362

REVIEW OF ECONOMIC STUDIES

where

YI is the mean corrected return on holding the asset at time t, h, is the log volatility

at time

t which is assumed to follow a stationary process

(I

c/J

I< I) with h, drawn from

the stationary distribution,

CI and

1]1

are uncorrelated standard normal white noise shocks

and

%(.,.)is the normal distribution. The parameter

f3

or exp

(JJ

/2)

plays the role

of

the constant scaling factor and can be thought

of

as the modal instantaneous volatility,

c/J

as the persistence in the volatility, and aT/the volatility of the log-volatility.

For

indenti-

fiability reasons either

f3

must be set to one or

JJ

to zero. We show later that the param-

eterization with

f3

equal to one in preferable and so we shall leave

JJ

unrestricted when

we estimate the model but report results for

f3

= exp

(JJ

/2)

as this parameter has more

economic interpretation.

This model has been used as an approximation to the stochastic volatility diffusion

by Hull and White (1987) and Chesney and Scott (1989). Its basic econometric properties

are discussed in Taylor (1986), the review papers by Taylor (1994), Shephard (1996) and

Ghysels, Harvey and Renault (1996) and the paper by Jacquier, Polson and Rossi (1994).

These papers also review the existing literature on the estimation of SV models.

In this paper we make advances in a number of different directions and provide the

first complete Markov chain Monte Carlo simulation-based analysis

of

the SV model

(I)

that covers efficient methods for Bayesian inference, likelihood evaluation, computation

of

filtered volatility estimates, diagnostics for model failure, and computation

of

statistics

for comparing non-nested volatility models. Our study reports on several interesting find-

ings. We consider a very simple Bayesian method for estimating the SV model (based on

one-at-a-time updating

of

the volatilities). This sampler is shown to be quite inefficient

from a simulation perspective. An improved (multi-move) method that relies on an offset

mixture

of

normals approximation to a log-chi-square distribution coupled with an import-

ance reweighting procedure is shown to be strikingly more effective. Additional refinements

of the latter method are developed to reduce the number

of

blocks in the Markov chain

sampling. We report on useful plots and diagnostics for detecting model failure in a

dynamic (filtering) context. The paper also develops formal tools for comparing the basic

SVand

Gaussian and t-GARCH models. We find that the simple SV model typically fits

the data as well as more heavily parameterized

GARCH

models. Finally, we consider a

number

of

extensions

of

the SV model that can be fitted using our methodology.

The outline

of

this paper is as follows. Section 2 contains preliminaries. Section 3

details the new algorithms for fitting the SV model. Section 4 contains methods for simula-

tion-based filtering, diagnostics and likelihood evaluations. The issue

of

comparing the

SV and

GARCH

models is considered in Section 5. Section 6 provides extensions while

Section 7 concludes. A description of software for fitting these models that is available

through the internet is provided in Section 8. Two algorithms used in the paper are

provided in the Appendix.

2. PRELIMINARIES

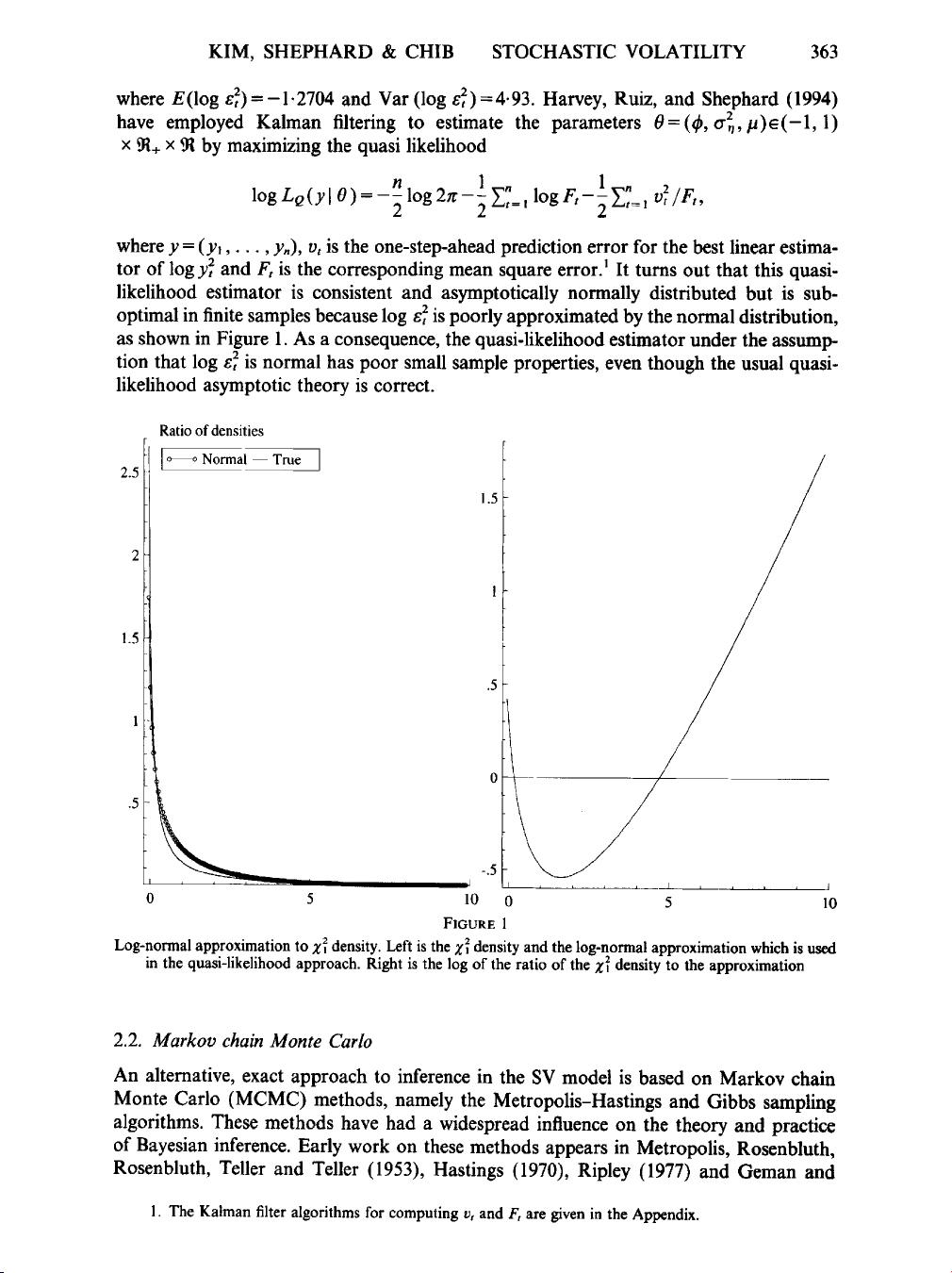

2.1. Quasi-likelihood method

A key feature

of

the basic SV model in (1) is that it can be transformed into a linear

model by taking the logarithm of the squares of observations

log

(2)

at University of Texas at Austin on October 5, 2011restud.oxfordjournals.orgDownloaded from

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功