2 TECHNICAL ASSISTANCE IN THE EUROPEAN FINANCIAL ARCHITECTURE

TA IN THEORY

Technical assistance/cooperation is defined by the OECD as “the provision of resources aimed at the

transfer of technical and managerial skills or of technology” for the purpose of building up general

national capacity or for the purpose of implementing specific investment projects.

2

In the context of

DFI investments, it serves four core purposes:

1. To develop a pipeline of projects, through the financing of feasibility studies and market devel-

opment research to identify and overcome obstacles to investments.

2. To de-risk investments, by financing project preparation and management, staff training, and

legal and contracting fees, and improving financial controls or improving governance systems of

private companies

3

to make business ideas commercially viable and attract investors.

3. To bolster impact by supporting clients to improve standards, particularly environmental, social

and governance (ESG) performances.

4. To facilitate an enabling business environment and create market opportunities by supporting

policy reforms in areas such as labour laws, fiscal regimes, competition policy and market reg-

ulation.

The case for TA derives from its crucial role in mitigating risks and increasing investors’ confidence.

The United Nations Capital Development Fund (UNDCF) emphasises the importance of TA in blended

finance for the so-called missing middle—small and medium enterprises (SMEs)—which are “too large

for microfinance, but too small or risky to access […] capital from conventional debt and equity inves-

tors,” and in particular, in least developed countries (LDCs) (OECD/UNCDF, 2019).

TA IN NUMBERS

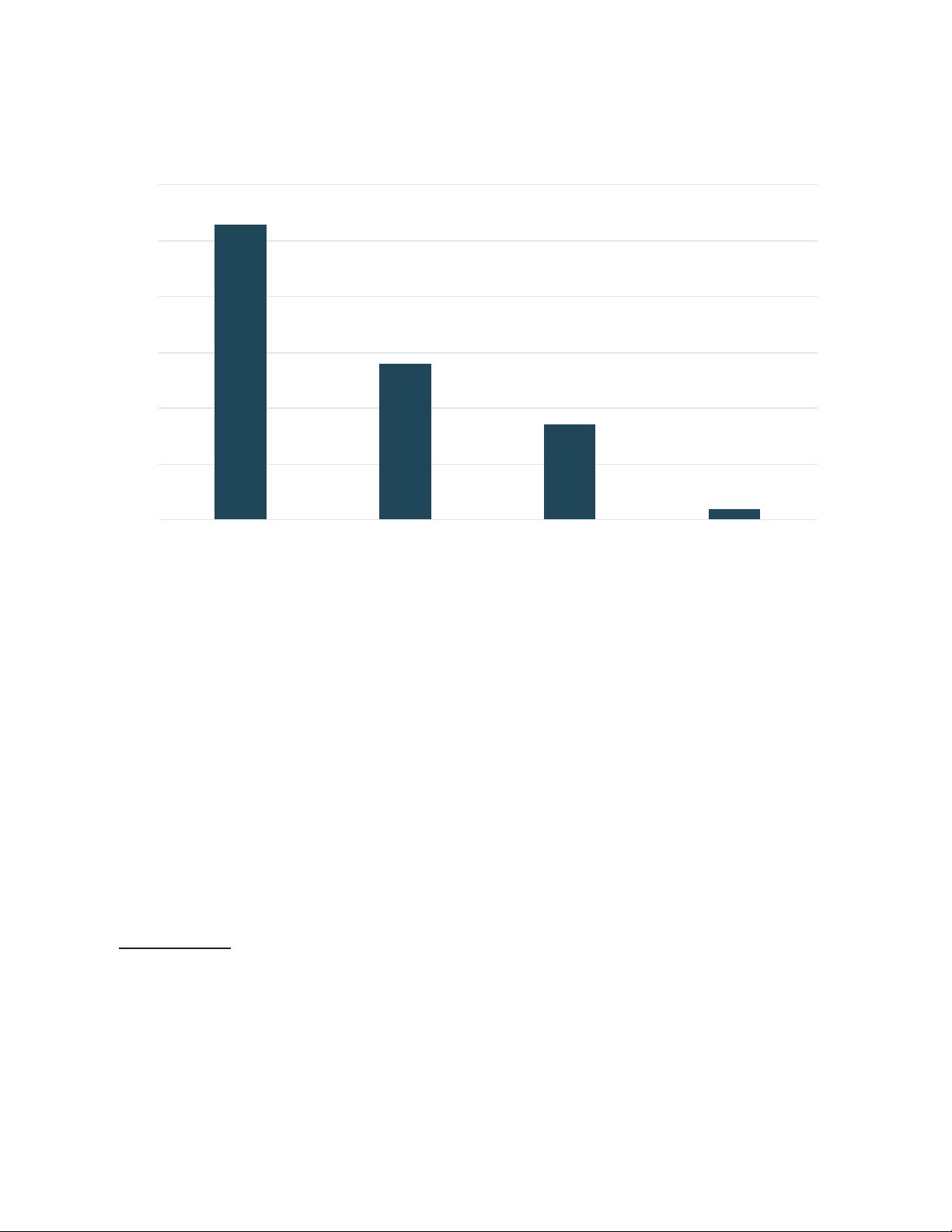

TA is used at different stages of the investment cycle. At the pre-investment stage, it is used to develop

a pipeline of projects or to facilitate the conditions for a business enabling environment. At the invest-

ment stage, it is used to subsidise the investment. Post-investment, it is used to bolster the impact of

the project. According to Convergence’s historical database on blended finance, out of 136 transactions

with a TA component, a majority (53 percent) of TA was targeted at post-investment interventions and

less than a third (28 percent) at upstream activities to develop a pipeline of bankable projects (see

Figure 1).

4

2 https://stats.oecd.org/glossary/detail.asp?ID=6022

3 https://www.bridgesfundmanagement.com/wp-content/uploads/2017/08/Shifting-the-Lens-A-De-risking-Toolkit-for-Im-

pact-Investment.pdf

4 https://assets.ctfassets.net/4cgqlwde6qy0/3RZClckJliqSyQVy5zkxaT/d3154bf0a55836bd3ec26fb07258a913/Technical_Assis-

tance_Brief_vFinal.pdf

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功