没有合适的资源?快使用搜索试试~ 我知道了~

【20220208】中国电动汽车行业报告-巴克莱_90页_英.pdf

0 下载量 191 浏览量

2024-07-28

17:23:51

上传

评论

收藏 1.65MB PDF 举报

温馨提示

【20220208】中国电动汽车行业报告-巴克莱_90页_英.pdf

资源推荐

资源详情

资源评论

Equity Research

8 February 2022

China Technology

China Electric Vehicles: Not Just

Brawn, But Brain Too - Initiate LI, NIO

and XPEV at OW

We are initiating coverage of leading Chinese EV makers with

Overweight ratings. EVs and Smart Cars are among China’s top

national priorities and the TAM is not just China but the global

auto market.

We believe that the rapid adoption of EVs around the world and booming EV sales have

presented China’s EV makers a rare opportunity to not only take a sizable market share of the

domestic auto market – the largest in the world with about 25-30% global share by units sold

per annum – but also build a dominant position on the world stage. It is a national priority for

China to develop cutting-edge EV and autonomous driving technologies, and to export

competitive EVs around the world, as Chinese smartphone manufacturers have done in recent

years. Several leading EV makers have already started selling their products in Europe.

Not only is China the world’s largest auto market, its auto industry accounts for over one-

third of the global automotive profit pool. The enormous domestic profits available

incentivize China’s EV makers to invest heavily both in technologies and in manufacturing

capacity in order to stay ahead of the pack. In addition, the highly developed EV component

supply chain in China enables EV start-ups to scale quickly.

Compared to many countries in the world, including the US, China has one of the most

supportive and well-thought-out government policy agendas for the EV industry. Measures

such as qualified subsidies for EV purchases (low-quality EVs excluded), sales taxes waivers, free

and readily available “green” license plates, as well as a national carbon credit system for all

auto makers, EV or ICE, have been instrumental in helping achieve EV penetration of around

14% in the country today.

It is nearly impossible at this point to accurately envision what the future smart car may look

like, or who the eventual winners and losers will be. Innovations and capabilities in

autonomous driving and automobile robotics will ultimately decide the winners. With this

as a backdrop, we initiate coverage with an Overweight rating on three leading Chinese EV

makers: purpose-built EV producer Li Auto (LI), luxury early mover and battery innovator NIO

(NIO), and mass-market oriented and value-focused XPeng Motors (XPEV), and aim to closely

monitor their progress in developing cutting-edge smart car technologies and expanding their

product portfolios to address mass-market needs.

Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies

covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could affect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision.

Please see analyst certifications and important disclosures beginning on page 81 .

CORE

Initiating Coverage

#energyrevolution

China Technology

Jiong Shao, CFA

+1 212 526 5562

jiong.shao@barclays.com

BCI, US

Jesse Chao

+1 212 526 7518

jesse.chao@barclays.com

BCI, US

Lian Xiu (Roger) Duan

+1 212 526 4633

lianxiu.duan@barclays.com

BCI, US

China Technology

POSITIVE

U

nchanged

Completed: 07-Feb-22, 18:48 GMT Released: 08-Feb-22, 05:10 GMT Restricted - External

Barclays | China Technology

8 February 2022 2

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Electric Vehicle Landscape . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

EV Penetration rising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

China’s EV market is massive but crowded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

G

overnment policy historically an EV adoption driver . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Critical parts of the value chain in China . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Consumer adoption considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

New energy tech and alternative EV makers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Tesla in China . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

A complicated relationship . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Li Auto (LI) - Purpose-built for families to start . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Investment Thesis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Company Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Financials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

NIO Inc. (NIO) - Made in China luxury . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Investment Thesis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Company Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Financials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

XPeng Motors (XPEV) - Affordable and advanced . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Investment Thesis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Company Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Financials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

CONTENTS

8 February 2022 3

Barclays | China Technology

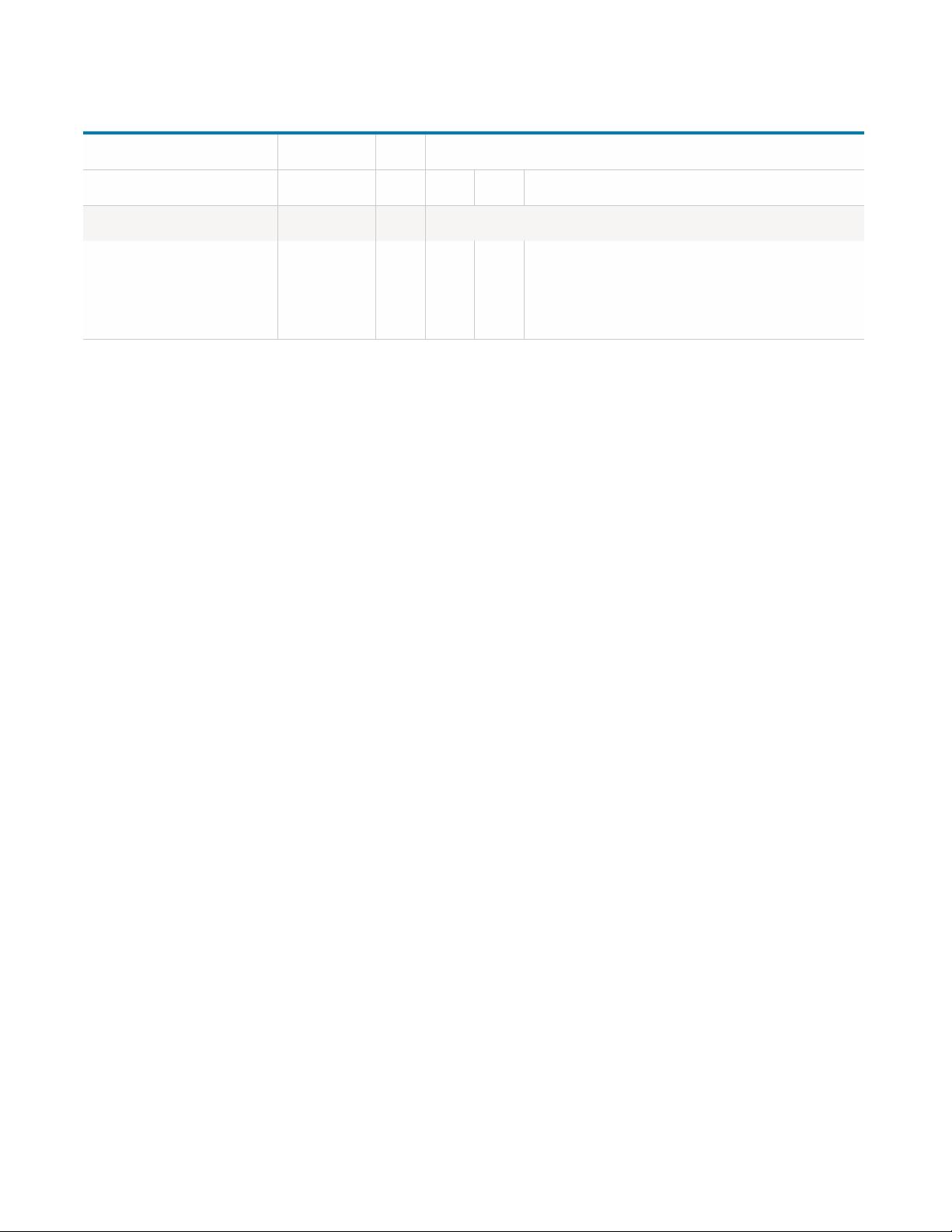

Summary of our Ratings, Price Targets and Earning Estimates

Rating Price Price Target EPS FY1 (E) EPS FY2 (E)

Company Old New 3-Feb-22 Old New %Chg Old New %Chg Old New %Chg

China Technology Pos Pos

Li Auto Inc (LI) NR OW 26.83 N/A 38.00 - N/A 0.51 - N/A 0.64 -

Nio Inc (NIO) NR OW 23.13 N/A 34.00 - N/A -1.52 - N/A -1.29 -

XPeng Inc (XPEV) NR OW 34.52 N/A 45.00 - N/A -6.66 - N/A -6.31 -

Source: Barclays Research. Share prices and target prices are shown in the primary listing currency and EPS estimates are shown in the reporting currency. FY1(E): Current

fiscal year estimates by Barclays Research. FY2(E): Next fiscal year estimates by Barclays Research. Stock Rating: OW: Overweight; EW: Equal Weight; UW: Underweight; RS:

R

ating Suspended Industry View: Pos: Positive; Neu: Neutral; Neg: Negative Potential +/-: Potential Upside/Downside 1 Percentage change in EPS relative to previous year.

8 February 2022 4

Barclays | China Technology

Valuation Methodology and Risks

China Technology

Li Auto Inc (LI / LI)

Valuation Methodology: Our price target of $38 is based on 25x FY23E nominal EBITDA of $1.5bn.

Risks which May Impede the Achievement of the Barclays Research Valuation and Price Target: 1.) EREV obsolescence faster than expected, may

face difficulty and margin pressure in transition to BEV maker. 2.) Unable to expand product portfolio beyond the Li ONE. 3.) Increased competition in

its price segment. 4.) Lack of communication from mgmt and falling behind competitors in international expansion efforts

Nio Inc (NIO / NIO)

Valuation Methodology: Our price target of $34 is based on 25x FY23E nominal EBITDA of $2.2bn.

Risks which May Impede the Achievement of the Barclays Research Valuation and Price Target: 1.) Unsuccessful at transitioning to an EV maker

for the masses. 2.) Increased competition in the luxury segment from incumbent international (i.e. German) brands). 3.) Falls behind on autonomous

driving in the intermediate term.

XPeng Inc (XPEV / XPEV)

Valuation Methodology: Our price target of $45 is based on 25x FY23E nominal EBITDA of $1.7bn.

Risks which May Impede the Achievement of the Barclays Research Valuation and Price Target: 1.) Broad portfolio of competitively priced

products creates difficulties achieving economies of scale, hampering profitability. 2.) Hybrid sales model undesirable in communicating value

proposition vs. competitors. 3.) Mass market tilt does not produce outperformance in units delivered.

Source: Barclays Research

8 February 2022 5

Barclays | China Technology

Executive Summary

We are initiating coverage of three leading Chinese EV players, LI, NIO, and XPEV with OW

ratings and price targets of $38, $34, and $45, respectively.

As China has been making giant strides in advancing its technologies across multiple sectors,

from communication equipment and internet to high-end manufacturing and renewable

energy, the Chinese government has been proactively planning for the next set of national

priorities: technologies the country should be focused on in the next few decades. New Energy

Vehicles – and Electric Vehicles in particular – are likely top of the list, for several reasons.

Firstly, China has failed, for the most part, to establish a competitive position in the global ICE

market. Despite China being the largest auto market in the world in recent years, with about 25

mm units sold in 2021 out of worldwide sales of about 80 mm, domestic players have relatively

low market share even in China, and their cars are rarely seen outside the country. This is in

stark contrast to many car-producing countries. A casual observer is likely to see mostly

European cars in Europe and Japanese cars in Japan.

Delving into the background of the missed ICE opportunity, we note that at the time when

demand for ICE cars took off in China roughly 20 years ago, the Chinese government had little

experience dealing with foreign auto makers, or trying to transfer core technologies into China

or motivate domestic players to come up with competitive technologies and products.

Furthermore, domestic auto players were not ready to launch anything remotely close to what

foreign players were offering. Fast forward to today, and foreign-branded cars (European,

Japanese, Korean and American) make up the majority of the cars sold in China, particularly in

higher-tier cities.

Today’s China is obviously not what it was 20 years ago, and nor are today’s Chinese companies,

supported by an exceptionally exuberant capital investment environment (venture capital,

private equity, sovereign wealth, etc.) Chinese authorities and Chinese companies appear

determined not to let the EV opportunity slip through their fingers. We also believe Chinese EV

makers have the global auto market squarely in their sights over the long term, sensing a rare

opportunity to export their products and go global, as many American, European, Japanese and

Korean companies have over the last century.

Chinese EV players hope to follow in the footsteps of Japanese and Korean auto makers over

the last 40 years, with the goal of someday becoming the largest auto maker in the US – a feat

Toyota has only recently accomplished. It will surely be a very long road, but given strong

support from the Chinese government and an underlying desire for Chinese manufacturers to

move away from making children’s toys and towards high-value and high-tech consumer

products, we believe these companies should have a decent shot at success. Some of these

companies have recently started selling their cars outside of China (e.g. NIO and XPEV in

Norway) and these early attempts bear close monitoring.

One cannot talk about the EV industry without paying due respect to Tesla, which is not only the

largest EV seller in the US, but also in China, having about 20% market share, which is

equivalent to NIO, LI and XPEV combined. We see a reasonable basis for drawing a parallel here

between the smartphone and EV industries. Early on, Apple led the way in smartphones with its

revolutionary iPhone, and a number of Android-based phone manufacturers led by Samsung

completely took over the industry once dominated by traditional cell phone manufacturers

such as Nokia, Motorola and Ericsson. At the time, Chinese manufacturers had very little

presence. A few years later, leveraging the massive domestic cell phone end market and robust

domestic component supply chain, Chinese brands such as Huawei and Xiaomi quickly

emerged as top 5 global smartphone manufacturers. In the case of EVs, we think Chinese

剩余89页未读,继续阅读

资源评论

制了个了个杖

- 粉丝: 26

- 资源: 499

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 基于微信小程序的校园商铺系统--论文-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.zip

- 家政项目小程序+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 基于微信小程序的校园综合服务平台ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 驾校管理系统+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 健身房私教预约微信小程序+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 基于微信小程序的新生报到系统--论文-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.zip

- 基于微信小程序的新生自助报到系统--论文-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.zip

- win32汇编环境,对话框程序中模态对话框与非模态对话框的区别

- 基于微信小程序的新生报到系统的设计与实现ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 警务辅助人员管理系统+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 酒店管理系统+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 健身房私教预约系统+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 基于微信小程序的药店管理系统-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.zip

- 基于微信小程序的学习资料销售平台--论文-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.zip

- 基于微信小程序的学生签到系统设计与实现ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

- 客家菜餐馆点菜系统+ssm-微信小程序毕业项目,适合计算机毕-设、实训项目、大作业学习.rar

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功