没有合适的资源?快使用搜索试试~ 我知道了~

巴克莱-美股-农业行业-美国农业:3月Ben的牛肉配额-318-23页.pdf

试读

23页

需积分: 0 0 下载量 78 浏览量

更新于2023-07-26

收藏 1.04MB PDF 举报

巴克莱-美股-农业行业-美国农业:3月Ben的牛肉配额-318-23页.pdf

Equity Research

18 March 2019

CORE

Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with

companies covered in its research reports. As a result, investors should be aware that the

firm may have a conflict of interest that could affect the objectivity of this report. Investors

should consider this report as only a single factor in making their investment decision.

This research report has been prepared in whole or in part by equity research analysts

based outside the US who are not registered/qualified as research analysts with FINRA.

PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 18.

Restricted

- Internal

Americas Agribusiness

BBQ – Ben’s Beef Quotes: March 2019

Due to the US government shutdown and delayed data availability we decided to skip

our February edition of BBQ. Now as data feeds have been updated, we are

presenting our March edition of “BBQ – Ben’s Beef Quotes”. As in the past we

highlight important news, major trends in agri-product pricing, demand and trade

data. We include eggs, poultry, pork, some lamb and veal – it’s not all beef!

News

U.S. lawmakers debate over ‘meat’ substitutes in fear of the threat it poses to the

US$110bn U.S. meat market. Among many bills which have been presented regarding

plant-based products, some without success, the latest bill proposes making it illegal to

label meat alternatives/substitutes as ‘meat’.

Following 25 recalls of millions of pounds of meat and processed foods, the USDA

sets new guidelines for food companies. An increase in recalls of meat and poultry

products drove the U.S. government to increase its regulatory requirements for the

internal investigation processes as well as the way the companies receive and deal with

client complaints around the topic.

Prices & Feed

Our outlook continues to be cautious considering ongoing uncertainty in some

markets. Overall, while some metrics have shown improvements or maintain

healthy growth, others remain under pressure given volatility and uncertainty.

Chicken production still at positive growth rates, while turkey and red meat

production had a weaker performance. Flattish slaughter rates and lower numbers

of turkey eggs in incubators drove red meat and turkey productions contractions.

Trade & USDA

U.S. – E.U. trade negotiations focus on agricultural issues. Key topics include UK

markets’ bans of products including GMOs, hormone-boosted beef, and chlorine-

cleaned chickens, among others. We expect to see an extensive agenda ahead.

USDA takes action on food safety concern. Chicken and beef standards must

improve in order to help the domestic market as well as to expand to other markets.

Meat availability expected to further expand. USDA estimates for 2019 poultry and

red meat per capita availability at 220.5mn lbs. (vs. 218.8mn lbs. in 2018).

Our Stocks

Staying OW on TSN (Top Pick), PPC, JBS & BRFS; EW on HRL & SAFM and UW on MRFG.

INDUSTRY UPDATE

Americas Agribusiness

NEUTRAL

Unchanged

Americas Agribusiness

Benjamin M. Theurer

+52 55 5241 3322

benjamin.theurer@barclays.com

BBMX, Mexico

Antonio Hernandez

+ 52 55 5241 3323

antonio.hernandez@barclays.com

BBMX, Mexico

Barclays | Americas Agribusiness

18 March 2019 2

CONTENTS

AMERICAS AGRIBUSINESS .............................................................................. 3

News................................................................................................................................................................... 3

Commodity trends ......................................................................................................................................... 4

Price performance .......................................................................................................................................... 5

EGGS AND POULTRY ........................................................................................ 6

Production & Capacity .................................................................................................................................. 6

Pricing ................................................................................................................................................................ 7

Feed-Price Ratios ......................................................................................................................................... 10

Trade ............................................................................................................................................................... 11

RED MEAT ......................................................................................................... 12

Production & Capacity ............................................................................................................................... 12

Pricing ............................................................................................................................................................. 14

Feed-Price Ratios ......................................................................................................................................... 16

Trade ............................................................................................................................................................... 17

All prices are in U.S. dollars unless otherwise noted.

PROTEIN CATEGORY HIGHLIGHTS

Poultry

Chicken production generally maintained positive growth rates, while data for turkey

was mixed. Egg production in January grew +4.7% y/y while egg-type chicks hatchings

expanded 3.8% y/y. Weekly eggs-set at the start of March were up 2.5% y/y and chick

placements grew 1.4% y/y (Figures 6-9). As for turkey, eggs in incubators for the month of

March contracted 2.3% y/y and despite a lower number of placements during February,

hatchings managed to post a positive 1.0% y/y growth. In terms of pricing, performance

remained mixed for poultry products, yet mostly flattish on a y/y basis (Figures 14-17). The

feed-price ratios for December (broilers, turkey and eggs) performed mixed compared to

previous months yet were all fairly stable. In terms of trade during December, pressure on

growth of exports remains evident as both value and volumes dropped on a y/y basis.

Red Meat

Commercial production of red meat decreased in December, as slaughter rates for both

beef and pork were flat. Beef production fell 1.5% y/y in December, while pork production

dropped 0.1% y/y on the back of flatting slaughter growth. During February, inventory

levels for cattle on feed grew only 0.4% y/y, while figures reported for January cattle

placements were down 5.3% y/y (Figures 36-38). Wholesale prices for beef were flattish

during February while for pork price dropped significantly, -19.1% y/y (Figures 40-45) and

retail prices were overall flattish for pork and mixed for beef. Feed ratios came down for

both steers and heifers as well as for hogs on a q/q and y/y basis. As for trade, growth

remained pressured in December for exports with a minor increase in imports.

Barclays | Americas Agribusiness

18 March 2019 3

AMERICAS AGRIBUSINESS

News

U.S. lawmakers debate over meat substitutes in fear of the threat it poses to the

US$110bn U.S. meat market. Among many bills which have been presented around the

topic, some without success, the latest bill proposes making it illegal to label meat

alternatives/substitutes as ‘meat’. This movement has about half-a-million meat-industry

workers and more than 20 meat-producing states fearful of the impact this could cause,

especially considering the ~19% sales drop in cow milk in the past few years since non-dairy

milks such as almond, soy and coconut milks became a popular alternative beverage,

attributed to these being labeled as milk. As investigation progresses regarding plant-based

and lab-grown meat alternatives as a response to the dire issues surrounding global

warming, health issues, animal cruelty, among others, the battle between meat lovers and

animal lovers (or simply more conscientious individuals) grows. As a key driver of climate

change, taking up about 15% of greenhouse gas emissions, animal farming has many

people, including scientists, vegans and environmentalists working towards greener

alternatives. Though lab-grown meat is not yet being sold, it is well into its research and

development stage to shortly follow the plant-based foods already available in the market

and forecast to double to US$2.5bn by 2023 according to Euromonitor International. While

the jury is still out on whether the labeling meat-substitute products as meat should be

prohibited or not, we believe it is likely that the clean ‘meat’ market will continue to grow as

does the threat from our, presumably unsustainable, traditional animal meat option.

(Source: Reuters, “U.S. lawmakers tuck into juicy debate over meat substitutes” March 14,

2019)

Following 25 recalls of millions of pounds of meat and processed foods, the USDA sets

new guidelines for food companies. An increase in recalls of meat and poultry products

drove the U.S. government to increase its regulatory requirements for the internal

investigation processes as well as the way the companies receive and deal with client

complaints. Companies including Tyson Foods Inc., Smithfield Foods Inc., Perdue Foods,

and Pilgrim’s Pride Corp., among others, have had to face recalls due to contaminated

products possibly containing metal, plastic, wood or other foreign materials, which many

people blame on the increase in automation in the food processing production lines. As

food companies continue to work towards improving processes and quality, the new

guideline from the U.S. government states companies must alert the USDA within 24 hours

of receiving a customer complaint if it’s possible that contaminated products are in the

marketplace.

(Source: Reuters, “Exclusive: U.S. to issue meat company guidelines as recalls mount -

official” March 4, 2019)

Half-a-million meat-industry

workers and more than 20

meat-producing states

threatened by meat alternative

products being labeled ‘meat’.

Concern on food-safety

following many recalls of meat

and poultry products has the

USDA advising new guidelines

to food processing companies.

Barclays | Americas Agribusiness

18 March 2019 4

Commodity trends

During February, daily corn and soybean prices grew on average 2.2% and -9.8%,

respectively. Performance at the last day of the month had lower performance than last

year, down 3.3% for corn and down 14.1% y/y for soybean, while for the month (start to

finish) the contraction was -3.9% and -1.9%, respectively. By mid-March corn was at

~US$362 while soybean was at ~US$890 cents per bushel (Figures 1 - 4) and price

performance was also down YTD at -3.8% and -0.6%, respectively.

FIGURE 1

CBOT corn prices ended February down 3.3% y/y

FIGURE 2

Actual corn prices through February 2018 and Forward

Curve

Source: Refinitiv, Barclays Research.

Source: Refinitiv, Barclays Research

FIGURE 3

Soybean prices ended February down 14.1% y/y

FIGURE 4

Actual soybean prices through February 2018 and forward

curve

Source: Refinitiv, Barclays Research.

Source: Refinitiv, Barclays Research

-10.0%

-5.0%

0.0%

5.0%

10.0%

330

340

350

360

370

380

390

US$c/bsh

% YoY Growth, right

For the month: -3.9%

220

260

300

340

380

420

460

Actual

Future

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

840

860

880

900

920

940

US$c/bsh

% YoY Growth, right

For the month: -1.9%

600

800

1,000

1,200

1,400

Actual

Future

Barclays | Americas Agribusiness

18 March 2019 5

Price performance

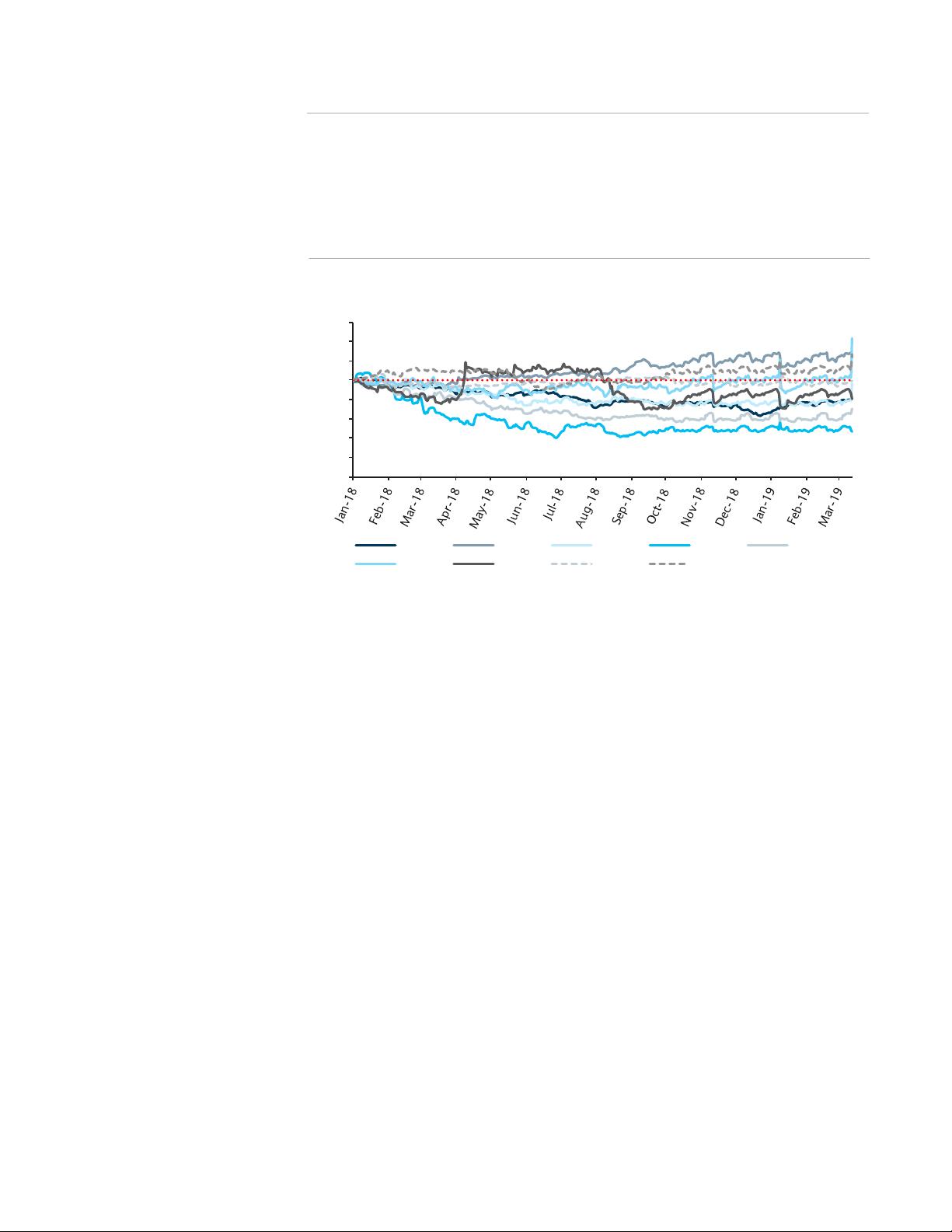

During February, our covered meat companies remained generally below the S&P 500

and the IBOV, with some outliers as shown in Figure 5. By mid-March, performance for our

covered companies on a YTD basis was generally positive highlighting the following: TSN

(+22%), SAFM (+25%), PPC (+10%), and JBS (+41%) while in the case of BRF (-11%), MRFG

(-9%) and HRL (-2%) growth was negative compared to the S&P 500 (+2%) and IBOV

(+12%).

FIGURE 5

Americas Agribusiness price performance vs. S&P 500

Source: Refinitiv, Barclays Research

0

20

40

60

80

100

120

140

160

TSN

HRL

SAFM

BRFS

PPC

JBS

MRFG

S&P 500

IBOV

剩余22页未读,继续阅读

资源推荐

资源评论

103 浏览量

2021-09-01 上传

2021-09-01 上传

2021-09-01 上传

2021-09-01 上传

2021-09-01 上传

115 浏览量

2021-09-01 上传

156 浏览量

2021-09-01 上传

2021-09-01 上传

133 浏览量

2021-09-01 上传

125 浏览量

162 浏览量

资源评论

icwx_7550592

- 粉丝: 20

- 资源: 7163

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 2018百度西交大大数据竞赛-商家招牌的分类与检测-初赛.zip

- 混凝土细观孔隙率模型,模型包含骨料,砂浆,过渡区以及孔隙,联系后会给一个cae文件,本构是cdp,算例是模拟单轴受压,用的是abaqus软件

- 基于小程序的个人健康管理系统小程序源码(小程序毕业设计完整源码+LW).zip

- 毕设-java-swing-购物系统项目(文档+视频+源码)

- 基于深度学习的卷积神经网络的农作物病虫害识别检测系统python源码+数据集

- 2019 数据智能算法大赛 baseline.zip

- 基于小程序的贵工程寝室快修小程序源码(小程序毕业设计完整源码+LW).zip

- comsol仿真电缆局部放电产生的超声波在电缆中传播特征

- 2019中国高校计算机大赛-大数据挑战赛 第15名 WriteUp.zip

- 基于小程序的机电公司管理信息系统源码(小程序毕业设计完整源码+LW).zip

- 2019厦门国际银行“数创金融杯”数据建模大赛 复赛第六.zip

- MATLAB代码实现凝固相场模拟-凝固模型,各向异性枝晶生长 纯物质凝固模型,激光增材制造,选择性激光熔融,SLM,凝固,铸造,焊接等等多种耦合场景 相场模拟-合金,金属凝固模型,各向异性枝晶生

- Android 数据库大作业,实现学生信息管理系统app.zip

- 毕设-java-swing-学生信息管理(文档+视频+源码)6.zip

- 电火花加工,热流耦合水平集comsol仿真,考虑表面力如下 6.1版本

- 基于小程序的校园失物招领系统的设计与实现源码(小程序毕业设计完整源码+LW).zip

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功