没有合适的资源?快使用搜索试试~ 我知道了~

资源推荐

资源详情

资源评论

www.jpmorganmarkets.com

North America Equity Research

09 July 2019

Large Cap Banks 2Q Preview

Modest 2Q Hurt By NIM; Divergent Signals From

Markets

Banks — Large-Cap

Vivek Juneja

AC

(1-212) 622-6465

vivek.juneja@jpmorgan.com

Bloomberg JPMA JUNEJA <GO>

Jonathan Summitt

(1-212) 622-6341

jonathan.summitt@jpmorgan.com

Andrew J Dietrich

(1-212) 622-4244

aj.dietrich@jpmorgan.com

J.P. Morgan Securities LLC

See page 37 for analyst certification and important disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be

aware that

the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this rep

ort as only a single

factor in making their investment decision.

We expect weak 2Q results, hurt primarily by the flatter yield curve plus mixed comps

for capital markets-related revenues. Key issue in 2Q is the economic outlook and

what banks are seeing among their customers, especially the impact of tariffs and trade

wars. Signals from markets are diverging: treasury yields are down sharply, indicating

concerns about slowdown, but equity and markets are holding up. Credit spreads have

been choppy but ended 2Q without much change, and equity markets are up. In our

view, this may imply that the markets do not expect a material slowdown, and hence,

manageable, even if there are a couple of Fed rate cuts, and the drivers of rate cuts

seem to be driven more by political factors. We expect large banks’ earnings will be

hurt a little by Fed rate cuts, but a modest downturn should be very manageable as

large banks have strong capital positions and underwriting standards are tighter than

before prior downturns. That said, some banks may have less ability to moderate the

impact of Fed rate cuts. As a result of this dichotomy, banks’ guidance may vary as

some may not incorporate rate cuts into their base case but instead give sensitivities.

We expect large bank stocks to be range bound near term due to political

uncertainty. Large bank stocks recovered recently after CCAR 2019 and good

employment data, which lowered expectations a tad for rate cuts. Banks raised

dividends in CCAR 2019, and dividend yields are attractive. Valuations remain

attractive – Money Centers are trading at 9.4x 2020 EPS on average, below 9.9x

long term avg, and Regionals are at 10.1x 2020 EPS, below 11.4x avg. Near term,

we recommend PNC and Citizens. Medium term, we continue to like banks with

non-macro drivers, such as Citi and PNC. Given uncertainty about rate cuts, could

add a more rate sensitive bank – Bank of America, but key is expense outlook.

Key 2Q drivers: 1) lower net interest margins due to flatter yield curve; 2) modest

loan growth (Fed weekly data muddied in 2Q); 3) mixed capital markets revenues –

investment banking and trading down, but asset management up; 4) pickup in

mortgage banking; 5) seasonal rise in some fee income categories; and 6) continued

good credit quality. Institutional leveraged loan growth slowed sharply.

Weekly Fed loan growth data muddied in 2Q at large banks by reconstitution,

impacting consumer loans, notably credit cards. We expect modest overall loan

growth. Higher refis boosted other loans and residential mortgages in the Fed data.

Deposit costs likely to rise further but at a slower pace. Banks are cutting deposit

rates, but: 1) rates on new money are still above existing deposit costs; and 2) shift

from non-interest bearing deposits into interest bearing is slower but continuing.

Expect banks will be less able to lower deposit costs than in last rate cut cycle

because they have: 1) lower share of higher rate deposits (e.g., CDs, money market

deposits); and 2) higher share of non-interest bearing deposits. Retail deposit costs

did not go up materially this rate hike cycle.

Mortgage banking revenue likely to rise in 2Q and rise more in 3Q from higher

refis. This will boost origination revenues, but servicing revenue will partly offset

due to weaker net MSR hedging results and higher MSR amortization expense.

Despite higher IPOs, investment banking fees are down, falling in most areas.

Announced M&A volumes remained strong – June was 3

rd

best month since crisis.

Trading revenues are also down due to lower volatility and tough comps.

Selected Recent Reports:

Mortgage Banking: Benefit In 2Q, 3Q

From Spike In Refis But Partial Offset

From

Servicing, dated July 2, 2019

CCAR 2019: Dividends Up Solidly;

Total Capital Return Up Most At PNC,

Followed By Northern Trust And

BofA

, dated June 28, 2019

2

North America

Equity Research

09 July 2019

Vivek Juneja

(1-212) 622-6465

vivek.juneja@jpmorgan.com

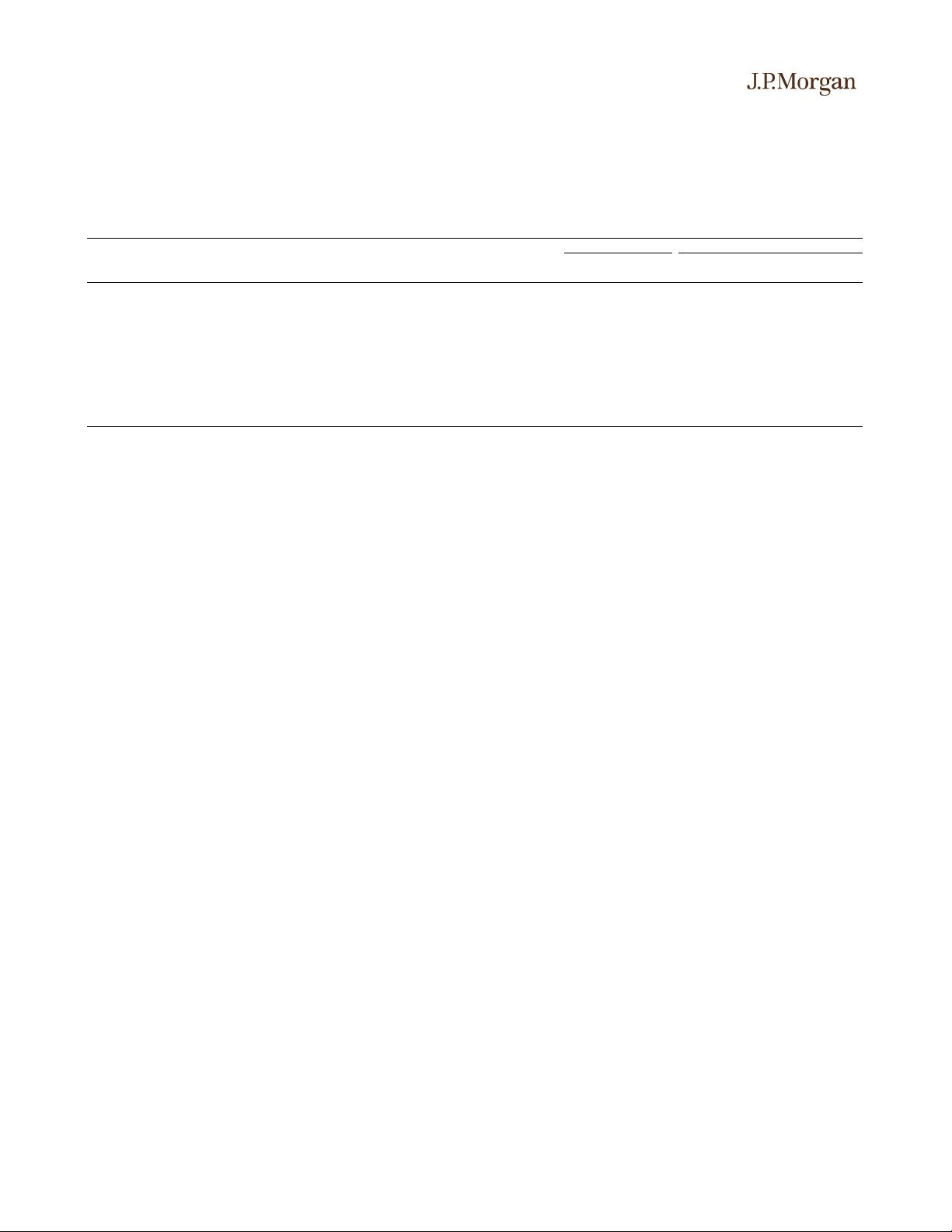

Equity Ratings and Price Targets

Mkt Cap

Rating

Price Target

Company

Ticker

($ mn)

Price ($)

Cur

Prev

Cur

End

Date

Prev

End

Date

Bank of America

BAC US

279,397.00

29.20

OW

n/c

29.50

Dec

-

19

30.50

n/c

BB&T Corporation

BBT US

37,828.79

49.39

N

n/c

50.50

Dec

-

19

51.50

n/c

Citigroup Inc.

C US

164,488.10

71.13

OW

n/c

77.00

Dec

-

19

75.00

n/c

Citizens Financial Group

CFG US

16,415.76

35.60

OW

n/c

40.50

Dec

-

19

41.50

n/c

Fifth Third Bancorp

FITB US

20,747.73

28.06

N

n/c

30.00

Dec

-

19

30.50

n/c

PNC Financial

PNC US

64,177.44

140.74

OW

n/c

142.00

Dec

-

19

137.50

n/c

Regions Financial

RF US

15,326.69

15.13

OW

n/c

17.00

Dec

-

19

17.50

n/c

SunTrust Banks, Inc.

STI US

28,189.09

63.53

OW

n/c

64.50

Dec

-

19

67.00

n/c

U.S. Bancorp

USB US

84,906.90

53.10

UW

n/c

52.50

Dec

-

19

51.00

n/c

Wells Fargo

WFC US

214,450.60

47.53

UW

n/c

47.50

Dec

-

19

48.50

n/c

Source: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 08 Jul 19.

3

North America

Equity Research

09 July 2019

Vivek Juneja

(1-212) 622-6465

vivek.juneja@jpmorgan.com

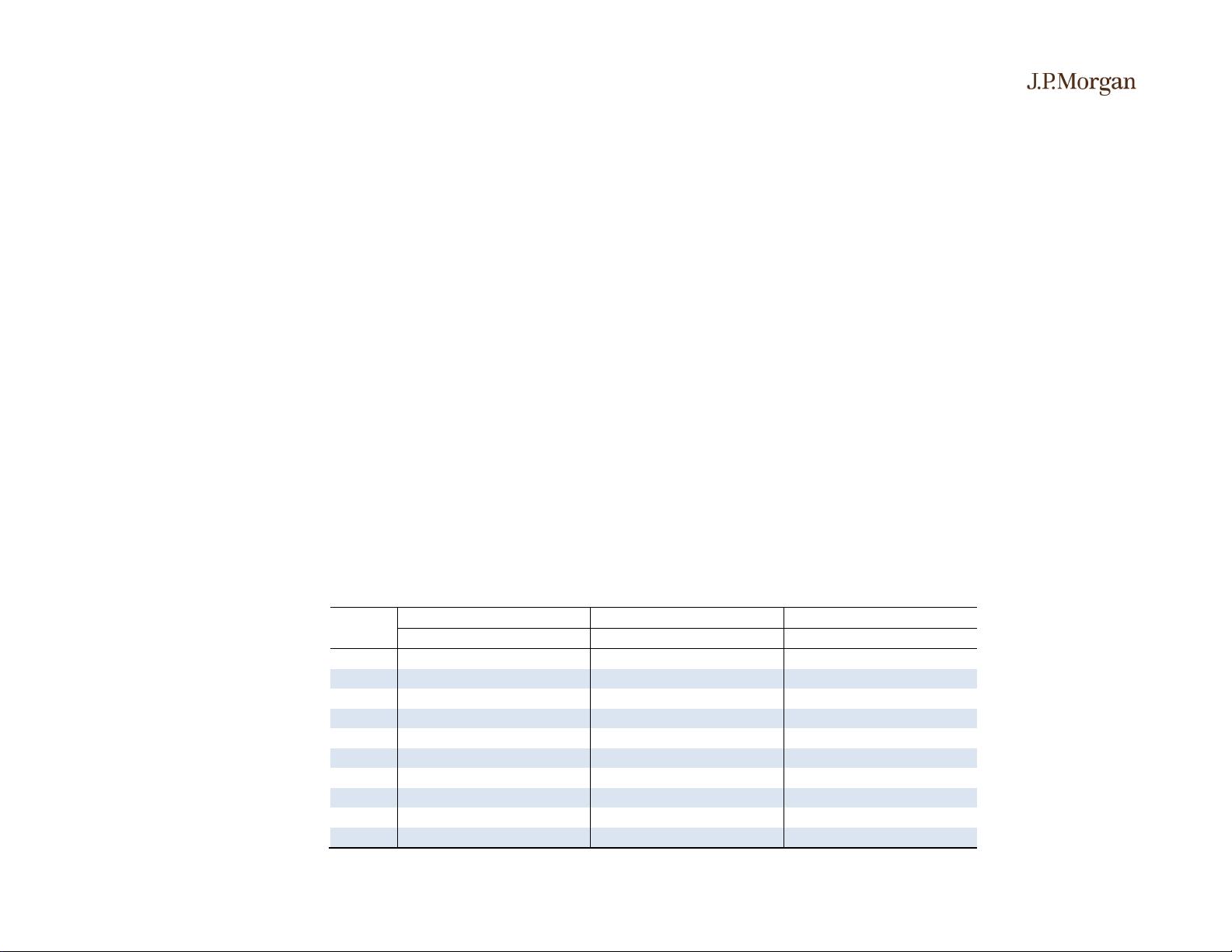

Mixed 2Q EPS; Cutting Estimates To Reflect Rate Cuts

We expect 2Q earnings to be marked by: 1) modest loan growth; 2) modest rise in net interest income on average, but

moderate decline in net interest margins (NIM) due to decline in both short term and long term rates; 3) some rebound in non-

interest income – rise in mortgage banking and asset/wealth management due to the market rebound, and some seasonal

increases in card fees and deposit service charges, partly offset by weakness in trading and investment banking; 4) expenses

up a tad qoq, but down seasonally at some; 5) continued good credit quality, but higher provisions; and 6) continued capital

return.

Adjusting estimates to reflect: 1) one Fed rate cut in September 2019 and one in December 2019; 2) trends in fixed income

and equity markets; and 3) company news and guidance. Wells Fargo's reported 2Q EPS is up due to gains from another sale

of pick-a-pay mortgages.

Table 1: EPS Estimate Changes

$ per share

2Q19E 2019E 2020E

New Old Change New Old Change New Old Change

BAC 0.70 0.70 - 2.76 2.81 (0.05) 2.96 3.07 (0.11)

BBT 1.09 1.09 - 4.28 4.35 (0.07) 4.67 4.80 (0.13)

C 1.84 1.86 (0.02) 7.53 7.57 (0.04) 8.55 8.60 (0.05)

CFG 0.96 0.96 - 3.86 3.91 (0.05) 4.10 4.20 (0.10)

FITB 0.66 0.66 - 2.77 2.78 (0.01) 2.98 3.04 (0.06)

PNC 2.81 2.81 - 11.22 11.22 - 11.85 11.96 (0.11)

RF 0.38 0.39 (0.01) 1.53 1.56 (0.03) 1.64 1.70 (0.06)

STI 1.46 1.48 (0.02) 5.80 5.86 (0.06) 5.98 6.22 (0.24)

USB 1.05 1.05 - 4.22 4.24 (0.02) 4.44 4.50 (0.06)

WFC 1.24 1.14 0.10 4.75 4.75 - 4.85 5.10 (0.25)

Source: J.P. Morgan estimates.

4

North America

Equity Research

09 July 2019

Vivek Juneja

(1-212) 622-6465

vivek.juneja@jpmorgan.com

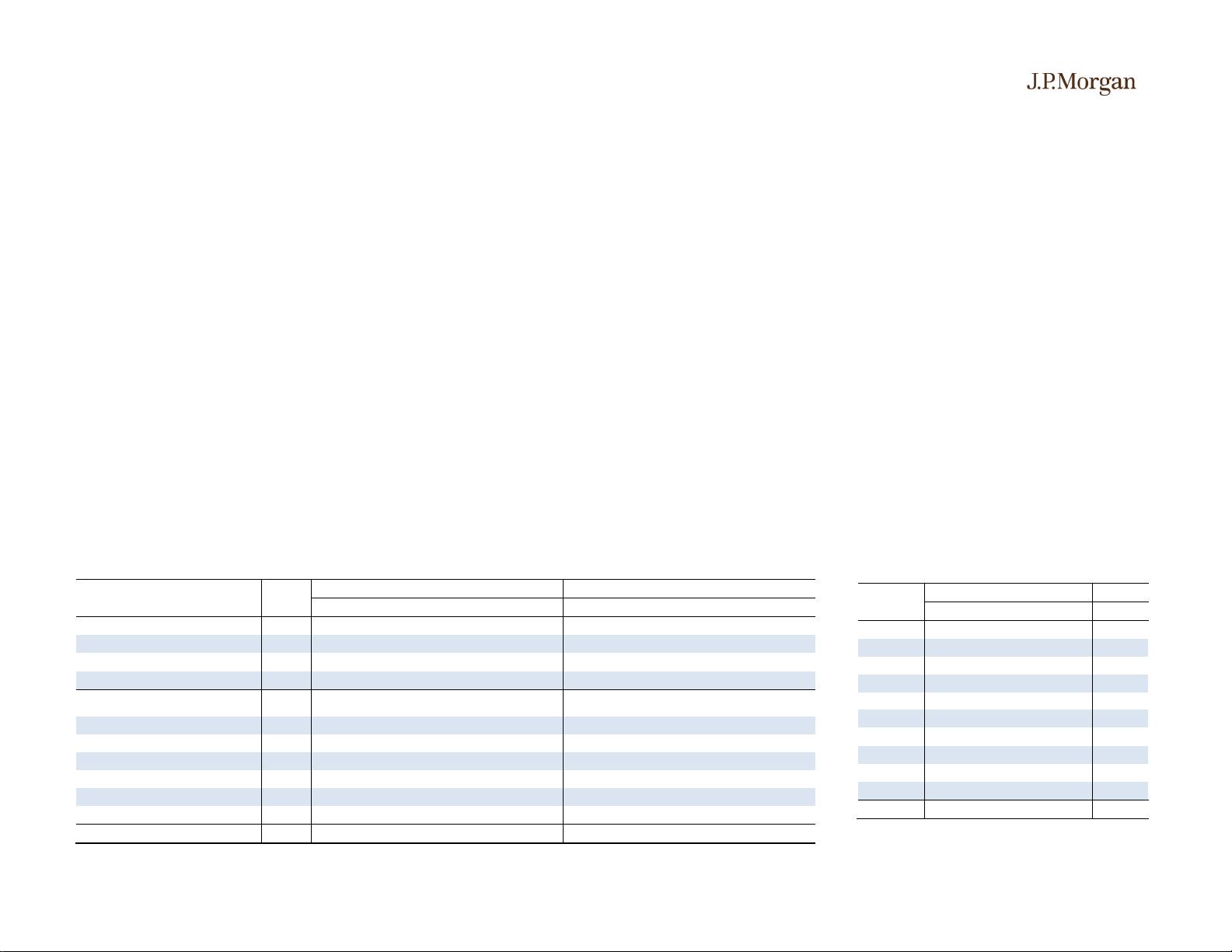

Fed Loan Data Muddied: Other Loans Up Sharply, Most Consumer Loan Categories Up

Total loans at large banks rose 2.0% qoq (+4.5% yoy) on period end basis through June 26

th

per Fed data, but trends were

muddied by reconstitution of the large banks group. QoQ trends were led by sharp growth in other loans – likely boosted by

growth in mortgage warehouse loans due to sharp jump in refis. Other consumer loans were also up strongly qoq and yoy.

Reported credit card loan growth is muddy for 1Q and 2Q – we expect much more modest organic credit card loan growth

than reported growth due to the reconstitution noted above.

C&I loans were up modestly by 0.5% qoq (+7.2% yoy), potentially due to a weaker M&A environment. However, C&I

plus other loans rose 1.7% qoq (+7.6% yoy) as all other loans grew 4.5% qoq, led by mortgage warehouse loans.

Residential mortgages up strongly by 1.7% qoq, likely the result of mortgage pipeline growth from the pickup in refi

originations – these loans will be securitized into MBS.

We expect average loan growth trends to be mixed at our banks – slower qoq growth at some banks (from loan sales at

some), but growth up at BB&T, US Bancorp, Citi, and PNC, with latter two driven by good period end C&I growth in 1Q.

Table

2

:

Weekly Fed Loan Data Muddied; 2Q Led by Sharp Growth in Other Loans, Other Consumer, and Residential

Mortgages

Large Banks’ period end growth, adjusted for M&A, as of June 26, 2019, NSA

Amount

($ bil)

QoQ Chg YoY Chg

2Q18 3Q18 4Q18 1Q19

(1)

2Q19 2Q18 3Q18 4Q18 1Q19

(1)

2Q19

(1)

C&I 1,301.4 1.9% 0.1% 6.1% 0.5% 0.5% 3.5% 4.3% 9.3% 8.7% 7.2%

Other

(2)

847.6 1.6% 0.6% 6.2% -2.1% 3.5% 7.0% 5.0% 7.7% 6.2% 8.3%

Loans to Non-Bank Financial Firms 349.2 5.1% 5.2% 7.9% 0.0% 2.2% 14.7% 15.0% 19.1% 19.2% 15.9%

All Other 498.3 -0.6% -2.3% 5.1% -3.4% 4.5% 2.6% -0.8% 1.0% -1.5% 3.6%

C&I Plus All Other 2,149.0 1.8% 0.3% 6.1% -0.5% 1.7% 4.9% 4.6% 8.7% 7.7% 7.6%

CRE 701.4 1.7% -0.7% 0.0% -0.1% -0.1% 1.0% 0.4% 0.6% 1.0% -0.8%

Resi Mtge 1,189.7 0.2% 0.7% -0.5% -0.4% 1.7% 2.6% 2.3% 0.4% 0.1% 1.5%

Home Equity 217.4 -3.4% -2.7% -2.3% -3.5% -2.7% -11.8% -12.0% -11.8% -11.3% -10.8%

Cards 665.4 2.8% -1.1% 5.5% -0.4% 7.5% 5.1% 2.0% 1.3% 6.9% 11.8%

Auto 356.5 0.1% 0.5% 0.1% 0.8% 2.3% 1.9% 0.9% 0.4% 1.5% 3.7%

Other Consumer 124.4 2.2% 3.1% 2.1% 1.3% 4.4% 4.7% 5.9% 8.4% 9.1% 11.5%

Total Loans

(3)

5,403.7 1.2% 0.0% 2.9% -0.4% 2.0% 2.7% 2.1% 3.2% 3.7% 4.5%

Source: Federal Reserve and J.P. Morgan calculations.

(1)

1Q19 qoq/yoy & 2Q19 yoy adjusted for M&A.

(2)

Other is the sum of Loans to Non-Depository Financial Institutions and All Other.

(3)

Excludes Fed Funds sold and reverse repos.

Table

3

:

Loan Growth at Our Banks Will Likely

B

e Mixed

Average total loan growth

QoQ Chg YoY Chg

4Q18 1Q19

(1)

2Q19E 2019E

BAC 0.4% 1.0% 0.6% 2.4%

BBT 0.9% 0.4% 1.6% 4.4%

C 0.8% 0.6% 1.4% 3.9%

CFG 1.7% 1.5% 0.2% 4.4%

FITB (ex MBFI) 1.6% 1.7% NA NA

PNC 1.2% 1.2% 2.4% 4.8%

RF 1.1% 2.3% 0.9% 4.7%

STI 2.5% 3.0% 1.2% 8.0%

USB 0.9% 0.9% 1.1% 3.6%

WFC 0.7% 0.4% 0.0% 1.0%

Median 0.9% 1.0% 1.1% 4.4%

Source: Company reports and J.P. Morgan estimates. FITB is adjusted to

exclude impact from its acquisition of MBFI.

5

North America

Equity Research

09 July 2019

Vivek Juneja

(1-212) 622-6465

vivek.juneja@jpmorgan.com

Institutional Leveraged Loan Growth Slowed Further In 2Q

Institutional leveraged loan growth slowed further in 2Q to 1.3%, after slowing down a little in 1Q19.

Some of this slowdown may be due to continued outflows from leveraged loan mutual funds.

In addition, growth in leveraged loans is likely being hurt by investors shifting back to high yield bonds, now that the

Fed is no longer raising rates.

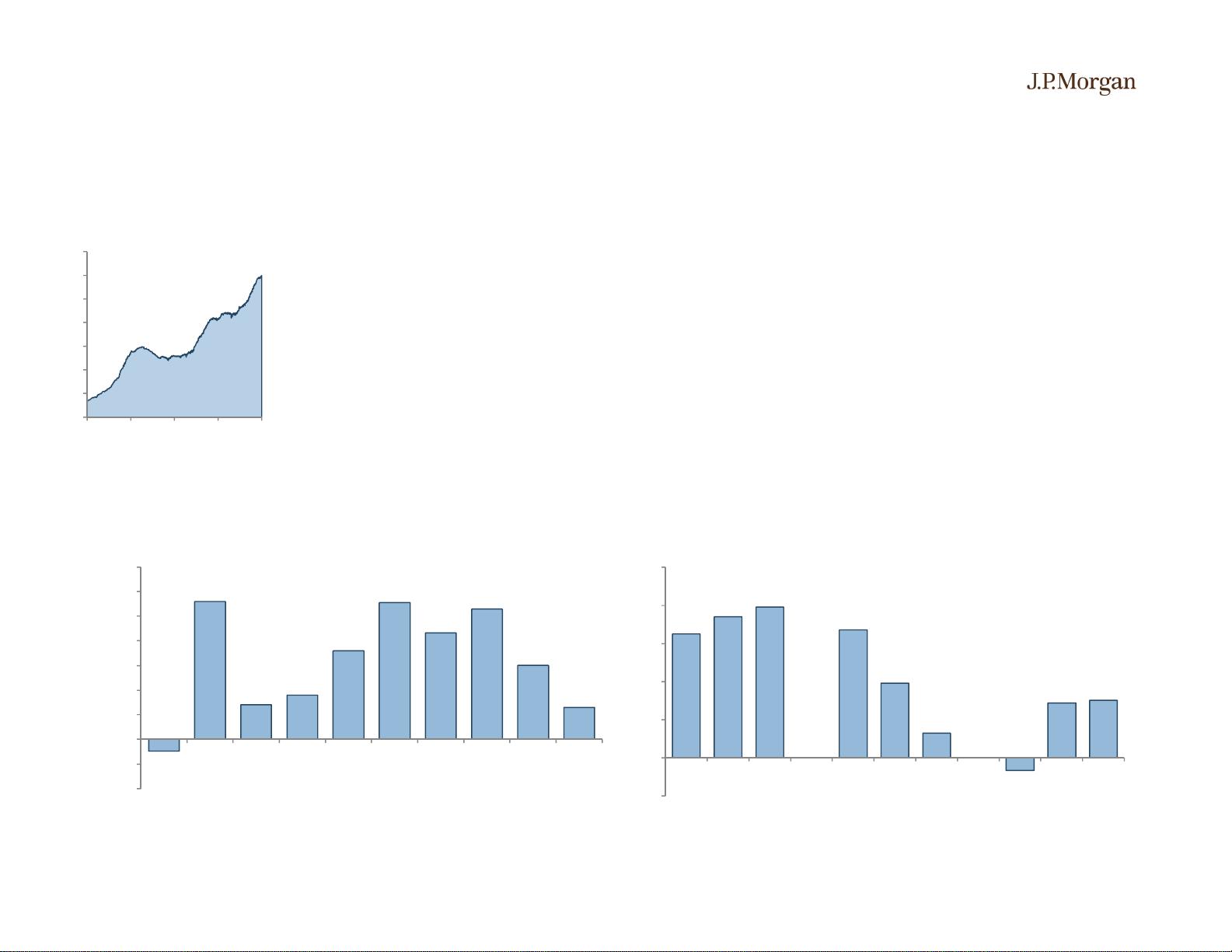

Figure

2

:

Leveraged Loan Growth Slowed

Sharply

to 1.3% QoQ in 2Q …

QoQ change, institutional leveraged loans outstanding

Source: S&P Global Market Intelligence (LCD). As of July 8, 2019.

Figure

3

:

… Growth in May and June Was Stronger

than April but Slower than Prior

Year

MoM change, institutional leveraged loans outstanding

Source: S&P Global Market Intelligence (LCD). As of July 8, 2019.

-0.5%

5.6%

1.4%

1.8%

3.6%

5.5%

4.3%

5.3%

3.0%

1.3%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19

1.6%

1.8%

2.0%

1.7%

1.0%

0.3%

-0.2%

0.7%

0.7%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Apr '18 May '18 June '18 Jan '19 Feb '19 Mar '19 Apr '19 May '19 June '19

Figure

1

:

Institutional Leveraged Loans

Up

13.8% YoY to $1.194 Tril…

Institutional leveraged loans outstanding, $ bil

Source: S&P Global Market Intelligence (LCD).

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

01/04 11/07 10/11 08/15 07/19

July 8, 2019: $1.194 tril

YoY Growth: 13.8%

剩余38页未读,继续阅读

资源评论

xox_761617

- 粉丝: 29

- 资源: 7802

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 基于java+ssm+mysql+微信小程序的食堂校园预约就餐小程序 源码+数据库+论文(高分毕业设计).zip

- 基于java+ssm+mysql+微信小程序的食堂线上订餐小程序 源码+数据库+论文(高分毕业设计).zip

- springboot-vue-民谣网站的设计与实现-源码工程-29页从零开始全套图文详解-32页设计论文-21页答辩ppt-全套开发环境工具、文档模板、电子教程、视频教学资源分享

- 基于python编写的视频合成代码

- T型三电平并网逆变器Matlab Simulink仿真模型,采用双闭环控制策略,并网电流外环,电容电流有源阻尼内环,电流波形质量完美, THD不到2%,采用三电平SVPWM算法,大扇区小扇区判断 报

- 河南地下粮仓工艺与设备设计

- 基于java+ssm+mysql+微信小程序的童装购买平台 源码+数据库+论文(高分毕业设计).zip

- 基于java+ssm+mysql+微信小程序的投票评选系统 源码+数据库+论文(高分毕业设计).zip

- 基于java+ssm+mysql+微信小程序的外卖点餐系统 源码+数据库+论文(高分毕业设计).zip

- Javascript数据类型转换规则电脑资料

- 基于java+ssm+mysql+微信小程序的微信评分小程序 源码+数据库+论文(高分毕业设计).zip

- 梯形图转HEX 51plc方案5.6.4.2版本,低成本plc方案,支持温湿度传感器,支持ds18b20.,支持无线联网,支持数码管按钮,最近发现软件在个别系统运行不良,(w764位95%可以用)

- java程序员辞职报告

- 多状态挠曲电结构电性能不确定性分析与仿真

- 微信小程序源码-大学生闲置物品交易平台的分析与设计-微信端-毕业设计源码-期末大作业.zip

- 微信小程序源码-大学生心理健康服务-微信端-毕业设计源码-期末大作业.zip

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功