Q1 Hospital Recap: Solid Vols Despite Tough

Flu Comp, Still Overall Results Mixed

■ Overall Results Mixed: Two of the four public hospital companies that we

cover reported EBITDA ahead of consensus expectations. HCA beat the

Street by a wide margin ($262 mln ahead, including an $86 mln payor

settlement award), while THC was ahead of the Street by $9 mln. UHS and

CYH both missed consensus expectations modestly.

■ Q1 Volumes Generally Strong Despite the Flu Comp: For the first

quarter of 2019, the hospital group reported SS inpatient admissions

growth of 1.5%, on average. This represents an increase in the Y/Y growth

rate of 110 bps sequentially and an increase of 130 bps Y/Y. UHS had the

strongest growth in SS admissions at 5.2%, followed by HCA at 0.9%. CYH

and THC both SS admissions down just 0.1%, a significant improvement

for both companies relative to the recent past. SS adjusted admissions

grew 2% for the group, on average, a sequential improvement of 110 bps

and a Y/Y improvement of 190 bps in the growth rate. UHS was strongest

on this metric as well at 4.9%, followed by HCA at 1.8%, CYH at 0.8%, and

THC at 0.6%. Each of the four companies said that a tough flu comp was a

headwind to volume growth on a Y/Y basis.

■ Q1 Pricing Metrics: On pricing, the group reported a Y/Y increase in net

revenue per adjusted admission of 1.9%, on average, in the first quarter of

2019. This represents a decrease in the Y/Y growth rate of 60 bps

sequentially and 200 bps relative to 1Q18. HCA had the strongest pricing

growth at 4.4% (3.6% ex- the settlement award), while UHS had a pricing

decline of 0.4%. UHS attributed the pricing weakness to a lower mix of

surgical services and a higher mix of medical cases.

■ Outlook for Remainder of Year: CYH, THC, and UHS maintained the key

figures in their 2019 guidance. HCA modestly increased its EBITDA

guidance to account for the $86 mln settlement award, which was not in

original guidance. HCA is tracking well ahead of expectations after Q1, so

we could see a positive guidance revision when the company reports Q2

results. For THC, operating trends are looking somewhat better. Conifer

profitability has improved, but focus remains on the company’s plan to

conduct a strategic transaction with respect to Conifer. We’ll look for UHS’

SS pricing to bounce back in Q2, and focus will stay on potential

improvement in the psych segment (which looked a bit better in 1Q19).

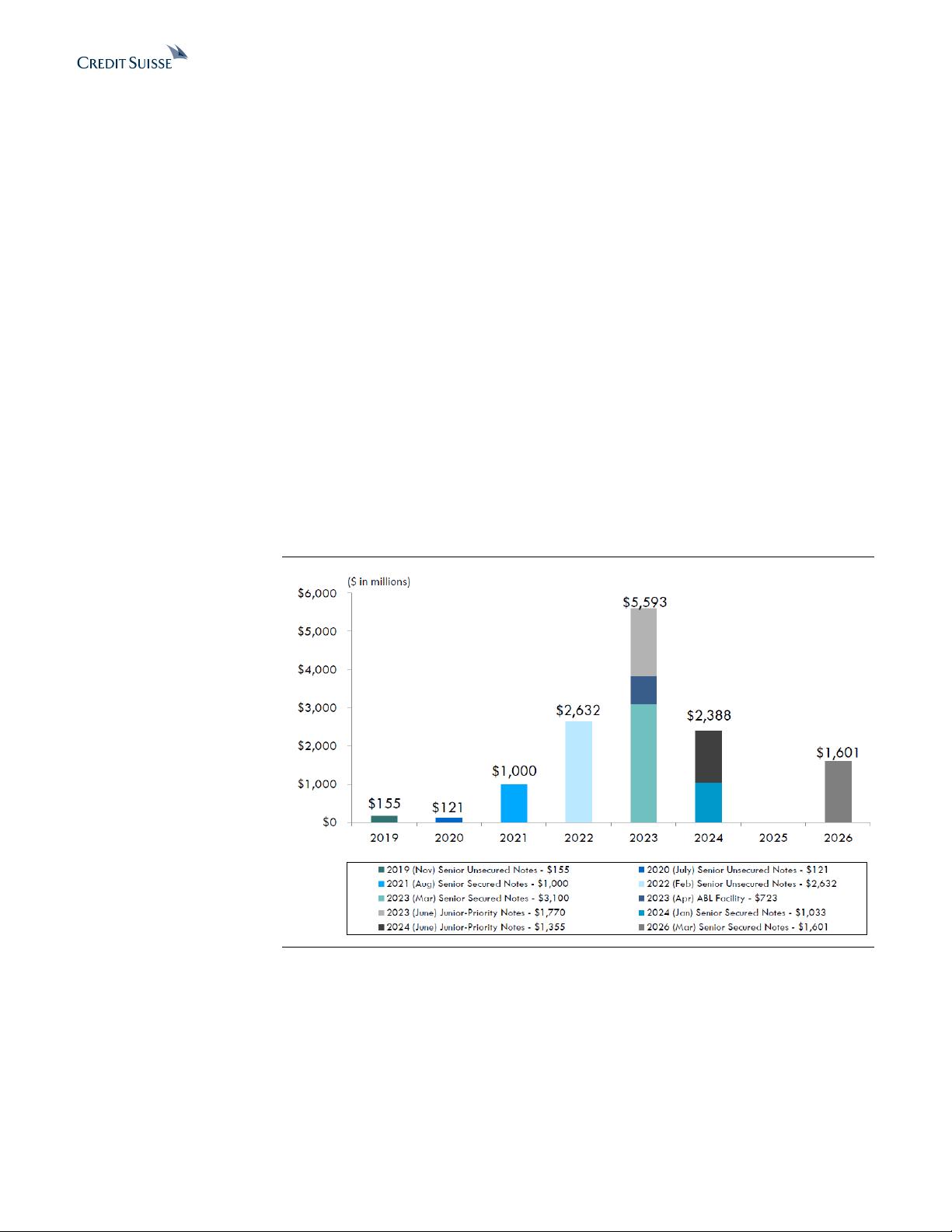

While CYH’s volumes have picked up, the main focus there continues to be

on the capital structure challenges and the divestiture program.

■ Updating Models: With this note, we are updating our CYH, THC, and

UHS models. Our THC target price is now $25 (prev $33), and our UHS

target price is now $150 (prev $152). Risks to our ratings and target prices

for all hospital companies include volume and pricing trends.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功