China K12 Tutoring Sector 3

Modelling offline regulation impact and

potential from online education

Resilient offline: Adapt to regulation in 2018;

consolidation trend to continue

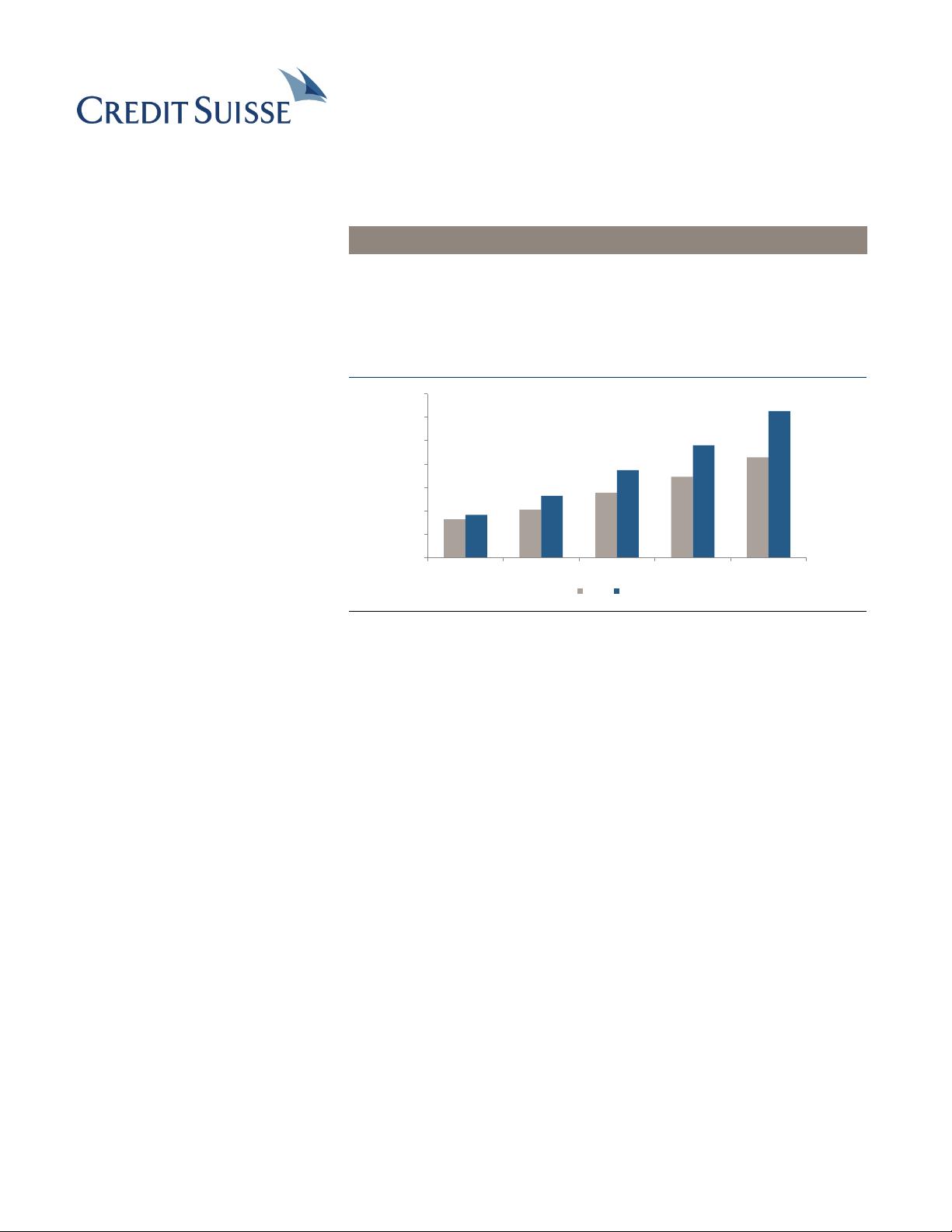

Though regulation tightening caused slowdown in capacity expansion and additional costs

to EDU and TAL’s offline business, we believe the offline business of EDU and TAL is still

resilient. We expect higher GPM in FY20-21 as a result of slower offline expansion as

utilisation rate rises to offset cost pressure from regulation. We view strong demand for

quality tutoring and market consolidation could continue post regulation. We expect EDU

and TAL’s combined market shares in China’s K12 tutoring market to increase from 6.5%

in 2018 to 8.3% in 2019 and 10.6% in 2020.

Enhanced online models to expand the boundary of

leading players

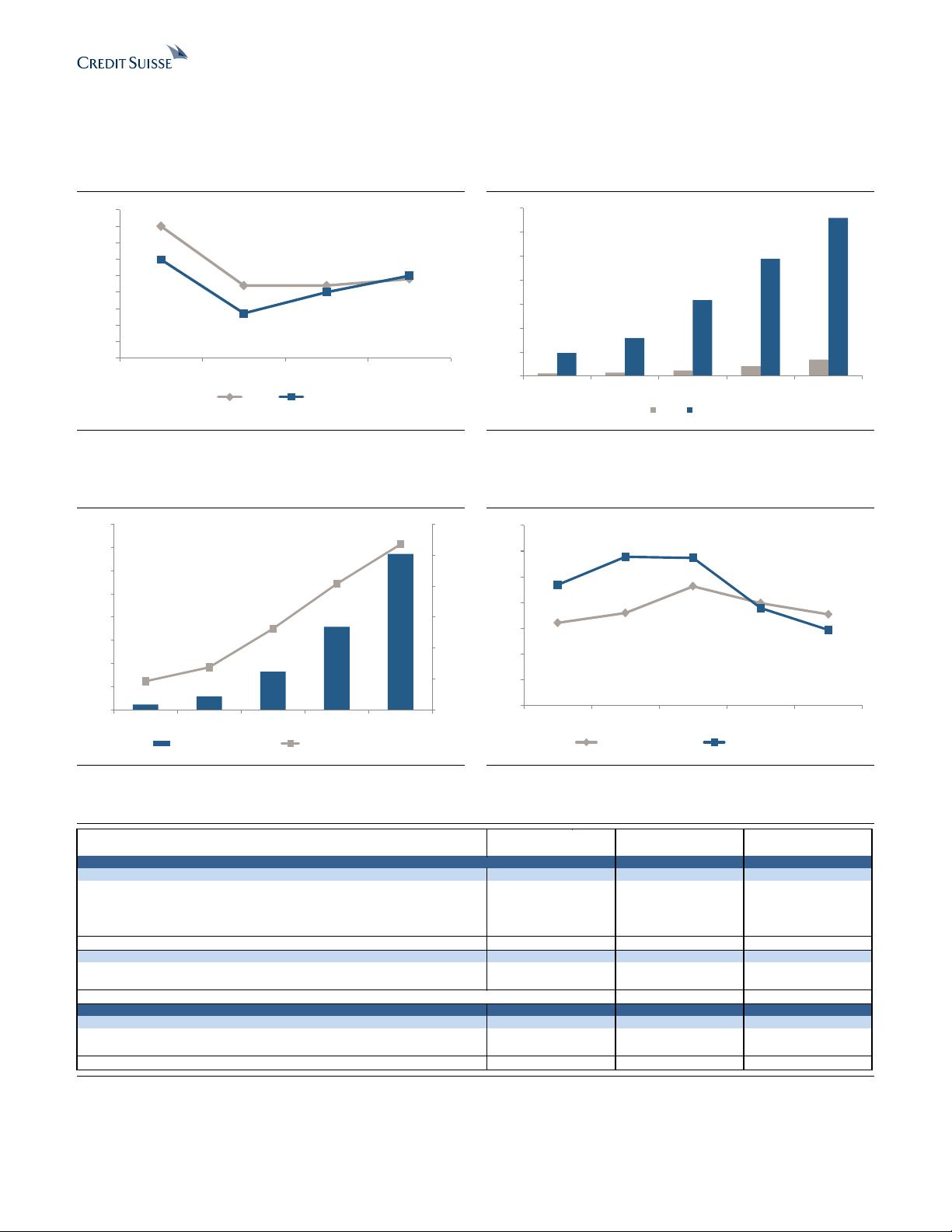

Riding on the trend of technology-driven innovation and strong demand for access to

quality education resources, we expect the online penetration rate of K12 tutoring market

to rise from 7% in 2018 to 16% in 2021. We view data-driven operation optimisation and

advanced technologies as the two key drivers to improve the performance of online K12

tutoring. We expect the user experience of dual teacher model in the offline learning

centres to reach the current level of face-to-face classes in 2019-20. We expect pure

online models to reach such level in 2022. We believe online education models should

evolve much faster than offline education. Leading players have been exploring various

online education models to cater to market demand and accelerate their expansion. The

market is large enough for multiple models to find suitable customers.

Investment in online creates value in the long term

As leading players of online K12 tutoring have made significant progress in terms of user

experience and study efficiency in 2018, we believe the industry is going to soar and

deliver secular growth with higher penetration. We believe industry leaders (TAL and EDU)

with deep moats in national brand, advanced technologies, teaching talent pool, and

operational expertise are best positioned to capture growth opportunities in online tutoring.

TAL is leading the trend in online. We expect pure online education revenue of TAL to

register 146% CAGR for FY18-20 and reach US$717 mn in FY20. The revenue

contribution of Xueersi.com to TAL is expected to exceed 13% in FY19 and 20% in FY20.

EDU is strengthening its online capability with its differentiated small class model. For

Koolearn of EDU, we expect revenue from K12 to register 138% CAGR for FY18-20 and

reach US$74 mn in FY20. The contribution of K12 in Koolearn is expected to rise from

13% in FY18 to 19% in FY19 and 29% in FY20.

Prefer EDU to TAL on clearer offline expansion plan

We believe the market has overestimated policy risk in the near term and underestimated

online education’s potential in the long run. We like EDU’s clear plan to expand offline

capacity and strengthen online capability under undemanding valuation. We also believe

TAL should be able to reaccelerate its offline expansion with dual teacher model. We

prefer EDU to TAL on its undemanding valuation and clearer offline capacity expansion

plan to take more market shares post regulation tightening. We roll over our P/E based

valuation for profitable offline business from FY19 to FY20 and increase our SOTP-based

TP for EDU and TAL to US$112.7 (from US$88.4) and US$44.3 (from US$36.6),

respectively. Key risks in the K12 tutoring industry include: (1) adverse regulatory

policies; and (2) failure in online product improvement.

We expect EDU and

TAL’s total market

shares in China’s K12

tutoring market to

increase from 6.5% in

2018 to 10.6% in 2020

We expect the online

penetration rate of K12

tutoring market to rise

from 7% in 2018 to 16%

in 2021

We believe TAL and

EDU are well-

positioned to capture

secular growth

opportunities in online

We prefer EDU to TAL

on clearer offline

capacity expansion

plan

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功