean meat for processing. The strong import growth in April resulted in the year-to-date total of 1 billion

pounds, 6 percent above the same period last year. The forecast for second-quarter beef imports was

revised upward by 25 million pounds to 830 million pounds, raising the 2019 annual import forecast to

3.038 billion pounds. The 2020 import forecast is unchanged from the previous month’s forecast at

2.960 billion pounds.

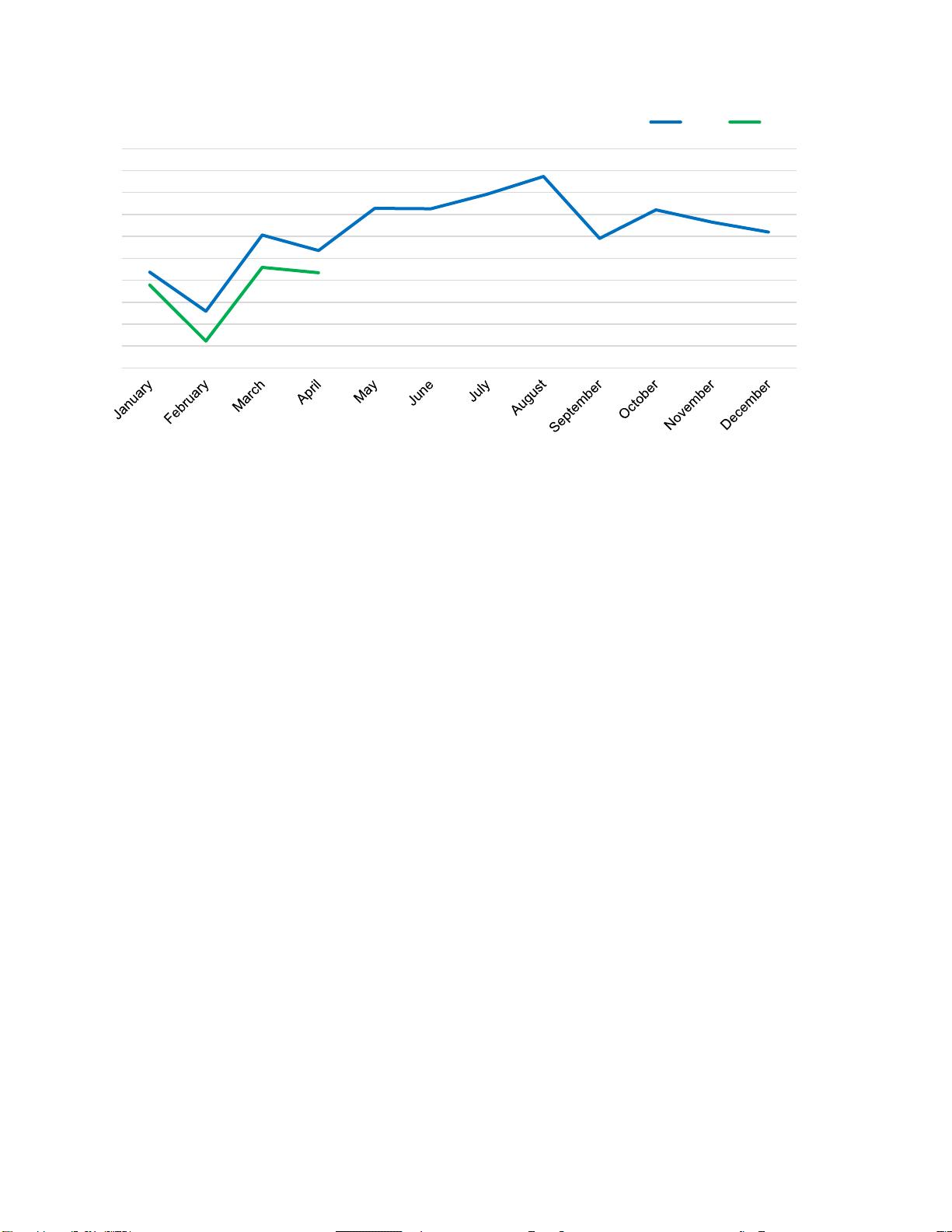

Beef Exports Continue To Lag Year-Ago Levels

U.S. beef exports for the month of April were down 4 percent from year-earlier levels, which kept year-

to-date exports almost 5 percent below the same period last year (see chart below). There were year-

over-year declines in shipments to most of the major destinations, with the exception of South Korea

and Taiwan. For the period January through April, most of the declines in U.S. beef exports reflected

lower exports to Hong Kong, Canada, and Japan. Exports to Hong Kong have continued to decline year

over year, with January to April shipments 44 percent lower compared to the same period last year.

Exports to Canada are likely being offset by domestic production; through late-April, weekly federally

inspected fed beef production in Canada was 12 percent above 2018. U.S. exports to Japan for

January-April were 4 percent below 2018. The decline likely reflects increased competition with other

suppliers such as Australia, Canada, and New Zealand, who have been granted tariff concessions

under the implementation of the 11-member Pacific trade deal known as the Comprehensive and

Progressive Trans-Pacific Partnership. In addition, larger beef production in Australia and Canada has

increased their supplies of exportable beef, increasing competition with U.S. product. Nonetheless,

through April, the U.S. share of Japan’s imports was 39 percent, about the same as January-April 2018.

5

Livestock, Dairy, and Poultry Outlook, LDP-M-300, June 17, 2019

USDA, Economic Research Service

FAS weekly sales reports suggest year-over-year higher export sales in May. However, this is not

expected to offset the decline in April. On this basis, the second-quarter 2019 export forecast was

revised downward by 10 million pounds to 800 million pounds for a 2019 annual forecast of 3.161 billion

pounds. The 2020 export forecast was left unchanged from the previous month at 3.245 billion pounds.

The 2019 Cattle Imports Revised Upward

In April 2019, U.S. cattle imports increased by 29 percent from year-earlier levels to 222,429 head, with

gains in imports of feeder cattle contributing two-thirds of the increase. Imports for the period were

higher from both Mexico and Canada. Cattle imports for January-April were up 23 percent from the

same period last year to 789,514 head, above the 5-year average levels (see chart below). The

Mexican cattle herd is an expanding phase, producing more feeder cattle and thus increasing available

shipments to the United States. Most of these calves will be for backgrounding. Slaughter-ready cattle

imports from Canada were more than 32 percent higher from year-earlier levels in the first 4 months of

2019.

200

210

220

230

240

250

260

270

280

290

300

2018 2019

million pounds

Source: USDA, Economic Research Service.

U.S. beef exports trend lower in early-2019

剩余26页未读,继续阅读

资源评论

icwx_7550592

- 粉丝: 20

- 资源: 7163

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 基于Delmia白车身侧围焊接的仿真分析与研究.pdf

- 基于Delmia白车身侧围焊接的研究.pdf

- 基于DSC的数字化逆变焊接电源的研制 - .pdf

- 基于FLUENT的CMT焊接熔池流场的数值分析 - .pdf

- 基于FPGA的焊接电源给定电流波形的研究 - .pdf

- 基于FPGA的焊接电源控制系统设计.pdf

- 基于GA算法的协调机器人双光束激光焊接轨迹规划研究.pdf

- 基于GMAW焊接快速制造的控形研究新进展 - .pdf

- 基于HMI和运动控制器的数控焊接系统设计.pdf

- 基于ISO15614-2标准的焊接工艺评定数据库系统 - .pdf

- 基于JB4708-2005的承压设备焊接工艺评定系统 - .pdf

- 基于MPC07运动控制卡的数控焊接机控制系统的开发.pdf

- 基于Labview平台的焊接电弧图像研究.pdf

- 基于MATLAB的仿人焊接机械手运动学分析和仿真 - .pdf

- 基于LabVIEW的搅拌摩擦焊焊接力监测系统设计.pdf

- 基于MFC和OpenGL的相贯线焊接仿真系统设计.pdf

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功