没有合适的资源?快使用搜索试试~ 我知道了~

美国农业部-美股-农业行业-美国小麦展望:-美国小麦产量、库存上升,出口受挫-0613-27页.pdf

试读

27页

需积分: 0 0 下载量 144 浏览量

更新于2023-07-26

收藏 1.45MB PDF 举报

美国农业部-美股-农业行业-美国小麦展望:-美国小麦产量、库存上升,出口受挫-0613-27页.pdf

W

heat Outlook

Jen

nifer K. Bond

Olga Liefert

2019/20 Wheat Production, Feed and Residual

Lifted, Exports Continue to Face Headwinds

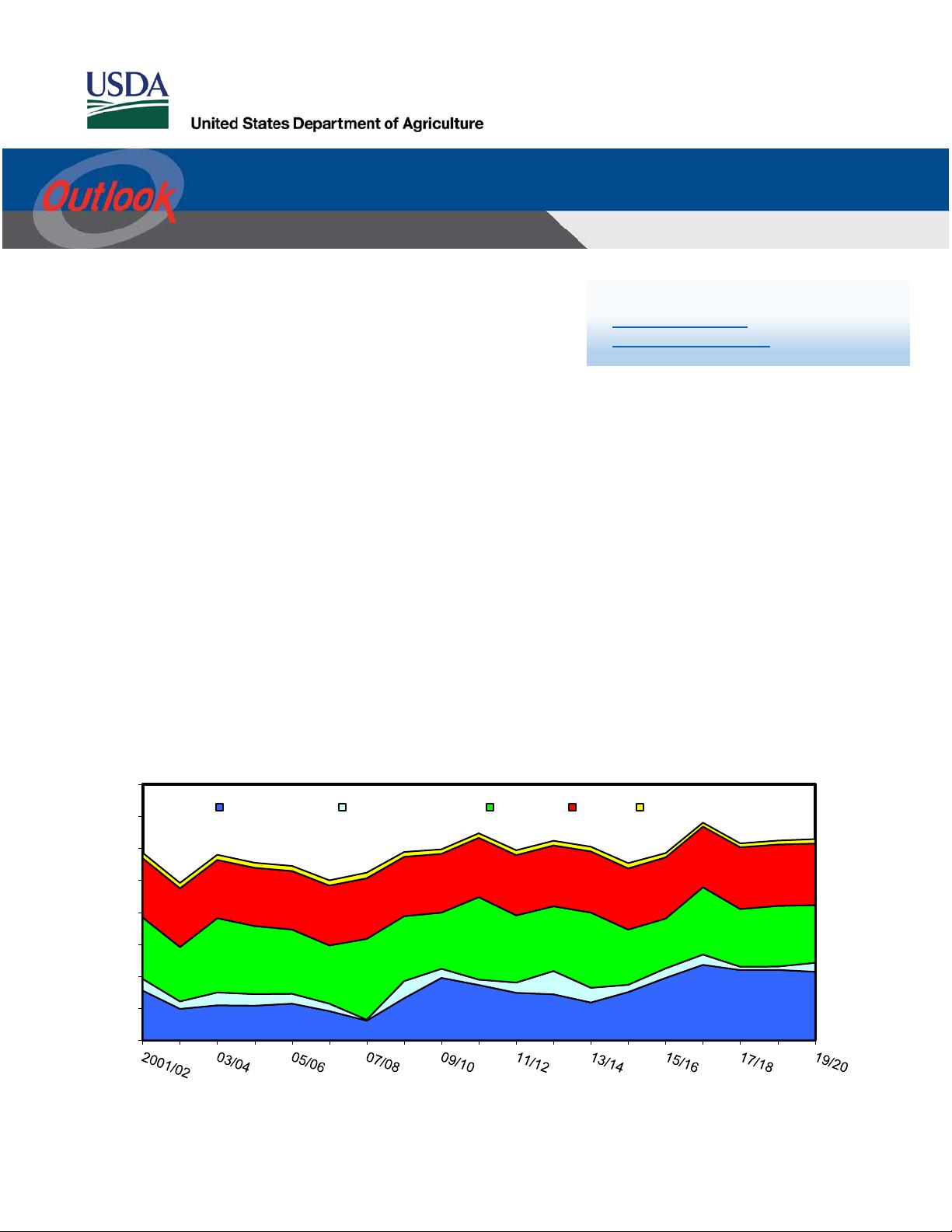

This month’s USDA, National Agricultural Statistics Service Crop Production report provided revised

winter wheat and desert durum production for 2019/20. On net, winter wheat is raised 6 million bushels

on improved yields. Production gains help to offset the effects of lower carryin stemming from increased

back-year exports and leading to reduced total supplies month-to-month. New crop all-wheat feed and

residual is increased by 50 million bushels on a sharp reduction in corn production and feeding (fig. 1).

Prospects for 2019/20 exports are not improved from the previous month and remain at 900 million

bushels. In 2019/20, recovery in European Union (EU) and Australia production and exportable

supplies creates formidable competition for U.S. wheat in global markets. On expectations for larger

crops, Russia and Ukraine exports are both raised a million tons this month and further inhibit growth in

U.S. exports in 2019/20.

0

5

00

1,000

1,500

2,000

2,500

3,000

3,500

4,000

E

nding stocks

F

eed and residual

Ex

ports

F

ood

S

eed

S

ource: USDA, World Agricultural Outlook Board, WASDE.

F

igure 1: Both new and old crop U.S. wheat utilization are raised as ending stocks tighten

M

il. bu

Economic Research Service | Situation and Outlook Report

N

ext release is

J

uly 15, 2019

W

HS-19f

|

J

une 13

,

201

9

In this report:

- Do

mestic Outlook

- I

nternational Outlook

Domestic Outlook

Domestic Changes at a Glance:

• U.S. Census Bureau trade data through April indicate a brisk pace of old crop shipments

in the fourth quarter and support a 25-million-bushel increase in the 2018/19 exports.

o Estimated total exports for the fourth quarter or the 2018/19 marketing year

exceeded expectations as the U.S. was able to capitalize on reduced exportable

supplies from the Black Sea region and more competitive export prices.

• Larger back year exports serve to lower 2018/19 ending stocks and carryin for the

2019/20 marketing year. Reduced carryin for 2019/20 is offset slightly growth in

projected wheat production.

• Winter wheat production for 2019/20 is raised 6 million bushels this month to 1,274.5

million on increased yields.

o USDA, National Agricultural Statistics Service (NASS) lifted hard red winter

(HRW) wheat production by more than 14 million bushels from the previous

forecast, more than offseting lower projected production for soft red winter

(SRW), down 6.3 million, and white winter wheat (down 1.8 million).

• Other spring wheat production is unchanged from the May forecast and will be re-

evaluated following the end of June release of the Acreage report.

• Forecast durum production for 2019/20 is cut slightly, down 194,000 bushels from the

previous projection on reduced desert durum production reported by NASS for Arizona.

• Carryin is reduced by more than production is increased, resulting in a net 19.2 million

bushel reduction in supplies, relative to the May projection.

• Total use for the new marketing year is raised 50 million bushels this month on a

significant expansion of projected feed and residual use.

o Wheat feed and residual use for 2019/20 is raised on sharp declines for both

corn production and corn feed and residual, which in turn supports a 50-cent

increase in the forecast season average corn price.

• The tighter wheat balance sheet for 2019/20 and a significant increase in the corn price

combine to lift the all-wheat season average farm price by 40 cents this month to $5.10

per bushel.

2

Wheat Outlook, WHS-19f, June 13, 2019

USDA, Economic Research Service

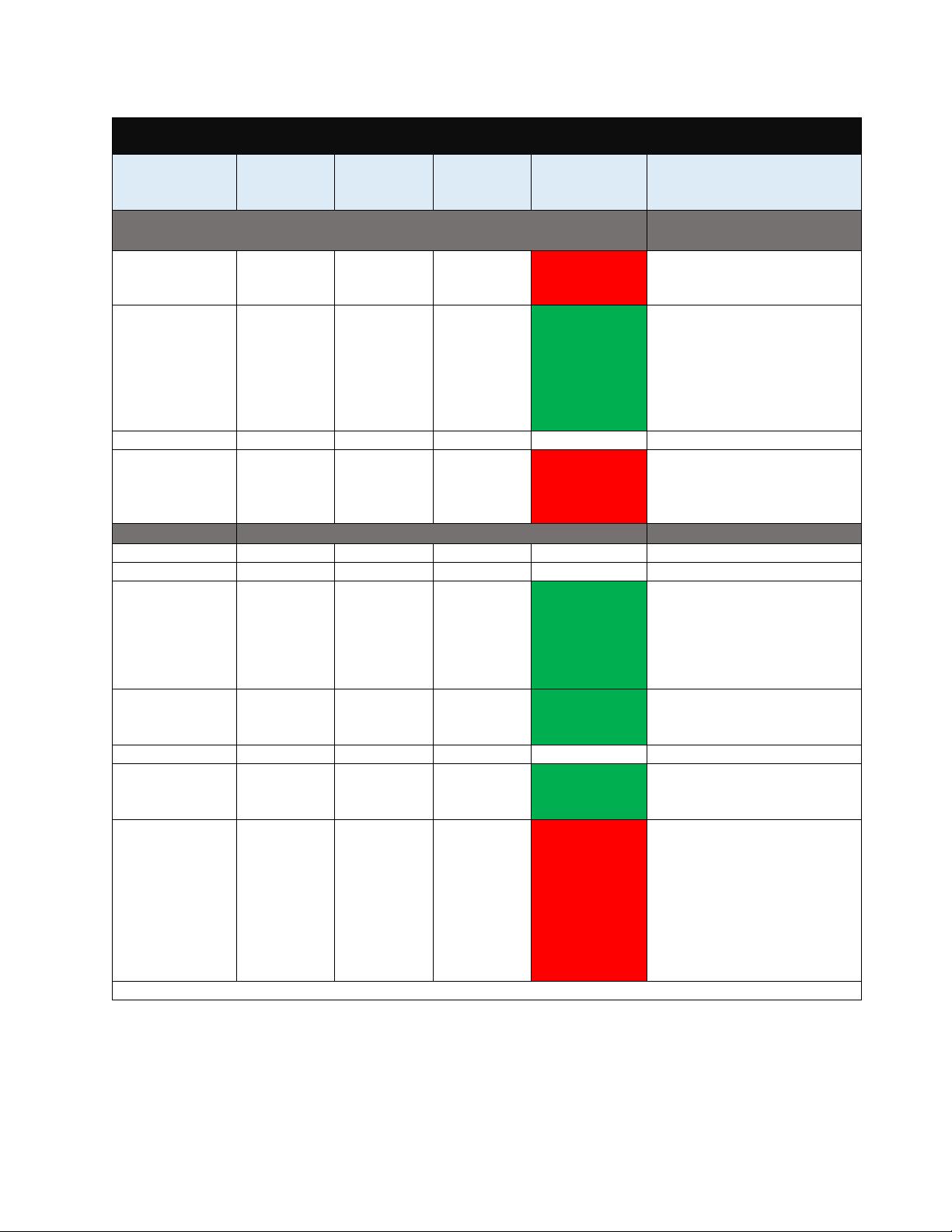

Table 1 - U.S. wheat supply and utilization at a glance, 2018/19 and 2019/20

Balance sheet

item

2018/19

June

2019/20

May

2019/20

June

Change from

previous

month

Comments

Supply, total Million bushels

May-June Marketing Year

(MY)

Beginning

stocks

1,098.9 1,126.8 1,101.8

-25.0

Carryin from 2018/19 is

lower on increased old crop

exports.

Production 1,884.5 1,896.9 1,902.7 5.8

New crop production is

raised 6 million bushels on

higher Hard Red Winter

wheat production that is not

offset by cuts to Soft Red

Winter and Winter White

wheat production

Imports

140.0

140.0

140.0

0.0

Supply, total 3,123.3 3,163.7 3,144.5 -19.2

Reduced carryin more than

offsets production gains,

resulting in lower total

supply in 2019/20.

Demand

Million bushels

Food

960.0

965.0

965.0

0.0

Seed

61.5

68.0

68.0

0.0

Feed and

residual

50.0 90.0 140.0

50.0

Feed and residual use for

2019/20 is raised 50 million

bushels on a sizable cut to

corn production and

associated reduction in corn

feeding.

Domestic, total 1,071.5 1,123.0 1,173.0 50.0

Domestic use is raised 50

million bushels on expanded

feed and residual use.

Exports

950.0

900.0

900.0

0.0

Use, total 2,021.5 2,023.0 2,073.0 50.0

Total use is lifted 50 million

bushels on expanded

domestic utilization.

Ending stocks 1,101.8 1,140.7 1,071.5 -69.2

Reduced supplies and

increased domestic use

combine to tighten the

balance sheet. A tighter all-

wheat balance sheet

supports a month-to-month

increase in the all-wheat

price, raised 40 cents this

month to $5.10 per bushel.

Source: USDA, World Agricultural Outlook Board Supply and Demand Estimates.

3

Wheat Outlook, WHS-19f, June 13, 2019

USDA, Economic Research Service

2019 Winter Wheat Production Nudged Higher on Improved

Prospects for Hard Red Winter Wheat

This month, USDA, National Agricultural Statistics Service (NASS) released the second survey-

based winter wheat production forecast for the 2019/20 marketing year. Farmer responses

collected by NASS between May 25 and June 6 inform projections of winter wheat area

harvested, yields, and production-by-State. In NASS’ June release of the Crop Production

report, winter wheat yields for 2019 are projected at 50.5 bushels per acre, up from 50.3

bushels estimated in May and comparable to the 47.9 bushels per acre that farmers realized in

2018.

Win

ter wheat yields are improved in a number of key States—most notably, Kansas, where

yields are estimated to have increased 1 bushel per acre from the May forecast. If realized, this

will be the second-highest winter wheat yield on record for Kansas, behind 2016 when 57

bushels per acre were realized. The projection for near record-high winter wheat yields is

attributable to relatively mild, though wet, growing conditions that have become increasingly

favorable as showers abated and weather has warmed. As of June 9, NASS reports that 64 of

U.S. winter wheat acreage was reported to be in “good” to “excellent” condition, 26 percentage

points above the same time in 2018.

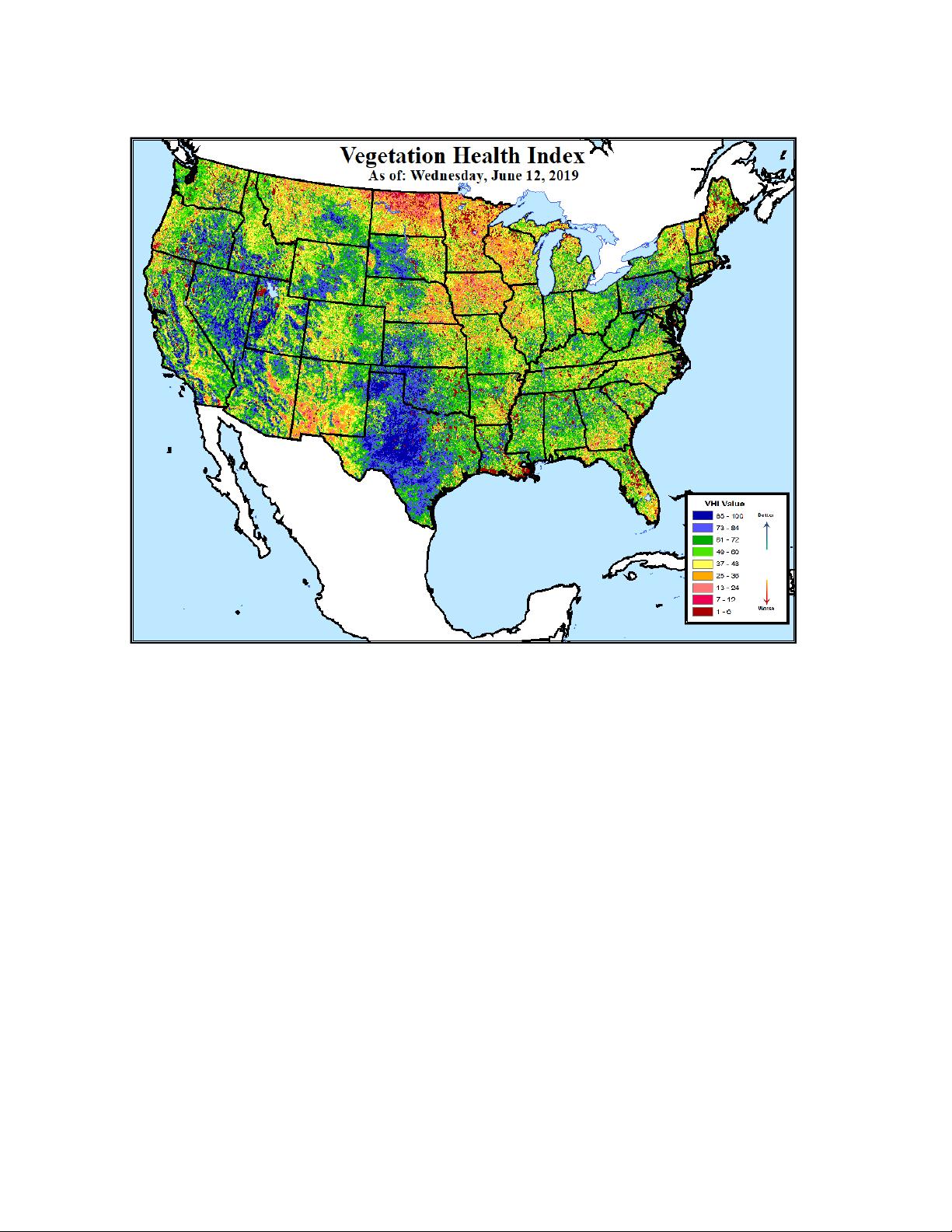

On June 12, the World Agricultural Outlook Board, Agricultural Weather and Assessments

Group released their map of the U.S. vegetative health index (VHI) based on data provided by

NOAA/NESDIS Center for Satellite Applications and Research (fig. 2). The VHI map clearly

shows better VHI values across the broad winter wheat production belt and support NASS’

finding that the vast majority of winter wheat rated “good” to “excellent.” Also visible is the

emergent drought conditions in the Northern Plains near the Canadian border. A lower VHI in

this key region of spring wheat production is also consistent with a slower-than-normal pace of

planting.

Developmentally, the 2019 winter wheat crop is slightly behind last year’s pace with 83 percent

of the crop headed as of the week ending June 9 compared to 90 percent in 2018 and a 5-year

average of 91 percent. Winter wheat production for 2019 is currently forecast at 1,274.5 million

bushels, up less than 1 percent from the May forecast and up about 90 million bushels (less

than 1 percent) from 2018.

4

Wheat Outlook, WHS-19f, June 13, 2019

USDA, Economic Research Service

Figure 2: U.S. vegetation health index affirms NASS winter wheat condition ratings

Sources: Dr. Felix Kogan et al, NOAA/NESDIS, Center for Satellite Applications and Research and USDA, World

Agricultural Outlook Board, Agricultural Weather and Assessments Group.

Net

gains in winter wheat production, month-to-month, are supported by a 14-million-bushel

increase in hard red winter (HRW) wheat production. Yield hikes in a key HRW-producing State,

Kansas, along with yield gains for Oklahoma and Montana, help to support the increase. Based

on improving yields, HRW production is up 2 percent from the May forecast to 794 million

bushels.

For ot

her classes of winter wheat, including SRW and both hard and soft white winter wheat,

NASS projects production down month-to-month. Yield reductions are reported for States where

SRW production is concentrated (fig. 3) and include Missouri (down 5 bushels per acre from

May), Ohio (down 6 bushels), Indiana (down 4 bushels), and Illinois (down 2 bushels). Areas of

concentrated SRW production have been beset by persistent rains and cooler-than-normal

temperatures, reportedly resulting in delayed maturation and some crop stress, as evidenced by

these month-to-month yield declines. Estimates for harvested area by class will be updated in

5

Wheat Outlook, WHS-19f, June 13, 2019

USDA, Economic Research Service

5

Wheat Outlook, WHS-19f, June 13, 2019

USDA, Economic Research Service

剩余26页未读,继续阅读

资源推荐

资源评论

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

157 浏览量

173 浏览量

110 浏览量

135 浏览量

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

182 浏览量

资源评论

icwx_7550592

- 粉丝: 20

- 资源: 7163

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功