没有合适的资源?快使用搜索试试~ 我知道了~

【巴克莱-2024研报-】Global_Portfolio_Manager_s_Digest_Tricks.pdf

0 下载量 14 浏览量

2024-11-22

08:40:01

上传

评论

收藏 1.45MB PDF 举报

温馨提示

行业研究报告

资源推荐

资源详情

资源评论

This document is intended for institutional investors and is not subject to all of the

independence and disclosure standards applicable to debt research reports prepared for retail

investors under U.S. FINRA Rule 2242. Barclays trades the securities covered in this report for its

own account and on a discretionary basis on behalf of certain clients. Such trading interests

may be contrary to the recommendations oered in this report.

Barclays Capital Inc. and/or one of its ailiates does and seeks to do business with companies

covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could aect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision.

* This individual is a member of the Product Management Group and is not a Research Analyst

All research referenced herein has been previously published. You can view the full reports,

including analyst certifications and other required disclosures, by clicking the hyperlinks in this

publication or by going to our Research portal on Barclays Live.

FOR ANALYST CERTIFICATION(S) PLEASE SEE PAGE 37.

FOR IMPORTANT EQUITY RESEARCH DISCLOSURES, PLEASE SEE PAGE 37.

FOR IMPORTANT FIXED INCOME RESEARCH DISCLOSURES, PLEASE SEE PAGE 38.

Global Portfolio Manager's Digest

Tricks of the Trade

We provide context and perspective on research across regions

and asset classes, this week highlighting our analysis of the

economic impacts of a potential global trade war; key

takeaways from the Barclays Global Financial Services

Conference; and our latest FX & EM Macro Strategy Quarterly.

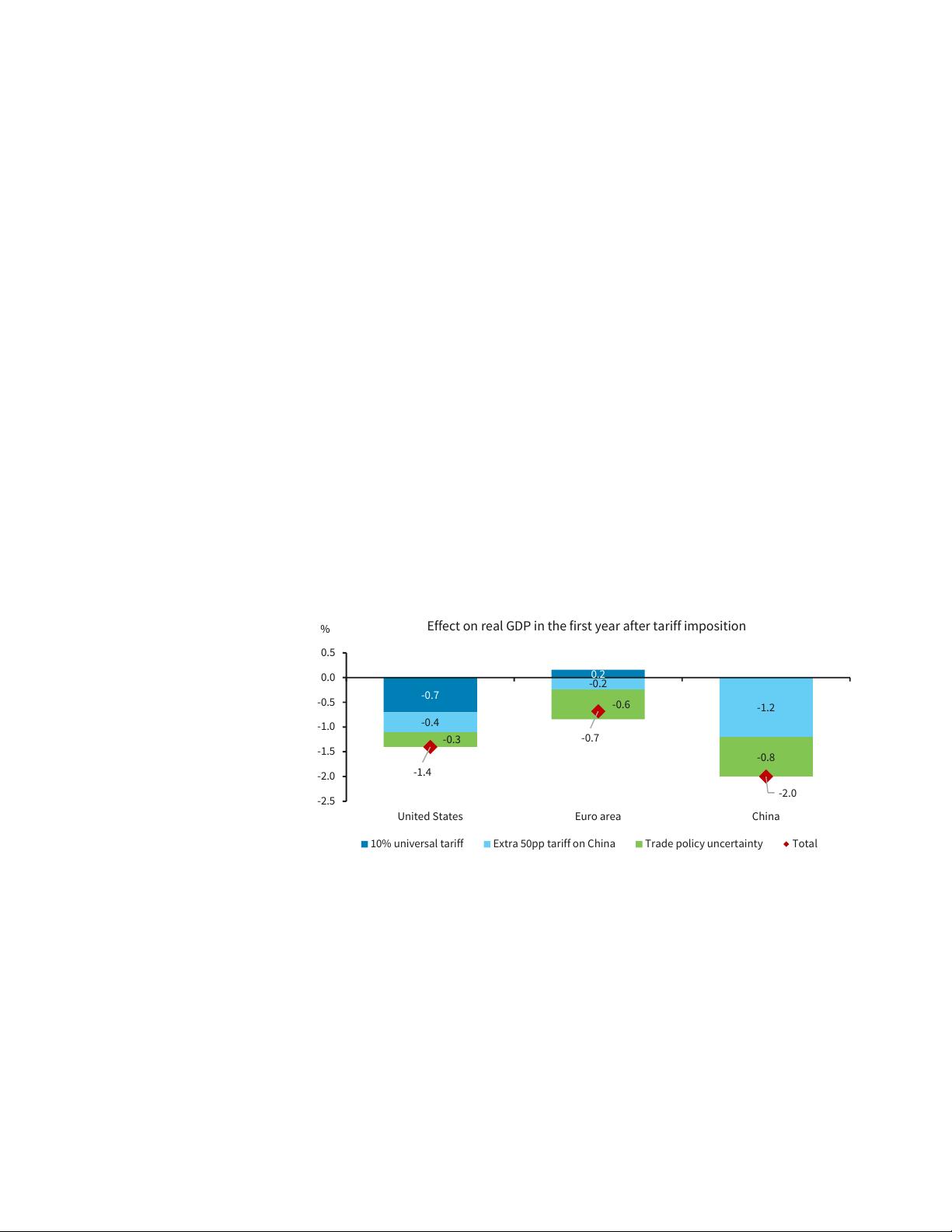

• Impacts of a Global Trade War: In our view, US tari increases to 60% and 10% on goods

imports from China and the RoW, respectively, as proposed by former President Trump,

would be a significant escalation of trade restrictions. Assuming symmetric retaliation from

all US trading partners, but accounting for dierent confidence eects, we estimate the eect

on the level of real GDP to be -2.0%, -1.4%, and -0.7% for China, the US, and the euro area

(EA), respectively, in the first 12 months. Inflation would rise in the short run, especially in the

US, by around 0.9pp, by our estimates, as the negative supply shock from higher taris

increases prices. US monetary policy would initially likely remain slightly tighter than in our

baseline of no tari increases, as inflation rises. But as activity starts weakening, amid trade

policy uncertainty and tighter financial conditions, we would expect the Fed to ease policy

rates more aggressively, possibly as much as 100bp. For the larger and more closed US

economy, the negative short-term eect would also likely more easily dissipate in the

following years. It could be more persistent for the more export-dependent China, EA, and

small open EM economies, especially if global trade tensions were to escalate beyond the

initial US tari increases.

• Global Financial Services Conference Takes: Despite loan growth remaining so and the

Fed widely expected to begin easing next week, most banks felt good about 2H24 net interest

income expectations as deposit trends show continued signs of stabilization. Still, investors

remain uncertain about how to think about 2025 net interest income. While fee income

should remain sound, some felt near-term trading and investment banking results could be a

little soer than expected; investment banking fees, however, should continue to rebound

Cross Asset Research

15 September 2024

FOCUS

Equity Product Management Group

Terence Malone

*

+ 1 212 526 7578

terence.malone@barclays.com

BCI, US

Rob Bate

*

+44 (0)20 7773 3576

rob.bate@barclays.com

Barclays, UK

FICC Product Management Group

Ben McLannahan

*

+44 (0)20 3134 9586

ben.mclannahan@barclays.com

Barclays, UK

Jennifer Cardilli

*

+1 212 526 8351

jennifer.cardilli@barclays.com

BCI, US

Completed: 13-Sep-24, 21:41 GMT Released: 15-Sep-24, 13:00 GMT Restricted - External

over the course of the next several quarters. On the expense front, while the theme of last

year’s Conference was stable expenses for 2024, it appears several banks are hanging their

hats on positive operating leverage for 2025. Asset quality trends appear relatively stable with

the lower-end consumer, though ALLY seemed to be an outlier on this front, while

idiosyncratic C&I and oice CRE remain the largest areas of near-term pressure. Lower

interest rates should aid CET1 ratios with AOCI and book value this quarter, while share

repurchase is expected to persist. Lastly, on M&A, while companies seemed to think bank

M&A makes sense in concept, hurdles remain.

• FX & EM Macro Strategy Quarterly Outlook: The market's intense focus on the Fed's

impending easing cycle rather than the notably weak economic momentum in Europe and

China has weighed on the dollar more than we had expected. That said, the bulk of dollar

weakness tends to occur ahead of the Fed easing cycles and the move has already been

chunky by historical standards. In addition, markets tend to overestimate Fed cuts during so

landings. We are still at a stage when bouts of further dollar weakness are likely, but a large

part of the dollar move is probably behind us. What is more, harder landings than currently

envisaged are also supportive for the greenback, as are lingering European (geo)political risk

and a still-uncertain US election. In all, we envisage a modest dollar recovery versus majors

once the market prices the Fed's cycle with more confidence and continued

underperformance of higher beta/small open economies. Poor macro prospects in Europe

and China leave open-economy currencies between a rock (US recession) and a hard place

(US outperformance). To that end, EM fixed income looks better placed for gains, thanks to

the Fed.

Chart of the Week: Tari increases with retaliation would likely reduce activity in the US, EA, and

China

-0.7

0.2

-0.4

-0.2

-1.2

-0.3

-0.6

-0.8

-1.4

-0.7

-2.0

-2.5

-2.0

-1.5

-1.0

-0.5

0.0

0.5

United States Euro area China

Effect on real GDP in the first year after tariff imposition

10% universal tariff Extra 50pp tariff on China Trade policy uncertainty Total

%

Numbers may not sum due to rounding.

Source: Barclays Research (see Global Trade: Taris: Counting the costs, 12 September 2024)

15 September 2024 2

Barclays | Global Portfolio Manager's Digest

Events

Conference Calls & Webcasts

Date Time Call/Webcast

Please click on the links to view details of forthcoming conference calls and webcasts

16 September 14:00 pm GMT / 9:00 am EST BoE preview: Mon 16 Sep

16 September 14:00 pm GMT / 9:00 am EST Fireside chat with Amadeus CEO

16 September 15:00 pm GMT / 10:00 am EST Lodging Post-Labor Day Expert Call with Jan Freitag of STR

16 September 15:30 pm GMT / 10:30 am EST Chesapeake (CHK) Fixed Income Virtual Meeting

16 September 15:30 pm GMT / 10:30 am EST Update on Temu, Tiktok Shops with Stuart Zhao, CEO at Bark and Meow Inc.

16 September 16:00 pm GMT / 11:00 am EST Industrials Weekly Call

17 September 12:45 pm GMT / 7:45 am EST Barclays Tuesday Credit Call

17 September 14:00 pm GMT / 9:00 am EST FOMC preview: 17 September

17 September 15:00 pm GMT / 10:00 am EST Monthly Thematic Investor Call - September 2024 (Adv. Recycling & Conference takeaways)

17 September 21:00 pm GMT / 4:00 pm EST Fixed Income Virtual Meeting with Dollar General Management

18 September 11:00 am GMT / 6:00 am EST UK Mid & Small Caps - Best Ideas

18 September 14:30 pm GMT / 9:30 am EST Devon Energy (DVN) Fixed Income Virtual Meeting

18 September 16:00 pm GMT / 11:00 am EST NKE FY1Q25 Preview & Sentiment Poll

18 September 16:00 pm GMT / 11:00 am EST Virtual Group Meeting with Coupang's IR Team

19 September 12:30 pm GMT / 7:30 am EST Thursday Macro: A global trade war?

20 September 15:00 pm GMT / 10:00 am EST The State of the US Spirits Industry | Expert call with Brian Kavalsky

20 September 15:00 pm GMT / 10:00 am EST Weekly Healthcare Call

20 September 15:00 pm GMT / 10:00 am EST What lessons do European wireless/wireline convergence hold for the US?

20 September 16:00 pm GMT / 11:00 am EST Bi-Weekly U.S. Soware Investor Call - 3Q24

23 September 15:00 pm GMT / 10:00 am EST Fixed Income Virtual Meeting with General Mills Management

26 September 7:00 am GMT / 14:00 pm Singapore Moody's on Indonesian Corporates and SOEs

27 September 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: ONT

27 September 15:00 pm GMT / 10:00 am EST State of Global Ingredients

27 September 15:00 pm GMT / 10:00 am EST Weekly Healthcare Call

30 September 14:00 pm GMT / 9:00 am EST Nestlé Fireside Chat with CEO, Mark Schneider & Warren Ackerman

30 September 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Sonova (SOON)

30 September 19:00 pm GMT / 2:00 pm EST TAVR and Structural Heart Expert Call

2 October 14:00 pm GMT / 9:00 am EST SLLBs: the latest innovation to hit the sustainable bond market

4 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Ambu (AMBUB)

7 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Carl Zeiss (AFX)

8 October 16:00 pm GMT / 11:00 am EST Fiber ABS with Fitch Ratings and Barclays ABS Structuring

9 October 19:00 pm GMT / 2:00 pm EST Fixed Income Virtual Meeting with Constellation Brands Management

10 October 14:00 pm GMT / 9:00 am EST Conversations with the C-Suite in EU MedTech & Services: Elekta (EKTAB)

11 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Fresenius SE (FRE)

15 September 2024 3

Barclays | Global Portfolio Manager's Digest

Conferences & Special Events

Date Event Location

Please contact your Barclays Sales representative for availability.

25–26 September Hybrids & Capital Conference London

26 September Data & Investment Science Conference London

26 September QIS Conference London

9–10 October Oicial Institutions Conference London

10 October Insurance Consolidators Conference 2024 London

20–21 November Global Automotive and Mobility Tech Conference New York

3–5 December Eat, Sleep, Play, Shop Conference New York

11–12 December Global Technology Conference San Francisco

Replays from the Past Week

Date Conference Call/Webcast/Conference

Please click on the links for select conference call replays and webcasts/podcasts from the past week.

13 September Asia Pulse: Ajay Rajadhyaksha, Barclays Research Chairman discussing the Q4 Global Outlook

12 September Barclays CEO Energy - Power Conference Takeaways & Highlights

12 September Q4 Global Outlook: Thursday, 12 September

12 September Life without Palm Oil: Fireside Chat with the CEO of C16 Biosciences

12 September Systematic Credit: Breaking Down Debt-Equity Investing

11 September Discussing RCS Messaging Rollout with Expert

11 September EM sovereign restructurings: What next?

10 September Barclays Tuesday Credit Call: Sour Start to September

10 September ECB preview: Tue, 10 Sep

9 September European credit: When to buy HY over IG?

6 September Weighing in on GLP-1 - EASD Edition

15 September 2024 4

Barclays | Global Portfolio Manager's Digest

FICC RESEARCH

Economics

Best of Barclays

Global Trade

Taris: Counting the costs

Christian Keller, Barclays, UK | Marc Giannoni, BCI, US | Jian Chang, Barclays Bank, Hong Kong |

Silvia Ardagna, Barclays, UK | Mark Cus Babic, BCI, US | Pooja Sriram, BCI, US | Yingke Zhou,

Barclays Bank, Hong Kong

Excerpted from Global Trade: Taris: Counting the costs,published on September 12, 2024

Tari increases by the US on China and the RoW would lead to output losses for all. Their

size and distribution depend on US trade exposure, retaliation measures and confidence

eects. China would be hardest hit, knocking ~2pp o growth, followed by the US and EA.

The downturn would lead the Fed and ECB to ease more.

US tari increases to 60% and 10% on goods imports from China and the RoW, respectively, as

proposed by former President Trump, would be a significant escalation of trade restrictions.

They would reverse decades of trade liberalisation, with consequences far beyond the 2018-19

US-China trade war.

Assuming symmetric retaliation from all US trading partners, but accounting for dierent

confidence eects, we estimate eect on the level of real GDP to be -2.0%, -1.4% and -0.7% for

China, the US and the euro area (EA), respectively, in the first 12 months. The US and China are

mostly hit by the direct impact through the trade channel, while for the EA, adverse confidence

eects play a significant role.

Inflation would rise in the short run, especially in the US, by around 0.9pp, as the negative

supply shock from higher taris increases prices. It would then revert down, aer the tari

increases have passed through prices and as demand weakens over time. In the EA, the

inflationary eects would be much more limited (0.1%), while in China the eect of higher

import prices would be more than oset by much weaker demand (-0.1%).

US monetary policy would initially likely remain slightly tighter than in our baseline of no tari

increases, as inflation rises. But as activity starts weakening, amid trade policy uncertainty and

tighter financial conditions, we would expect the Fed to ease policy rates more aggressively,

possibly as much as 100bp. We think the ECB would initially keep rates in line with the no-tari

baseline, but would then lower policy rates by 50bp more than in the baseline as activity

weakens.

For the larger and more closed US economy, the negative short-term eect would likely more

easily dissipate in the following years. It could be more persistent for the more export-

dependent China, EA and small open EM economies, especially if global trade tension were to

escalate beyond the initial US tari increases: for example, the RoW could impose taris as

protection against diverted Chinese goods flows due to the very high US taris.

15 September 2024 5

Barclays | Global Portfolio Manager's Digest

剩余43页未读,继续阅读

资源评论

soso1968

- 粉丝: 3330

- 资源: 1万+

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 风光柴储直流微网(并离网均可) 含: 永磁风机+整流 光伏发+boost+mppt 柴油机380V+整流 储能双向DCDC稳压直流母线800V 离网逆变器VF控制 0.85s时刻负荷突增20kW 波

- 西门子1200PLC大型项程序,生产线生产案例,包含气缸,通讯,机械手,模拟量等,各种FB块,可用来参考和学习 若能学懂这个,大型程序基本能独当一面 plc博图15以及以上,威纶通触摸屏,共计控制2

- GWO-LSTM多变量回归预测,灰狼算法优化长短期记忆网络的回归预测(Matlab) 1.data为数据集 2.MainGWO-LSTMNN.m为程序主文件,其他为函数文件无需运行 3.命令窗口输

- Abb万能密钥,带涂胶工艺包,选项快捷方便,可做工作站-涂胶

- 三菱PLC转盘机程序 三菱plc学习借鉴程序案例,没触摸屏 此程序已经实际设备上批量应用,程序成熟可靠,借鉴价值高,程序有注释,用的三菱fx3u系列plc 是入门级三菱PLC电气爱好从业人员借鉴和参

- 储能系统双向DCDC变器 双闭环控制 蓄电池充放电仿真模型有buck模式和boost模式,依靠蓄电池充放电维持直流母线电压平衡

- 软件使用:Matlab Simulink 适用场景:采用模块化建模方法,搭建14自由度整车模型,作为整车平台适用于多种工况场景 产品simulink源码包含如下模块: 工况: 阶跃工况 包含模块

- 无感FOC 滑膜观测器 算法采用滑膜观测器,启动采用Vf,全开源c代码,全开源,启动顺滑,提供原理图、smo推导过程及仿真模型

- 50KW储能逆变器变流器结构设计图源文件 SOLID WORKS工具格式 是基于高效、可靠、免维护的理念,开发的光伏储能产品,为家庭和工业不间断供电提供了灵活多样及安全可靠的系统解决方案 离并网一体

- Simulink仿真:基于DC DC双向变器的多电池主动均衡技术 关键词:锂电池;不一致性;模糊控制理论;DC DC双向主动均衡;荷电状态(SOC);均值-差值法 参考文献:基于DC DC双向变器的多

- 西门子1200立库机器人码垛机伺服视觉AGV程序 包括2台西门子PLC1215程序和2台西门子触摸屏TP700程序 PLC与工业相机视觉定位及机器人使用Modbus TCP通讯 PLC和码垛机Modb

- 声子晶体声表面波-等离子激元效应仿真案例文献复现Surface acoustic waves-localized plasmon interaction in pillared phononic cr

- 三菱FX3U PLC FX3U-485BD自由口跟23个上海众晨Z2000变频器通讯,读运行电流,写入设定频率;读RKC RD700温控表温度值,读电能表正向有功功率;程序简洁明了,注释详细 单PL

- 水处理程序,中文注释,内容齐全,风机,阀,传感器,PID样样齐全 汽车厂大程序,有很大参考借鉴意义值得你拥有

- OMRON CP1H PLC脉冲控制三轴伺服, 码垛机,实际项目,程序结构清析,有完整的注释,重复功能做成FB功能块,在其它项目可以导出直接用,MCGS触摸屏程序,有电气CAD图纸

- 新能源电池焊接1200程序 西门子PLC做的电池焊接程序,电池包里面有n*m行列个电池,主要功能: 1.每个电池的焊点坐标能够独立调整 2.每个电池的焊接能量可独立选择 3.任意一个或者多个电池可以随

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功