2022年最大的社交媒体趋势(英)-38页.pdf

2.虚拟产品一经售出概不退款(资源遇到问题,请及时私信上传者)

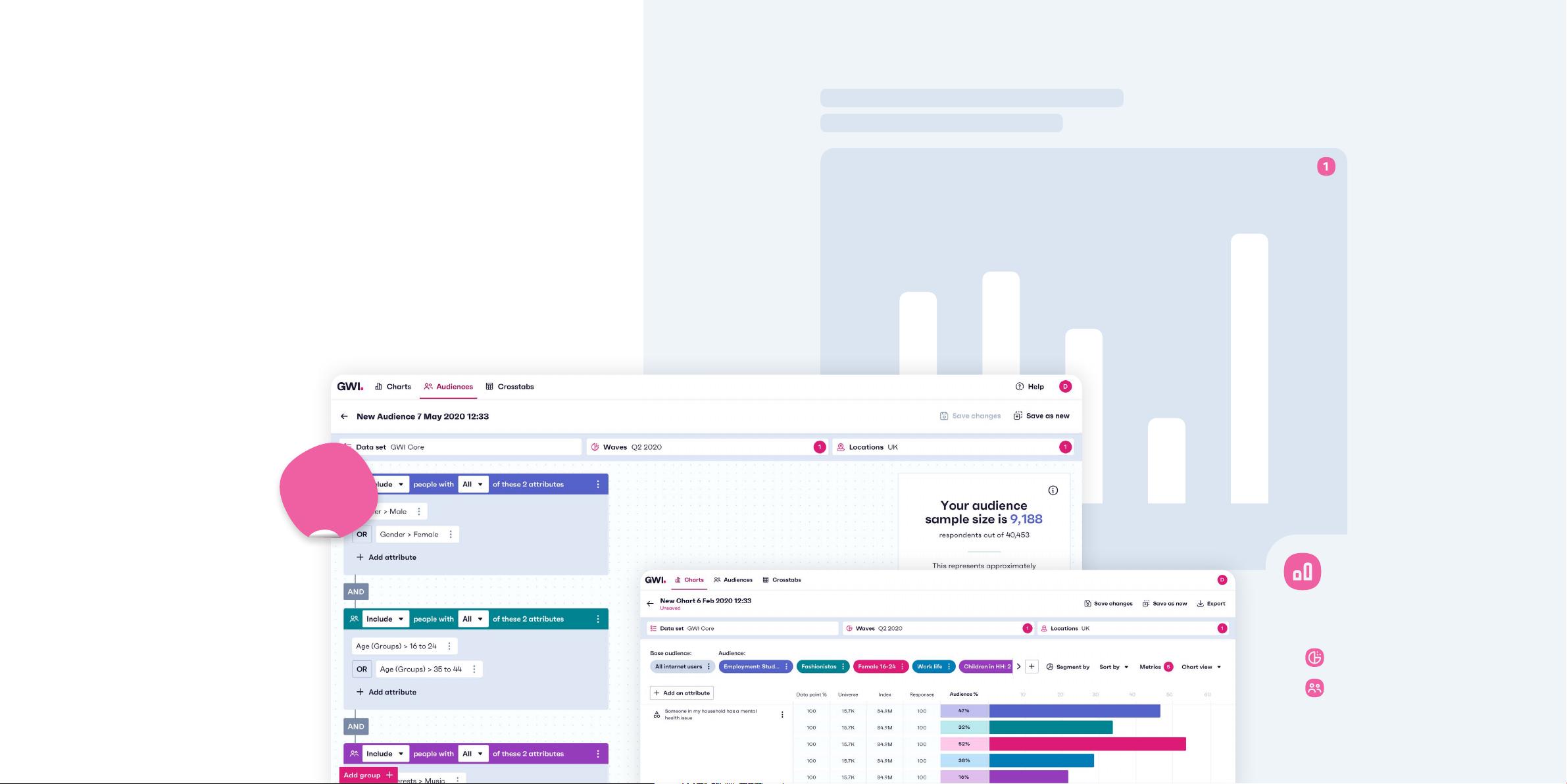

【2022年最大的社交媒体趋势】 随着2022年的推进,社交媒体行业经历了许多显著的变化,这些变化不仅反映了用户行为的演变,还揭示了品牌如何利用这些平台与消费者建立联系。GWI(GlobalWebIndex)发布的旗舰报告深入探讨了最新的社交媒体趋势,为我们提供了宝贵的洞察。 1. **时间投入与疫情的影响**:自新冠疫情爆发以来,人们在社交媒体上的时间发生了怎样的变化?封锁措施是否催生了持久的习惯?报告指出,封锁期间人们更倾向于在线社交,这可能导致社交媒体使用时间的长期增长。品牌需要理解这种新习惯,以便在消费者的注意力经济中找到定位。 2. **最受欢迎的平台**:哪些应用正在变得更受欢迎?是什么让用户对这些平台保持忠诚?例如,TikTok的迅速崛起展示了短视频的力量,而Instagram的Reels和Facebook的Watch等效仿功能则反映了平台之间的竞争和创新。 3. **市场间的主要差异**:中国等市场的独特趋势,如微信的全面生态系统,是否会影响西方的社交媒体格局?不同市场可以为全球趋势提供何种启示?例如,中国的社交电商模式可能为其他国家提供可借鉴的经验。 4. **行为趋势的跟踪**:哪些受众更喜欢短格式内容而不是长视频?故事(Stories)和增强现实(AR)工具如何发展?这些新兴格式如何影响品牌的内容策略?品牌需要不断调整,以适应用户对于快节奏、互动性更强的内容的需求。 5. **社交电商的未来**:影响者营销是否已经过时?社交电商是否正在起飞?随着越来越多的购物行为发生在社交媒体上,品牌必须探索如何有效地利用这些平台进行销售,同时维持与消费者的互动。 GWI的数据来源于对16-64岁互联网用户的在线调研,覆盖全球多个市场,确保了报告的代表性和全面性。值得注意的是,由于互联网普及率的差异,某些地区的在线样本可能偏向年轻、城市化、富裕且受教育程度较高的群体。 这份报告不仅仅是对过去一年趋势的总结,也是对未来的预测,提醒业界关注社交媒体动态,以便及时调整战略,抓住机遇。无论是品牌还是内容创作者,都需要密切关注这些变化,以适应不断演变的社交媒体环境。

剩余37页未读,继续阅读

- 粉丝: 50

- 资源: 6万+

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- C#联合halcon的demo 直线 找圆 形状模板匹配及等级识别等功能 功能有找直线,找圆,形状模板匹配,二维码识别及等级识别,相机内参标定,相机外参标定,以及几何测量 另外还有某论坛的开源控件,并

- BM260、310、410系列.pdf

- P9500系列.pdf

- 西门子PID程序西门子plc模板程序西门子通讯程序案例 1200和多台G120西门子变频器Modbud RTU通讯,带西门子触摸屏,带变频器参数 Modbus通讯报文详细讲解,PID自写FB块无密

- NOI级 数学与其他-2025.01.09(K).pdf

- 毕业设计-基于python大学生就业信息管理系统(django)毕业设计与实现源码+数据库

- 电机控制器,感应异步电机的无传感器矢量控制,完整的C代码+仿真模型: 基于“电压模型+电流模型”的磁链观测器,实现转子磁场定向控制(FOC),可实现电机在低速、中高速段的高精度的转速估算;代码已经成功

- Scrum指南-中文版-2020

- 探索CDN技术:互联网内容加速的分布式解决方案

- Hadoop环境中MapReduce集群的操作命令与Web管理界面介绍

- 西门子PID程序西门子PLC 1200和多台G120西门子变频器Modbud RTU通讯,带西门子触摸屏,带变频器参数 Modbus通讯报文详细讲解,PID自写FB块无密码可以直接应用到程序,PID带

- 大数据处理中PySpark操作与实战案例:RDD创建及基本操作教程

- 毕业设计-基于python招聘数据分析可视化系统(django)毕业设计与实现源码+数据库

- GEE 案例-基于sentinel-2的主成分分析(查看不同波段的主成分结果).pdf

- SUES-大四上-计科课程-学习/考试/复习/实验资料

- 基于分布式驱动电动汽车的车辆状态估计,分别采用无迹卡尔曼,容积卡尔曼,高阶容积卡尔曼观测器等,可估计包括纵向速度,质心侧偏角,横摆角速度,以及四个车轮角速度七个状态 模型中第一个模块是四轮驱动电机

信息提交成功

信息提交成功