没有合适的资源?快使用搜索试试~ 我知道了~

【巴克莱-2024研报-】Global_Portfolio_Manager_s_Digest_Striking.pdf

0 下载量 191 浏览量

2024-11-22

08:40:01

上传

评论

收藏 1.1MB PDF 举报

温馨提示

行业研究报告

资源推荐

资源详情

资源评论

This document is intended for institutional investors and is not subject to all of the

independence and disclosure standards applicable to debt research reports prepared for retail

investors under U.S. FINRA Rule 2242. Barclays trades the securities covered in this report for its

own account and on a discretionary basis on behalf of certain clients. Such trading interests

may be contrary to the recommendations oered in this report.

Barclays Capital Inc. and/or one of its ailiates does and seeks to do business with companies

covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could aect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision.

* This individual is a member of the Product Management Group and is not a Research Analyst

All research referenced herein has been previously published. You can view the full reports,

including analyst certifications and other required disclosures, by clicking the hyperlinks in this

publication or by going to our Research portal on Barclays Live.

FOR ANALYST CERTIFICATION(S) PLEASE SEE PAGE 31.

FOR IMPORTANT EQUITY RESEARCH DISCLOSURES, PLEASE SEE PAGE 31.

FOR IMPORTANT FIXED INCOME RESEARCH DISCLOSURES, PLEASE SEE PAGE 32.

Global Portfolio Manager's Digest

Striking a Balance

We provide context and perspective on research across regions

and asset classes, this week highlighting our thoughts on what

could turn sentiment positive on the "AI trade"; adjusting our

call following the Fed's decision to cut rates by 50bp; and what

the Fed's move means for Asia markets.

• What's Next for the "AI Trade": The bull case around AI boils down to a simple concept: if

scaling laws hold and frontier model performance continues to improve at great leaps over

coming generations, then end-user products in consumer and enterprise will similarly

improve greatly in terms of functionality and accuracy and adoption will increase. To that

end, we see GPT-5’s upcoming release as a potential catalyst to get things going again. If

successful, sentiment could shi greatly, AI hyperscaler capex would need to ramp further,

and all this investment will likely end up being another expensive moat for mega-cap tech.

Further, we think that another recent breakthrough around test-time-compute could usher in

a new sub-category of frontier AI lab innovation around finding a more optimal mix of training

and inference compute, which could dramatically reduce the capex needs of the overall

industry, but it's too early to tell. An alternative view, and much more bearish take, is that

scaling laws don’t hold up, the foundation models stop improving, and the capex wave stops.

In this scenario, GPT-5 would likely be introduced in late 2024 or early 2025 to great fanfare,

only to see the same kind of experimental enterprise AI workloads running on top of it but no

killer apps or broad-based consumer/enterprise adoption.

• The Fed's Recalibration: The FOMC initiated its rate-cutting cycle with a 50bp cut, against

our expectation of a 25bp cut, in an eort to recalibrate the policy stance and to maintain the

labor market at full employment. We think that the FOMC statement suggested that future

rate cuts are likely to be in 25bp steps, by showing no alarm about the cooling labor market,

and mentioning that risks to achieving "employment and inflation goals are roughly in

balance." The new Summary of Economic Projections (SEP) also suggested a slower pace of

Cross Asset Research

22 September 2024

FOCUS

Equity Product Management Group

Terence Malone

*

+ 1 212 526 7578

terence.malone@barclays.com

BCI, US

Rob Bate

*

+44 (0)20 7773 3576

rob.bate@barclays.com

Barclays, UK

FICC Product Management Group

Ben McLannahan

*

+44 (0)20 3134 9586

ben.mclannahan@barclays.com

Barclays, UK

Jennifer Cardilli

*

+1 212 526 8351

jennifer.cardilli@barclays.com

BCI, US

Completed: 20-Sep-24, 23:05 GMT Released: 22-Sep-24, 13:00 GMT Restricted - External

rate cuts ahead. Considering this large cut and the new SEP, we adjust our rate call. We

continue to expect that the FOMC will cut rates 25bp at the November and December

meetings, as well as three times in 2025 – in March, June, and September. However, given the

larger-than-expected rate cut, our forecast interest-rate path is now 25bp lower, reaching

4.25-4.50% at end-2024, and 3.50-3.75% at end-2025.

• What 50bp Means for Asia Markets: We examined the impact of the Fed's rate decision on

Asian markets and central bank policy. We do not rule out further bouts of USD weakness in

the weeks ahead and expect overall downward pressure on USD/Asia FX to be sustained.

Much had been priced in, in terms of Asian FX gains ahead of the Fed decision, yet the USD

remains a sell on rallies versus Asia FX. We maintain our view that aer further USD/Asia FX

weakness in Q4, there will be a reversal into 1H25. Further, we think the presumed USDJPY

recovery next year may have become front loaded if markets' peak dovishness proves to have

already passed. However, Japan's LDP election on 27 September poses some risks to the JPY.

Moreover, we expect Asia credit to trade with a firm tone. To that end, we expect the recent

HY-IG decompression to pause and expect investors to add risk through longer-dated bonds.

In the short term, the recalibration in bonds is likely to be the main driver of cross-asset price

action. For global equities, we expect this to translate into a continued bid for lagging value

plays as growth stocks will remain challenged on valuations and crowding.

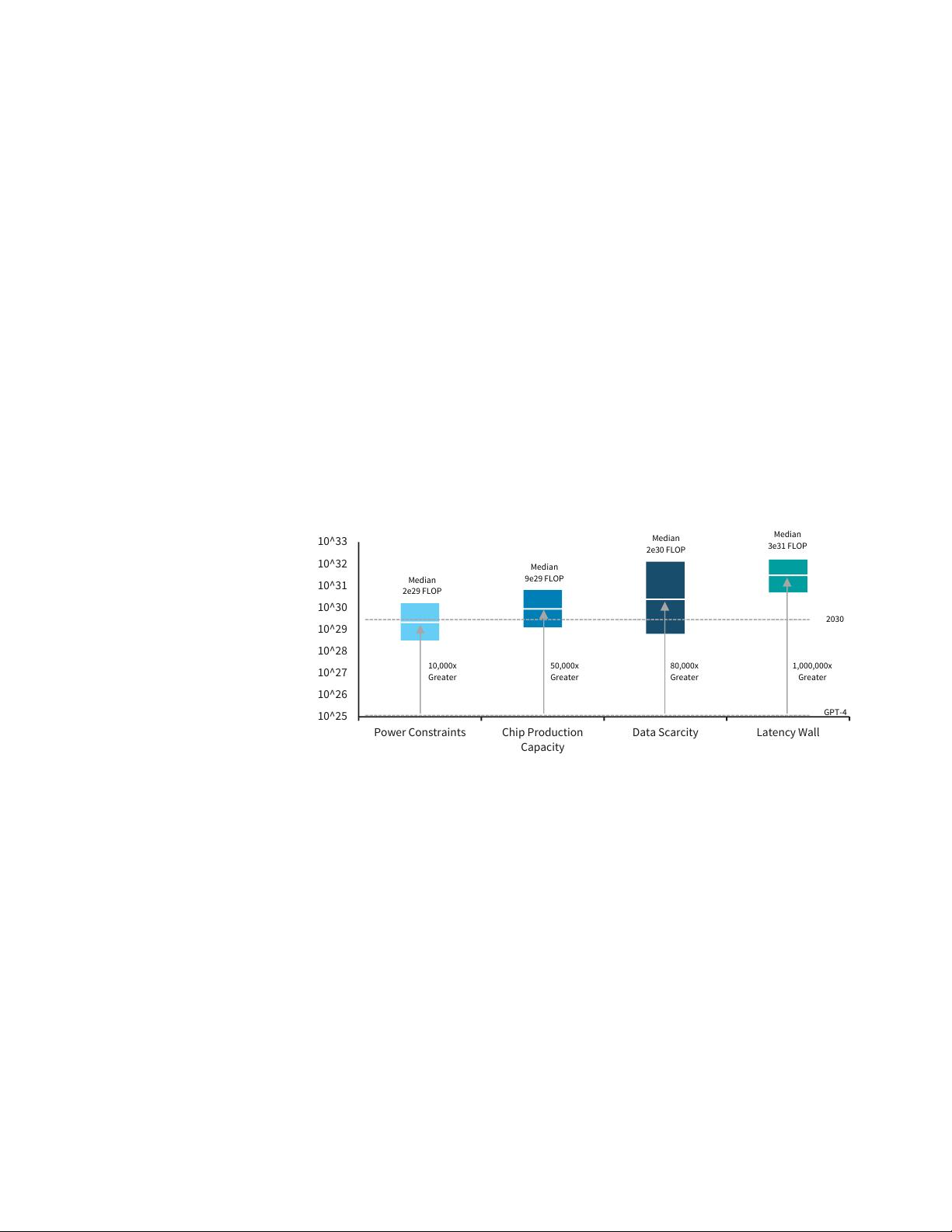

Chart of the Week: Epoch AI estimates we could see compute increase by 4x per year through 2030, or

10,000x more compute than GPT-4 (2022), clusters of "dozens of millions" of GPUs

10^25

10^26

10^27

10^28

10^29

10^30

10^31

10^32

10^33

Power Constraints Chip Production

Capacity

Data Scarcity Latency Wall

2030

GPT-4

10,000x

Greater

50,000x

Greater

80,000x

Greater

1,000,000x

Greater

Median

2e29 FLOP

Median

9e29 FLOP

Median

2e30 FLOP

Median

3e31 FLOP

Source: Epoch AI, Barclays Research (see U.S. Internet & Semiconductors: What's Next in AI? GPT-5, MOAR GPUs, Test-Time-

Compute, and Avoiding the AI Winter, 17 September 2024)

22 September 2024 2

Barclays | Global Portfolio Manager's Digest

Events

Conference Calls & Webcasts

Date Time Call/Webcast

Please click on the links to view details of forthcoming conference calls and webcasts

23 September 15:00 pm GMT / 10:00 am EST Fixed Income Virtual Meeting with General Mills Management

23 September 16:00 pm GMT / 11:00 am EST Weekly Industrials Call

24 September 8:30 am GMT / 15:30 pm Singapore Shiing China bid as Asia credit market transforms

24 September 12:45 pm GMT / 7:45 am EST Barclays Tuesday Credit Call

26 September 7:00 am GMT / 14:00 pm Singapore Moody's on Indonesian Corporates and SOEs

27 September 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: ONT

27 September 15:00 pm GMT / 10:00 am EST State of Global Ingredients

27 September 15:00 pm GMT / 10:00 am EST Weekly Healthcare Call

30 September 14:00 pm GMT / 9:00 am EST Nestlé Fireside Chat with CEO, Mark Schneider & Warren Ackerman

30 September 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Sonova (SOON)

30 September 19:00 pm GMT / 2:00 pm EST TAVR and Structural Heart Expert Call

2 October 14:00 pm GMT / 9:00 am EST SLLBs: the latest innovation to hit the sustainable bond market

4 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Ambu (AMBUB)

7 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Carl Zeiss (AFX)

8 October 10:00 am GMT / 17:00 pm Hong Kong Asia corporate governance: progress and prospects

8 October 16:00 pm GMT / 11:00 am EST Chesapeake (CHK) Fixed Income Virtual Meeting

8 October 16:00 pm GMT / 11:00 am EST Fiber ABS with Fitch Ratings and Barclays ABS Structuring

9 October 9:00 am GMT / 16:00 pm Singapore Shenzhen Inovance IR Virtual Fireside Chat

9 October 19:00 pm GMT / 2:00 pm EST Fixed Income Virtual Meeting with Constellation Brands Management

10 October 14:00 pm GMT / 9:00 am EST Conversations with the C-Suite in EU MedTech & Services: Elekta (EKTAB)

10 October 16:00 pm GMT / 11:00 am EST Global Aerospace & Defense 3Q24 Earnings Preview

11 October 15:00 pm GMT / 10:00 am EST Conversations with the C-Suite in EU MedTech & Services: Fresenius SE (FRE)

15 October 15:00 pm GMT / 10:00 am EST U.S. Machinery & Construction 3Q24 Earnings Preview

Conferences & Special Events

Date Event Location

Please contact your Barclays Sales representative for availability.

25–26 September Hybrids & Capital Conference London

26 September Data & Investment Science Conference London

26 September QIS Conference London

9–10 October Oicial Institutions Conference London

10 October Insurance Consolidators Conference 2024 London

20–21 November Global Automotive and Mobility Tech Conference New York

3–5 December Eat, Sleep, Play, Shop Conference New York

11–12 December Global Technology Conference San Francisco

22 September 2024 3

Barclays | Global Portfolio Manager's Digest

Replays from the Past Week

Date Conference Call/Webcast/Conference

Please click on the links for select conference call replays and webcasts/podcasts from the past week.

19 September European Fixed Income: Rates and credit Q4 outlook

19 September Thursday Macro: On the brink of a global trade war?

18 September EM Horizons: Quarterly Outlook

18 September Nike, Inc.: FY1Q25 Preview: See NA Upside Oset by Growing China Uncertainty

17 September Barclays Tuesday Credit Call: Rate Cut Conundrum

17 September FOMC preview: 17 September

17 September HY-Lights Creditcast: Verizon Acquisition of Frontier; Recent HY Telecom Rally

17 September KOL Call #2: Focus on Achondroplasia post ApproaCH data

17 September Monthly Thematic Investor Call - September 2024 (Adv. Recycling & Conference takeaways)

16 September BoE preview: Mon 16 Sep

16 September KOL Call #1: Focus on Achondroplasia post ApproaCH data

16 September Update on Temu, TikTok Shops with Stuart Zhao, Bark and Meow Inc CEO

22 September 2024 4

Barclays | Global Portfolio Manager's Digest

EQUITY RESEARCH

U.S. Internet

Positive

U.S. Semiconductors &

Semiconductor Capital Equipment

Neutral

Best of Barclays

U.S. Internet & Semiconductors

What's Next in AI? GPT-5, MOAR GPUs, Test-Time-Compute, and Avoiding

the AI Winter

Ross Sandler, BCI, US | Trevor Young, CFA, BCI, US | Alex Hughes, BCI, US | Joseph Petroline, BCI,

US | Michael DiSanto, BCI, US | Tom O'Malley, BCI, US | Scott Fessler, BCI, US | Kyle Bleustein,

BCI, US

Excerpted from U.S. Internet & Semiconductors: What's Next in AI? GPT-5, MOAR GPUs, Test-Time-

Compute, and Avoiding the AI Winter,published on September 17, 2024

The investment community has soured a bit on AI based on the slow end-user adoption,

high cost to serve, and capex vs. revenue mismatch. While this kind of time lag is normal

for big technology transitions, in this report we take a stab at “where could we go from

here?” and what could turn sentiment back up.

The Key Take-Away: The market cap exposed to “the AI trade” is enormous, with five of the

largest companies in the world duking it out for pole position. The fate of the NASDAQ (and to a

lesser degree the S+P 500) depends on which way “the AI trade” goes over coming quarters and

years. We have already seen a quick sentiment shi following the publishing of our first in this

series of AI reports (see “FOMO or Field-Of-Dreams,” from June). Some in the investment

community (including us) are currently asking: Are we entering a trough of disillusionment or just

in an air pocket? What could bring back the animal spirits witnessed in 2023 and early 2024? This

report attempts to predict what could play out next in AI. We unpack a bunch of new important

things that help explain where we are on the AI capacity vs. uptake debate, key things that

could impact future compute needs, and clear up some of the confusion given the limited

disclosures from the biggest players in the space.

We were somewhat taken aback when Character.ai more or less threw in the towel and its

senior sta joined Google. Aer all, their founder was a lead inventor of the transformer back in

the day at Google (the “T” in GPT), and Character.ai was generally perceived to be the #2

company in the consumer AI space behind ChatGPT, measured by users and engagement. Aer

similar high-profile flame-outs at Inflection and others, it begs the question of whether the cost

of compute in AI is just too great, and more broadly if we are headed into an “AI Winter” or if

these are simply normal bumps along the road for any new space riddled with start-ups. We

think the latter. We see more catalysts, like the GPT-o1 model release from OpenAI this past

week, coming over the next few months that could re-invigorate bullish investor sentiment.

22 September 2024 5

Barclays | Global Portfolio Manager's Digest

剩余37页未读,继续阅读

资源评论

soso1968

- 粉丝: 2669

- 资源: 1万+

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- ResNet-50 是一个深度卷积神经网络架构,常用于图像识别任务 它是 ResNet 系列网络中的一个变种,具有 50 层深度 ResNet-50以其深度残差连接结构而闻名,这种结构允许网络训练更深

- java前后端分离vue个人博客系统源码数据库 MySQL源码类型 WebForm

- 基于ESP8266和继电器模块实现远程控制电脑电源(网页界面远程开关机).zip

- 卷积神经网络研究综述-周飞燕

- Jesse的个人博客,以梦为马,不负韶华 技术栈:HTML、CSS、JavaScript、TypeScipt、Vue、React、Angular、Node、Hybrid App、数据结构与算法等

- Mars 是微信官方的终端基础组件,是一个使用 C++ 编写的业务性无关、平台性无关的基础组件 目前已接入微信 Android、iOS、Mac、Windows、WP 等客户端

- 零基础入门计算机图形学必不可少的在线网络公开课,手把手教您现代 OpenGL 的点点滴滴,构建爆款游戏引擎 基于 OpenGL 的 3D 游戏引擎,开发出爆款开源游戏

- 基于JavaFX的UI组件库-含常用的UI组件-快速构建JavaFX应用程序界面+使用说明.zip

- 基于Java和Kotlin的炉石传说自动化脚本项目源码+说明文档.zip

- 基于Laravel开源免费的自媒体商城博客CMS企业建站系统

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功