3

GLOBAL FUND PERFORMANCE REPORT (AS OF Q1 2022)

OVERVIEW

Overview

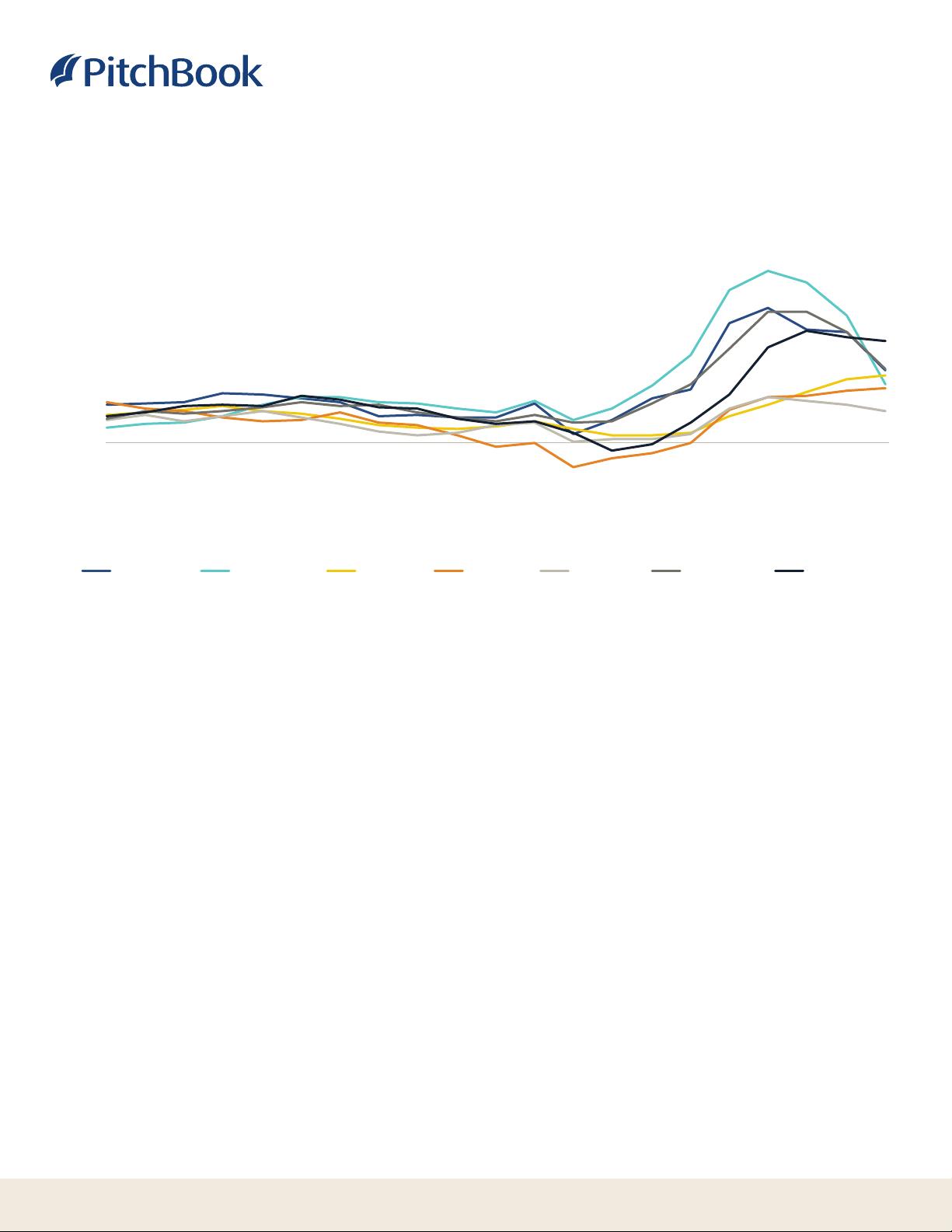

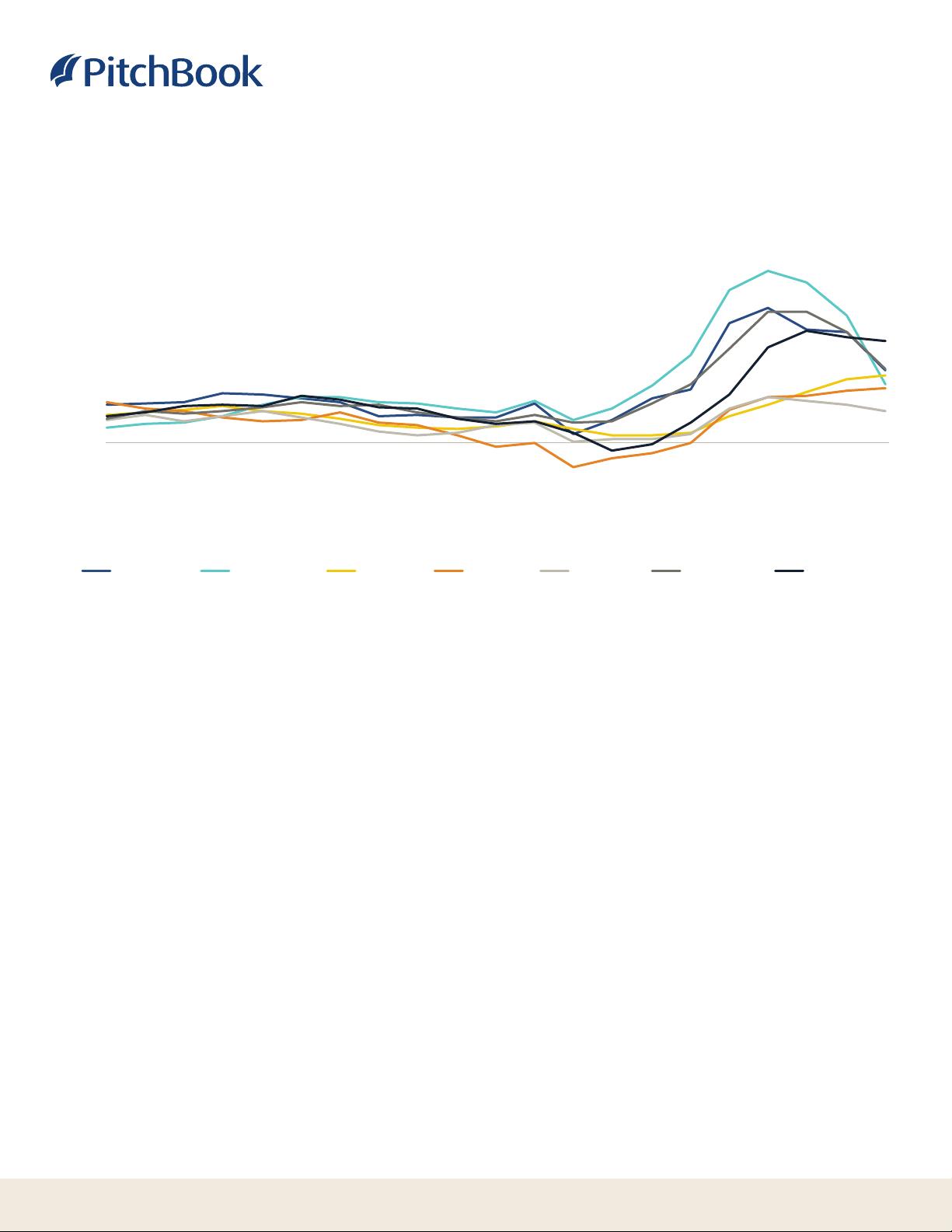

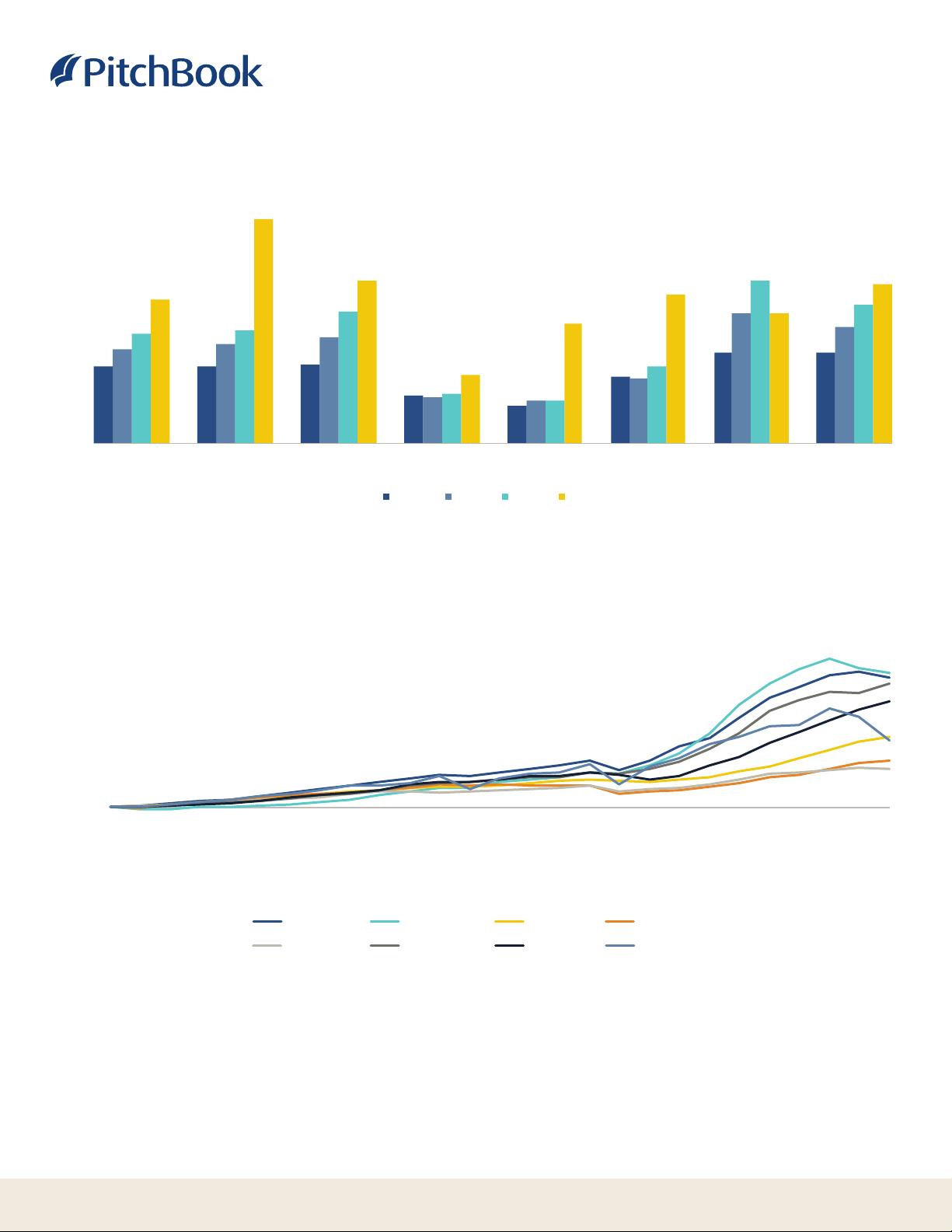

Private equity Venture capital Real estate Real assets Private debt Funds of funds Secondaries

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

70%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2017 2018 2019 2020 2021

Rolling one-year horizon IRRs by strategy

Source: PitchBook | Geography: Global

*As of March 31, 2022

Hilary Wiek, CFA, CAIA

Lead Analyst, Fund Strategies & Sustainable Investing

Through the first quarter of 2022, one-year private fund

performance was still at historically high levels, as more

muted performance in Q1 2022 was still overcome by three

quarters of phenomenal 2021 performance. While well off

from the 42.8% one-year figure seen just three quarters

earlier, the 27.0% overall private capital return was still well

ahead of the 10-year average of 14.5%. Preliminary figures for

Q2 2022 do show a recognition that the macro environment

has shifted, as private capital is indicating a -1.1% return. In

the preliminary figures, PE and VC trailed the other private

fund strategies in Q2 2022, with the highest fliers of 2021

having further to fall back to recognize the new normal.

As often happens when the public markets fall dramatically,

private markets tread a less volatile path. While arguments

can and will be made that the muted volatility in private

funds versus public markets may not fully reflect reality,

private funds valuations are not indicating much concern

about the macro environment in comparison to the S&P

500. Inclusive of the preliminary results of Q2 2022, several

strategies continued to increase in value in the first half of

the year, although VC, PE, and private debt have all come

off their peaks. Compared to the 20.0% drop in the S&P,

however, the -6.7% VC return for the first six months through

June was much milder than one might have expected given

the headlines around the war in Ukraine, inflation, and the

possibility of entering a recession.

While private funds have not shown extreme volatility

overall, within strategies the median returns mask a fairly

high amount of dispersion, meaning that any one investor’s

experience of individual funds may vary widely from the

headline median numbers. As an example, while we report

that VC funds that launched between 2004 and 2017 had

a median IRR of 15.5%, top decile funds provided a 39.9%

return or better and bottom decile funds have returned

-6.7% or worse. Private debt continues to have the narrowest

band of top-to-bottom returns, with the median IRR of 8.5%

flanked by a top decile return of 15.7% and a bottom decile

of 1.5%. Funds of funds (FoF) and secondaries have seen a

nice positive skew to their return dispersion—top decile FoF

performed 15.2% better than the 12.5% median, while bottom

decile FoF only did 8.2% worse. Secondaries fund outcomes

ranged from 14.9% above to 8.8% below the 13.6% median.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功