没有合适的资源?快使用搜索试试~ 我知道了~

德银-新兴市场-宏观策略-新兴市场地方利率:溢价衡量-215-25页.pdf

试读

24页

需积分: 0 0 下载量 118 浏览量

更新于2023-07-26

收藏 1.79MB PDF 举报

报告标题:“德银-新兴市场-宏观策略-新兴市场地方利率:溢价衡量”主要探讨了新兴市场地方利率中的期限溢价(Term Premium, TP)及其对市场的影响。期限溢价是评估债券价值和风险的重要因素,特别是在新兴市场。在过去的几年里,期限溢价为新兴市场利率提供了一定的价值和缓冲。

自2018年11月初以来,期限溢价显著下降,从历史高位回落到金融危机后的一般水平,这导致新兴市场本地固定收入(Local Fixed Income, LFI)的再定价。尽管发达市场(DM)和部分新兴市场的增长放缓似乎仍在持续,但报告认为期限溢价仍有进一步压缩的空间。然而,这种缓冲已经减小,对市场波动的抵御能力也随之减弱。

报告深入分析了期限溢价和风险中性利率的最新动态,探讨了驱动期限溢价的关键因素,如政策利率和核心利率。在加息周期中,拉丁美洲国家的收益率曲线通常为久期提供更大的缓冲,而亚洲市场的久期则更为脆弱。此外,报告还指出了债券期限溢价与掉期期限溢价之间基差的不匹配情况。

报告的主要发现包括:

1. 期限溢价对新兴市场利率具有重要意义,提供了价值和风险保护。2018年11月初的高期限溢价水平为市场修正提供了空间,推动了新兴市场本地固定收入的强劲表现。目前,尽管期限溢价有所压缩,但秘鲁、罗马尼亚、巴西和南非的期限溢价仍处于高位或历史高位,而韩国、捷克共和国和土耳其的期限溢价则较低且进一步下降。

2. 期限溢价主要受政策利率和核心利率影响。在加息期间,拉丁美洲国家的收益率曲线提供的缓冲更大,而亚洲市场的久期暴露度较高。

3. 期限溢价是选择久期的最强信号。较高的期限溢价排名意味着更高的久期回报。秘鲁、巴西、哥伦比亚和南非在期限溢价排名中名列前茅,预期回报(包括外汇影响)最高。

这些发现对投资者和政策制定者具有重要的战略意义。对于投资者来说,了解期限溢价的动态可以帮助优化投资组合,尤其是在新兴市场。而对于政策制定者而言,理解期限溢价如何受政策利率变化的影响,有助于他们在货币政策正常化过程中更好地管理市场预期和风险。因此,关注并理解新兴市场的期限溢价,对于在全球经济环境中进行有效的投资决策至关重要。

15 February 2019

EM Special Publication

Asia

Emerging Europe

Latin America

Fixed Income

EM Special

Publication

Date

15 February 2019

Deutsche Bank

Research

EM Local Rates: Measuring Premium -

The Shrinking Cushion

Term premium (TP) has been an important component of value and cushion for

EM rates over the years. Our latest report on TP published last November (when

US yields hit a seven-year high) stressed the hefty cushion built between late '16

and late '18 due to rising TP, across a large set of EM curves.

Since early November, TP has significantly declined from historical highs to

post-tantrum average levels, thus accounting for most of the recent repricing in

EM local fixed income (LFI). The slowdown in growth across DM and some EM

still seems poised to continue, judging by leading indicators. We believe there is

room for additional TP compression. But the cushion has shrunk.

In this report, we assess the recent development in TP and risk-neutral rates,

study TP's underlying drivers, examine the remaining cushion during policy

normalization, identify dislocations in basis of bond TP vs swap TP, and provide

strategy implications at the end.

Main takeaways:

■

Term premium (TP) has been an important component of value and

cushion for EM rates. The extreme levels in TP in early November provided

room for correction and led to a broad-based strong performance in EM

LFI. Regardless of the recent compression in TP, we see TP still high or

at historical highs in Peru, Romania, Peru, Brazil and South Africa. This

contrasts with already low and further reduced TP in South Korea, Czech

Republic and Turkey.

■

TP is largely driven by policy rates and core rates. During hiking cycles,

LatAm curves tend to provide the largest cushion for duration while

duration tend to be more vulnerable in Asian curves.

■

TP is the strongest signal for choice of duration. Higher TP rankings imply

higher returns on duration. Peru, Brazil, Colombia and South Africa are

top-ranked based on TP, and provide the highest expected returns (FX-

hedged) on duration. In contrast, Turkey, South Korea, Thailand, and

Czech Republic are at the bottom of the TP table and provide the lowest

returns accordingly.

■

While term-premium declined noticeably, it is still significantly higher

in bonds than swaps. Here Mexico, Malaysia, and Thailand stand out

as providing attractive entrance levels for long-end ASW-spreads. The

contrary is the case for Brazil.

Jundong Zhang

Research Associate

+44-20-754-72056

Drausio Giacomelli

Strategist

+1-212-250-7355

Christian Wietoska

Strategist

+44-20-754-52424

Swapnil Kalbande

Strategist

+65-6423 5925

Deutsche Bank AG/London

DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 091/04/2018 .

Distributed on: 15/02/2019 13:27:10 GMT

7T2se3r0Ot6kwoPa

15 February 2019

EM Special Publication

Table Of Contents

Reassessing term premium: The shrinking cushion.......................................... 3

Term premium: How much left?........................................................................ 4

The anatomy of premium: What drives TP........................................................ 6

What term premium tells us about duration?....................................................8

A tale of two premia - bonds vs swaps...........................................................10

Implications for strategy...................................................................................12

Appendix A: Methodology of yield decomposition..........................................14

Appendix B: Bond valuation model..................................................................14

Appendix C: Term premium for both bonds and swaps.................................. 15

Page 2

Deutsche Bank AG/London

15 February 2019

EM Special Publication

Reassessing term premium: The shrinking cushion

■

Term premium (TP) has been an important component of value and

cushion for EM rates.

■

The extreme levels in TP in early November provided room for correction

and led to a broad-based strong performance in EMFI (FX-hedged).

■

Since then, TP has significantly declined and is back to post-tantrum

average levels. The compressed TP, combined with real rate differentials

between EM vs DM hovering near historical lows, suggests reduced

upside for EM LFI (FX hedged).

Term premium (TP) has been an important component of value and cushion

for EM rates over the years. We have repeatedly highlighted TP's increasing

importance as real rate differentials vs. the US have compressed - especially since

taper tantrum. Our latest report on TP published last November (when US yields

hit a seven-year high) discussed that TP could serve as a cushion for duration

during hiking cycles and also stressed the hefty cushion built between late '16

and late '18 due to rising TP, across a large set of EM curves (please see here ).

In our view, these extreme levels (in early November) of TP boded for a

correction and served as a cushion (for many but not for all) as CBs normalized

monetary policy. Since early November in 2018, EM local fixed income (LFI) has

seen a broad-based strong performance, rallying 3.4% (FX hedged). As a result,

TP has shrunk to reflect the Fed's move to neutral and reduced inflationary risks

associated with lower growth prospects and lower commodities. Meanwhile, risk-

neutral rates have stabilized.

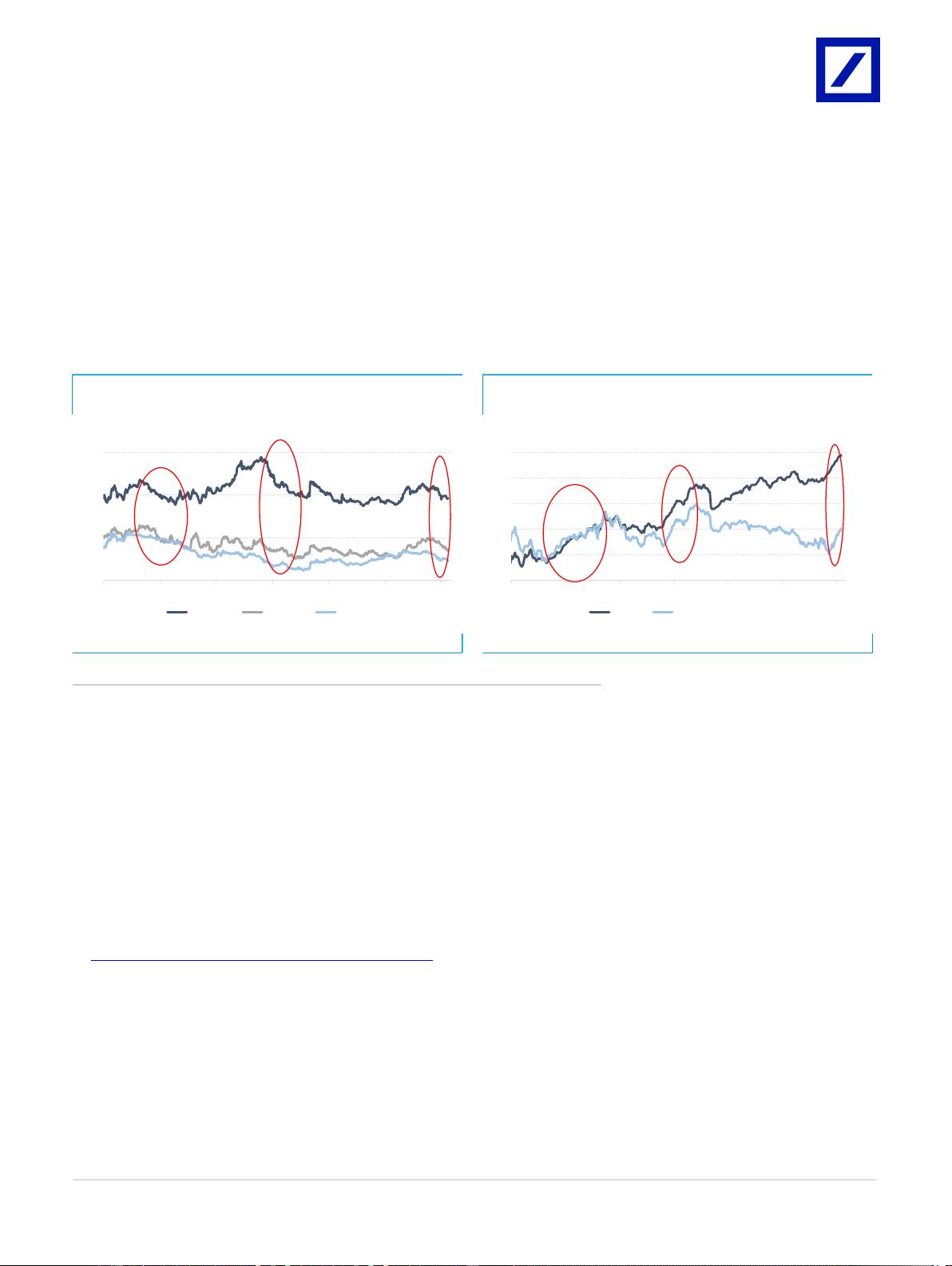

Figure 1:EM term premium has compressed from

historical highs over the past three months

Figure 2: CBs are normalizing monetary policy and risk

neutral rates have stabilized of late

0.4

0.9

1.4

1.9

2.4

2.9

3.4

3.9

Jan 13 Nov 13 Sep 14 Aug 15 Jun 16 Apr 17 Mar 18 Jan 19

EM 10Y bonds term premium, %

Latam_TP EMEA_TP Asia_TP

taper tantrum

US election

EM slowdown and the end of

the commodity cycle

EM selloff in May

2.0

3.0

4.0

5.0

6.0

Jan 13 Nov 13 Sep 14 Aug 15 Jun 16 Apr 17 Mar 18 Jan 19

EM 10Y bonds risk-neutral rates, %

Latam_RN EMEA_RN Asia_RN

Source: Deutsche Bank, Bloomberg Finance LP Source: Deutsche Bank, Bloomberg Finance LP

Since early November, TP has significantly declined from historical highs to

post-tantrum average levels across all the three regions, thus accounting for

most of the recent repricing in EM LFI. The slowdown in growth across DM

and some EM still seems poised to continue, judging by leading indicators.

Accordingly, our DM strategists also see room for further flattening and contained

inflation expectations, and we also believe that there is room for additional TP

compression. But the cushion has shrunk.

The already compressed TP, combined with real rate differentials between

EM vs DM hovering near historical lows, suggests reduced upside for EM LFI

Deutsche Bank AG/London

Page 3

15 February 2019

EM Special Publication

(FX hedged). If DB's scenario of a soft patch in H1 followed by recovery in H2

materializes, this means negative returns for low yielders this year. However, it

is important to stress that EM LFI is one of the most idiosyncratic asset classes

within EM. Select high yielders still offer value - if anything - because of still benign

inflation outlooks and still high risk-neutral rates and TP. That said, investors do

need to be more selective.

In this report, we provide a brief description of our methodology and reassess TP

valuation. In particular, we analyze the recent development in term premium and

risk-neutral rates, study TP's underlying drivers, examine the remaining cushion

for policy normalization, identify dislocations in basis of bond TP vs swap TP, and

provide strategy implications in the end.

Figure 3: EM local bonds have rallied over the last three

months...

Figure 4: ...Similar to previous rallies, the rally is largely

driven by the compression of TP

3.00

5.00

7.00

9.00

Jul 13 Jun 14 May 15 Apr 16 Mar 17 Jan 18 Jan 19

EM 10Y bond constant maturity bond yields, %

LatAm_10Y EMEA_10Y Asia_10Y

0.0

0.5

1.0

1.5

2.0

2.5125

130

135

140

145

150

Jul 13 Jun 14 May 15 Apr 16 Mar 17 Jan 18 Jan 19

EM local bonds total return hedged vs EMTP

hedged EM_TP( %, rhs, rev.order)

Source: Deutsche Bank, Bloomberg Finance LP Source: Deutsche Bank, Bloomberg Finance LP

Term premium: How much left?

■

TP serves as cushion for duration during hiking cycles.

■

Regardless of the recent compression of TP, we still see TP high or at

historical highs in Peru, Romania, Peru, Brazil, South Africa, Chile and

Malaysia. This contrasts with already low and further reduced TP in

South Korea, Czech Republic and Turkey.

■

On the other hand, risk-neutral rates are still high in South Africa,

Russia, Mexico, India, Indonesia and Brazil.

Breaking down EM yields into policy and risk: We decompose EM 10Y constant

maturity bond yields into two components using the methodology described

in Appendix A: Methodology of yield decomposition (we also apply the same

methodology to swap curves). The first component - the risk-neutral rates (RN) -

reflects the expected path of short-term rates. As such it depends on growth and

inflation trade-offs. The second component, TP, is the residual after excluding RN

from market yields. It captures all the risk factors derived from policy uncertainty,

inflation, credit, market volatility and appetite for risk. It reflects the premium

required to compensate risk-averse investors.

On policy normalization and RN: EM CBs entered an easing cycle starting early

2016 as foreign credit conditions tightened (on stronger USD and reduced USD

cross-border liquidity). As the USD weakened and external liquidity conditions

eased, CBs have turned more hawkish - especially since early 2018 as the chart

Page 4

Deutsche Bank AG/London

15 February 2019

EM Special Publication

above shows. Accordingly, RN rates dropped noticeably in 2016-17 and have

bottomed out since early 2018. The chart also shows that RN has stabilized in

recent months, which implies that the recent rally results largely from the TP

compression rather than RN.

We expect further repricing of RN to be limited. First, except for Asia, RN rates

are running near historical lows - or within 50bp of the recent trough. Second,

even if at a lower pace than predicted, EM is on a recovery path. The trough of

2017 and early 2018 reflected a significant credit crunch and slowdown across

EM over the preceding years that we find unlikely to repeat barring recession in

the US and the EU.

In contrast with RN, TP's hefty cushion accumulated from 2016 through late

2018 has only partially compressed and still offers pockets of value. Initially,

TP rose from historical lows in early 2016 on the back of policy easing, and the

recovery from the EM slowdown in late 2015. The US election in November of

2016 also boosted TP significantly as a by-product of core yields repricing up. In

LatAm, TP reached historical highs by early November in 2018. More recently, this

rise in TP has partially reversed, largely driven by the collapse of core yields. As

the chart below shows, TP and RN tend to be negatively correlated (with higher

RN - or tighter policy - associated with reduced premium.

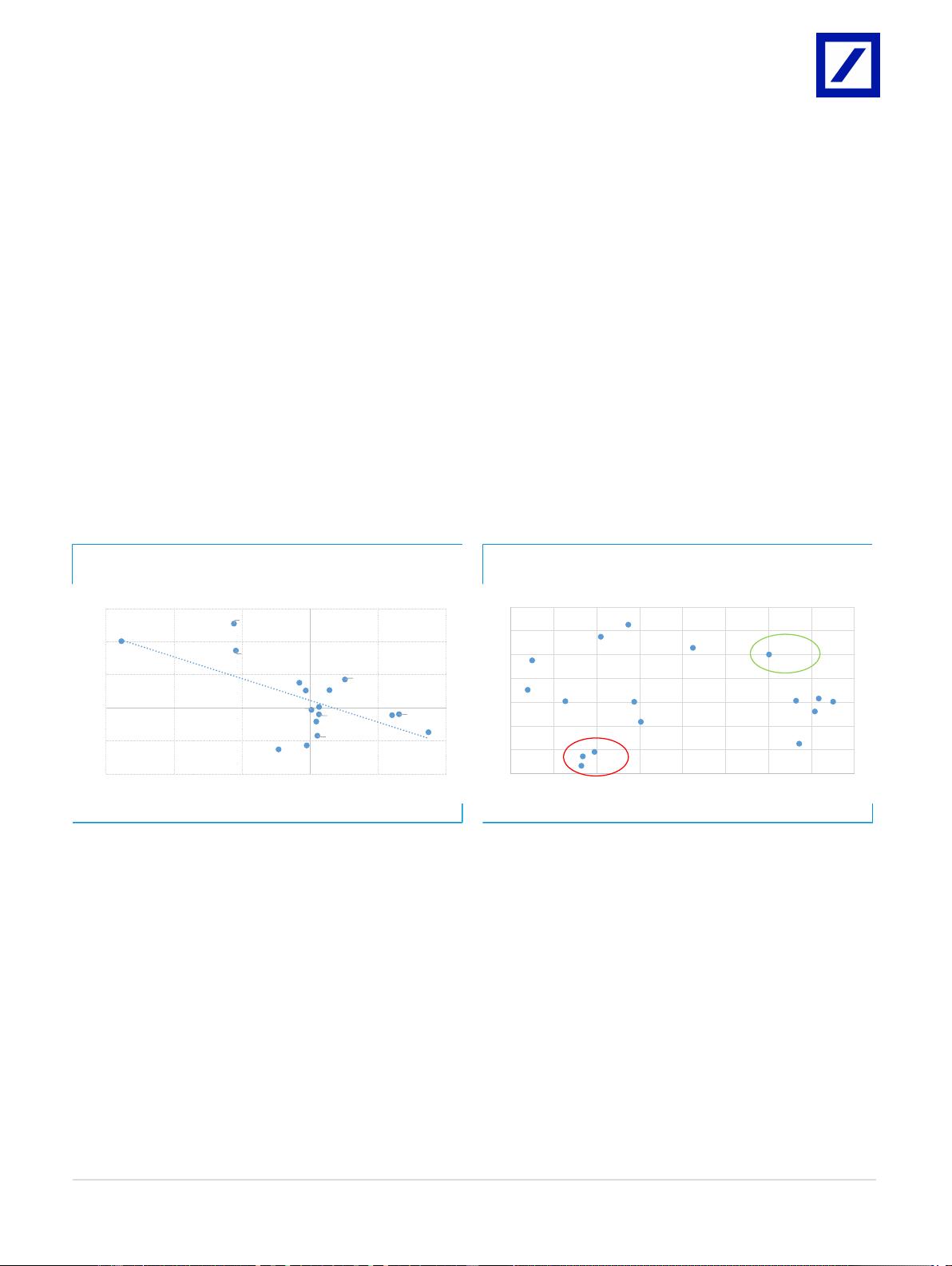

Figure 5: Term premium compresses as risk-neutral rate

rises

Figure 6: Current TP vs current RN: Where is the value

left?

CZK

HUF

ILS

PLN

RON

RUB

ZAR

BRL

CLP

COP

MXN

PEN

INR

IDR

MYR

KRW

THB

-1.0

-0.5

0.0

0.5

1.0

1.5

-3.0 -2.0 -1.0 0.0 1.0 2.0

2y change - RN, %

2y change - TP, %

corr=-0.62

CZK

HUF

ILS

PLN

RON

RUB

ZAR

BRL

CLP

COP

MXN

PEN

INR

IDR

MYR

KRW

THB

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0

current RN, %

current TP, %

Source: Deutsche Bank, Bloomberg Finance LP Source: Deutsche Bank, Bloomberg Finance LP

How much value is left? TP has compressed to the middle section of the

distribution from historical highs since last November, with CEEMEA's TP

shrinking the most, followed by LatAm's TP (less so for Asia). The bar charts below

show the distribution for TP and RN across EM. No countries have seen their TP

increased over the last three months. Actually, TP in most countries has shrunk

noticeably, with exceptions of Chile, Colombia, Romania and Asian countries.

Among others, South Korea and Czech Republic have TP near historical lows

(close to zero). Regardless of the recent TP compression, for a number of curves

- including Peru, Romania, Peru, Brazil, South Africa, Chile and Malaysia - TP

is still either high in absolute levels or near historical highs. This contrasts with

already low and further reduced TP in South Korea, Czech Republic and Turkey.

Deutsche Bank AG/London

Page 5

剩余23页未读,继续阅读

资源推荐

资源评论

2021-09-11 上传

127 浏览量

177 浏览量

2023-07-26 上传

2023-07-26 上传

2023-07-25 上传

2021-04-08 上传

2021-04-08 上传

181 浏览量

2025-02-24 上传

120 浏览量

2025-02-28 上传

资源评论

qq_41146932

- 粉丝: 13

- 资源: 6306

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 微控制器固件包_STM32CubeG0_1741142084.zip

- 《ARM9嵌入式系统设计基础教程》第13章图形用户接口(GUI).ppt

- 《机械设计基础》课后习题答案

- C#调用Ni板卡进行实现采集任务(模拟量输入输出)示例2

- 《实验一 Java开发环境&语法基础》

- 2016级河南大学计算机与信息工程学院创新实践计划-消防机器人.zip

- Java课程设计-学生成绩管理系统-Swing+MySQL.zip

- 《AE影视后期特效制作实例教程》8-3++空中气流写字字帖.ppt

- Unwrap Pro是一个3ds Max插件,可以在产生低失真,无重叠,加权密度的UVs的同时展开网格,而不像3ds Max Peel命令,它产生具有高面积失真的重叠UV,UnwrapPro是非常快的

- 大二下SQL实验学生信息系统.zip

- macd指标算法 php语言编写 大智慧/同花顺 数据一致

- 2025修复版绿色全自适应php核心制作的邮编查询网整站源码带百万数据+定时触发更新

- 人工智能&深度学习:PyTorch 图像识别实战 - 卷积神经网络与模块应用资源(源码+数据集+说明资料)

- 《Java语言编程基础立体化实用教程》2-6+成绩增加和成绩修改窗体的实现.ppt

- ITECH艾德克斯交直流程控源使用手册

- 实时操作系统_FreeRTOS_内核组件_通用与特定_1741145229.zip

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功