没有合适的资源?快使用搜索试试~ 我知道了~

【莱坊-2024研报】Build to Rent Market Update Q3 2024.pdf

需积分: 5 0 下载量 52 浏览量

2024-11-16

10:32:06

上传

评论

收藏 5.94MB PDF 举报

温馨提示

行业研究报告、行业调查报告、研报

资源推荐

资源详情

资源评论

UK BTR

market update

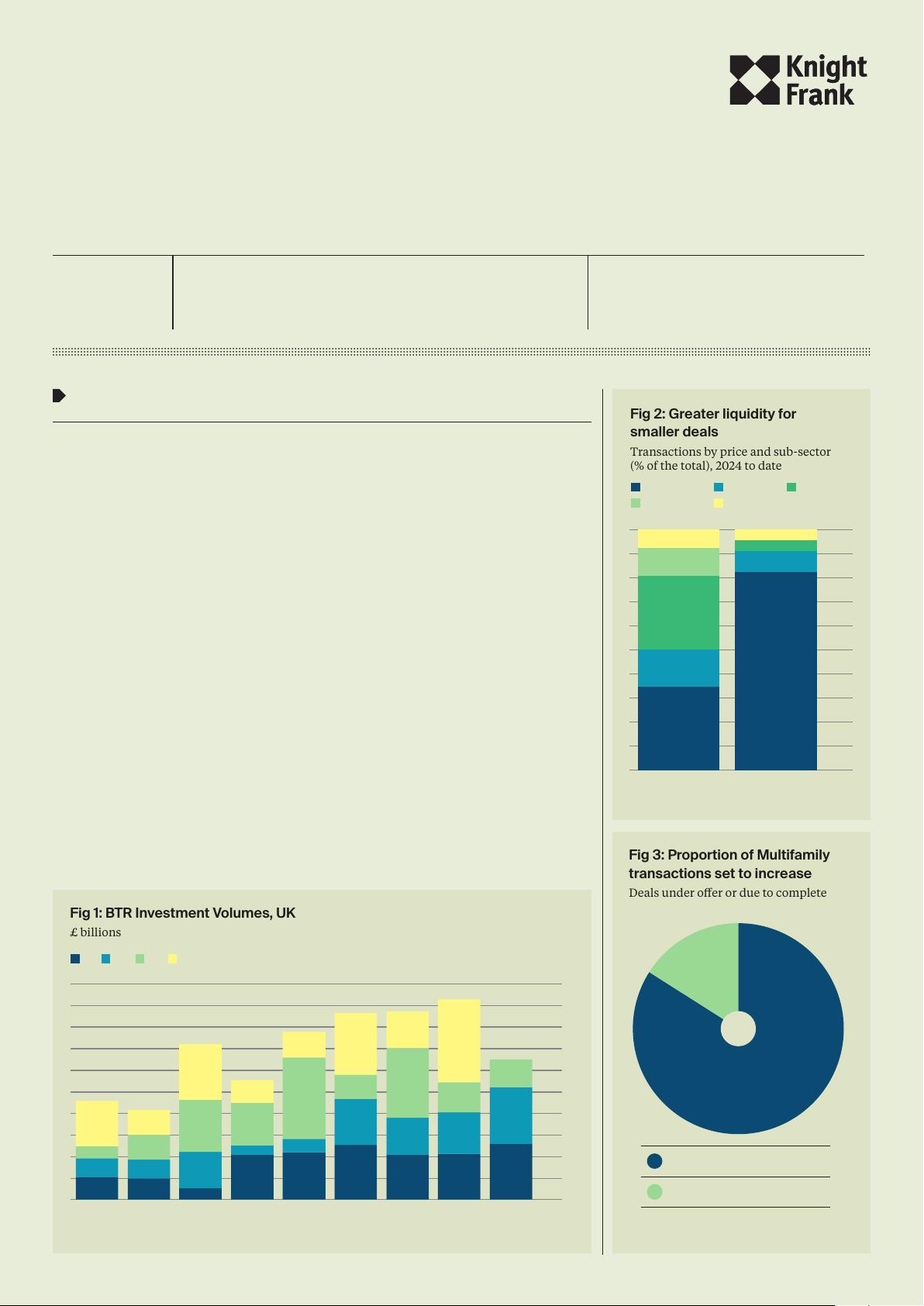

On track for a record year for BTR completions.

Investment volumes subdued in Q3…

Investment volumes in the third quarter of 2024 were muted, following a record-

breaking first half of the year. A quieter Q3 reflects a seasonal lull in activity over

the summer period, as well as the fact that deals are taking longer to put together.

The market also remains in price discovery mode, with a wide spread of bids on

some assets. In total, 14 deals completed, with a combined value of £640 million.

Investment in Q3 was 8% lower than the near £700 million that traded in Q3

2023. Some 65% of investment over the course of the quarter was for multifamily

transactions with the remainder for single family assets, whilst 35% of capital

deployed was into operational schemes – up from just 20% in H1. As has been

the case throughout the year, there remains greater liquidity for smaller deals.

In total, deal volumes so far in 2024 are 29% higher than Q1-Q3 2023.

…but investor appetite undimmed

Despite a quieter third quarter for investment volumes, there is still strong

appetite among investors to acquire assets. Our agency and valuation teams

are tracking a further £1.6 billion of transactions that are under offer or due

to complete, of which 84% is for multifamily transactions. Outside of our

investment figures, there has been a flurry of recapitalisations and equity raises,

including a £755 million preferred equity commitment between Ares and Lone

Star at Wembley Park, advised by Knight Frank, while Greystar raised €1.5 billion

to invest in its European value-add fund focused on rental residential real estate.

Such deals and commitments confirm the long-term attractiveness of the sector.

knightfrank.com/researchQ3 2024

Knight Frank’s quarterly review of the key investment themes in the

UK Build to Rent (BTR) market covering co-living, multifamily and

single family housing

Fig 2: Greater liquidity for

smaller deals

Transactions by price and sub-sector

(% of the total), 2024 to date

Fig 3: Proportion of Multifamily

transactions set to increase

Deals under offer or due to complete

Source: Knight Frnk Reserch

UP TO £M

£M£M£M£M

Source: Knight Frnk Reserch

MFH & Co-living SFH

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Fig 1: BTR Investment Volumes, UK

£ billions

Source: Knight Frnk Reserch

QQ

Q Q

£M£M MORE THAN £M

35% 54%

2016 2017 2018 2019 2020 2021 2022 2023

£BILLIONS

£5.0

£4.5

£4.0

£3.5

£3.0

£2.5

£2.0

£1.5

£1.0

£0.5

£0.0

Q1-Q3 2024

35% 83%

Multifamily 84%

Single Family 16%

资源评论

segwyang

- 粉丝: 1338

- 资源: 229

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 【java毕业设计】电气与信息类书籍网上书店源码(ssm+mysql+说明文档+LW).zip

- 【java毕业设计】蛋糕甜品商城系统源码(ssm+mysql+说明文档+LW).zip

- 【java毕业设计】大众书评网源码(ssm+mysql+说明文档).zip

- 个人信用报告2024111620011020286035.zip

- 【java毕业设计】大学运动场地管理系统源码(ssm+mysql+说明文档+LW).zip

- 【STM32项目】基于STM32+彩屏+PWM调控震动电机+时钟日期及刷牙计时牙刷-毕设/课设/竞赛/项目/实训/作业等

- 【java毕业设计】大学生社团管理系统源码(ssm+mysql+说明文档).zip

- 【java毕业设计】大学生勤工助学管理系统源码(ssm+mysql+说明文档+LW).zip

- 最新更新!!!数字化转型“同群效应”(2000-2023年)

- lv_0_20241117192631.mp4

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功