Managed Care

Annual Health Benefits Survey – 2020 Outlook;

Some Moderation in Premium Growth, But

Pricing Still to Exceed Cost Growth

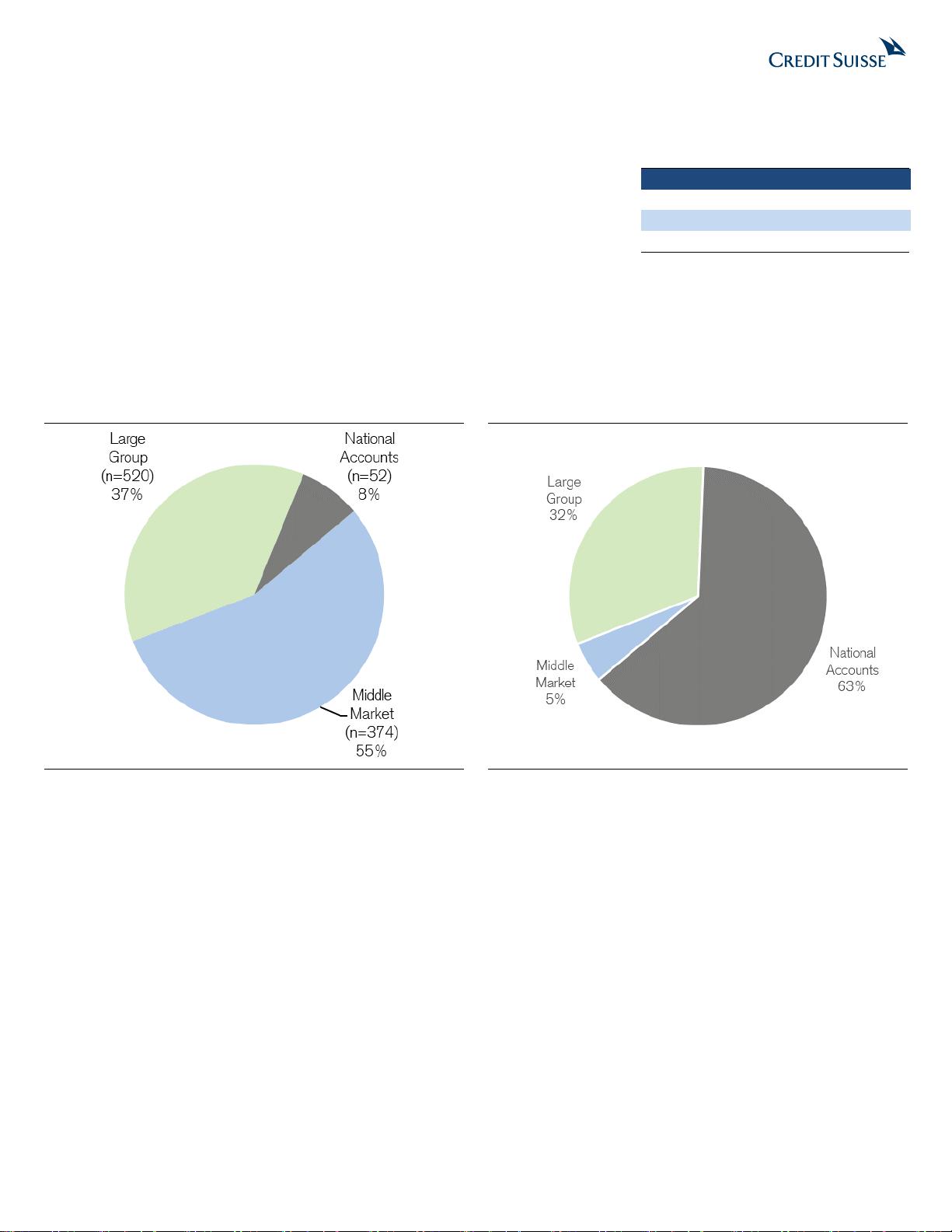

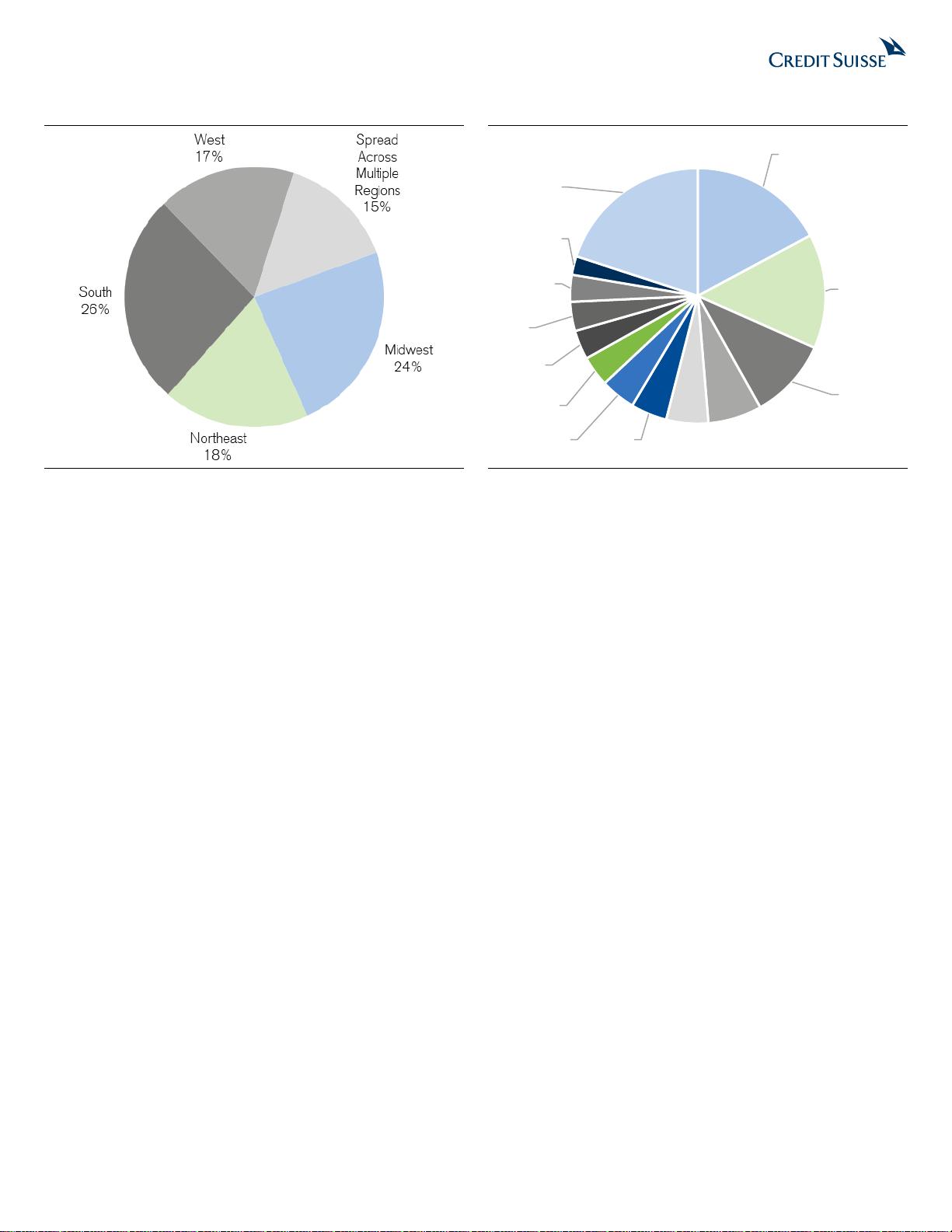

We surveyed 676 health benefit managers regarding their plans for health benefits for 2020.

We asked their views about health insurers, cost trends, premium expectations, and priorities.

■ 2020 Premium Growth to Moderate but Still Increase Faster than Cost Trend

Expectations. Employee premiums are expected to increase 5.4%, on avg (vs 6.1% a

year ago). This compares with an expected gross medical cost increase of 5.1% Y/Y for

2020 (vs a 5.1% Y/Y increase expectation in our 2019 survey). Benefit buydowns are

expected to reduce employers' net medical cost trend increases by approx. 130 bps (vs

150 bps last year), bringing the expected net medical cost trend to a 3.8% Y/Y increase in

2020 (vs a 3.6% Y/Y expected increase for 2019 in our survey last year). Similar to last

year, “Specialty drug costs” was seen most often as the primary driver of medical cost

growth, followed by “Proliferation of high cost claimants” and “Drug costs generally.” On a

weighted avg basis, employers expect overall drug costs to increase by 5.5% Y/Y in 2020,

a step down from the expected 6.0% Y/Y drug cost increase expected for 2019.

■ In Aggregate, all Major MCOs Improved or Had Stable Competitive Positioning

Y/Y. Across major national health plans (Aetna, Blues, Cigna, and UnitedHealthcare),

aggregate scores were either relatively stable or improved versus last year. The Y/Y

improvement was highest for Aetna (0.06 pts or 1.6%), followed by Blues (0.05 pts or

1.3%). Under Customer Services, all major health plans showed improvement Y/Y, with

the rating for Blues increasing the most. In the Care/Condition Management category,

Aetna and the Blues showed improvement Y/Y, while CI was stable and UNH declined by

0.02 pts (0.5%). Under Plan Support & Tools, Aetna, Blues, and CI showed Y/Y

improvement, while UNH declined 0.08 pts (2.2%). Finally, under Networks, Blues

maintained their leadership but the scores for Aetna (up 2.9%) improved the most Y/Y.

Across all MCOs in the survey, non-ANTM BCBS was the leader, on an aggregate basis.

Among public MCOs, CI took the leading position, followed by UNH and Aetna.

■ Medical Cost Trends in 2019 In-Line to Slightly Higher than Expectations. Among

self-insured employers, 33% of respondents (vs 36% last year) are seeing higher gross

medical costs than their expectation heading into 2019. Some 51% see 2019 medical

costs in-line with expectations, while 16% have experienced a favorable trend in 2019.

■ Fewer Employers are Issuing RFPs for 2020. While a greater percentage of

respondents have their PBM contracts up for renewal for 2020 (72% vs 64%), only 26%

of respondents plan to formally release a new RFP for their PBM relationship in 2020 (vs.

36% issuing or planning to issue an RFP for 2019 in our survey last year). Some 46% of

respondents have chosen to renew their existing PBM vendor for 2020 which is consistent

with results from our survey last year (43% of respondents). This could be explained by

various factors including PBMs aggressively trying to maintain their current customer base

without going through an RFP process, changing PBMs can be highly disruptive and some

employers may be choosing not to disrupt their employee base during a time when

employment is tight, employers may have done informal market checks by gauging the

outcomes of some high profile re-bids, etc.

3 October 2019

Equity Research

Americas | United States

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS,

LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do

business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of

interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their

investment decision.

Research Analysts

A.J. Rice

212 325 8134

aj.rice@credit-suisse.com

Eduardo Ron

212 325 7491

eduardo.ron@credit-suisse.com

Jailendra Singh

212 325 8121

jailendra.singh@credit-suisse.com

Caleb Harris, CPA

212 325 7458

caleb.harris@credit-suisse.com

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功