没有合适的资源?快使用搜索试试~ 我知道了~

高盛-中国定制家具投资策略分析-1219-44页.pdf

试读

43页

需积分: 0 0 下载量 47 浏览量

更新于2023-07-26

收藏 686KB PDF 举报

在中国经济快速发展的背景下,定制家具市场作为房地产下游行业之一,一直在随着房地产市场的波动而变化。尽管近年来中国房地产市场整体呈现疲软态势,市场竞争日趋激烈,但是定制家具行业依然面临着巨大的整合机遇和扩张空间,主要原因是市场参与者众多而分散,行业集中度不高。根据高盛发布的投资策略分析报告,我们深入了解了中国定制家具行业的发展现状及未来趋势,并分析了其中的重点企业。

从市场规模来看,中国定制家具行业正随着居民生活水平的提高而逐渐壮大。根据AVC的数据,2018年全国精装修新房销售量约为460万套,占到新房销售总量的23%,并且预计到2020年,精装修新房数量将达到610万套。这一数据表明,精装修政策的实施显著推动了定制家具的需求增长,尤其是在精装修新房市场中,定制家具因其个性化和功能化的特点,受到了越来越多消费者的青睐。

在这样一个大背景下,中国定制家具行业出现了一些领军企业,如欧派和广州尚品宅配。欧派作为中国厨房橱柜行业的龙头企业,通过品类扩展、提升单店销售额以及持续投资于制造扩张,其业务增长潜力巨大。报告预测欧派在未来几年内将保持较高的增长速度,复合年增长率分别为收入的16%和净利润的13%。然而,欧派的股价已基本与目标价82.0元持平,因此首次评级为中性,提示投资者需要对市场有清晰的认识。

广州尚品宅配则通过直管和购物中心店面以及外包产品的模式,获得了稳定的收入来源。尽管如此,由于家具产品差异化程度不高,预计其营收增长速度将会放缓。这些信息揭示出,尽管行业前景广阔,但企业之间在产品创新、市场定位、渠道管理等方面的能力差异,将直接影响其在市场整合过程中的竞争地位。

除了上述企业,报告还提到,随着精装修政策的持续推行,预计能够满足精装修新房对产品规格、交货时间以及付款期限严格要求的大型企业将会获得更多的市场份额。这主要是由于大型企业通常拥有更出色的财务状况和分销资源,能够更有效地应对市场变化和消费者需求。

在分析投资策略时,高盛建议投资者应关注那些具有竞争优势、创新能力以及能适应市场变化的企业,从而在行业整合过程中寻找投资机会。市场领导者的品牌效应和规模经济优势是不可忽视的重要因素,这些因素能够帮助企业在竞争中脱颖而出,抵御风险,实现长期增长。

虽然中国定制家具行业正面临一些挑战,但精装修政策的推行、市场需求的增长以及行业本身的整合潜力,共同为该行业的发展提供了积极的前景。投资者在制定投资决策时,应深入分析企业的核心竞争力、成长性以及市场策略,以期在这一充满活力的行业中获得理想的回报。

China’

s customized furniture industry – though facing headwinds from a property

downcycle and intensifying competition, especially in the furniture mall channel –

offers a significant consolidation opportunity in a vast, yet fragmented, market.

Going forward, we expect industry leaders to gradually, but consistently, gain share

from smaller players. We expect industry leaders, which enjoy manufacturing and

distribution advantages, to benefit from the rising portion of furbished new

properties, accelerating their market share concentration.

Developers’ channel: Long-term revenue opportunity for leading players

A

ccording to All View Cloud (AVC), c. 4.6mn units of furbished new properties were

sold in 2018, 23% of the total new properties sold. The number is expected to rise to

6.1mn by 2020E based on the 13th Five-Year Plan. In comparison, Suofeiya, a leading

wardrobe manufacturer, only had 0.6mn customers in 2018. Hence, we believe

capturing even a small portion of this growing segment will translate into

considerable growth for furniture companies. Furthermore, we expect stringent

requirements on product specifications, delivery time and payment period will

mainly benefit large players with superior financial and distributor resources.

Initiating on two market leaders; reiterate Buy on Suofeiya with 34% upside

We expect Oppein, a dominant player in kitchen cabinets and the developers’

channel, to grow revenue/net profit by 16%/13% CAGRs in 2019E-20E, driven by: 1)

category expansion; 2) per-store sales growth; and 3) continued investment in

manufacturing expansion. However, with the shares trading in line (6%

downside) with our 12-month discounted EV/EBITDA-based target price of

Rmb82.0, we initiate at Neutral. Guangzhou Shangpin has differentiated itself with

more direct-owned and shopping mall based stores, and a large revenue contribution

from outsourced products. However, given relatively less differentiation in its

furniture products, we expect revenue growth to decelerate sharply in 2019E, posing

downside risk to the currently high valuation. We initiate at Sell with a 12-m

discounted EV/EBITDA-based target price of Rmb49.0, implying 21% downside.

We continue to favor Suofeiya for its industry-leading manufacturing capabilities and

distributor network. Reiterate Buy with 34% upside potential.

Nicolas Yi

+86(21)240

1-8922 | nicolas.yi@ghsl.cn

Beijing Gao Hua Securities Company

Limited

China Consumer Durables

Customized furniture: Setting the table – Initiate Oppein

at Neutral, Shangpin at Sell; reiterate Buy on Suofeiya

19 December 2018 | 8:06PM CST

Goldman Sac

hs does and seeks to do business with companies covered in its research reports. As a result,

investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC

certification and other important disclosures, see the Disclosure Appendix, or go to

www.gs.com/research/hedge.html

.

Analysts employed by non-US affiliates are not registered/qualified as research

analysts with FINRA in the U.S.

PM Summary: Initiating on two customized furniture manufacturers;

long-term opportunity from developer’s channel

Customized furniture manufacturers primarily sell through retail channels in China.

Recently they have been paying more attention to the developer’s channel amid

property demand slowdown and intensifying competition in retail channels. According to

AVC, only 23% of new properties sold were furbished in China in 1H18. Per the 13th

Five-Year Plan, the ratio is expected to rise to 30% in 2020E driven by a combination of

favorable government policies and differentiated competition strategies especially from

leading real estate developers. In our view, such penetration avenues will present a

significant revenue opportunity and primarily benefit leading furniture manufacturers

with better financial and distributor resources. We expect Suofeiya and Oppein, the two

key players in the segment, to be the major beneficiaries of the trend given their

continuous investment in manufacturing capabilities and established distributor

network.

Suofeiya (Buy; 12-m TP: Rmb24.4)

We continue to favor Suofeiya as a major beneficiary of a structural growth in

customized furniture industry, due to its leading manufacturing capabilities and

distributor network. Although, industry is facing headwinds from a short-term property

downcycle (for details, refer to China Real Estate: Slower property investment in 2019;

consolidation to accelerate, published on November 23, 2018) and intensified

competition, we expect Suofeiya to mitigate the growth headwinds by launching more

quality products and improving competitiveness of its distributors by both providing

more financial support and replacing less efficient distributors. Moreover, we expect

developers’ channel to contribute more to revenue growth in coming years as the

company continues cooperating with large developers and investing in manufacturing

facilities. We expect revenue/net profit CAGR of 19%/16% in 2019E-20E. With the

stock currently trading at 15X 2019E P/E (vs. its 6-year median 12-m forward P/E

of 27X), we reiterate Buy on the stock.

Oppein (Neutral; 12-m TP: Rmb82.0)

Oppein - At a glance

The largest player in China kitchen cabinet market by revenue size: The 1.

company derived Rmb5.4bn revenue from kitchen cabinet business in 2017, greater

than the sum of No.2-No.4 listed players. Recently Oppein has been leveraging its

strong brand in kitchen cabinet segment to expand into other product categories

such as wardrobe, wooden door, etc.

One of the strongest distributor networks characterized by both extensive 2.

reach and efficiency. By 1H18, the company had 6,711 stores across different

product categories and tiers of cities, the largest among all competitors. The

company has the highest per store sales for kitchen cabinet and has been ramping

up quickly in the wardrobe segment as of 1H18.

19 December 2018

3

Goldman Sachs

China Consumer Durables

A leader in developer’s market. Oppein derived Rmb964mn from the developer’s 3.

channel in 2017, highest among its listed competitors. The company has been

partnered with leading developers for a long time and has developed an experienced

network distributors for developers to expand the business and alleviate cash flow

risks.

Investment thesis

We expect Oppein’s revenue to be driven by both new product category penetration and

channel expansion. We expect Oppein to leverage its strong brand and distributor

network in kitchen cabinet segment to drive up sales in other products such as

wardrobes. On the other hand, we expect Oppein to continue its expansion in both

retail and developer’s channel, utilizing its strong distributor network. However, we

expect the margins to gradually trend down due to higher competition and increasing

share of developer revenue. Factoring in the above, we expect revenue/net profit CAGR

of 16%/13% in 2019E-20E. Our 12-m target price is derived by applying a 12X exit

multiple to 2021E EBITDA and discounting back to 2018E at 9% COE. With 6%

downside to our TP, we initiate on Oppein with a Neutral rating.

Guangzhou Shangpin (Sell; 12-m TP: Rmb49.0)

Shangpin - At a glance

A Leading customized furniture manufacturer with a unique channel strategy: 1.

We expect Shangpin to derive c. 39% of its total revenue in 2018E from

directly-owned stores, vs. only 2%-3% for Suofeiya and Oppein. Due to the

opex-intensive nature of its channel strategy, Shangpin has had much lower

profitability compared to Suofeiya and Oppein. However, since late 2017, Shangpin

has started focusing on an aggressive franchise-driven strategy, recruiting multiple

distributors in each city (vs. only 1 or 2 for Suofeiya and Oppein) to drive up revenue

growth.

Shopping mall based store location + online marketing strategy: Shangpin has 2.

over 50% of its stores in shopping malls (vs. 20% for Suofeiya), which, in our view,

helps it to avoid high competition in furniture malls. The company utilizes online

marketing strategy including its own website and other platforms such as Baidu and

Taobao to funnel customer traffic to its shopping mall stores.

Higher contribution from outsourced products: Shangpin is expected to derive c. 3.

20% of revenue from sales of outsourced products in 2018E based on our

estimates. (vs. 4% for Suofeiya in 2018E)

Investment thesis

We expect Shangpin’s revenue growth to be driven by increasing franchise store

openings and growth of outsourced products, however, at a declining pace. We expect

more store closures and slower per store sales growth as newly recruited distributors

face more pressure during the industry downcycle in 2019E. On the other hand, we

expect the sales growth of outsourced products to decelerate along with the sales from

its customized furniture segment. On the margin side, we expect GPM to trend down

19 December 2018

4

Goldman Sachs

China Consumer Durables

due to rising share of low-margin franchise revenue and outsourced products sales.

Factoring in the above, we expect revenue/net profit CAGR of 18%/17% in 2019E-20E.

Our 12-m target price is based on an 11X exit multiple applied to its 2021E EBITDA and

discounted back to 2018E at 9% COE. With 21% downside, we initiate on Guangzhou

Shangpin with a Sell rating.

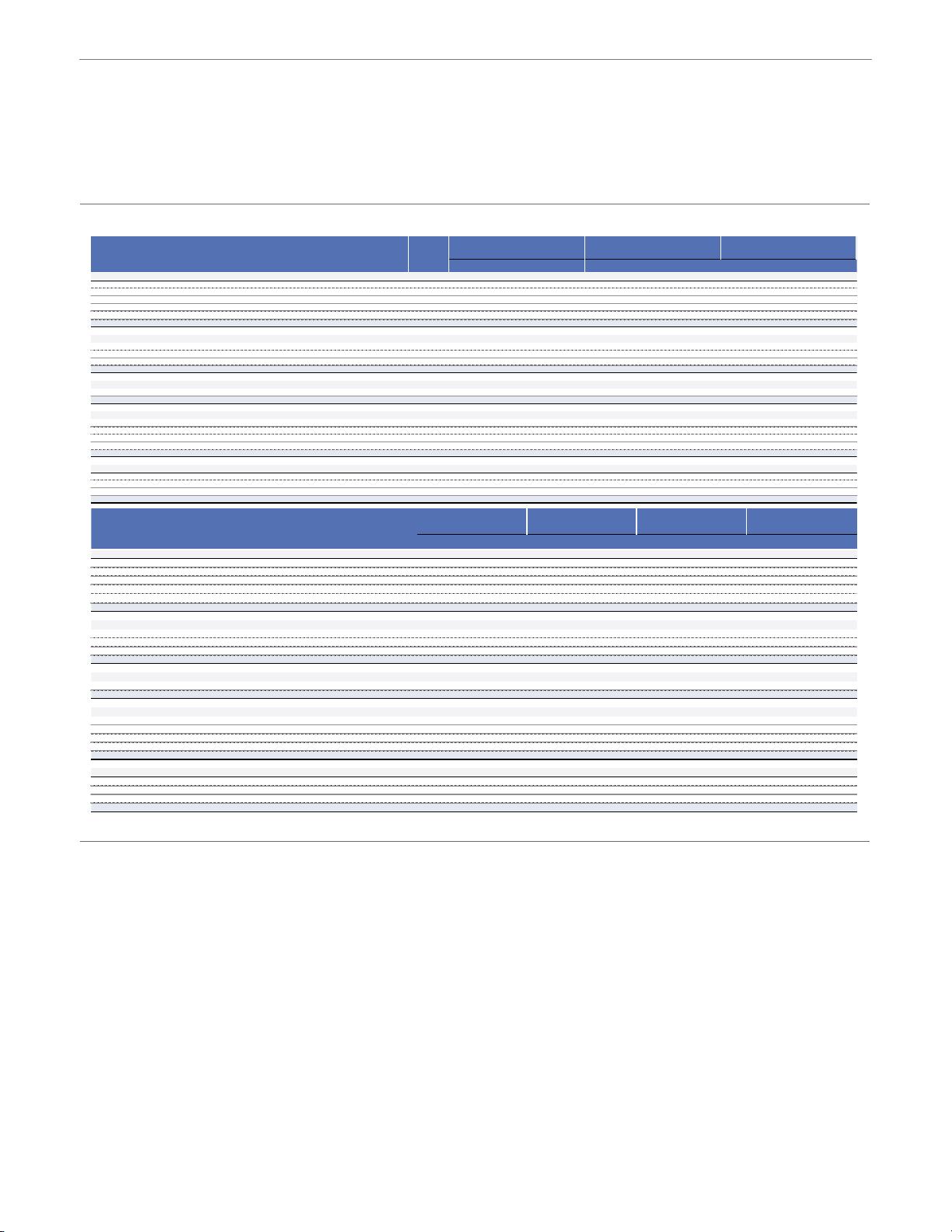

Exhibit 1: Global appliances, furniture and automation comp

2017A 2018E 2019E 2020E 2017A 2018E 2019E 2020E 2017A 2018E 2019E 2020E

China appliances

Midea Group 000333.SZ CNY 38.81 50.00 29% Buy 37.0 14% 14.8x 12.6x 11.6x 9.8x 3.5x 3.0x 2.6x 2.3x 10.9x 8.3x 7.6x 6.2x

Gree Electric 000651.SZ CNY 36.80 44.00 20% Neutral 32.1 -2% 9.9x 7.8x 9.0x 8.1x 3.4x 2.7x 2.3x 1.9x 4.9x 3.5x 3.8x 3.3x

Haier Electronics 1169.HK HKD 18.54 23.90 29% Buy* 6.6 12% 13.7x 12.0x 10.9x 9.6x 2.1x 1.9x 1.7x 1.5x 7.2x 6.1x 5.2x 4.2x

Little Swan 000418.SZ CNY 45.84 47.00 3% Neutral 4.2 15% 19.2x 18.9x 17.3x 14.3x 4.1x 3.7x 3.3x 2.9x 16.6x 15.3x 13.3x 10.5x

Hangzhou Robam 002508.SZ CNY 22.08 23.40 6% Neutral 3.0 7% 14.3x 13.7x 12.7x 11.9x 4.0x 3.5x 3.0x 2.7x 22.1x 9.9x 9.2x 8.2x

Median

20% 6.6 12% 14.3x 12.6x 11.6x 9.8x 3.5x 3.0x 2.6x 2.3x 10.9x 8.3x 7.6x 6.2x

China furniture

Suofeiya 002572.SZ CNY 18.31 24.40 33% Buy 2.5 16% 18.6x 16.7x 14.6x 12.5x 3.8x 3.4x 3.0x 2.6x 23.8x 10.3x 8.9x 7.5x

Oppein 603833.SS CNY 87.67 82.00 -6% Neutral 5.3 13% 28.4x 22.0x 19.9x 17.4x 5.9x 5.0x 4.2x 3.6x 26.5x 16.1x 14.2x 12.2x

GZSP 300616.SZ CNY 62.33 49.00 -21% Sell 1.8 17% 32.6x 24.4x 21.2x 17.8x 4.7x 4.2x 3.7x 3.3x 32.9x 23.2x 19.4x 14.7x

Median

-6% 2.5 16% 28.4x 22.0x 19.9x 17.4x 4.7x 4.2x 3.7x 3.3x 26.5x 16.1x 14.2x 12.2x

China LED lighting

Opple Lighting 603515.SS CNY 27.99 32.00 14% Neutral 3.1 12% 30.8x 24.6x 23.1x 19.5x 5.8x 5.0x 4.4x 3.9x 28.2x 23.9x 21.7x 17.6x

Median

14% 3.1 12% 30.8x 24.6x 23.1x 19.5x 5.8x 5.0x 4.4x 3.9x 28.2x 23.9x 21.7x 17.6x

Global appliances

Electrolux ELUXb.ST SEK 190 208 9% Neutral 6.0 19% 9.6x 15.4x 12.2x 10.9x 2.7x 2.5x 2.3x 2.1x 6.8x 5.3x 5.4x 5.0x

Daikin 6367.T JPY 12,240 15,000 23% Neutral 31.6 3% 23.2x 18.9x 19.3x 17.9x 3.2x 2.8x 2.5x 2.2x 10.0x 10.7x 10.0x 9.0x

Panasonic 6752.T JPY 1,068 1,800 69% Buy 21.9 6% 16.6x 10.6x 9.6x 9.3x 1.6x 1.4x 1.3x 1.2x 4.6x 5.3x 3.3x 3.0x

Arcelik ARCLK.IS TRY 15.25 19.90 30% Neutral 1.9 50% 12.2x 15.5x 8.9x 6.9x 1.5x 1.4x 1.3x 1.1x 10.3x 7.7x 6.0x 5.1x

Median

27% 13.9 13% 14.4x 15.4x 10.9x 10.1x 2.1x 2.0x 1.8x 1.6x 8.4x 6.5x 5.7x 5.0x

Global automation

Fanuc 6954.T JPY 16,850 21,000 25% Neutral 28.8 -11% 25.6x 18.0x 18.8x 22.6x 2.4x 2.2x n.a. n.a. 16.0x 15.4x 11.0x 11.3x

Yaskawa 6506.T JPY 2,977 3,900 31% Buy 7.0 4% 38.9x 19.9x 17.4x 18.2x 4.0x 3.4x 3.1x 2.8x 10.4x 14.3x 11.1x 11.0x

ABB ABBN.S CHF 19.2

Not Rated

41.5 23% 19.1x 17.8x 14.0x 11.8x 2.8x 2.7x n.a. n.a. 11.1x 8.8x 7.7x 6.9x

Median

28% 28.8 4% 25.6x 18.0x 17.4x 18.2x 2.8x 2.7x 3.1x 2.8x 11.1x 14.3x 11.0x 11.0x

P/E

P/B

EV/EBITDA

Company

Ticker

PCY

Last closing

price

Target

price

Upside/

(downside)

Rating

Mkt Cap

(US$bn)

18E-20E

EPS CAGR

2017A 2018E 2019E 2020E 2017E 2018E 2019E 2020E 2017A 2018E 2019E 2020E 2017A 2018E 2019E 2020E

China appliances

Midea Group 000333.SZ CNY 38.81 50.00 29% Buy 23% 23% 21% 22% 17% 15% 14% 15% 3% 4% 4% 5% 8% 10% 8% 11%

Gree Electric 000651.SZ CNY 36.80 44.00 20% Neutral 37% 38% 27% 26% 17% 20% 13% 11% 0% 5% 4% 5% 6% 12% 7% 6%

Haier Electronics 1169.HK HKD 18.54 23.90 29% Buy* 16% 15% 15% 15% 81% 44% 40% 40% 1% 2% 2% 2% 6% 2% 7% 8%

Little Swan 000418.SZ CNY 45.84 47.00 3% Neutral 20% 18% 17% 18% 27% 25% 27% 34% 2% 2% 3% 3% 6% 9% 9% 9%

Hangzhou Robam 002508.SZ CNY 22.08 23.40 6% Neutral 31% 27% 25% 24% 28% 48% 20% 33% 2% 4% 4% 4% 3% 14% 8% 8%

Median

20% 23% 23% 21% 22% 27% 25% 20% 33% 2% 4% 4% 4% 6% 10% 8% 8%

China furniture

Suofeiya 002572.SZ CNY 18.31 24.40 33% Buy 20% 20% 20% 21% 30% 26% 26% 25% 1% 3% 3% 4% 0% 2% 2% 2%

Oppein 603833.SS CNY 87.67 82.00 -6% Neutral 29% 25% 23% 22% 52% 42% 33% 30% 1% 1% 2% 2% 0% 0% 0% 2%

GZSP 300616.SZ CNY 62.33 49.00 -21% Sell 22% 18% 19% 20% 49% 28% 47% 49% 1% 1% 2% 2% 3% 1% 2% 6%

Median

-6% 22% 20% 20% 21% 49% 28% 33% 30% 1% 1% 2% 2% 0% 1% 2% 2%

China LED lighting

Opple Lighting 603515.SS CNY 27.99 32.00 14% Neutral 20% 22% 20% 21% 22% 26% 28% 33% 1% 1% 2% 2% 4% 5% 5% 5%

Median

14% 20% 22% 20% 21% 22% 26% 28% 33% 1% 1% 2% 2% 4% 5% 5% 5%

Global appliances

Electrolux ELUXb.ST SEK 190 208 9% Neutral 30% 23% 20% 20% 16% 12% 12% 12% 3% 5% 5% 5% 7% 2% 4% 6%

Daikin 6367.T JPY 12,240 15,000 23% Neutral 14% 15% 13% 13% 14% 19% 20% 20% 1% 1% 1% 1% 6% 6% 5% 6%

Panasonic 6752.T JPY 1,068 1,800 69% Buy 8% 13% 13% 12% 8% 12% 12% 12% 2% 2% 3% 3% 3% 3% 7% 8%

Arcelik ARCLK.IS TRY 15.25 19.90 30% Neutral 13% 9% 15% 17% 16% 11% 13% 14% 3% 2% 4% 5% -4% -13% -6% 9%

Median

27% 14% 14% 14% 15% 15% 12% 12% 13% 3% 2% 4% 4% 4% 3% 4% 7%

Global automation

Fanuc 6954.T JPY 16,850 21,000 25% Neutral 9% 13% 11% 9% 16% 24% 17% 14% 2% 2% 5% 3% 1% 2% 5% 3%

Yaskawa 6506.T JPY 2,977 3,900 31% Buy 11% 18% 18% 16% 13% 17% 18% 16% 1% 1% 2% 2% 4% 3% 3% 4%

ABB ABBN.S CHF 19.2

Not Rated

20% 21% 22% 24% 10% 11% 12% 13% 3% 4% 6% 6% 5% 6% 8% 9%

Median

28% 11% 18% 18% 16% 13% 17% 17% 14% 2% 2% 5% 3% 4% 3% 5% 4%

Dividend yield

FCF yield

ROE

CROCI

Company

Ticker

PCY

Last closing

price

Target

price

Upside/

(downside)

Rating

Notes: * Denotes stock is on our regional Conviction List. TPs are on a 12-month time frame. Prices as of 12/18/2018

Source: Bloomberg, Goldman Sachs Global Investment Research, Gao Hua Securities Research

19 December 2018

5

Goldman Sachs

China Consumer Durables

剩余42页未读,继续阅读

资源推荐

资源评论

2023-07-24 上传

2023-07-26 上传

2021-09-16 上传

112 浏览量

2023-07-26 上传

181 浏览量

132 浏览量

168 浏览量

2021-05-12 上传

161 浏览量

186 浏览量

114 浏览量

170 浏览量

200 浏览量

2023-07-25 上传

资源评论

qq_41146932

- 粉丝: 12

- 资源: 6307

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功