高盛-中国-基础材料行业-中国基础材料1月监测:季节性疲软,预期分歧-0121-38页.pdf

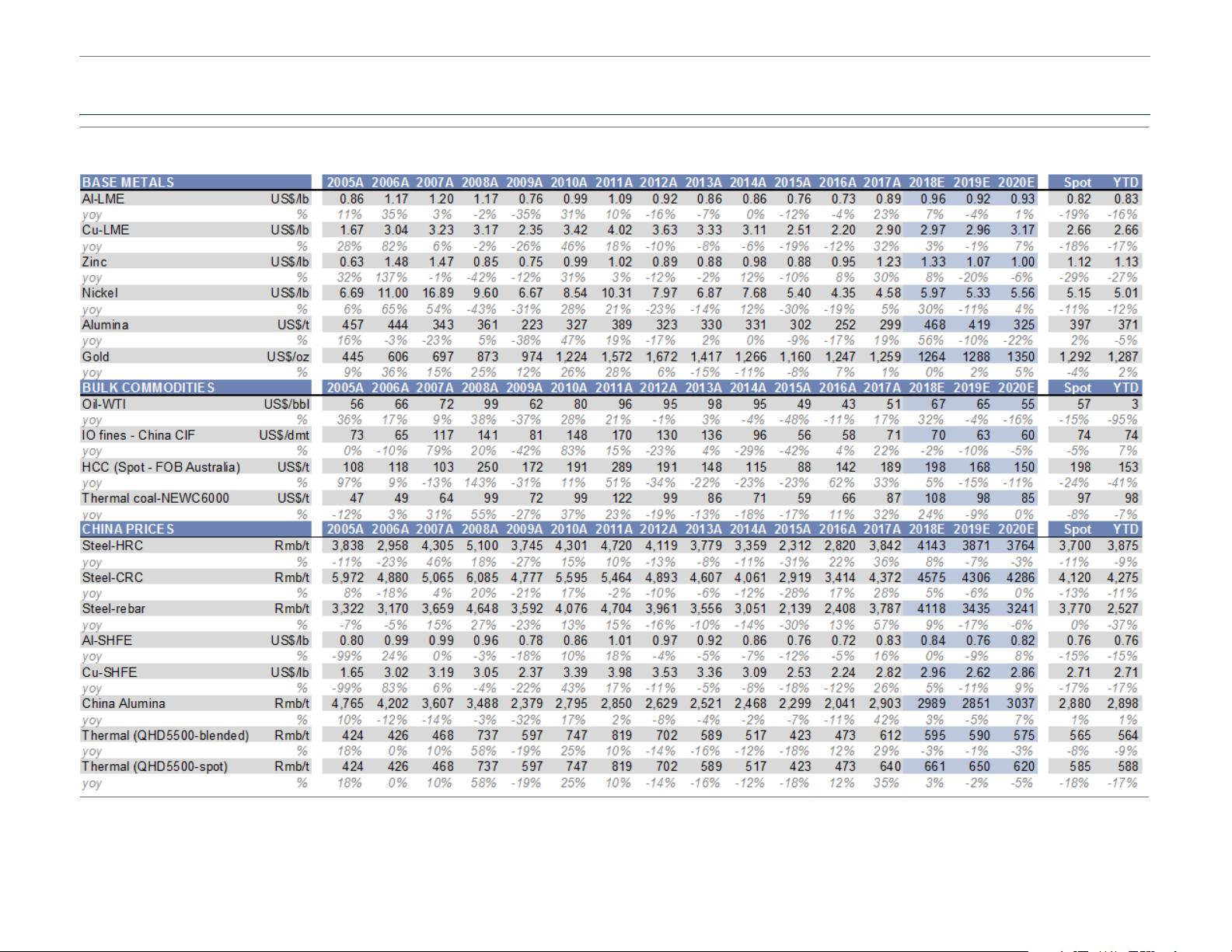

"高盛-中国-基础材料行业-中国基础材料1月监测:季节性疲软,预期分歧" 该报告主要关注中国基础材料行业的1月监测,涵盖季节性疲软和预期分歧的分析。报告由高盛发布,提供了对中国基础材料行业的独特见解。 知识点1:季节性疲软 报告指出,基础材料行业在1月份出现季节性疲软,这是由于春节假期的影响。这种疲软趋势在过去几年中都是常见的,但今年的疲软程度较往年为轻。 知识点2:预期分歧 报告显示,基础材料行业的预期存在分歧,一些生产商对未来需求持乐观态度,而另一些生产商则对需求持悲观态度。这反映了行业中的不确定性和不稳定性。 知识点3:订单书趋势 报告提供了订单书趋势的分析,显示基本材料和下游产品的订单书趋势存在差异。基本材料的订单书趋势较弱,而下游产品的订单书趋势相对稳定。 知识点4:行业分段订单书趋势 报告还提供了行业分段订单书趋势的分析,显示汽车、家电、房地产、机械、电力、钢铁、水泥、金属等行业的订单书趋势存在差异。其中,汽车和家电行业的订单书趋势较弱,而房地产和机械行业的订单书趋势相对稳定。 知识点5:市场预期 报告对市场预期进行了分析,显示基础材料行业的市场预期存在分歧。一些生产商对未来需求持乐观态度,而另一些生产商则对需求持悲观态度。这反映了行业中的不确定性和不稳定性。 知识点6:基础材料行业的发展趋势 报告对基础材料行业的发展趋势进行了分析,显示行业的发展趋势存在不确定性。一些生产商对未来需求持乐观态度,而另一些生产商则对需求持悲观态度。这反映了行业中的不确定性和不稳定性。 知识点7:订单书调查 报告提供了订单书调查的结果,显示基础材料和下游产品的订单书趋势存在差异。基本材料的订单书趋势较弱,而下游产品的订单书趋势相对稳定。 知识点8:生产商的看法 报告对生产商的看法进行了分析,显示生产商对基础材料行业的看法存在分歧。一些生产商对未来需求持乐观态度,而另一些生产商则对需求持悲观态度。这反映了行业中的不确定性和不稳定性。 知识点9:基础材料行业的挑战 报告对基础材料行业的挑战进行了分析,显示行业面临着季节性疲软、预期分歧、订单书趋势下降等挑战。 知识点10:高盛的研究报告 报告是高盛的一份研究报告,提供了对中国基础材料行业的独特见解。该报告对基础材料行业的发展趋势、订单书趋势、市场预期等方面进行了分析和讨论。

剩余37页未读,继续阅读

- 粉丝: 12

- 资源: 6307

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- BLE蓝牙单片机CC2540、CC2541裸机简易C语言程序开发之看门狗程序.zip

- 数据挖掘上机操作题二.docx

- BLE蓝牙单片机CC2540、CC2541裸机简易C语言程序开发之继电器控制.zip

- 饮料瓶瓶罐检测13-YOLO(v5至v9)、COCO、CreateML、Darknet、Paligemma、TFRecord、VOC数据集合集.rar

- BLE蓝牙单片机CC2540、CC2541裸机简易C语言程序开发之光敏电阻环境传感器.zip

- 本代码为我设计的一款基于FPGA的交通信号灯项目,FPGA型号位野火征途PRO开发板

- 渝北职教中心.apk.1

- 价值268元的 Zing-Pro主题, 模块化的WordPress企业主题+整站源码

- 基于前端技术UniApp和后端技术Node.js的电影购票系统论文

- Python高级教程:核心特性和应用

信息提交成功

信息提交成功