没有合适的资源?快使用搜索试试~ 我知道了~

【摩根大通-2024研报】JPMorgan Econ FI-US Fixed Income Overview.pdf

需积分: 5 0 下载量 5 浏览量

2024-11-14

08:54:13

上传

评论

收藏 736KB PDF 举报

温馨提示

行业研究报告、行业调查报告、研报

资源推荐

资源详情

资源评论

1

Phoebe White

AC

(1-212) 834-3092

phoebe.a.white@jpmorgan.com

J.P. Morgan Securities LLC

Liam L Wash (1-212) 834-5230

liam.wash@jpmchase.com

J.P. Morgan Securities LLC

North America Fixed Income

Strategy

01 November 2024

J P M O R G A N

•

Economics: Nonfarm payrolls increased 12k in October, likely weighed down by hurri-

cane and labor strike distortions, and we take more signal from the downward revision

in prior months’ job creation. We continue to expect the Fed to ease by 25bp at next

week’s FOMC meeting

•

Treasuries: We think roughly 21bp of the recent intermediate Treasury moves could be

attributed to the shift in election expectations in favor of a red sweep. We still see a

further 20bp upside to 10-year Treasury yields if this outcome materializes, and would

expect yields to decline somewhat in a divided government outcome, particularly in a

Harris presidency. Valuations appear cheap, but we stay neutral given election uncer-

tainty and next week’s front-loaded refunding supply. Markets continue to price in too

little tariff risk: maintain beta-weighted 5-year breakeven wideners paired with an ener-

gy hedge

•

Interest Rate Derivatives: Swap spreads moved sharply narrower this week on the

back of election-driven deficit concerns. Looking ahead to next week and beyond, we

now recommend de-risking and turning neutral on swap spreads across the curve.

Although structural upside risk to supply remains a source of narrowing pressure, there

are numerous potential near term offsets. We continue to recommend a bullish stance

on short-expiry volatility, especially in longer tails

•

Short Duration: SOFR will likely stay elevated for a few days as repo averages remain

higher in the fed funds corridor. Unsecured funding spreads typically widen this time

of year, but significant widening is likely limited due to ongoing demand from money

market investors

•

Securitized Products: The election promises potential regulatory changes which could

impact mortgage market plumbing, and we review potential changes to Basel 3 End-

game capital requirements, GSE reform, and FHA streamline rulings

•

Corporates: HG bond spreads have been sub-100bp for 4 weeks now with ratings and

sector dispersion low, indicating that investors are not focused on potential election

impacts on specific sectors

•

Near-term catalysts: Fed Meeting (11/6-11/7), Oct CPI (11/13), Oct PPI (11/14), Oct

Retail Sales (11/15)

Another week closer. Consistent with recent trends, Treasury yields continued to rise, cor-

porate credit spreads remained tight, and mortgage spreads widened further despite a back-

drop of mixed economic data. Overall the data point to moderating inflationary forces

alongside continued labor market cooling, even while consumer spending remains buoyant.

Starting with the Fed’s preferred measure of wage growth, the employment cost index rose

0.8% in 3Q, or 3.9% annualized, which is the slowest pace in three years. This signals less

wage pressure on core services prices and, with wage growth still running above PCE infla-

tion, should fuel strong real consumer spending (see US: Employment Cost Index continues

to cool in 3Q, Michael Hanson, 10/31/2024). Indeed, the September personal income report

showed core PCE rose 0.25% m/m (2.65% oya), close to Fed expectations, while real con-

sumer spending rose a solid 0.4% (see US: Moderate inflation, strong spending in Septem-

ber, Abiel Reinhart, 10/31/24).

Must Read This Week

The dirty dozen, Michael Feroli, 11/1/24

Corporate Hybrids: Re-electrifying US

bond markets, Daniel Lamy and

Nathaniel Rosenbaum et al., 10/31/24

2024 US Election Watch: The

Homestretch, Amy Ho and Joyce Chang

et al., 10/31/24

UK Budget: Tax, borrow and spend on a

large scale, Allan Monks, 10/30/24

And Now Hear This…

More questions than answers in the

October jobs report, Michael Feroli and

Phoebe White, 11/1/24

At Any Rate - Trick or treat: recapping the

US Fixed Income Overview

Wrapping up our election insights

2

Phoebe White

AC

(1-212) 834-3092

phoebe.a.white@jpmorgan.com

J.P. Morgan Securities LLC

Liam L Wash (1-212) 834-5230

liam.wash@jpmchase.com

J.P. Morgan Securities LLC

North America Fixed Income

Strategy

US Fixed Income Overview

01 November 2024

J P M O R G A N

Meanwhile, nonfarm employment increased only 12k in October, the smallest gain since

late 2020, though it’s hard to say precisely how much of that downside surprise was due to

strikes and storms. Estimates of the prior two months employment growth were revised

down by a cumulative 112k. The household survey, which should be less influenced by

strike and storm effects, came in a smidge on the soft side. The unemployment rate was

unchanged at 4.1% in October, though to higher precision moved up from 4.05% in Septem-

ber to 4.14%. Average hourly earnings increased 0.4% last month, a tick firmer than expec-

tations, though each of the prior two months was revised down a tenth, and the year-ago gain

came in at 4.0%, as expected. While the picture is a little cloudier than usual, the combined

message from today’s number and the earlier JOLTS and ECI reports points to a labor market

that is moving into a well-balanced sweet spot. Next week’s FOMC meeting is a refreshingly

easy call, and we continue to look for a 25bp cut in the funds rate target (see The dirty dozen,

Michael Feroli, 11/1/24).

However with markets pricing such an outcome with near certainty, the key risk next

week involves the US elections on Tuesday. The presidential race remains too close to

call and will likely hinge on voter turnout. We caution that certifying the election results

could take days in the case of the presidential and potentially weeks for House races. Penn-

sylvania is still seen as the determinative battleground state, but if Harris wins North Caroli-

na, it could be an early indicator of the election outcome (see 2024 US Election Watch, Amy

Ho and Joyce Chang, 10/31/24). As we have previously stated, we think the presidential

election is unlikely to drive major changes in the Treasury market if the results are accompa-

nied by a divided government, while a clean sweep in either direction would likely drive

medium-term deficit expectations higher, contributing to higher yields and steeper curves.

Given what we know about both candidates’ platforms, we argued that a Republican sweep

would likely lead to a more pronounced bear steepening.

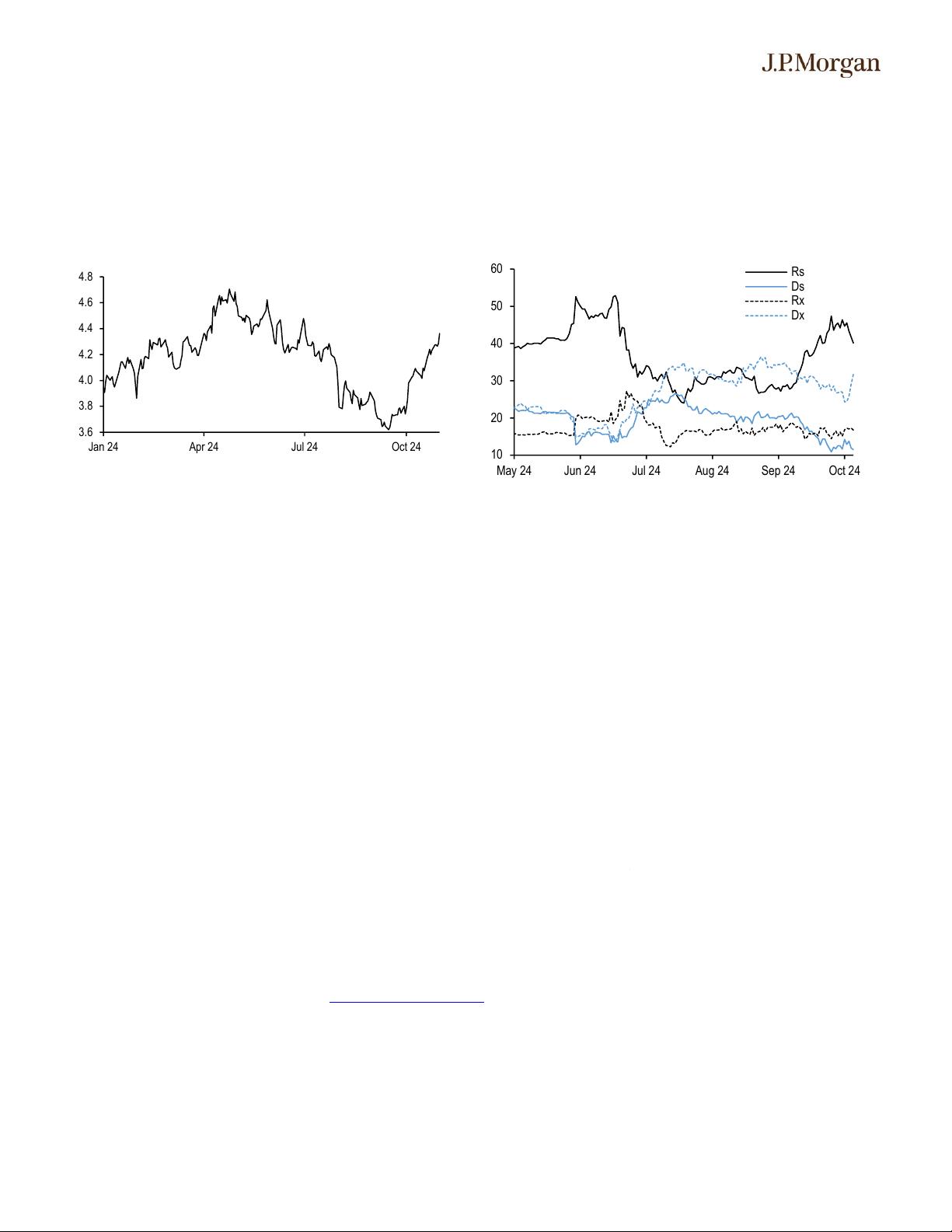

However, with 10-year Treasury yields nearly 75bp higher from their local lows just prior

to the FOMC, it’s natural to ask how much of the recent move reflects shifting electoral

expectations (Figure 1Intermediate Treasury yields have risen nearly 75bp from their local lows just prior to the September FOMC meeting). Of the 72bp move higher in intermediate yields since the Septem-

ber FOMC meeting, our fair value model attributes roughly one-third (25bp) to changes in

fundamental factors including near-term Fed expectations, as well as medium-term growth

and inflation expectations. Of the remaining 48bp or so, we think 21bp can be attributed to

election expectations, given the extent of the moves over the last three weeks, when the

perceived probability of a Republican sweep according to betting markets began to shift

more meaningfully (Figure 2The probability of a red sweep has fallen from its peak late in October, but remains the expected modal outcome in online prediction markets). Thus, in the event of a Republican sweep, we now estimate

that 10-year yields could rise roughly 20bp (versus our earlier estimate of 40bp). Mean-

while, this suggests that Treasury yields would decline from current levels in the divided

government scenarios, with the rally likely to be larger in a Harris victory than a Trump

victory. Given elevated uncertainty over the election, we remain neutral on duration

despite valuations appearing cheap. Moreover we are cognizant that Treasury is set to

auction $125bn in nominal supply in the days surrounding the election and weakening

Treasury market liquidity combined with reduced risk appetite suggest this supply

could require larger concessions in order to be digested smoothly (see Treasuries).

November refunding announcement, Jay

Barry and Afonso Borges, 10/31/24

Key Takeways from the 2024 IMF/World

Bank Fall Meetings, Joyce Chang et al.,

10/31/24

3

Phoebe White

AC

(1-212) 834-3092

phoebe.a.white@jpmorgan.com

J.P. Morgan Securities LLC

Liam L Wash (1-212) 834-5230

liam.wash@jpmchase.com

J.P. Morgan Securities LLC

North America Fixed Income

Strategy

01 November 2024

J P M O R G A N

Figure 1: Intermediate Treasury yields have risen nearly 75bp from their

local lows just prior to the September FOMC meeting

10-year Treasury yields; %

3.6

3.8

4.0

4.2

4.4

4.6

4.8

Jan 24 Apr 24 Jul 24 Oct 24

Source: J.P. Morgan

Figure 2: The probability of a red sweep has fallen from its peak late in

October, but remains the expected modal outcome in online prediction

markets

Probability of various US presidential election outcomes from Polymarket*; %

10

20

30

40

50

60

May 24 Jun 24 Jul 24 Aug 24 Sep 24 Oct 24

Rs

Ds

Rx

Dx

Against the backdrop of a steepening yield curve ahead of election and supply early next

week, swap spreads moved sharply narrower this week, led by the belly. Meanwhile swap

spreads at the long end outperformed, alongside a slight narrowing in term funding premi-

um, and this is likely related to a slightly improved deficit picture given the fact that Trea-

sury’s borrowing estimates for the next two quarters came in ~$150bn below our expecta-

tions (adjusting for differences in cash balance and QT assumptions). Looking ahead, we

recommend de-risking swap spread positions and turning tactically neutral on spreads. We

continue to believe swap spreads are biased narrower over the medium term given

duration supply is likely biased higher over the long run. However, over the near term

the chance of a divided government election outcome, the post-auction cyclical widen-

ing we typically see in spreads, and any discussion of QT’s cessation at the FOMC

meeting all present widening risk.

After a choppy week, implied volatility is mostly higher over the week, with longer tails

outperforming short tails given election-driven shifts in deficit expectations. Looking

ahead, we remain bullish on short expiry volatility in most tails except for the front end,

where we recommend turning neutral. We maintain our bullish stance on gamma because

of looming event risk next week. Following next week, given current levels of implied vola-

tility and individual 1-day breakevens (Figure 3Next week brings considerable event risk, as illustrated by breakevens from 1-day inter-dealer options markets ), we estimate implied volatility is likely

to drop by 0.3-0.4bp/day. Meanwhile we saw realized volatility in 2016 and 2020 increase

by ~4.5bp/day in the weeks following the election. Thus, given current levels of realized

volatility, this suggests realized volatility can hover around ~8.5bp/day in the after-

math of elections next week and as a result implied volatility is unlikely to see signifi-

cant declines after passing of next week’s event risk. This is most pronounced in longer

tails, and we see bearish risks for front end volatility after next week’s FOMC meeting (see

Interest Rate Derivatives).

Turning to inflation markets, we believe risks to front-end breakevens remain two-sid-

ed in the near-term but skew wider over the medium term. We see the greatest scope for

widening in the event of a red sweep, where 5-year breakevens could restest YTD wides and

push wider still over subsequent weeks as uncertainty over tariff implementation lingers.

We see the greatest downside risk under a Harris victory with a split government, in which

case 5-year breakevens could narrow close to 15bp, but this would likely be short-lived

given breakevens are fairly priced against a more status quo policy backdrop. Indeed the

剩余12页未读,继续阅读

资源评论

segwyang

- 粉丝: 1303

- 资源: 156

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- (源码)基于Python的电力管理系统.zip

- 2024年第十届数维杯国际大学生数学建模挑战赛LaTeX模版.zip

- YOLOv8-streamlit-app软件,使用yolov8做的物体识别语义分割姿态检测,使用streamlit做的显示界面

- SADFSDFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFF

- 2021-2024CSP-S真题与答案.zip

- (源码)基于SpringBoot和Java的混合关键系统模拟工具.zip

- SpringBoot - Async异步处理

- (源码)基于JavaFX和MySQL的会议室管理系统.zip

- (源码)基于TinyML和Arduino的加纳语(TWI)语音控制灯光系统.zip

- (源码)基于SpringBoot的日志上传与事件处理系统.zip

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功