www.jpmorganmarkets.com

North America Equity Research

09 July 2019

Equity Ratings and Price Targets

Date

Date

Source: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 08 Jul 19.

Earnings Preview

Focus Remains on Sustainability of Parts & Services

Strength; Raise FY Estimates on Favorable Rates

Autos & Auto Parts

Rajat Gupta

AC

(1-212) 622-6382

rajat.gupta@jpmorgan.com

Ryan Brinkman

(1-212) 622-6581

ryan.j.brinkman@jpmorgan.com

Daniel J Won

(1-212) 622-3221

daniel.j.won@jpmorgan.com

J.P. Morgan Securities LLC

page 22 for analyst certification and important disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aw

the firm may have a conflict of interest that could affect th

e objectivity of this report. Investors should consider this report as only a single

factor in making their investment decision.

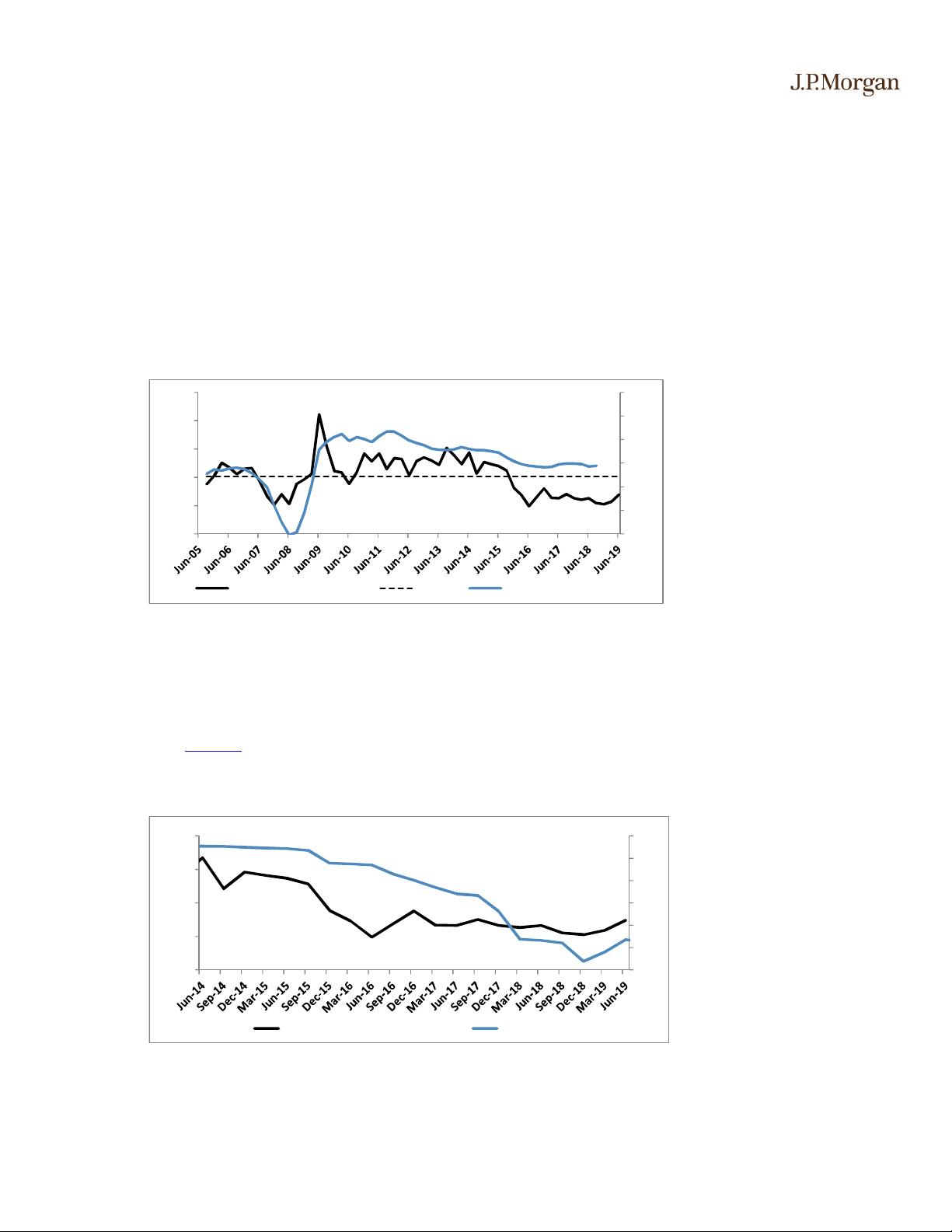

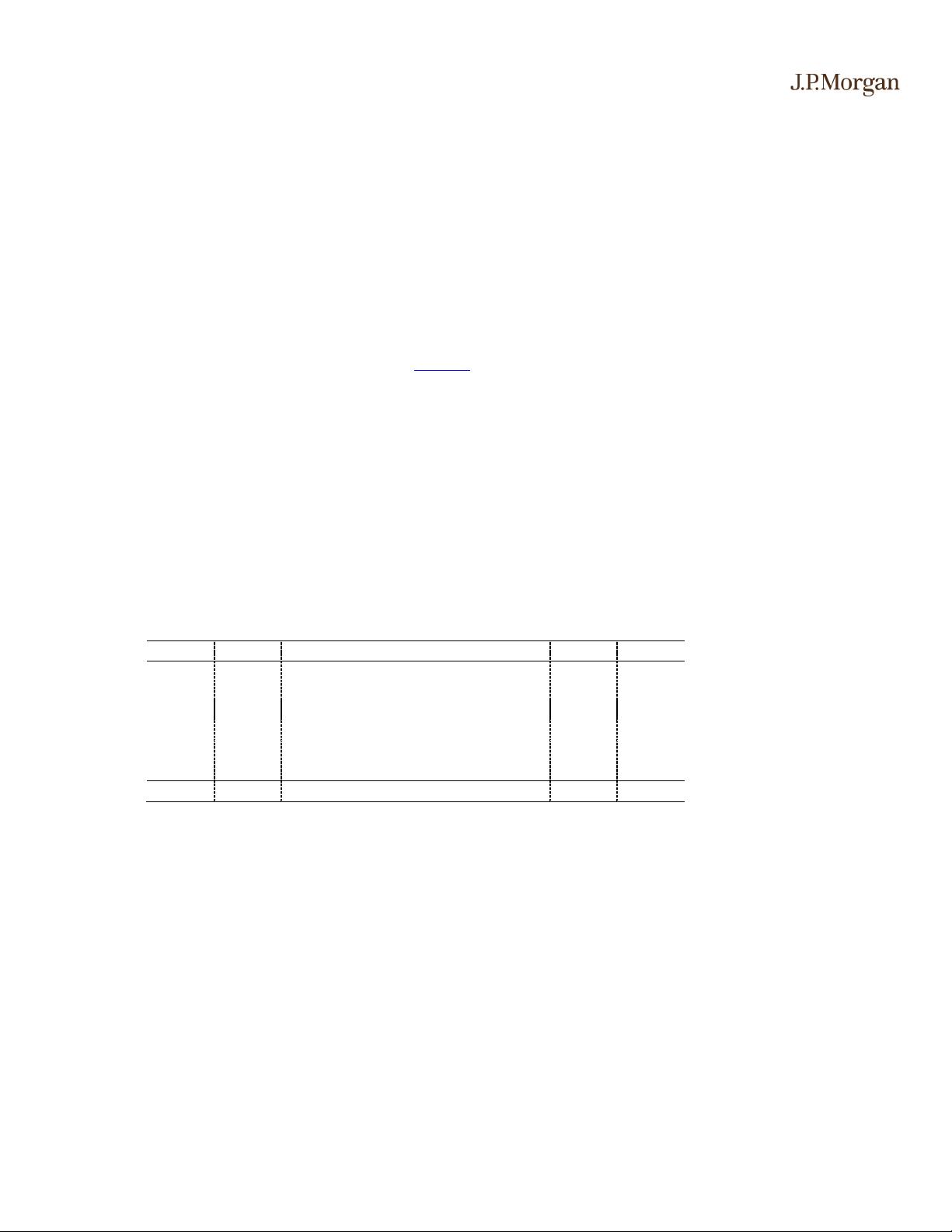

After better than expected 1Q19 results, where same-store gross profit growth was

+3% for the group, driven primarily by solid, +6%, Parts & Services same-store

growth, we expect focus to remain on Parts & Services as an offset to pressures on

front-end vehicle profitability. We do not expect any material changes in new

vehicle profitability trends, and expect 1Q trends to largely continue, with used

vehicle profitability potentially getting better as evident by KMX’s results. We

believe Parts & Services should see continued mid-single digit same-store gross

profit growth for the remainder of 2019 driven by a combination of both macro

and micro factors including, an increase in UIO, increasing average vehicle age,

increasing complexity of parts, which favors dealers with OEM-certified parts vs.

independent aftermarket shops, improvement in penetration of post-warranty

customers driven by greater product offerings, and digital initiatives. We also

raise our 2019/2020 estimates for US Auto franchise dealerships driven primarily

by lower floor plan expense expectations vs prior due to favorable direction of

interest rates. We believe expectations for the group are somewhat elevated after

~1,000bps of relative re-rating since the beginning of 1Q19 reports, and we

maintain our balanced view on the sector, acknowledging some of the structural

and cyclical risks with our Dec’19 PTs showing flat upside on average.

We remain selective on stock picks, with LAD our top pick given sustained top-

tier execution, best growth metrics and highest relative upside from capital

allocation though we don’t necessarily see 2Q19 as catalyst for further re-

rating given the recent run (stock now at a ~10% premium), and future stock

outperformance will be driven by relative EPS revisions which is likely to be

gradual. Neutral rated PAG now moves higher up the pecking order given

compelling valuation after the recent derating as well as recent headwinds

potentially easing in 2H19. We remain OW on GPI given improved execution

in recent quarters, potential for continued upward relative revisions, and an

attractive valuation (~15% discount on P/E). On ABG, valuation has come in

recently, and we see the setup as favorable heading into the 2Q print. We

remain UW on AN despite improved execution in 1Q19, but still sustained

below par growth metrics that does not support its premium valuation (~5%

premium). On SAH, after recent outperformance (driven primarily by EchoPark

turning profitable), we think the stock is unattractive from a valuation

perspective (~15% premium on P/E) on our estimates, particularly given

relatively less upside from capital allocation vs peers and likely below average

Parts & Services profit growth.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功