没有合适的资源?快使用搜索试试~ 我知道了~

JP 摩根-中国-医疗保健行业-中国医疗保健:PD1与PD-L1行业-53-109页.pdf

试读

109页

需积分: 0 0 下载量 96 浏览量

更新于2023-07-28

收藏 4.51MB PDF 举报

中国医疗保健行业正在经历一场由量变到质变的转型,尤其在生物医药领域,特别是PD-1/PD-L1单克隆抗体(mAB)市场的发展趋势尤为显著。这一转变受到一系列有利监管政策的推动,以及患者对创新药物可及性的提高。PD-1/PD-L1抑制剂作为肿瘤免疫疗法的重要组成部分,已成为癌症治疗的新焦点。

PD-1和PD-L1是免疫系统中的两个关键分子,它们参与了肿瘤细胞逃避免疫监视的机制。PD-1/PD-L1抗体通过阻断这一信号通路,恢复免疫细胞对肿瘤细胞的攻击能力,从而达到治疗癌症的效果。在中国,这个市场预计将以每年28%的速度增长,到2030年市场规模将达到799亿元人民币(约116亿美元),为众多参与者提供了广阔的发展空间。

报告中提到了四家在中国生物药领域具有代表性的公司:上海君实(覆盖评级为超配,目标价HK$37)、CStone(超配,HK$18)、 BeiGene(超配,HK$93(H) US$155(N))以及Innovent(超配,HK$33)。这些公司在生物医药领域的综合平台和丰富的产品线被认为是成功的关键因素。

上海君实和CStone是新兴的生物科技公司,专注于开发创新疗法,包括PD-1/PD-L1抑制剂。BeiGene是一家全球性的生物科技公司,在肿瘤治疗领域拥有广泛的管线产品,其PD-1抑制剂已经在全球范围内取得显著成果。Innovent则以其在肿瘤免疫治疗领域的研发实力和多元化产品组合而知名。

中国生物医药市场的快速发展主要源于以下几个方面:1) 国家对创新药的支持政策,如加快药品审批流程、提供资金支持等;2) 患者对高质量医疗需求的增加,尤其是对肿瘤等严重疾病的有效治疗方案;3) 技术进步,如基因测序、生物信息学分析等,推动了新药研发的效率和成功率。

然而,尽管市场潜力巨大,但也存在挑战,如高昂的研发成本、严格的监管环境、市场竞争激烈等。因此,企业需要持续投入研发,提升创新能力,同时加强与国内外合作伙伴的合作,以降低风险并加速产品商业化进程。

中国的PD-1/PD-L1市场正在快速发展,这为投资者和医药企业带来了巨大的机遇。随着监管政策的不断完善和医疗创新的持续推动,预计这一领域的竞争将更加激烈,也将催生出更多的市场领导者。投资者应充分考虑研究报告提供的信息,并结合其他因素做出投资决策。

Asia Pacific Equity Research

03 May 2019

China Healthcare Sector

Biotech 101: China’s PD1/PD-L1 Sector

Healthcare

Ling Wang

AC

(852) 2800 8599

ling.wang@jpmorgan.com

Bloomberg JPMA LWANG <GO>

Leon Chik, CFA

(852) 2800-8590

leon.hk.chik@jpmorgan.com

David XY Li

(852) 2800-8546

david.xy.li@jpmorgan.com

Sherry Yin

(852) 2800-8681

sherry.yin@jpmorgan.com

Christine Wang

(852) 2800-8528

christine.qy.wang@jpmorgan.com

Alex Tso, CFA

(852) 2800-0496

alex.tso@jpmorgan.com

J.P. Morgan Securities (Asia Pacific) Limited

See page 105 for analyst certification and important disclosures, including non

-

US analyst disclosures.

J.P. Morgan does and seeks to do business with

companies covered in its research reports. As a result, investors should be aware that the

firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report

as only a single factor in

making their investment decision.

www.jpmorganmarkets.com

Within China’s Pharmaceutical industry, we believe early signs of a shift from

volume-driven to innovation-driven growth are emerging. We expect this

trend to intensify, driven by favorable regulatory policies and improved

patient access to innovative drugs. We believe leading this wave is the market

for biologics oncology treatment/the emerging PD-1/PD-L1 monoclonal

antibody (mAB) market. We see this space growing 28% p.a to Rmb79.9bn

(or US$11.6bn) revenues by 2030; big enough for multiple winners riding this

wave. We expand our coverage of the biologics space; initiating coverage on

Shanghai Junshi (OW, HK$37) and CStone (OW, HK$18) and assuming

coverage on BeiGene (OW, HK$93(H) US$155(N)) and Innovent (OW,

HK$33). All have integrated platforms and broad pipeline, which we think are

keys to success.

Fast growing China biologics market offers significant opportunities.

The China biologics market is at an early stage. Eight of the top 10 drugs in

the USA are Biologics, versus two in China. With the market (excl. TCM)

still dominated by generic products, we expect strong growth for the

biologics market driven by a supportive regulatory environment, improved

reimbursement, and increasing demand for novel drugs, including biologics

and targeted therapies.

Strong growth expected for China’s PD-1/PD-L1 mAB market. The

global PD-1/PD-L1 mAB market has grown rapidly since the launch of the

first PD-1 inhibitor in 2014 (US$10bn revenues in 2018); while China's PD-

1/PD-L1 mAB market has just begun to emerge. We project the China’s PD-

1/PD-L1 market to reach Rmb79.9bn (or US$11.6bn) revenue by 2030, a

28% CAGR. Longer run, we expect domestic players to dominate market

share given their pricing advantage over (MNCs) and increased clinical data.

Opportunity to buy into Pioneers early: BeiGene, CStone, Innovent and

Shanghai Junshi are top players in the space. We view these stocks as

compelling opportunities to access the fast growing China biologics market.

The PD-1/PD-L1 mABs of these four companies are expected to be among

the first five to be introduced to the market among the domestic players. We

project the combined market share of the top 5 companies (including

Hengrui's (OW, covered by Leon Chik) PD-1 mAB) at peak to be over 50%

among the domestic players. These companies also have strong drug

development platform for sustained growth and future innovations.

Investment risks. A high growth rapidly evolving sector, like China

biotechnology, comes with uncertainties. In the intermediate term, we

believe execution risks, clinical, regulatory and marketing risks/pricing

pressure are key risks. The space is also in the early stage of

commercialization. News rather than earnings is the stock driver, downside

risks are development setbacks potentially exacerbated without an earnings

cushion.

China Biotech Coverage

Name

Ticker

R

ec

PT

BeiGene (HK)

6160 HK

OW

HK$93

BeiGene (US)

BGNE

OW

US$155

CStone

2616 HK

OW

HK$18

Innovent

1801 HK

OW

HK$33

Junshi

1877 HK

OW

HK$37

Source: Bloomberg, J.P. Morgan estimates

2

Asia Pacific

Equity Research

03 May 2019

Ling Wang

(852) 2800 8599

ling.wang@jpmorgan.com

Table of Contents

Executive Summary .................................................................3

Four recent Hong Kong Biotech IPOs – how do they stand

among the international peers ................................................6

Overview of China oncology market.......................................8

China biologics market ............................................................8

Biopharmaceutical market in China is still at an early stage and expects to have

strong growth ..........................................................................................................9

Strong industry tailwind for the biotechnology industry in China ...........................10

PD-1 and PD-L1 mAbs market overview...............................12

Mechanism of action .............................................................................................12

Key characteristics of PD-1/PD-L1 therapy ...........................................................12

Anti-PD-1 and PD-L1 mAbs are expected to become backbone therapy for cancer

treatment...............................................................................................................14

Global anti PD-1/PD-L1 market landscape.............................................................14

Competitive landscape in PD-1/PD-L1 mAB market in China................................14

Clinical trials under development for large indications...........................................15

Projections of PD-1/PD-L1 market size in China ...................................................16

Investment risks .....................................................................17

Companies ..............................................................................20

Beigene.................................................................................................................21

CStone Pharmaceuticals ........................................................................................39

Innovent Biologics (1801) .....................................................................................62

Shanghai Junshi Biosciences .................................................................................79

3

Asia Pacific

Equity Research

03 May 2019

Ling Wang

(852) 2800 8599

ling.wang@jpmorgan.com

Executive Summary

We are expanding our coverage of the China biologics industry. We are initiating

coverage on Shanghai Junshi (1877 HK - OW) and CStone (2616HK- OW) and

assuming coverage on BeiGene (6160 HK/BGNE US) and Innovent (1801 HK -

OW). As pioneers in the China’s biopharmaceutical industry, we believe these

companies provide good exposure to the fast growing China biologics market. The

PD-1/PD-L1 mABs of these four companies are expected to be among the first five

to be introduced to the market among the domestic players, and we expect these

companies to gain meaningful market share in this market. These companies also

have a strong drug development platform that enables sustained growth and future

innovations, driven by both organic growth and external partnerships.

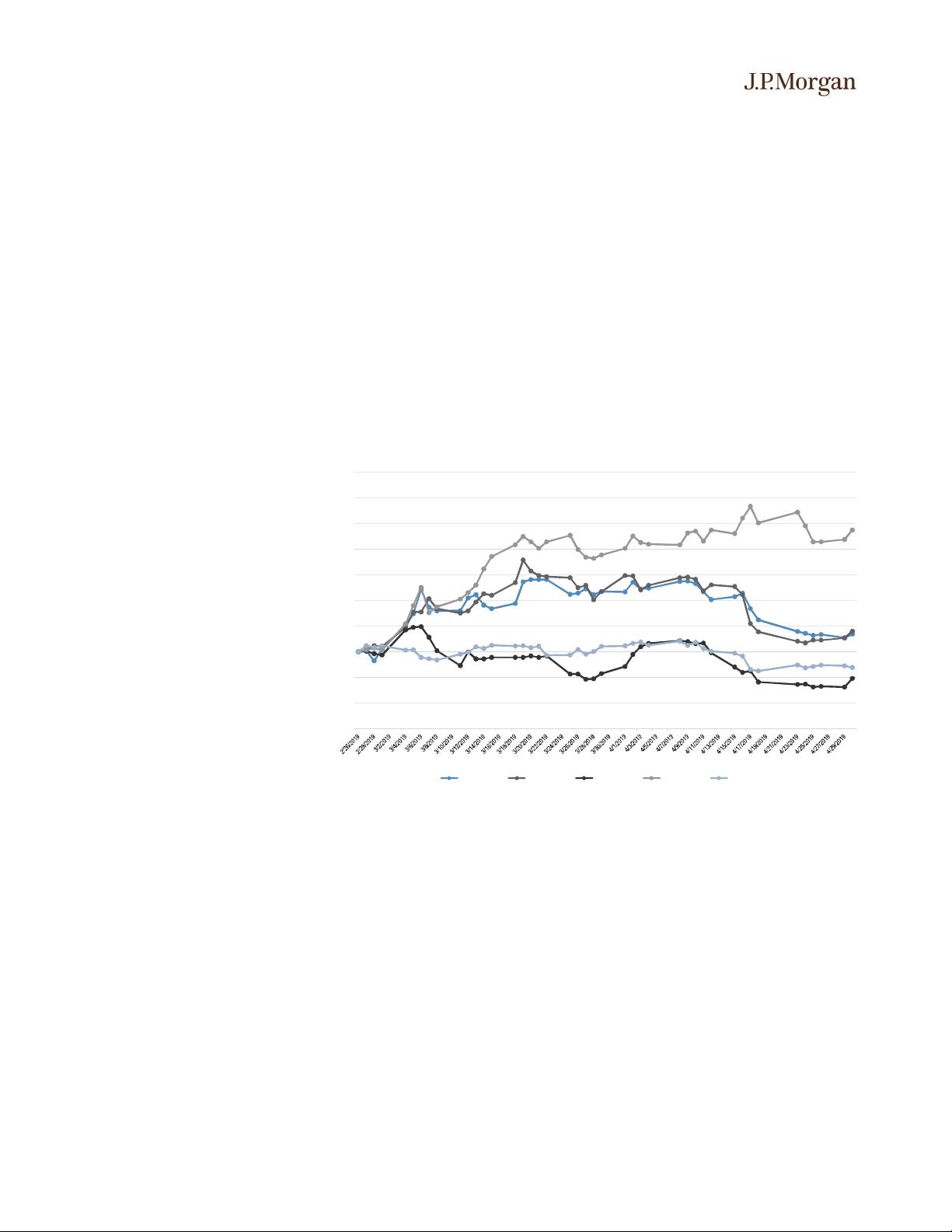

Figure 1: Stock relative performance

Source: Bloomberg.

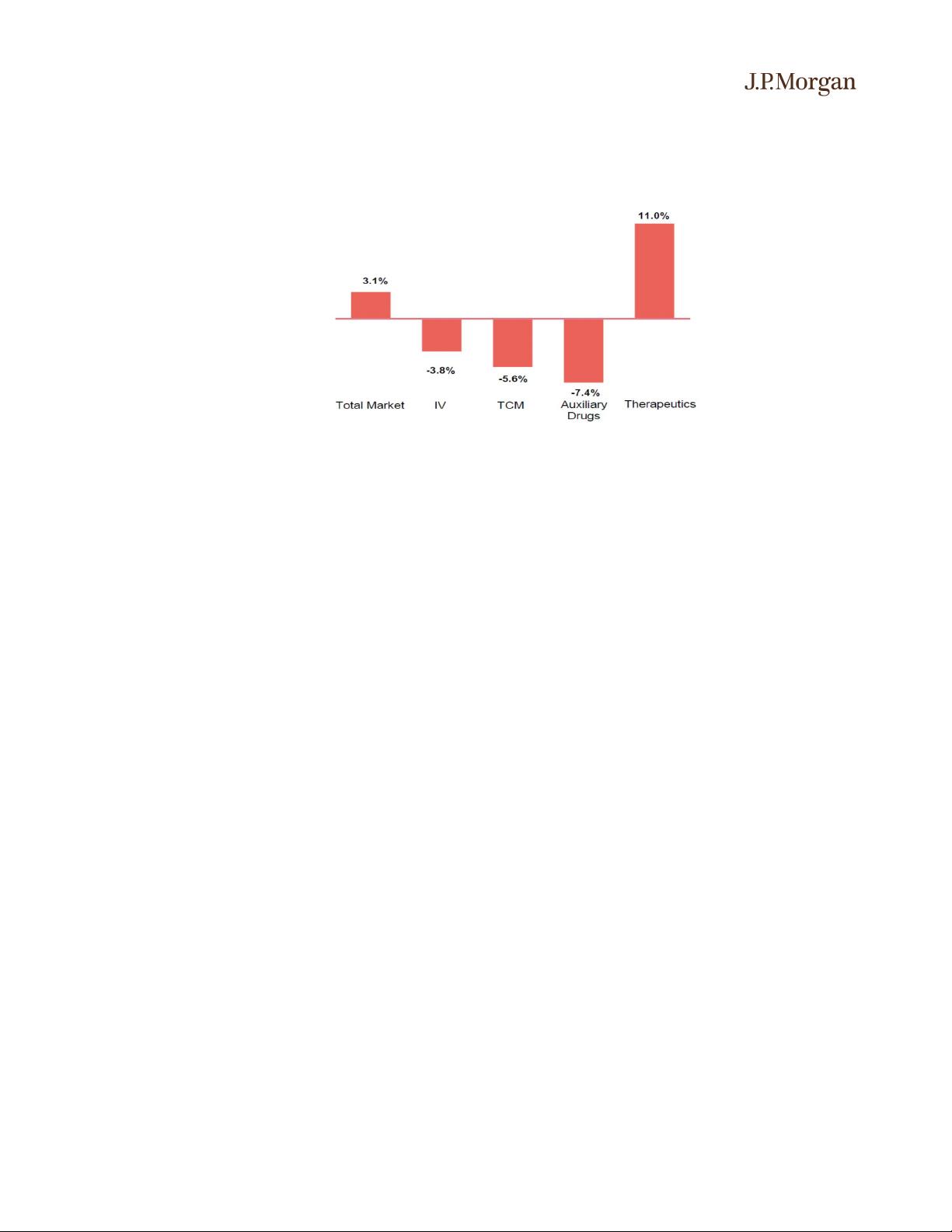

Fast growing China biologics market offers significant opportunities for

domestic and multi-national players

We expect strong growth for the China biologics market driven by a supportive

regulatory environment for innovative products, improved patient

access/reimbursement and huge demand for novel therapies. Within a broader trend

in China’s Pharmaceutical industry towards therapeutic drugs from more traditional

medications, we believe early signs of a shift from volume driven to innovation

driven growth are emerging. As an important component of innovative drugs, the

biologics market is still at a very early stage in China. Compared to the global level,

China lags in biologics innovation, with the majority of the market share (excluding

TCM) currently still dominated by generic products, thereby creating substantial and

sustainable opportunities for players developing innovative biologics.

70

80

90

100

110

120

130

140

150

160

170

2616 HK Equity 1801 HK Equity 6160 HK Equity 1877 HK Equity BTK Index

Key glossary

mAB – monoclonal antibodies

NMPA – National Medical Products

Administration (former CFDA)

NRDL - National Reimbursement Drug List

PD-1 – Programmed death protein 1

PD-L1 – Programmed death ligand 1

4

Asia Pacific

Equity Research

03 May 2019

Ling Wang

(852) 2800 8599

ling.wang@jpmorgan.com

Figure 2: Market growth is shifting towards therapeutics - Trend by category

Source: BeiGene Company Report & IQVIA

Our model projects PD-1/PD-L1 mAB market in China to reach Rmb79.9bn (or

US$11.6bn) revenue by 2030, big enough to support multiple winners

Immuno-oncology therapies (IOs) are expected to become the backbone therapies for

a wide variety of tumors due to their distinctive characteristics (broad efficacy &

good safety). While the global PD-1/PD-L1 inhibitors market has been growing

rapidly since the launch of the first anti-PD-1 MAB in 2014, and has already reached

over US$10bn revenues in 2018, China's PD-1/PD-L1 mAB market has just begun

emerging. Our market model projects the China PD-1/PD-L1 mABs market, if

successfully developed, to reach Rmb79.9bn (or US$11.6bn) revenue by 2030,

driven by increasing new cancer cases, improving national reimbursement (NRDL)

of innovative drugs & commercial insurance coverage, and potentially improving

efficacy by novel combinations. Over the long run, with the increased body of

clinical data from domestic PD-1/PD-L1 mABs and pricing advantage, we expect the

domestic players to take significant market share, while products from MNCs are

likely to be reserved for high-end patients with premium ability to pay.

Strong industry tailwind

The growth of the China biopharmaceutical industry has been fueled by increased

spending in the life sciences sector and the Chinese government’s favorable policies

to attract talent from overseas. Recently China’s regulatory environment has become

increasingly favorable for innovative drugs that address unmet medical needs by

significantly accelerating the new drug evaluation/approval process. Although

currently the efforts in boosting the Chinese biotech industry by the government have

not fully translated into biologics innovations (to the level of western countries), we

believe the efforts have created a strong basis for future innovation in the region. In

fact, we expect the four companies, although they are currently focused on fast

follow-ons and/or biosimilars, to rapidly develop and manufacture innovative

biologics once their R&D platform is upgraded and novel pipelines are established.

Investment risks

Generally speaking, the future of a high growth sector like China biotechnology,

which is full of changing opportunities, is associated with many uncertainties. In the

near to intermediate term, we believe execution risks, clinical, regulatory and

marketing risks as the key risks in investing in biopharmaceutical companies in

China. The China biopharmaceutical industry has, since inception, been driven by

favorable policy support by the Chinese government, and hence along with huge

5

Asia Pacific

Equity Research

03 May 2019

Ling Wang

(852) 2800 8599

ling.wang@jpmorgan.com

opportunities come significant risks. In our view, over the longer term, the main risk

in investing in the China biopharmaceutical industry lies in the uncertainties

surrounding the policies and macroeconomic factors. Additionally, the US/China

trade war might also impact the sustainable growth of the industry since

collaborations between Chinese companies and innovative biotech companies and

top academic centers in the US are likely an important source of future innovations.

The space is also in early stage of commercialization. News rather than earnings are

the key stock driver, with downside risks from development setbacks potentially

exacerbated without an earnings cushion.

Table 1: Stock performance (1M, 3M, YTD)

Stock performance

1M

3M

YTD

BeiGene

-

5%

-

4%

-

11%

CStone

-

11%

17%

17%

Innovent

-

16%

20%

4%

Junshi

5%

49%

32%

MSCI China index

0.1%

10%

28%

NYSE ARCA Biotech index (BTK)

-

10%

-

5%

10%

Source: Bloomberg.

剩余108页未读,继续阅读

资源推荐

资源评论

186 浏览量

2023-07-26 上传

2023-07-29 上传

2023-07-26 上传

2023-07-29 上传

146 浏览量

2023-07-29 上传

155 浏览量

2023-07-29 上传

2023-07-26 上传

2023-07-26 上传

153 浏览量

125 浏览量

168 浏览量

145 浏览量

155 浏览量

2023-07-28 上传

2023-07-28 上传

122 浏览量

120 浏览量

资源评论

2301_76429513

- 粉丝: 15

- 资源: 6728

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 员工培训需求调查问卷.doc

- 如何确定针对性的培训需求.doc

- 素质能力培训需求分析模型.doc

- 怎样进行有效的培训需求分析(doc 9).doc

- 制造业各工位培训需求.doc

- 做好培训需求分析,奠定企业员工培训的基础(DOC 8页).doc

- SQLSERVER2005卸载方法word文档doc格式最新版本

- MicrosoftSQLServer2008安装和数据库实例创建操作手册doc版冯冰最新版本

- 西电微机原理实验PDF

- P6ProfessionalSetup R24.12 安装包

- MicrosoftSQLServer2008数据库安装图解集合[特别整理版]最新版本

- 含光伏的储能选址定容模型 14节点 程序采用改进粒子群算法,对分析14节点配网系统中的储能选址定容方案,并得到储能的出力情况,有相关参考资料 这段程序是一个粒子群算法(Particle Swarm O

- PROGPPCNEXUS读写烧录刷写软件 飞思卡尔MPC55xx 56xx 57xx 58xx 没有次数限制

- 01_python_基本语法_纯图版.pdf

- 考虑新能源消纳的火电机组深度调峰策略 摘要:本代码主要做的是考虑新能源消纳的火电机组深度调峰策略,以常规调峰、不投油深度调峰、投油深度调峰三个阶段,建立了火电机组深度调峰成本模型,并以风电全额消纳为前

- EV3100电梯专用变频器源代码

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功