没有合适的资源?快使用搜索试试~ 我知道了~

资源推荐

资源详情

资源评论

1

Minsu Chung

1

⋅Uijung Kim

2

⋅Hyeonseo Lee

3

⋅Seongju Hong

4

⋅Dongryeol Lee

5

The Seoul Metropolitan Region (SMG) is disproportionately over-concentrated,

squeezing more than half of the population into a space just 12% of South Korea’s total

land area. The density has worsened from continued influx of young population. From

2015 to 2021, youth migrants were behind a 78.5% increase in the population of the

capital region, while dealing respective declines of 75.3%, 87.8%, and 77.2% in Dongnam,

Honam, Daegyeong Regions during the same period.

The persistent hemorrhage of productive youth force poses serious problems for the

non-capital areas. Depopulation has accelerated as the result of birth deficiency. In Honam,

the birth loss due to fewer young population across last two decades was equivalent to

49.7% of the number of newborns in 2021. The setback ratio was 31.6% for Daegeyeong

and 21.9% for Dongnam Regions. The shortage of youth force deepened labor mismatch

and damaged employment outside the capital region, worsening their environment to host

companies. The phenomenon portends secular implications for human capital and growth

potential outside the capital area due to the loss of the young with tertiary education.

The government paid utmost attention to regional development for decades to deter

polarization, but obviously to little avail as evinced by the increased concentration around

the capital. The consequence demands a reexamination in the even-growth model for

regional development by concentrating resources to breed core municipalities to maximize

policy effects and benefits from the economies of agglomeration.

Youth mobility pivoted towards the capital region stems not just from higher income

expectations but also from the disparities in social amenities such as entertainment and

medical facilities. All non-capital regions cannot grow to be as resourceful as Seoul area,

given the demographic and fiscal constraints. The most practical policy option would be

vitalization of core municipalities through maximization of agglomeration and spillover

benefits. Empirical studies of other countries support the effectiveness of big metropolitan

No. 2023-29

BOK ISSUE NOTE

Nov. 2, 2023

Regional Migration and Economy

3

Contents

Ⅰ. Introduction

Ⅱ. Seoul Metropolitan Region Concentration

Ⅲ. Inter-regional Migration Trend and Impact on Capital Area

Concentration

1. Change in Regional Population and Inter-regional Migration

2. Youth Migration and Capital Concentration

Youth Migration in Demographic Context

Youth Migration in Human Capital Context

Factors behind Migration

3. Impact from Youth Migration to Capital Region

Outmigration and Regional Population

Outmigration and Regional Labor Market

Outmigration and Regional Economies

Youth Migration and National Economy

Ⅳ. Balanced Growth Model Based on Regional Cores

1. Why a New Approach is Necessary

Past Decentralization and Balanced Development Strategies

Shift towards Hub Cities

Decentralization Effect from Growth of Core Cities

2. Growth Potential for Core Cities

Population Change in Core Metropolitan Areas

Internal Youth Migration to Core Cities

Better Service Options in Core Cities

Improvement in Economic Data in Core Cities

3. hub city Development Vision

Concentration of Large Public Infrastructure

The Need of Metro Area Governance Body and Within-migration

Regional Specialization

Knowledge Agglomeration in Core Cities

Ⅴ. Conclusions

4

Ⅰ. Introduction

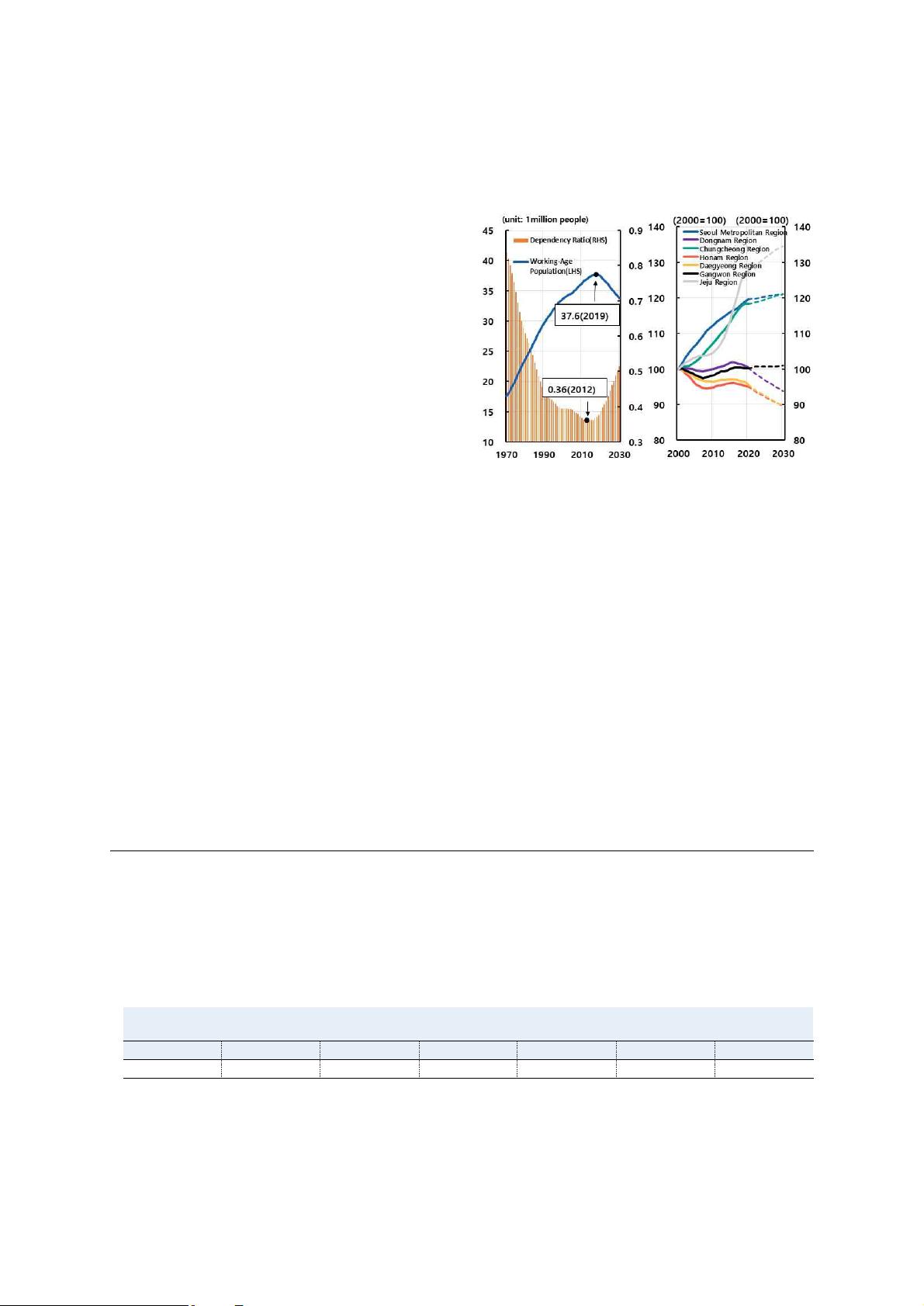

Demographic dividend

1)

has turned into a

deficit for South Korea after working

population peaked out in 2019. The cocktail

of ultra-low birthrate, fast aging

2)

, and

depopulation pressure portends detrimental

consequences throughout the country, but

the damage can deal heavier on non-capital

regions than the capital area.

Over-concentration in the capital region has

deepened, with the population share

exceeding 50% from 2020. Other regions are

shrinking fast with some already veering

towards the brink of extinction.

3)

[Figure 1] Working-Age Population and

Dependency Ratio

1)

(Left) and

Population by Region (Right)

Note: 1) The dotted area in the trendline is an estimate.

Source: Statistics Korea (Population Projections).

The population polarization owes more to

net migration than natural change, the

difference between births and deaths, driven

by young migrants. The loss of young

people has fed a vicious cycle due to

growth and job constraints from reduced

births and aged structure. Disproportionate

youth inflow into already densely populated

Seoul area worsens environment for

marriage and birth from over-competition to

damage long-term social sustainability. If the

imbalance is uncorrected, it can threaten the

1) Demographic dividend refers to the upside to the economic growth potential from the demographic

structure where the working population aged between 15 and 64 is larger than the share of

dependents (14 and younger and 65 and older). Korea’s dependency ratio has bee on the rise since

logging 0.36 in 2012.

2) Korea’s total fertility rate has been hovering below 1.3 since 2002. Korea moved from “aging society”

- with the proportion of people aged 65 or older at 7% of total population - to “aged” (with senior

ratio at 14%) in 18 years, faster than 25 years taken for Japan and is expected to shift to the

“superaged” category in 7 years versus Japan’s 10.

Years taken for countries to become superaged

(with the elderly share exceeding 20%)

S. Korea

Japan

USA

UK

France

Germany

Italy

2025 (7)

2004 (10)

2029 (15)

2025 (50)

2018 (39)

2008 (36)

2007 (19)

The number in parenthesis is years taken for the shift from aged to superaged.

Source: UN.

3) Of 228 cities, counties, and district wards in the country, nearly half or 113 faced extinction risk as of

March 2022, with the share of fertile women aged 20 to 39 against the population aged 65 and

older falling to 0.5 or lower. (Korea Employment Information Service. April 2022)

5

national stability and fundamentals.

The government has taken actions to ease

the imbalance for decades through

enhancement of regional infrastructure to

raise the living standards across the region

and support self-sufficiency. The contrary

results underscore the limitation in the past

policy measures. The capital region’s

attractiveness only strengthened due to the

enlarged benefits of agglomeration

economies from the advance of knowledge

services and IT technologies and eased

congestion costs through enhancement of

transport and commuting infrastructure. The

regional development based on even

appropriation of budgetary subsidies should

be redressed to scale up core municipalities

to enhance their metropolitan role. Core

municipalities must live up to their central

role with global competitiveness even if they

cannot fully match Seoul.

It is impossible to attain exponential growth

for all metropolitan areas due to demographic

and fiscal constraints. The best option would

be building up the economies of scale for

central locations through concentrated

infrastructure to maximize agglomeration

benefits so that they can be formidable urban

settlement alternative for young population.

Ⅱ. Seoul Metro Region (SMR)

Concentration

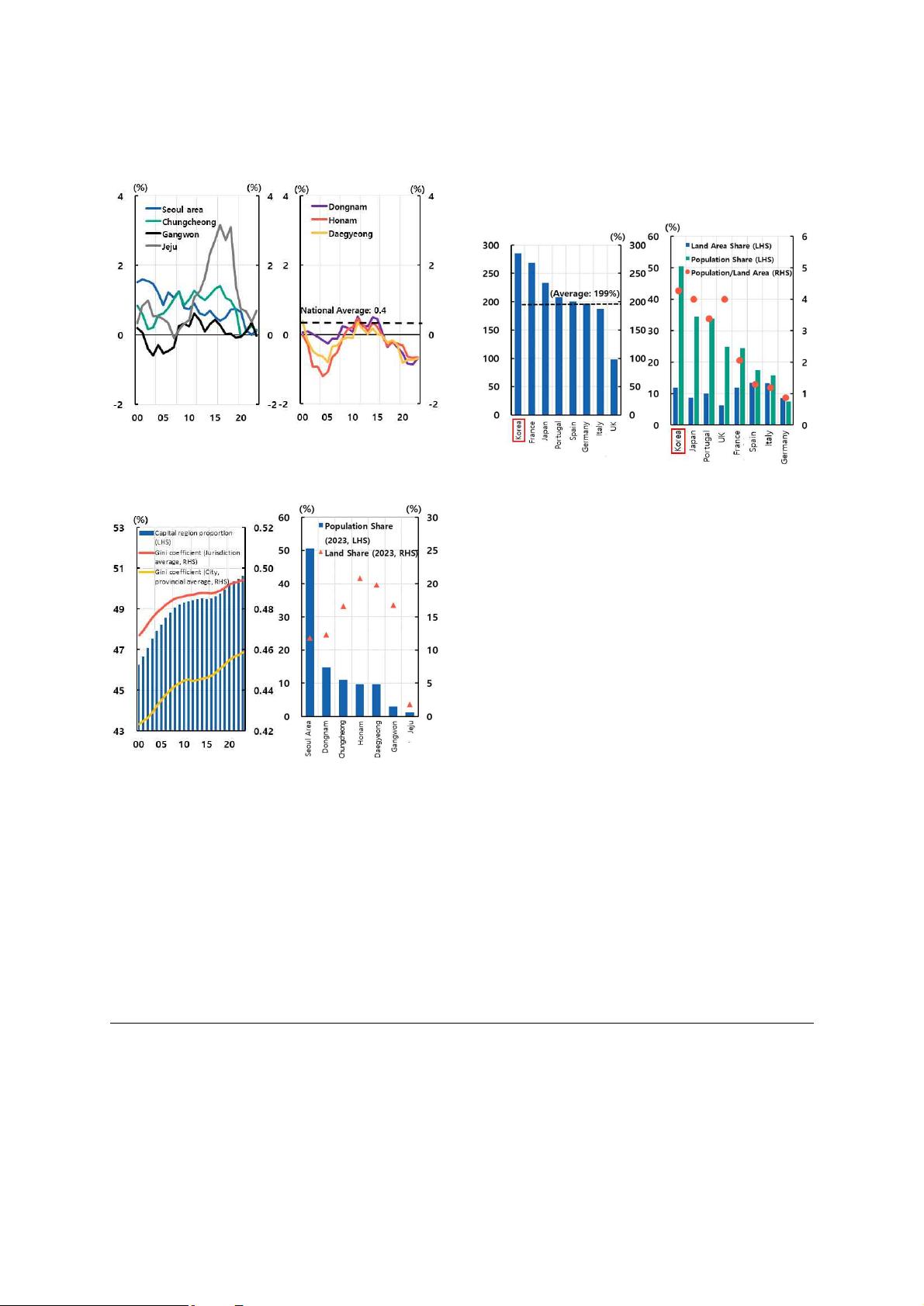

Demographic divide has deepened in Korea’s

7 geographical jurisdictions

4)

across the last

two decades. On the growing side are – the

Seoul Metropolitan Region (SMR),

Chungcheong, Gangwon, and Jeju Regions –

and the shrinking side are – Dongnam,

Honam, and Daegyeong – whose population

has been on the decline except for early

2010s. The capital area has been showing

the most robust growth after Jeju

5)

to host

more than half of the country’s population

since 2020. Representing higher density in

urbanized areas, the Gini coefficient rose

from 0.47 in 2000 to 0.49 2023 on

jurisdiction level and from 0.42 to 0.46 on

municipality and provincial level.

6)

Few capital in the global map has the

density level of Seoul area. Seoul is 2.8

times more populated than the second

largest city of Busan, above the average of

2 times in the relative primacy between the

capital and the second largest city in

countries of comparable territorial and

economic scale (<Figure 4>).

No other country has more than half of the

population squeezed into just 10 percent of

its territorial space.

7)

.

4) BOK in “Regional Economy Report” divides territorial jurisdictions as Seoul Metropolitan Region,

Dongnam Region, Chungcheong Region, Honam Region, Daegyeong Region, Gangwon Region, and

Jeju Region.

5) Jeju Region from mid-2010s has seen sharp influx of youth and middle-aged population in search of

healthier environment and education options. Jeju was populated by 680,000 in 2023, 1.3% of Korea’s

total population of 51.56 million.

6) The disparity between Seoul area and other regions is widening not just in sheer population number

but also in the demographic (aging) structure. (<Box 1>).

6

[Figure 2] Population Change by Region

Source: Statistics Korea

[Figure 3] Capital Area Concentration

Source: Statistics Korea, Authors’ Calculation

[Figure 4] Population Gap btw Capital-2nd

Biggest City

1)2)

(Left) and Capital

Density Comparison

3)4)

(Right)

Notes: 1) Based on 2023 data (2019 for UK).

2) UK data based on Government Office Regions.

3) Based on 2022 data (2019 for UK).

4) Capital and neighboring municipalities compiled

for other countries for more accurate comparison

with Seoul capital region.

Sources: Statistics Korea, World Population Review,

Eurostat, OECD.

Small countries tend to have higher

concentration around the capital. The

scatterplot in <Figure 5> illustrates the

OECD sample members

8)

having negative

correlation between the weight of capital

share and their population and gross

regional domestic product (GRDP)

9)

. Korea

stands markedly above the average trendline

to rank highest in capital city weight against

population and GDP among 26 OECD

members.

The weight of second to fourth largest cities

in population and GDP fell in line with

OECD average. <Figure 6>). In short, the

7) Capital area accounted for 50.6% of total population as of 2023 and 11.8% of total land area as of

2022.

8) Samples for population were 26 OECD member countries – Australia, Austria, Belgium, Canada,

Switzerland, Chile, Columbia, Czech, Germany, Denmark, Spain, Finland, France, U.K., Hungary, Ireland,

Italy, Japan, Korea, Mexico, the Netherlands, Poland, Portugal, Sweden, Turkiye, and the USA. GDP

samples were 27 including Norway.

9) The finding slightly differs from the results in <Figure 4> as they are based on OECD geographic

taxonomy of Functional Urban Area(FUA).

剩余44页未读,继续阅读

资源评论

wh3933

- 粉丝: 119

- 资源: 1004

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功