没有合适的资源?快使用搜索试试~ 我知道了~

高盛-新兴市场-宏观策略-不要“忘乎所以”:在新兴市场寻找正确的方向-0201-23页.pdf

试读

23页

需积分: 0 0 下载量 116 浏览量

更新于2023-07-25

收藏 1006KB PDF 举报

【新兴市场宏观策略与收益交易】新兴市场(EM)的外汇收益交易(FX carry trade)在2019年初美联储政策缓和、美元疲软的背景下受到更多关注。然而,当我们把收益交易定义为收益率占总回报比例较高的资产时,EM FX 更多地被视为一种风险偏好的交易,与美国国债和新兴市场固定收益资产的显著收益相比,其风险特征更为明显。

【收益环境的构成因素】低波动性环境自然为收益交易提供了良好的机会。在经济周期的角度,收益交易在温和的经济增长放缓时期(尤其是与股票等风险交易相比)显得更具吸引力。这是因为当经济放缓但尚未进入衰退时,市场预期央行可能采取宽松政策,这有利于高收益资产的表现。

【EM本地债券的优势】对于2019年,我们坚信EM本地债券在所有EM资产中提供了最佳的风险调整回报(Sharpe比率)。同样,我们也对某些EM FX对持乐观态度。衡量EM货币机会的常见指标是收益与波动性的比率,但我们建议同时考虑收益与价值的比例。菲律宾比索(PHP)和印尼盾(IDR)在吸引人的收益对波动率指标中表现突出,而南非兰特(ZAR)、巴西雷亚尔(BRL)和哥伦比亚比索(COP)也具有强劲的价值信号(相对于近期历史水平)。这些货币已被纳入我们的顶级交易推荐(ZAR和COP在利率领域,IDR在本地债券);墨西哥比索(MXN)在收益对波动率和收益对价值基础上也很突出,但我们更倾向于在那里寻求股票敞口。

【战术性投资巴西】我们对巴西持战术性乐观态度,并首选巴西雷亚尔作为其他资产的替代。这种策略反映了我们认为巴西资产在特定时间窗口内可能提供较好的投资机会。

【综合考虑风险与回报】投资者在进行决策时应将这份报告视为众多因素之一。为了符合Reg AC认证和其他重要披露要求,请参阅披露附录或访问www.gs.com/research/hedge.html获取更多信息。

高盛的报告强调了在新兴市场寻找正确收益交易的重要性,不仅要考虑收益率,还要结合市场波动性和资产价值。在低利率和经济不确定性环境中,理解并选择正确的收益策略对于投资者来说至关重要。此外,报告还提到了个别货币的相对吸引力,为投资者提供了具体的配置建议。

What defines a car

ry trade? EM FX carry trades are becoming more in focus

n

giv

en the continued Fed reprieve and weak USD environment in early 2019.

However, if we consider carry trades to be assets where the yield represents a

high share of total return (i.e. covering mark-to-market risk), EM FX is more a

“risk on” trade compared with the sizeable carry in both US Treasuries and EM

fixed income.

What makes a good carry environment? Low volatility regimes naturally

n

present good car

ry opportunities, and in terms of the economic cycle, carry

trades appear most attractive during periods of modest growth slowdown

(especially when compared with risk trades such as equities).

Finding the Right Carry in EM. We remain convinced that EM local bonds

n

present the best Sharpe ratio f

or 2019 across EM assets

, and, similarly

, we are

bullish certain EM FX pairs. Carry-to-volatility metrics are the most commonly

cited gauges for EM currency opportunities, but we recommend considering

carry-to-value as well.

Attractive carry-to-vol EM FX include PHP and IDR, but we are also positive on

ZAR, BRL, and COP which also have strong value signals (relative to recent

history). These currencies have featured in our Top Trades (ZAR and COP in rates,

IDR in local bonds); and MXN stands out as well on a carry-to-vol and

carry-to-value basis, but we prefer equity exposure there. We are tactically

positive on Brazil and prefer BRL over other assets there.

Caesar Maasry

+1(21

2)902-8763 |

caesar.maasry@gs.com

Goldman Sachs & Co. LLC

Ron Gray

+1(21

2)357-6762 | ron.gray@gs.com

Goldman Sachs & Co. LLC

EM Strategy Views

Let’

s not get “Carried Away”: Finding the Right Carry in

EM

1 February 2019 | 12:01AM EST

In

vestors should consider this report as only a single factor in making their investment decision. For Reg AC

certification and other important disclosures, see the Disclosure Appendix, or go to

www.gs.com/research/hedge.html

.

Let’s not get “Carried Away”: Finding the Right Carry in EM

The Fed reprieve for EM has continued into late January with the latest FOMC meeting

bolstering the market’s suspicion that rate hikes may be on hold for some time to come.

The benign rate environment has helped soften the Dollar rally of last year, which of

course has fueled the ‘search for carry’ across EM assets. In this report, we tackle the

question of what makes a good carry trade over the business cycle and in the current

context of an uncertain global growth backdrop.

(1) What is a carry trade?

Anecdotally, we find that there really is not a strong consensus as to what “carry trade”

really refers. Traditionally, carry trades refer to an FX strategy of borrowing low yielding

currencies to fund positions in high yielding FX, but more practically carry trades tend to

refer to any investment with a significant yield, large dividend, or high forward vs. spot

price.

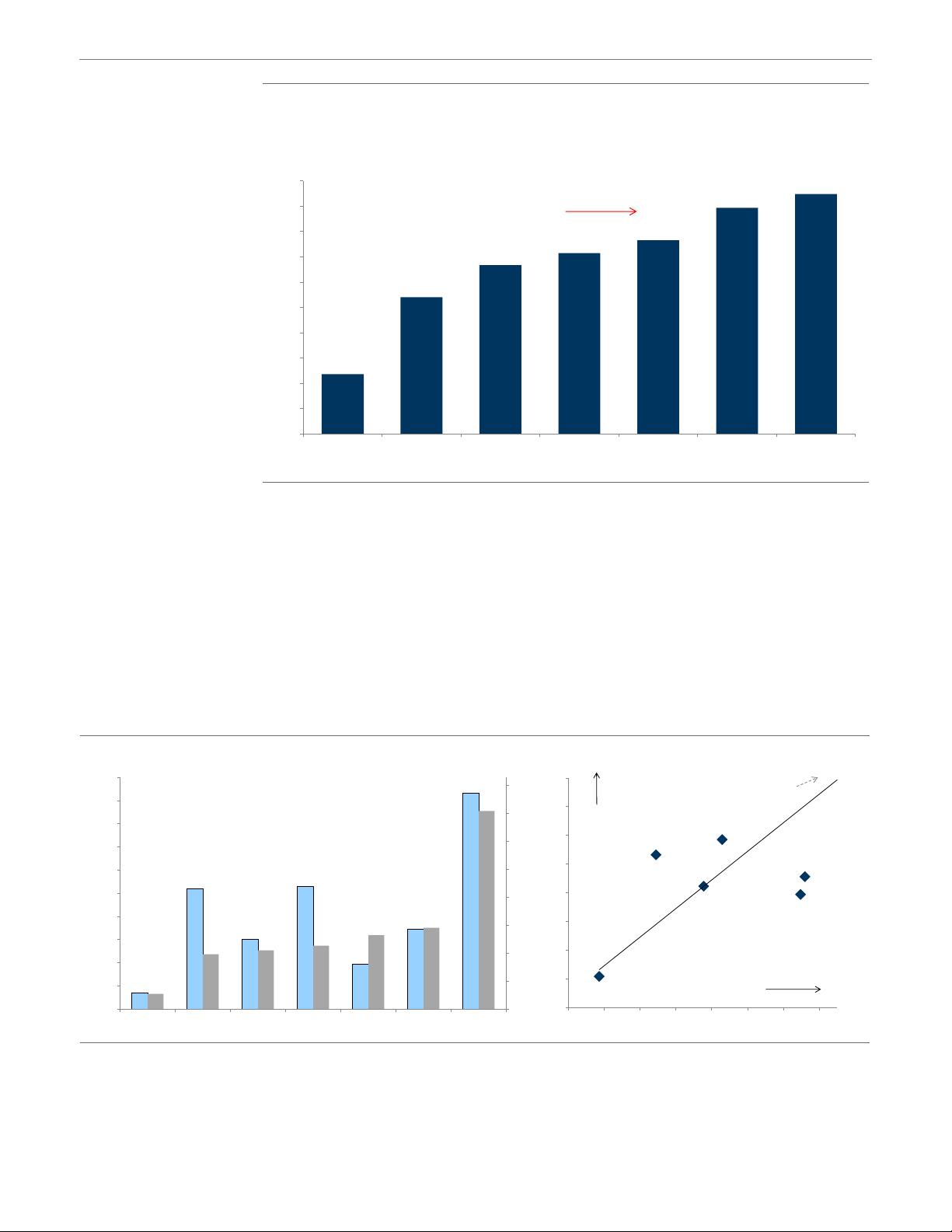

In our view, the key attribute of a carry trade has to do with the ratio of the yield to

volatility (a commonly used ratio across currency investors) - or some measure of yield

vs. “mark-to-market risk”. To gauge this, we look at yields of different assets as a share

of their total return profiles over time (see Exhibit 1). From this perspective, credit is the

most typical “carry trade”; that is, on average, carry tends to represent the highest

share of credit indices’ total returns compared with EM local bonds, US treasuries, EM

currencies, and especially equities (which really are not carry trades, as illustrated by

this metric).

While it is a simple point, we nevertheless would highlight that from this perspective,

EM FX does not really screen as a “carry trade” asset class on the whole. As we

discuss below, this does vary over the course of the business cycle and by individual

currency.

1 February 2019

2

Goldman Sachs

EM Strategy Views

In addition, we stress that carry trades are asymmetric in nature, and usually have

capped upside (with high Sharpe ratios) but significant left-tail risks associated. We think

is critically important to keep in mind when comparing carry trades, particularly across

asset classes. For example, if we consider current carry-to-volatility ratios and compare

them with carry-to-drawdown ratios (using max 3-month drawdown since 2007), credit

indices appear much less attractive. Outside of US 2-year Treasuries, EM sovereign

credit screens as the highest carry-to-vol asset class currently; however, on a

carry-to-drawdown basis, EM credit looks less attractive than EM local bonds and US

10-year Treasuries.

Exhibit 1: Credit and rates tend to be the true carry trades while equities screen as the least carry-driven

12%

27%

33%

36%

38%

45%

47%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

EM Equities US 10-year EM FX US 2-year GBI-EM EMBIG-DIV US HY Credit

Share of Total Return that comes from Carry (Yield)

average of quarterly return profile since 2007

More of a "carry trade"

asset class

Source: FactSet, Datastream, Goldman Sachs Global Investment Research

Exhibit 2: EM local bonds screen as having the highest carry-to-drawdown among EM assets

0.2

1.3

0.8

1.3

0.5

0.9

2.3

0.2

0.6

0.6

0.7

0.8

0.9

2.1

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.00

0.25

0.50

0.75

1.00

1.25

1.50

1.75

2.00

2.25

2.50

MXEF USHY FX EMBIG-DIV US 10yr GBI-EM US 2yr

Finding the Right Carry

Carry-to-Vol &

Carry-to-Drawdown

Carry-to-Vol

Carry-to

Drawdown

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40

US 10yr

EM Credit

EMBIG-DIV

EM Local Bonds

GBI-EM

US HY

Credit

EM Equities

EM FX

Carry-to-Drawdown

Carry-to-Vol

US 2-year

Source: FactSet, Datastream, Goldman Sachs Global Investment Research

1 February 2019

3

Goldman Sachs

EM Strategy Views

(2) What makes a good carry environment?

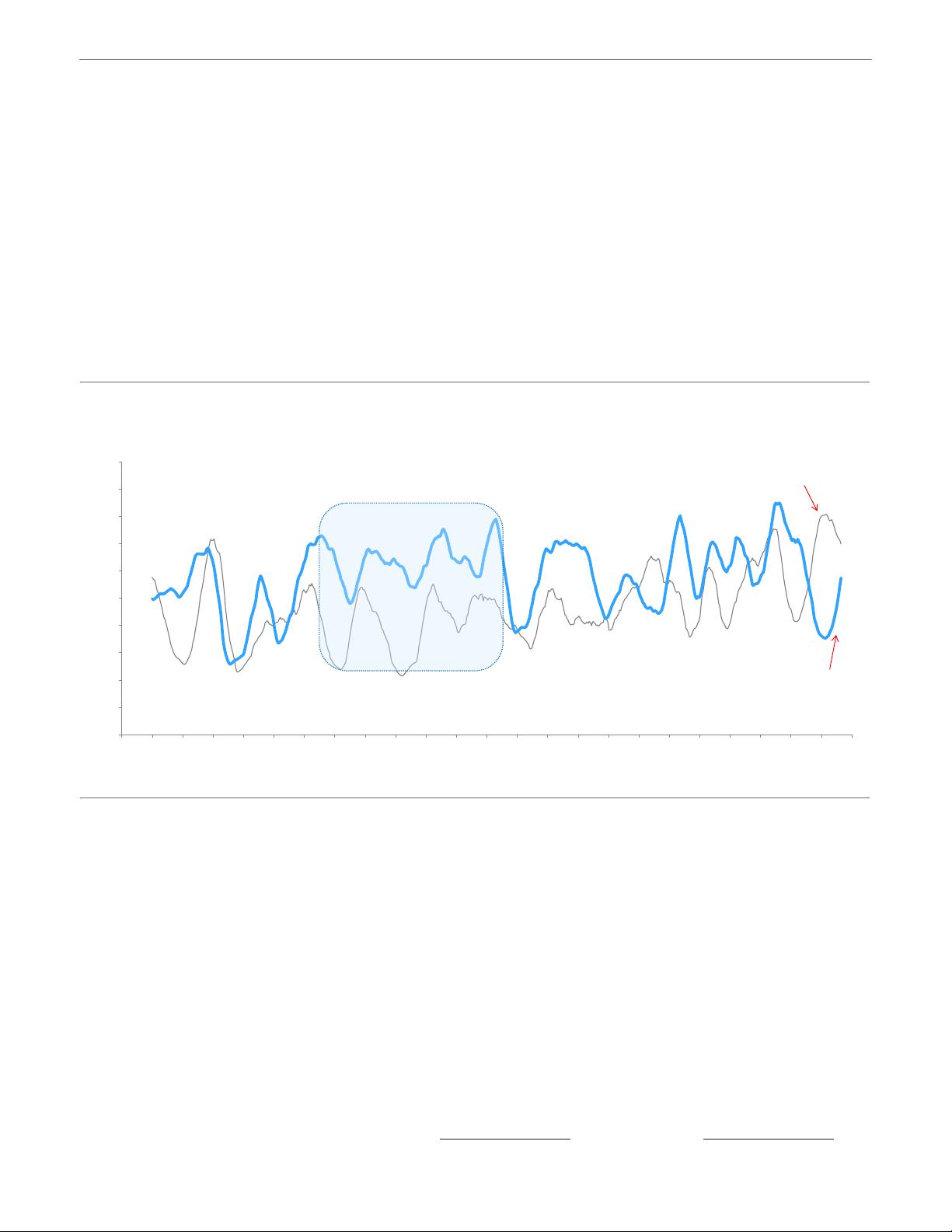

Following from the above, if we consider a carry asset class to be defined by the carry

relative to mark-to-market risk, then similarly a good carry environment should be one

where general market volatility is low (or has a low return profile). Relatedly, the

competitive carry environment is also worth considering (i.e. the yield or

carry-to-volatility of US Treasuries).

As we highlight in Exhibit 3, the QE era appears to be one of the best environments for

EM carry on this relative basis. However, the rise in US yields in early 2018 and

subsequent decline in rate volatility in 3Q made for a very high hurdle for other carry

trades. The rebuild of yield in EM assets (and stabilization of prices) has narrowed the

gap between carry metrics, and we have argued that EM carry trade opportunities now

look attractive, particularly in high-yielding local debt.

In addition to the ‘competitive carry environment’, we find it useful to benchmark carry

trades relative to ‘risk on’ trades (ie. equities). In Exhibit 4, we analyze EM carry trades

relative to global equities dependent on global growth outcomes. The relationship

between equities and Treasuries is well known (though the correlations can shift over

time), in that periods of accelerating global growth clearly favor equity investments

whereas growth slowdowns favor US fixed income.

Comparing EM carry with global equities, however, again we find that EM trades

inevitably have a strong affinity to ‘risk’ as even high-carry EM trades tend to lose

money when global growth decelerates significantly (carry cannot overcome the

mark-to-market risk in these episodes). But, importantly, a period of moderate

deceleration tends to favor EM carry over global equities - not just in terms of

outperformance but also in terms of direction. Given the current uncertainty over global

growth in the short term (weak Europe PMIs, continued bumpy slowdown in China

Exhibit 3: The QE era screens as one of the best environments for EM carry on a share-of-total-return basis

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Mar-07

Sep-07

Mar-08

Sep-08

Mar-09

Sep-09

Mar-10

Sep-10

Mar-11

Sep-11

Mar-12

Sep-12

Mar-13

Sep-13

Mar-14

Sep-14

Mar-15

Sep-15

Mar-16

Sep-16

Mar-17

Sep-17

Mar-18

Sep-18

Mar-19

Share of Total Return from Carry

EM

(Avg. of EMBI, GBI, FX)

US Rates

(avg. of 2 & 10 year)

US Treasury Carry was high

relative to mark-to-market risk

in Q3 2018

EM Carry > US Rates

relative to mark-to-market

risk during QE

Taper

Tantrum

EM Carry

becoming

more favorable...

Source: Datastream, Goldman Sachs Global Investment Research

1 February 2019

4

Goldman Sachs

EM Strategy Views

剩余22页未读,继续阅读

资源推荐

资源评论

121 浏览量

143 浏览量

149 浏览量

127 浏览量

155 浏览量

2025-01-09 上传

152 浏览量

133 浏览量

资源评论

qw_6918966011

- 粉丝: 27

- 资源: 6165

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 2000-2023年上市公司高管绿色认知数据/企业环保注意力数据(含原始数据+计算代码+结果)

- 学生学业表现数据集.zip

- 计算机专业课程中Linux环境下访问MySQL数据库服务器的实验指导与常见问题解决

- Mysql数据库部署与多语言访问技术指南 - Linux环境下的数据库服务器实践

- Mysql数据库管理与使用指南-涵盖配置、安全管理和日常运维指令

- 设置每天定时关机.bat

- 圆盘抽真空包装机-MINI半导体卷盘包装分拣流水线sw16全套技术资料100%好用.zip

- 实验十一、Linux用户与用户组实验.doc

- 学生考试数据集.zip

- GLPI资产管理平台OVF导入包,支持虚拟化平导入可用

- 实验十二、Linux组共享目录权限配置.doc

- InterruptedException如何解决.md

- 性别分类数据集.zip

- 资源不足异常解决办法.md

- ClassNotFoundException如何解决.md

- 不平衡电网下的svg无功补偿,级联H桥svg无功补偿statcom,采用三层控制策略 (1)第一层采用电压电流双闭环pi控制,电压电流正负序分离,电压外环通过产生基波正序有功电流三相所有H桥模块直流

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功