没有合适的资源?快使用搜索试试~ 我知道了~

资源推荐

资源详情

资源评论

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST

CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit

Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware

that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report

as only a single factor in making their investment decision.

5 September 2019

Americas/United States

Equity Research

Life Science Tools and Diagnostics

Life Science Tools &

Diagnostics

SECTOR REVIEW

Research Analysts

Erin Wilson Wright

212 538 4080

erin.wright@credit-suisse.com

Katie Tryhane

212 325 2713

katie.tryhane@credit-suisse.com

Haley Christofides

212 325 2000

haley.christofides@credit-suisse.com

Top Questions for Management Teams

With several investor and industry conferences approaching, we have

compiled a list of relevant questions and topics of discussion for respective

management teams across our diverse coverage universe of Life Science

Tools and Diagnostics companies, with an emphasis on the following sub-

sectors: Animal Health, Contract Services Organizations, Clinical Laboratories,

Dental, Life Sciences, and Drug Distributors, among others. Please reach out

to our team for copies of our latest models or other requests in preparation for

your meetings.

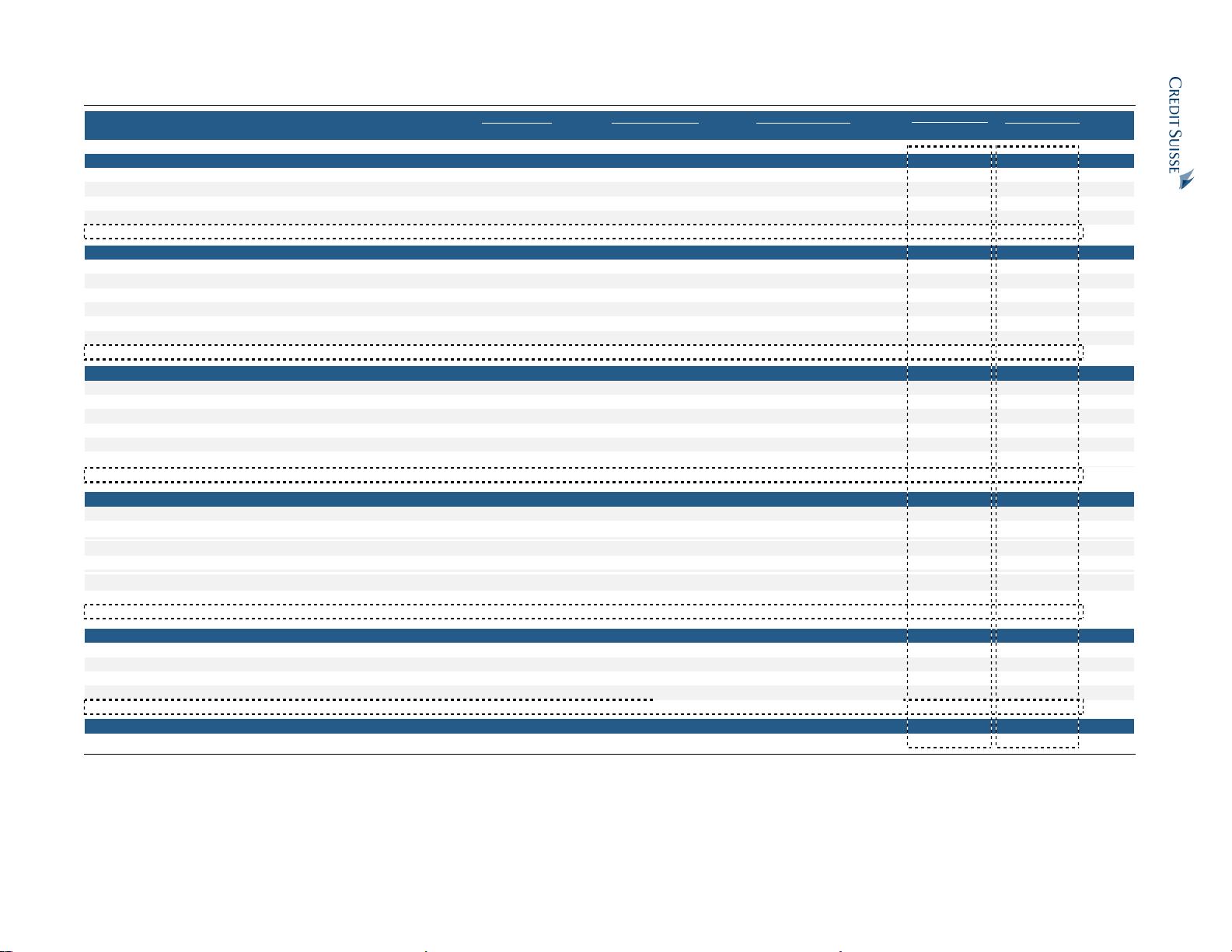

Figure 1: Life Science Tools & Diagnostics Coverage Universe

Dental

Dentsply Sirona XRAY IQVIA Holdings IQV

Align Technology ALGN ICON PLC ICLR

Henry Schein HSIC PRA Health Sciences PRAH

Patterson Companies PDCO Syneos Health SYNH

Medpace MEDP

Animal Health

Charles River Laboratories CRL

Zoetis ZTS

IDEXX Laboratories IDXX

Elanco Animal Health ELAN Avantor AVTR

Phibro Animal Health PAHC Danaher DHR

Covetrus CVET LabCorp LH

Petmed Express PETS Quest Diagnostics DGX

Fulgent Genetics FLGT

Distributors

Lantheus Holdings LNTH

AmerisourceBergen ABC

Cardinal Health CAH

McKesson MCK

Owens & Minor OMI

Contract Research Organizations

Life Sciences & Diagnostics

Source: Credit Suisse

Links to recent industry research:

Drug Distributor Update: Generic Drug Pricing Monitor

SYNH: Summertime with Syneos—Management on the Road

Animal Tracks: July Pet Adoptions Accelerate; Pet Retail Tracker Healthy

ELAN: ELAN + Bayer Q&A Takeaway

Drug Distributor Update: Opioid Litigation Overhang Endures

Dental Update: Survey Says: Dental Demand Builds

5 September 2019

Life Science Tools & Diagnostics 2

Table of contents

Pharmaceutical Supply Chain 4

AmerisourceBergen (ABC).......................................................................................4

Cardinal Health (CAH) .............................................................................................6

McKesson (MCK) .....................................................................................................8

Owens & Minor (OMI) ............................................................................................10

Clinical Laboratories 12

LabCorp of America (LH) .......................................................................................12

Quest Diagnostics (DGX).......................................................................................14

CROs 16

Charles River Laboratories ....................................................................................16

ICON PLC (ICLR)...................................................................................................18

Syneos Health (SYNH) ..........................................................................................19

Medpace (MEDP)...................................................................................................21

PRA Health Sciences (PRAH) ...............................................................................23

IQVIA Holdings (IQV) .............................................................................................25

Dental 27

Align Technology (ALGN) ......................................................................................27

DENTSPLY Sirona (XRAY)....................................................................................29

Henry Schein (HSIC)..............................................................................................31

Patterson Companies (PDCO)...............................................................................33

Animal Health 35

Covetrus (CVET)....................................................................................................35

IDEXX Laboratories (IDXX)....................................................................................37

Phibro Animal Health (PAHC) ................................................................................40

Petmed Express (PETS) ........................................................................................42

Zoetis (ZTS) ...........................................................................................................43

Life Science Tools & Diagnostics / Other 46

Avantor (AVTR)......................................................................................................46

Fulgent Genetics (FLGT) .......................................................................................48

Lantheus (LNTH)....................................................................................................49

5 September 2019

Life Science Tools & Diagnostics 3

Figure 2: Life Science Tools & Diagnostics Coverage Universe

Price Upside / 9/4/19 Market

52 Week

Avg Daily

Revenue (CY)

Avg (5yr)

EPS (CY)

Avg (5yr)

EV/EBITDA (CY)

Dividend

Ticker Rating Target Downside Price Cap High Low

Vol (000's)

2019 2020 Rev Gr. 2019 2020 EPS Gr. 2019 2020 2019 2020 Yield

Dental

Dentsply Sirona XRAY Outperform $63 23% $51.33 $11,479 $59 $34 1,775 $3,955 $4,088 7% $2.39 $2.69 -2% 21.5x 19.1x 14.8x 13.4x 0.7%

Align Technology ALGN Outperform $320 81% $176.38 $14,211 $399 $172 1,722 $2,462 $2,884 25% $5.21 $6.71 28% 33.9x 26.3x 21.8x 16.5x -

Patterson Companies PDCO Outperform $25 55% $16.13 $1,521 $27 $16 1,302 $5,627 $5,799 8% $1.36 $1.46 -7% 11.9x 11.0x 8.3x 7.9x 6.4%

Henry Schein HSIC Neutral $66 8% $61.06 $9,113 $91 $57 1,322 $10,036 $10,382 7% $3.47 $3.78 11% 17.6x 16.1x 11.4x 10.9x -

Average

12% 7% 21.2x 18.1x 14.1x 12.2x

Animal Health

Zoetis ZTS Outperform $130 2% $127.59 $61,195 $128 $79 1,911 $6,235 $6,651 5% $3.58 $3.98 18% 35.6x 32.1x 26.5x 24.3x 0.5%

IDEXX Laboratories IDXX Outperform $293 1% $288.90 $25,553 $292 $176 395 $2,394 $2,626 10% $4.89 $5.56 20% 59.0x 51.9x 40.8x 37.0x -

Elanco Animal Health (1) ELAN Restricted $26.36 $9,668 $38 $26 4,070 $3,100 $3,197 2% $1.09 $1.27 28% 24.2x 20.8x 15.9x 14.2x -

Covetrus CVET Neutral $15 11% $13.50 $1,525 $50 $12 2,108 $3,928 $4,146 - $0.45 $0.65 - 30.0x 20.8x 13.3x 11.8x -

Phibro Animal Health PAHC Neutral $25 23% $20.34 $825 $48 $20 236 $827 $862 5% $1.31 $1.57 29% 15.5x 13.0x 10.0x 9.8x 2.4%

Petmed Express PETS Underperform $13 -17% $15.74 $322 $38 $15 950 $279 $286 4% $1.02 $0.94 19% 15.5x 16.8x 9.2x 10.0x 6.9%

Average

5% 23% 30.0x 25.9x 17.4x 16.1x

Contract Research Organizations

IQVIA Holdings IQV Outperform $170 12% $151.46 $30,135 $164 $105 1,010 $9,485 $10,217 7% $6.38 $7.29 15% 23.8x 20.8x 16.8x 15.3x -

ICON PLC ICLR Outperform $160 3% $155.41 $8,358 $165 $118 228 $2,817 $3,025 7% $6.87 $7.61 29% 22.6x 20.4x 16.8x 15.6x -

PRA Health Sciences PRAH Outperform $118 19% $99.15 $6,482 $122 $82 575 $3,103 $3,349 23% $5.03 $5.62 52% 19.7x 17.7x 14.0x 12.7x -

Syneos Health SYNH Outperform $58 10% $52.51 $5,524 $56 $36 433 $4,627 $4,969 59% $3.12 $3.57 62% 16.8x 14.7x 13.0x 11.8x -

Medpace MEDP Outperform $77 -5% $81.39 $3,053 $83 $46 482 $860 $943 26% $2.91 $3.24 11% 27.9x 25.1x 20.2x 18.3x -

Charles River Laboratories CRL Neutral $138 5% $131.71 $6,382 $149 $103 309 $2,654 $2,881 14% $6.46 $7.23 16% 20.4x 18.2x 13.0x 12.1x -

Average

19% 26% 18.7x 16.7x 13.4x 12.2x

Life Sciences & Diagnostics

Danaher (1) DHR Restricted $140.26 $103,389 $146 $95 2,013 $20,741 $24,445 10% $4.80 $5.66 14% 29.2x 24.8x 22.6x 21.0x 0.5%

Avantor AVTR Outperform $20 16% $17.24 $11,206 $20 $14 1,630 $6,100 $6,416 - $0.55 $0.75 - 31.1x 22.8x 15.4x 13.4x -

LabCorp of America LH Outperform $182 8% $168.19 $16,442 $178 $119 695 $11,491 $11,962 15% $11.26 $12.23 10% 14.9x 13.7x 11.3x 10.8x -

Quest Diagnostics DGX Neutral $105 2% $102.73 $13,788 $110 $79 1,016 $7,733 $7,908 1% $6.54 $6.84 8% 15.7x 15.0x 10.9x 10.8x 2.1%

Fulgent Genetics FLGT Neutral $9 -26% $11.41 $215 $13 $3 92 $32 $48 189% $0.06 $0.28 - - 40.3x 74.1x 21.7x -

Lantheus Holdings LNTH Neutral $25 17% $21.36 $860 $30 $13 432 $350 $371 4% $1.11 $1.33 - 19.3x 16.1x 9.6x 9.2x -

Average

44% 11% 22.1x 22.1x 24.0x 14.5x

Pharmaceutical & Medical Supply Chain

AmerisourceBergen ABC Outperform $98 15% $85.18 $17,832 $95 $69 1,347 $180,696 $190,167 13% $7.36 $7.79 15% 11.6x 10.9x 7.8x 7.5x 1.9%

Cardinal Health CAH Outperform $53 20% $44.35 $13,221 $58 $41 3,123 $148,297 $153,651 8% $5.12 $5.20 3% 8.7x 8.5x 7.1x 7.0x 4.3%

McKesson MCK Neutral $143 2% $140.54 $26,122 $151 $106 1,693 $220,577 $228,010 6% $14.00 $15.01 12% 10.0x 9.4x 8.4x 7.6x 1.1%

Owens & Minor OMI Underperform $3 -52% $6.39 $383 $18 $2 1,435 $9,965 $10,130 2% $0.65 $0.71 -8% 9.8x 9.0x 6.7x 6.6x 0.2%

Average

- - - - - -

Indices

S&P 500 Index SP50 2,938 3,028 2,347 $200.59

P/E (CY)

Source: Company data, Credit Suisse estimates, FactSet. $ in Millions, except per share data

(1) DHR, ELAN based on FactSet Consensus estimates

5 September 2019

Life Science Tools & Diagnostics 4

Pharmaceutical Supply Chain

AmerisourceBergen (ABC)

General

■ Generic pricing visibility? Can you provide an update on what you are seeing?

■ You maintained that your assumption for brand price inflation of +MSD in the latest

quarterly report. Can you provide an update on what you are seeing in the market, your

level of visibility thereon?

■ Other US Regulatory Update: How should we think about the potential implications of

Part B drugs transitioning to Part D, and other concepts such as specialty step therapy

across your specialty business? Implications of the proposed importation plan? Which

segments of your business are exposed?

■ Could you provide an update on your efforts to implement differential pricing strategies

across varying product types?

■ On opioids, can you provide an update on how opioid litigation is progressing in

relation to ABC? Can you speak to your positioning and thoughts as we approach

relevant trails? Update on expected litigation-related costs in FY19? How does your

accounting for the associated expenses differ from the other distributors?

■ Update on your relationship with WBA and what a potential more formal alignment

would add for you? Where would there be potential dis-synergies (i.e. independent

pharmacy relationships)?

■ Amazon has formally entered the Healthcare Supply Chain Services continuum with its

purchase of PillPack. What are your thoughts on how Amazon will impact the industry,

and what impact do you see for ABC? Update on current supply relationship with ABC?

■ M&A pipeline update? Focus on pharma distribution and related services vs. ancillary

services deal? Deal sizes (Tuck-ins vs. something more transformational)?

■ As it relates to your diversification strategy, do you plan to expand your current

offerings (e.g. MWI, World Courier) or into other service offerings? Do you expect

these efforts to be organic or inorganic?

■ Diversified profit drivers: What percent of revenues and profits stem from businesses

outside of core distribution? Where does this metric go over the next 3-5 years?

Pharmaceutical Segment

■ The Pharma segment margin strengthened in F3Q. Can you speak to the drivers of the

recent outperformance and the sustainability thereon?

■ Are you concerned about a potential irrational sell-side environment, given recent

contract re-pricing across the industry?

■ PharMEDium update: You recently entered a Consent Decree (May 17). How are

PharMEDium / DOJ discussions progressing? Any surprises relative to expectations?

− Can you speak to your decision to close one of the PharMEDium facilities? Prior to

closing this facility, you had mentioned that the remaining open facilities (ex.

Memphis) do not cover the cost base, meaning the PharMEDium business was

operating at a loss. How does this recent optimization effort change that dynamic?

− Can you speak to the findings by your cGMP consultant, particularly as it relates to

the current demand environment for PharMEDium offerings?

− Can you provide an update on your overall strategic review as it relates to

PharMEDium? When should we expect further clarity?

5 September 2019

Life Science Tools & Diagnostics 5

■ Can you comment on the state of contract renewals and current conversations you are

having with customers? Any major contracts up near term?

■ We have heard now for some time from a number of industry constituents about the

ongoing move away from contracts that depend on drug price inflation as an essential

component of overall compensation. What is the split of the gross profits you generate

from drug distribution that comes from fixed contracts versus variable? Is it correct to

assume you are pursuing a strategy to change that mix towards 100% FFS over time?

■ Seeing as FFS agreements can be based on the total pharmaceutical spend managed

for a manufacturer, profitability of these contracts still depend, to a degree, on inflation

even as you move away from contracts more directly tied to the metric. When we think

about the relative importance of some branded inflation compared to what you are able

to generate on generic drugs, how would you help us frame those two buckets in terms

of their importance to gross profit?

■ Can you provide your view on the resumption of manufacturer brand price increases in

2019? Do you view this trend will continue? What are the implications? View on

political environment around drug pricing?

■ How do you compare capital efficiency of your generic sourcing capability relative to

those of your competitor? (i.e. WBAD vs. Red Oak and ClarusONE)

■ What kind of impact has ESRX’s entrance into WBAD had on your gross margin? Are

you realizing the full benefit of WBAD, or do you view there is room for improvement as

it relates to generic purchasing? What more can you do with WBAD?

■ How is the HD Smith (HDS) integration progressing? What core customer groups did

HDS add? In light of accelerated synergy capture relative to expectations, do you

foresee further synergy capture opportunities? Are there future consolidation

opportunities similar to HD Smith?

■ Can you speak to your strategy/opportunity in specialty, which you define as the

distribution of oncology and physician-administered drugs? Biosimilar opportunity?

Profit dynamics across this business and how that will trend over the next 3-5 years?

Other Segment

■ Can you speak to the longer term potential of Lash Consulting in terms of strategic

positioning, topline growth, and profit trajectory?

− Can you provide an update on the Lash Consulting, and the progress on Fusion

implementation? What factors are driving implementation costs higher than

anticipated, and why is the account migration taking longer than expected?

■ In Animal Health/MWI, any changes in the demand trends for the companion and

production animal markets? Your expanded relationship with Mars/WOOF?

− Potential implications of an evolving flea/tick/heartworm market in the US?

− Thoughts on direct distribution dynamics, particularly as manufacturers more

broadly open up to alternative channels (e.g. PetMed Express, Chewy)?

■ What are the implications, in your view, of the Henry Schein spin (Covetrus, CVET)

and merger with Vets First Choice? Can you speak to your investment in Vetsource,

the leading competitor to Covetrus’ Vets First Choice platform?

■ Update on World Courier growth, longer term profit prospects?

剩余52页未读,继续阅读

资源评论

supeerzdj

- 粉丝: 12

- 资源: 6184

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 西工大noj 116题及答案word版.doc

- 模拟采访ppt封面(英文版)

- Django开发中常见问题与解决方案的全面指南

- 基于51单片机的波形发生器设计(protues仿真)-毕业设计

- 安卓开发注意事项及踩坑示例:从环境搭建到性能优化全面指南

- 车辆船只检测5-YOLO(v5至v9)、COCO、CreateML、Darknet、Paligemma、TFRecord、VOC数据集合集.rar

- Questasim仿真脚本

- Questasim仿真脚本2

- 基于51单片机的正弦波方波锯齿波振幅频率可调波形发生器设计(protues仿真)-毕业设计

- 西工大noj 题及答案word版.docx

- 计算机视觉与机器学习的OpenCV开发资源指南

- YOLO目标检测算法学习与开发资源全面整理

- 基于51单片机的定时插座数码管设计(protues仿真)-毕业设计

- 车辆船只检测8-YOLO(v5至v9)、COCO、CreateML、Darknet、Paligemma、TFRecord、VOC数据集合集.rar

- mp3转换器小程序-音频20241222115740.mp3

- 汇编语言学习开发资源指南:计算机科学基础与实践

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功