没有合适的资源?快使用搜索试试~ 我知道了~

【PitchBook-2024研报-】新兴技术未来报告:更新我们的人工智能展望(英).pdf

1.该资源内容由用户上传,如若侵权请联系客服进行举报

2.虚拟产品一经售出概不退款(资源遇到问题,请及时私信上传者)

2.虚拟产品一经售出概不退款(资源遇到问题,请及时私信上传者)

版权申诉

0 下载量 11 浏览量

2024-10-25

19:22:32

上传

评论

收藏 1.4MB PDF 举报

温馨提示

行业研究报告

资源推荐

资源详情

资源评论

1

PitchBook Data, Inc.

Nizar Tarhuni Executive Vice President of

Research and Market Intelligence

Paul Condra Head of Emerging

Technology Research

Institutional Research Group

Analysis

The Emerging Tech Research Team

Publishing

Designed by Jenna O’Malley

Contents

pbinstitutionalresearch@pitchbook.com

Published on September 30, 2024

Introduction 1

Enterprise applications 3

AI & ML 3

Crypto 6

Data analytics 8

Enterprise SaaS 10

Fintech 12

Information security 15

Insurtech 17

Consumer applications 19

E-commerce 19

Gaming 21

Industrial applications 23

Agtech 23

Climate tech 25

Defense tech 27

Foodtech 29

Mobility tech 32

Space tech 34

Supply chain tech 36

Healthcare applications 38

Biotech 38

Digital health 40

Healthcare IT 43

Medtech 46

EMERGING TECH RESEARCH

Emerging Tech Future Report:

Updating Our Generative

AI Outlook

Models thrive while complexity, costs

impact applications

PitchBook is a Morningstar company providing the most comprehensive, most

accurate, and hard-to-find data for professionals doing business in the private markets.

Brendan Burke; Robert Le; Derek Hernandez;

Rudy Yang; Eric Bellomo; Alex Frederick; John

MacDonagh; Ali Javaheri; Jonathan Geurkink;

Kazi Helal, Ph.D.; Aaron DeGagne, CFA; Rebecca

Springer, Ph.D.

Introduction

In May 2023, our team published perspectives on how Generative AI (GenAI) was

poised to impact various industries and technologies. This note revisits those

perspectives with fresh takes on how GenAI is (or is not) manifesting itself and how

expectations have changed or evolved.

The rise of ChatGPT in early 2023 was a pivotal moment, marking the point when

AI became understood as an easily adaptable technology with the potential for

broad application. Since then, investment in related technologies and startups has

skyrocketed, highlighted by intense competition in the foundation model space as

new startups and technology incumbents have aggressively jumped into the fray.

The GenAI-infrastructure landscape is stratifying across several use cases, such as

on-device inference, domain-specific knowledge, and simply raw power to produce

the best results the fastest. Some form factors, such as general consumer search

and chatbots, have emerged as battlegrounds for tech giants like Google and Meta

as they seek to keep users within their ecosystems. Other strategies include more

specialized applications, such as personal assistants for enterprise use cases and

software development.

2

Emerging Tech Future Report: Updating Our Generative AI Outlook

However, as our analysts describe in this note, several blockers to adoption remain

despite intensified efforts toward AI transformation. These include high compute

costs, data availability, data security, and overall system complexity. Whereas much

progress has been made at the foundation model level, where investment capital

appears endless, application-level startups face a more challenging fundraising

environment as they feel near-term pressures to demonstrate commercial viability.

Paul Condra

Head of Emerging Technology Research

paul.condra@pitchbook.com

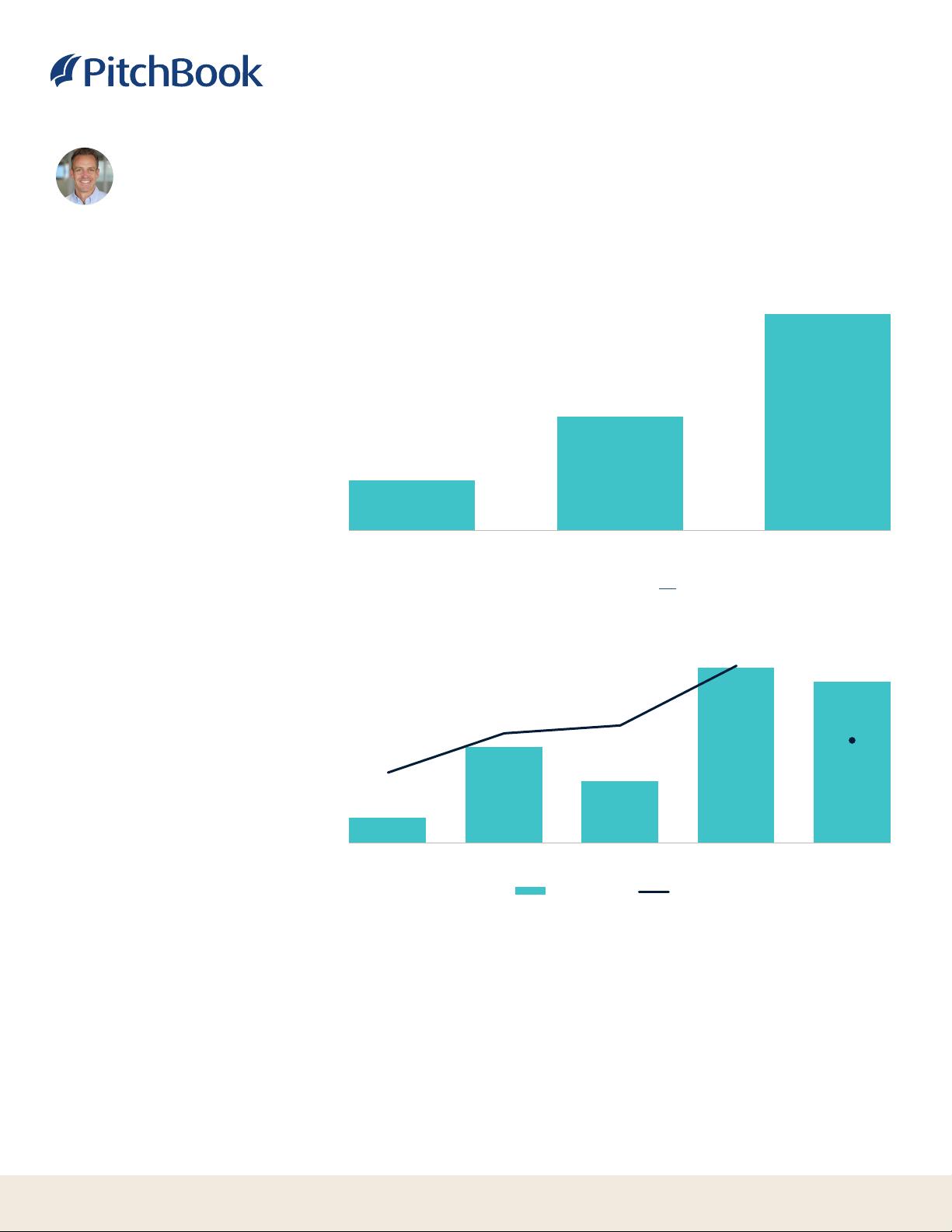

GenAI software spending estimate ($B)

$7.5 $17.0 $32.4

2023 2024 202 5

Source: IDC • Geography: Global • As of August 20, 2024

GenAI VC deal activity

$3.8 $14.3 $9.3 $26.0 $23.9

349

544

582

877

508

2020 2021 2022 2023 2024

Deal value ($B) Deal count

Source: PitchBook • Geography: Global • As of August 20, 2024

3

Emerging Tech Future Report: Updating Our Generative AI Outlook

Enterprise applications

AI & ML

Prior expected impacts

At the outset of GenAI’s irruption, we saw the limitations of large language models

(LLMs) for enterprise use cases and early signs of trends that are now maturing.

Expected innovations included the maturation of a supporting LLM operations

(LLMOps) industry, including foundation model orchestration and vector search,

along with AI agents. The need for supporting software for LLMs has been

exacerbated by the limitations of successive model releases after OpenAI’s GPT-4

and the proliferation of copycat open-source models, requiring users to get higher-

quality outputs from similar generative models. In the long term, we expected

foundation models to create more decacorns valued at over $10.0 billion and

code generation to progress the field to a greater extent than image generation

or chatbots.

Reality one year later

GenAI has transformed the existing AI & machine learning (ML) vertical in

fundamental yet still limited ways. While new LLMs represent the future of the

industry, they have not extinguished legacy approaches, and pre-existing models still

outnumber LLM applications. GenAI software will contribute only about 14% of AI

software spending in 2024 with $14.5 billion and is on pace to contribute only 32.3%

of spending by 2028, according to IDC estimates.

1

Even so, companies building legacy

ML models have seen their estimated valuations plunge, including DataRobot’s by

over 90% and H20.ai’s by over 80% in the face of GenAI disruption.

2

New research

into model techniques can further progress the field in deterministic areas of

software, as covered in our analyst note on foundation models. LLM innovators are

capturing mindshare and market share from their predictive predecessors.

Brendan Burke

Senior Analyst, Emerging Technology

brendan.burke@pitchbook.com

1: “Worldwide AI and Generative AI Spending Guide,” IDC, Karen Massey, et al., August 20, 2024.

2: “Caplight MarketPrice,” Caplight, August 28, 2024.

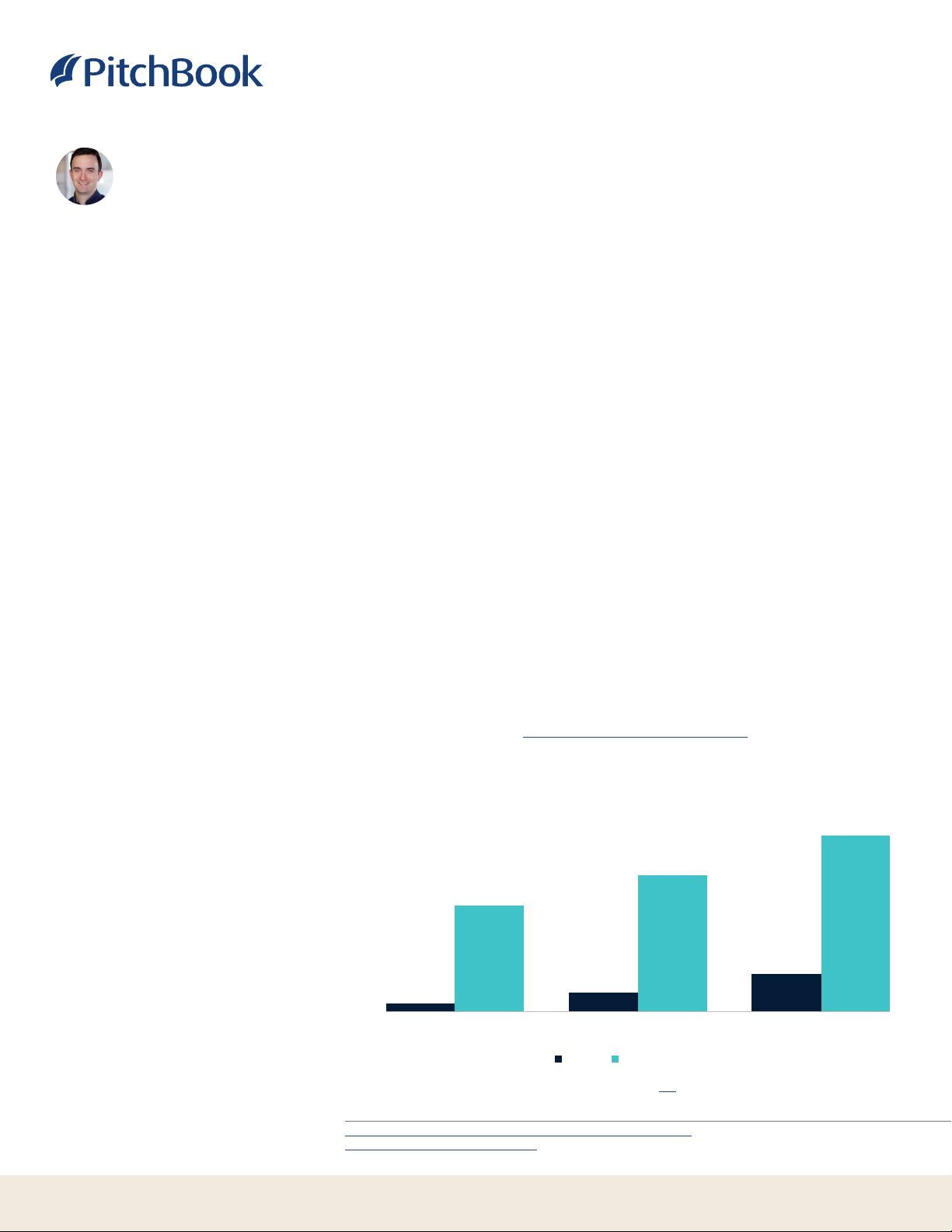

AI-centric software spending estimate by type ($B)

$0

$20

$40

$60

$80

$100

$120

$140

2023 2024 2025

GenAI Predictive AI

Source: IDC • Geography: Global • As of August 20, 2024

4

Emerging Tech Future Report: Updating Our Generative AI Outlook

Enterprise rollouts have progressed more slowly than initially forecast, and models

have not continued to take on new capabilities. Because of the tepid adoption

of applications, the infrastructure layer, including model architecture labs and

semiconductor startups, has achieved 25 of the 39 unicorn valuations we have

tracked in the LLMOps space. Semiconductors, model research labs, and startup

cloud providers have shown the need for a new stack and have demonstrated

the ability to create new software innovations without a significant surrounding

ecosystem. We did not anticipate the demand for startup cloud providers that have

achieved high valuations, including CoreWeave, Crusoe, Lambda, and Together AI.

New semiconductors have achieved breakthroughs in LLM inference and datacenter

networking, building on the NVIDIA GPU ecosystem, including those of Astera Labs,

Cerebras, and Groq.

Other software categories face challenges to prove their legitimacy. We tracked a

doubling of VC deal count for GenAI operations software in 2023, including in data

preparation, model orchestration, and application deployment, and 2024 is on pace

for a further 50% growth. Deal value has not kept up with the infrastructure layer,

however. These LLMops companies have not grown large independently, given

the spectrum of configuration options and continuously improving features from

hyperscalers. Vector databases in particular have become commoditized and are

unlikely to present a growth category as open-source options extend their network

effects and incumbent databases offer vector support. The AI agent space has

become crowded, yet we believe it will be disrupted by more action-oriented model

capabilities. Few acquisitions of model orchestration companies have been made

to justify early-stage VC investments as acquirers monitor the monetization of

LLM tools.

Real-world progress

In the long term, commercial gains will likely come before artificial general

intelligence (AGI) potentially renders software irrelevant. Incumbents have taken

more commanding positions than was clear last year via aggressive startup

investments. We predicted that more $10.0 billion companies would be created

after OpenAI, which has proven true with Anthropic, CoreWeave, and Scale AI,

yet other contenders have fallen short of that total before succumbing to Big

Tech offers, including Adept AI, Character.AI, and Inflection AI. AI in software

development has accelerated to widespread adoption, with large customers relying

on AI code generation. Coding assistant startups raised over $1.0 billion in H1 2024

after raising only $480.6 million in 2023, showing the success of the technology

and scale of the market. Generative media lags expectations, facing VC funding

declines in multimedia content suites and video generation. Vertical-focused

companies face accusations of vaporware as they align general-purpose LLMs with

customer workflows and occasionally wait for base models to improve before their

products do.

PitchBook users can access a full list of AI

agent startups here.

5

Emerging Tech Future Report: Updating Our Generative AI Outlook

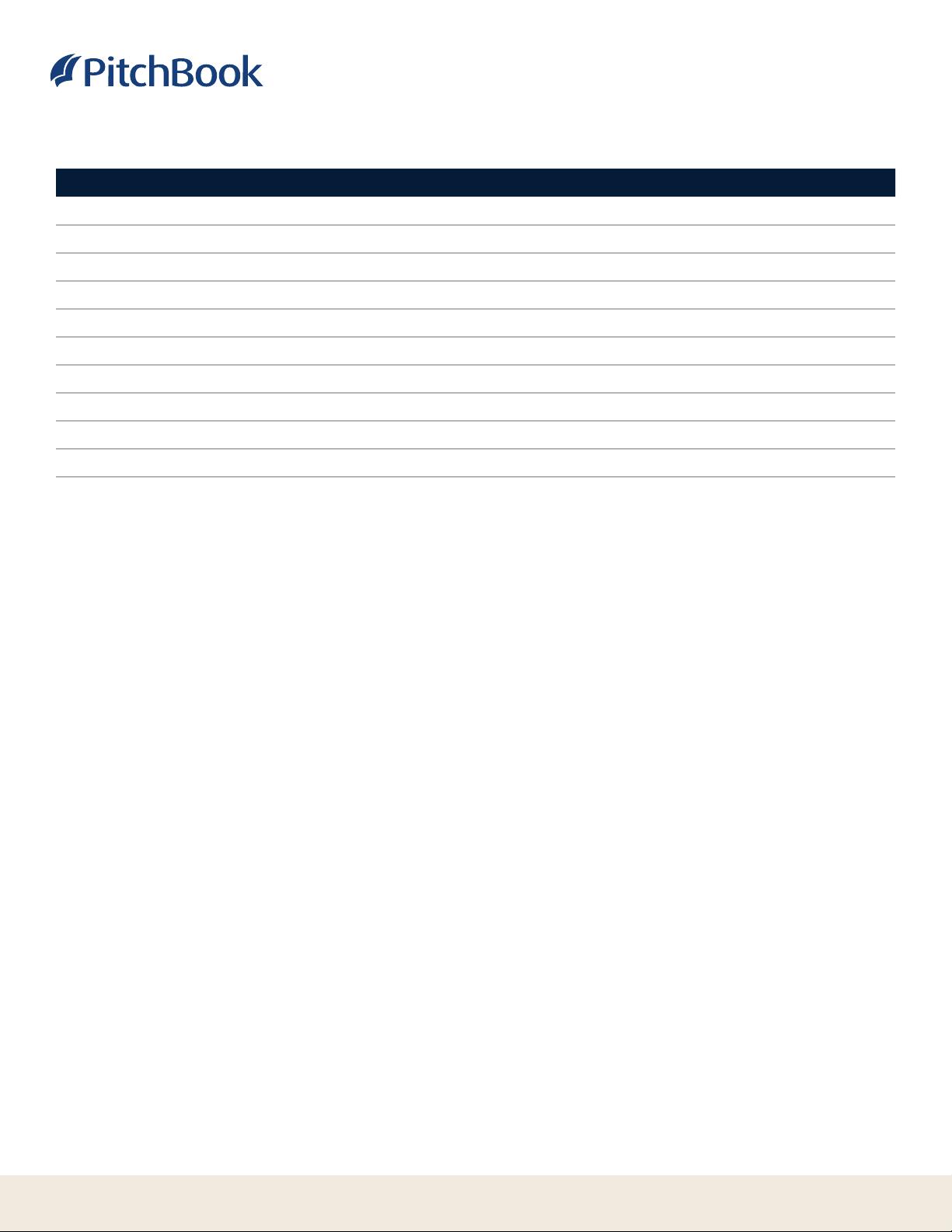

Key recent GenAI VC exits and talent acquisitions

Source: PitchBook • Geography: Global • As of June 30, 2024

Company Close date (2024) Segment Category Exit value ($M) Acquirer

Character.AI August 22 AI core Model architecture $2,500.0 Alphabet

Adept AI June 28 AI core Model architecture N/A Amazon

Clickable June 26 Visual media Content suite N/A Beehiiv

Argilla June 13 AI core Model architecture N/A Hugging Face

Uizard May 24 Code Testing N/A Miro

Deci May 2 AI core Deployment $300.0 NVIDIA

Mirage April 8 Visual media 3D models N/A Harvey

PartyKit April 4 AI core Orchestration N/A Cloudflare

Inflection AI March 21 AI core Model architecture $650.0 Microsoft

DarwinAI January 1 Vertical applications Industrial N/A Apple

剩余46页未读,继续阅读

资源评论

soso1968

- 粉丝: 2270

- 资源: 1万+

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功