没有合适的资源?快使用搜索试试~ 我知道了~

巴克莱-美股-医疗保健行业-美国生命科学与诊断行业展望-13-397页.pdf

试读

397页

需积分: 0 0 下载量 71 浏览量

更新于2023-07-26

收藏 5.72MB PDF 举报

《美国生命科学与诊断行业展望:工具与诊断的避风港》

在医疗保健行业中,美国的生命科学工具与诊断行业被视为一个相对稳定的领域。2018年虽然以动荡收尾,但该行业仍然跑赢市场,实现了10%的增长,而同期S&P 500指数下跌了6%,这表明其具有一定的抵御风险能力。2019年的展望中,我们预计生命科学工具与诊断将继续保持强劲的增长势头。

生物制药行业将继续作为增长引擎。随着对研发投资的增加,生物制药公司对创新技术和差异化服务的需求不断增长,特别是在生物制品生产、伴随诊断(CDx)以及合同研究组织(CRO)的服务方面。近期的融资和投资数据显示出积极的态势,这为工具类公司的增长提供了有力支持。

全球范围内对学术研究的资金支持将推动生命科学工具行业的发展。学术研究的进步是创新技术的重要来源,持续的投入将有助于推动行业的长期增长。

然而,尽管医疗保健行业拥有可持续的长期增长动力,但我们对诊断领域的选择仍然谨慎。近年来国家实验室面临的挑战,如临床实验室公正性法案(PAMA)带来的价格削减和整合趋势,是我们关注的主要风险因素。这将对我们的实验室和诊断覆盖范围内的公司产生显著影响。

在我们2019年的展望报告中,我们特别关注了两个关键部分:

1. 冷冻电子显微镜(Cryo-EM)调查——分辨率革命:通过对17家客户的访谈和调查,我们发现Thermo Fisher Scientific收购FEI后的Cryo-EM技术在结构生物学研究中开辟了新的机会,客户反馈非常积极。结合Thermo Fisher的客户服务理念和战略,我们将其选为我们的首选股票。

2. Jack的工作板——推出生命科学工具与诊断职业追踪器:我们利用网络爬虫技术监控覆盖范围内公司的招聘活动。初期发布时,我们注意到MYGN(未上市)在基因检测领域的招聘活动增加,这可能预示着公司在这一领域的扩张和技术创新。

美国生命科学工具与诊断行业在2019年将面临机遇与挑战并存的局面。投资者应关注行业内的技术创新、市场需求以及政策影响,以做出明智的投资决策。同时,对于那些能够提供独特价值和应对市场变化的公司,如Thermo Fisher Scientific,可能蕴藏着更大的投资潜力。

Equity Research

3 January 2019

FOCUS

U.S. Life Science Tools & Diagnostics

2019 Outlook: Tools & Dx a Relative

Safe Haven, TMO Our New Top Pick

Looking into 2019, our view is that Life Science Tools & Diagnostics should continue

to be a relative safe haven in healthcare. While 2018 ended on a rocky note, the group

again outperformed the market – up 10%, vs the S&P 500 down 6%. Looking across

end markets, we believe biopharma will remain a growth engine supported by R&D

investment. The push toward personalized medicine drives demand for bioproduction,

CDx, and differentiated offerings from the CROs. Recent data on funding and

investment has been strong. Additionally, industrial macro datapoints provide 2-3

quarters of visibility into end market momentum, an important growth driver for our

Tools coverage. Next, global support for academic funding should continue to drive

LSD growth. Finally, while healthcare has sustainable long-term drivers of growth, we

remain selective in Dx given recent challenges at the national labs. PAMA remains a key

risk, where cuts and consolidation are major themes for our labs & Dx coverage.

We highlight several proprietary sections of our 2019 Outlook:

- Cryo-EM Survey – the Resolution Revolution, TMO Our Top Pick: Customer

feedback on Cryo-EM is very positive – further strengthening the strategic rationale of

Thermo Fisher’s FEI acquisition, and our conviction that the company can sustain peer-

leading growth into 2019. In 4Q18, we performed a series of interviews and survey of

17 customers. Feedback was very positive on how Cryo-EM at FEI is pioneering new

research opportunities in structural biology. Coupled with Thermo Fisher’s customer

value proposition and compelling strategy, we designate TMO as our Top Pick.

- Jack’s Job Board - Launching our Life Science Tools & Dx Careers Tracker: We are

using web-scraping to monitor hiring activity for our coverage universe. For our initial

publication, we highlight A) MYGN (UW): increased GeneSight sales rep openings,

almost 30% annualized since April. B) HOLX (EW): adding “Customer Success

Managers” at CynoSure, while GYN Surgical openings have increased. C) CROs: a

significant increase in the number of employees being hired, which could suggest an

approaching inflection in revenue growth. IQV’s (OW) hiring stands out among peers.

- Lab Survey Says: Network Access Drives Share Changes to Start 2019: We surveyed

primary care docs (n=50) on lab ordering patterns with upcoming network access

expansion. 1) Quest (OW) is expected to gain share (+570bp to 36.1%), predominantly

at the detriment of hospital based labs (-360bp to 19.8%). LabCorp (OW) is expected to

lose modest share (-80bp to 28.6%). 2) Quest and LabCorp were expected to gain

share with 16 and 22 physicians, respectively; a wide margin over hospital labs (3) and

other independent labs (1). 3) Regionally, Quest’s strength was broad-based.

Actions: We designate Thermo Fisher (TMO) as our Top Pick, and raise our PT to $280.

We also upgrade Bio-Rad (BIO) to OW. Finally, we lower our PTs on Myriad Genetics

(MYGN) to $21 and Syneos Health (SYNH) to $45.

In this report, we provide a comprehensive update on the Life Science Tools,

Diagnostics, Labs & CRO industries – including our proprietary end market trackers

and industry overviews. Please join us for a 2019 Outlook conference call today,

January 3, at 11:00am ET: Dial-in: 1-800-706-8249, Passcode: 7757098.

INDUSTRY UPDATE

U.S. Life Science Tools & Diagnostics

NEUTRAL

Unchanged

For a full list of our ratings, price target and

earnings changes in this report, please see

table on page 2.

U.S. Life Sc

ience Tools & Diagnostics

Jack Meehan, CFA

+1 212 526 3909

jack.meehan@barclays.com

BCI, US

Mitchell Petersen

+1 212 526 3367

mitchell.petersen@barclays.com

BCI, US

Andrew Wald

+1 212 526 9436

andrew.wald@barclays.com

BCI, US

Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with

companies covered in its research reports. As a result, investors should be aware that the

firm may have a conflict of interest that could affect the objectivity of this report. Investors

should consider this report as only a single factor in making their investment decision.

PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE

391.

Barclays | U.S. Life Science Tools & Diagnostics

3 January 2019 2

Summary of our Ratings, Price Targets and Earnings Changes in this Report (all changes are shown in bold)

Company

Rating

Price

Price Target

EPS FY1 (E)

EPS FY2 (E)

Old

New

31-Dec-18

Old

New

%Chg

Old

New

%Chg

Old

New

%Chg

U.S. Life Science Tools & Diagnostics

Neu

Neu

Bio-Rad Laboratories (BIO)

EW

OW

232.22

315.00

315.00

-

5.45

5.45

-

6.50

6.55

1

Myriad Genetics Inc. (MYGN)

UW

UW

29.07

23.00

21.00

-9

1.73

1.73

-

1.90

1.75

-8

Syneos Health, Inc. (SYNH)

EW

EW

39.35

51.00

45.00

-12

2.73

2.73

-

3.15

3.10

-2

Thermo Fisher Scientific, Inc. (TMO)

OW

OW

223.79

275.00

280.00

2

11.06

11.06

-

12.30

12.30

-

Waters Corp. (WAT)

EW

EW

188.65

190.00

190.00

-

8.05

8.05

-

9.05

9.30

3

Source: Barclays Research. Share prices and target prices are shown in the primary listing currency and EPS estimates are shown in the reporting currency.

FY1(E): Current fiscal year estimates by Barclays Research. FY2(E): Next fiscal year estimates by Barclays Research.

Stock Rating: OW: Overweight; EW: Equal Weight; UW: Underweight; RS: Rating Suspended

Industry View: Pos: Positive; Neu: Neutral; Neg: Negative

Barclays | U.S. Life Science Tools & Diagnostics

3 January 2019 3

TABLE OF CONTENTS

EXECUTIVE SUMMARY – NEUTRAL INDUSTRY VIEW ............................. 5

INVESTMENT POSITIVES ................................................................................. 9

INVESTMENT RISKS ........................................................................................ 22

CRYO-EM SURVEY: THE RESOLUTION REVOLUTION, TMO IS OUR

TOP PICK ............................................................................................................ 38

Background on FEI and the Opportunity in Cryo-EM ........................................................................ 38

The Resolution Revolution as a Driver of Market Demand .............................................................. 42

Biopharma Adoption Provides an Avenue for Future Demand ...................................................... 46

Thermo Fisher is the Dominant Player in Cryo-EM ............................................................................ 48

Mass Spec + Cryo-EM Opportunity Exists, but Remains Niche ...................................................... 52

NMR Viewed as Complementary, X-Ray Crystallography Viewed as a Competitor ................. 55

Funding Trends Remain Strong ............................................................................................................... 58

Gatan Takeaways: The Clear Leader in Direct Detection ................................................................. 62

JACK’S JOB BOARD: THE LIFE SCIENCE TOOLS AND DX CAREERS

TRACKER ........................................................................................................... 64

Myriad Genetics: Increased Turnover Among GeneSight Reps...................................................... 64

Hologic: CynoSure “Customer Success,” GYN Openings ................................................................. 66

CROs: Ready to Rip? Higher Hiring and Start-Up Employees .......................................................... 67

LAB SURVEY SAYS: NETWORK ACCESS DRIVES SHARE CHANGES TO

START 2019 ...................................................................................................... 70

COMPANY OUTLOOKS .................................................................................. 73

1) Agilent (A), Overweight/Neutral, $80 PT ........................................................................................ 73

2) Bio-Rad Labs (BIO), Overweight/Neutral, $315 PT ...................................................................... 85

3) Bruker (BRKR), Equal Weight/Neutral, $34 PT ............................................................................... 95

4) Charles River (CRL), Equal Weight/Neutral, $128 PT ................................................................ 102

5) Genomic Health (GHDX), Underweight/Neutral, $38 PT ......................................................... 108

6) Hologic (HOLX), Equal Weight/Neutral, $43 PT ......................................................................... 115

7) ICON (ICLR), Equal Weight/Neutral, $130 PT .............................................................................. 130

8) Illumina (ILMN), Overweight/Neutral, $370 PT .......................................................................... 136

9) IQVIA (IQV), Overweight/Neutral, $140 PT .................................................................................. 149

10) LabCorp (LH), Overweight/Neutral, $165 PT ............................................................................ 159

11) Mettler Toledo (MTD), Equal Weight/Neutral, $625 PT ......................................................... 173

12) Myriad Genetics (MYGN), Underweight/Neutral, $21 PT ...................................................... 180

13) PerkinElmer (PKI), Equal Weight/Neutral, $90 PT .................................................................... 208

14) PRA Health (PRAH), Overweight/Neutral, $115 PT ................................................................. 217

15) QIAGEN (QGEN), Overweight/Neutral, $43 PT ......................................................................... 223

16) Quest Dx (DGX), Overweight/Neutral, $117 PT ....................................................................... 233

17) Quidel (QDEL), Overweight/Neutral, $77 PT ............................................................................. 245

18) Syneos Health (SYNH), Equal Weight/Neutral, $45 PT ........................................................... 255

Barclays | U.S. Life Science Tools & Diagnostics

3 January 2019 4

19) Thermo Fisher (TMO), Top Pick, OW/Neutral, $280 PT ........................................................ 263

20) Waters (WAT), Equal Weight/Neutral, $190 PT ....................................................................... 280

LIFE SCIENCE TOOLS INDUSTRY OVERVIEW ........................................ 288

Life Science Tools Porter’s Five Forces ................................................................................................ 288

Company End Market and Mix Exposure............................................................................................ 289

Life Science Tools and Dx Market Share Analysis ............................................................................ 291

Chromatography Overview ($9 Billion Market) ................................................................................ 292

Mass Spectrometry Overview ($4 Billion Market)............................................................................ 293

Next Generation Sequencing Overview ($3 Billion Market) .......................................................... 297

Bioproduction Overview ($10 Billion Market) ................................................................................... 302

DIAGNOSTICS AND CLINICAL LABS INDUSTRY OVERVIEW ............ 308

Diagnostics Porter’s Five Forces ............................................................................................................ 308

Diagnostic Kits vs. Lab Developed Tests (LDTs) ............................................................................... 310

Test Quality Metrics .................................................................................................................................. 311

Clinical Laboratory Overview and Landscape .................................................................................... 311

Routine Testing Overview ....................................................................................................................... 313

Esoteric Testing: Molecular Dx, Companion Dx and Genomics ................................................... 314

Point of Care Testing ................................................................................................................................ 322

Core Lab Testing ........................................................................................................................................ 325

HCPCS Coding System & Top Test Trends ......................................................................................... 328

The HMO Framework for Diagnostics Reimbursement ................................................................. 334

CONTRACT RESEARCH ORGANIZATION (CRO) INDUSTRY

OVERVIEW ...................................................................................................... 336

Biopharma Services Industry Landscape ............................................................................................ 336

Porter’s Five Forces ................................................................................................................................... 336

The Trend Is Outsourcing ....................................................................................................................... 341

The Emergence of Strategic Resourcing ............................................................................................. 343

The Demand for Data and the “Next Generation CRO”.................................................................. 346

Performance Metrics: New Business, Cancellations, Net Book-to-Bill, and Revenue Burn ... 352

Barclays Biopharma R&D Tracker ......................................................................................................... 357

Barclays Biopharma Cash & Funding Trackers.................................................................................. 360

Barclays FDA Clinical Trials Tracker ..................................................................................................... 364

Drug Development Overview ................................................................................................................. 369

Central Laboratory Overview ................................................................................................................. 378

Outsourced Commercial Services ......................................................................................................... 380

Private Equity Interest .............................................................................................................................. 383

STOCK PRICE PERFORMANCE AND VALUATION ................................ 385

Stock Price Performance ......................................................................................................................... 385

Barclays | U.S. Life Science Tools & Diagnostics

3 January 2019 5

EXECUTIVE SUMMARY – NEUTRAL INDUSTRY VIEW

Looking into 2019, our view is that Life Science Tools & Diagnostics should continue to

be a relative safe haven in healthcare. While 2018 ended on a rocky note, the group again

outperformed the market – up 10%, vs the S&P 500 down -6%. Looking across end

markets, we believe the biopharma will remain a growth engine, supported by R&D

investment. The push toward personalized medicine drives demand for bioproduction, CDx,

and differentiated offerings from the CROs. Recent data on funding and investment has

been strong. Additionally, industrial macro datapoints provide 2-3 quarters of visibility into

end market momentum, an important growth driver for our Tools coverage. Next, global

support for academic funding should continue to drive LSD growth. Finally, while healthcare

has sustainable long-term drivers of growth, we remain selective in Dx given recent

challenges at the national labs. PAMA remains a key risk, where cuts and consolidation are

major themes for our labs & Dx coverage.

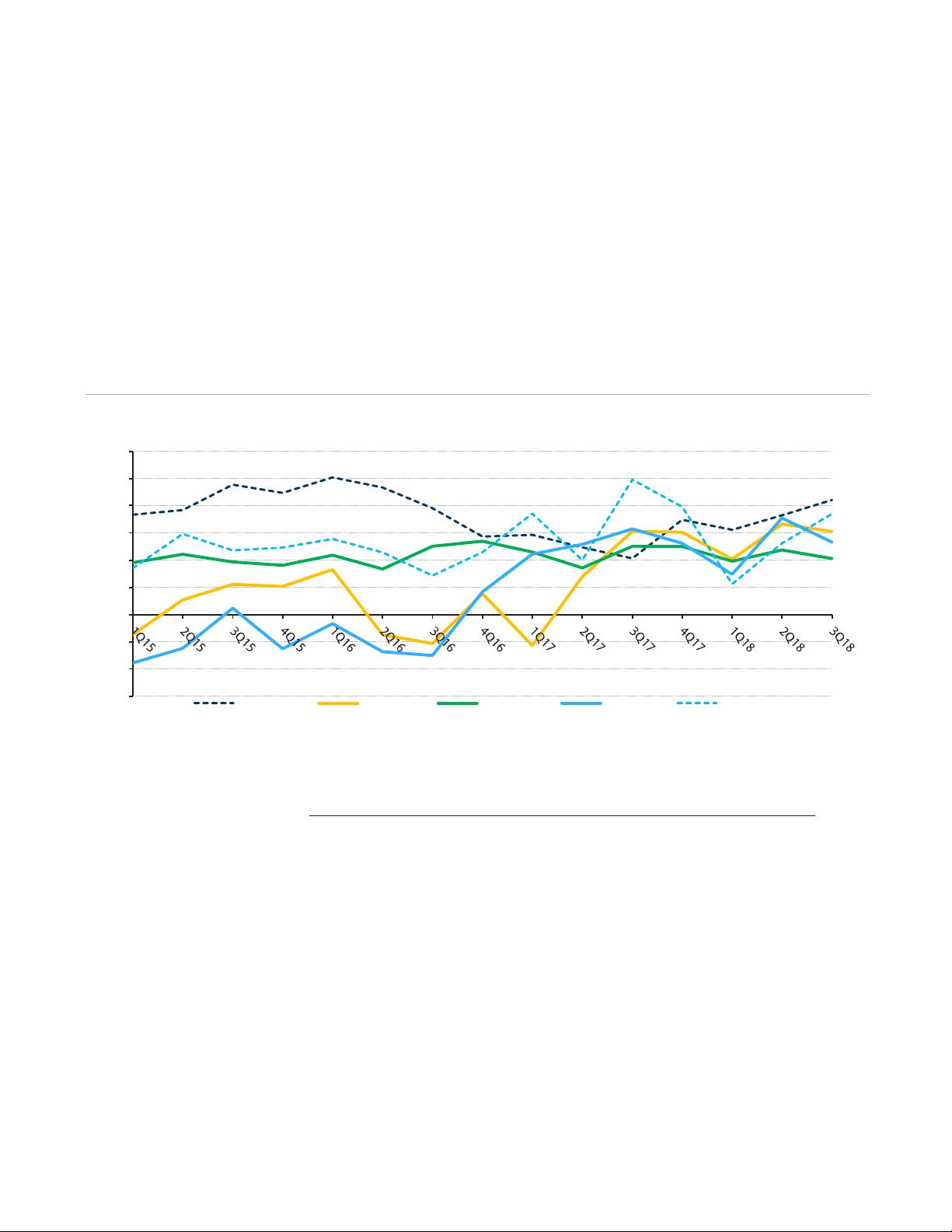

FIGURE 1

Organic Growth by End Market

Source: Company Documents, Barclays Research

Actions - We Make a Few Changes to our Recommendations and PTs:

Please see the following table for a summary thesis, as well as the company update

sections for full details:

Thermo Fisher (TMO): We designate as our Top Pick, and raise our PT to $280 (from

$275).

Bio-Rad (BIO): We upgrade to OW (from Equal Weight), and maintain out $315 PT

Myriad Genetics (MYGN): We lower our PT to $21 (from $23)

Syneos Health (SYNH): We lower our PT to $45 (from $51).

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

Biopharma

Academic

Healthcare

Industrial

Applied

剩余396页未读,继续阅读

资源推荐

资源评论

2023-07-28 上传

2021-04-08 上传

2023-07-26 上传

127 浏览量

2023-07-28 上传

2021-04-08 上传

105 浏览量

2021-04-08 上传

2023-07-26 上传

132 浏览量

2023-07-29 上传

128 浏览量

2023-07-26 上传

167 浏览量

173 浏览量

资源评论

xox_761617

- 粉丝: 29

- 资源: 7802

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 基于Springboot+Vue的影院订票系统的设计与实现-毕业源码案例设计(源码+数据库).zip

- 基于Springboot+Vue的疫情管理系统-毕业源码案例设计(高分项目).zip

- 基于Springboot+Vue的影城管理电影购票系统毕业源码案例设计(95分以上).zip

- 贝加莱控制系统常见问题手册

- uDDS源程序subscriber

- 基于Springboot+Vue的游戏交易系统-毕业源码案例设计(源码+数据库).zip

- 基于Springboot+Vue的在线教育系统设计与实现毕业源码案例设计(源码+论文).zip

- 基于Springboot+Vue的在线拍卖系统毕业源码案例设计(高分毕业设计).zip

- PDF翻译器:各种语言的PDF互翻译,能完美保留公式、格式、图片,还能生成单独或者中英对照的PDF文件

- 基于Springboot+Vue的智能家居系统-毕业源码案例设计(源码+数据库).zip

- 基于Springboot+Vue的在线文档管理系统毕业源码案例设计(源码+项目说明+演示视频).zip

- 基于Springboot+Vue的智慧生活商城系统设计与实现-毕业源码案例设计(95分以上).zip

- 基于Springboot+Vue的装饰工程管理系统-毕业源码案例设计(源码+项目说明+演示视频).zip

- 基于Springboot+Vue的租房管理系统-毕业源码案例设计(高分毕业设计).zip

- 基于Springboot+Vue电影评论网站系统设计毕业源码案例设计(高分项目).zip

- 基于Springboot+Vue服装生产管理系统毕业源码案例设计(95分以上).zip

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功