We Believe NIO Plays Valeant-esque Accounting Games to Inflate

Revenue and Boost Net Income Margins to Meet Targets

READ OUR DISCLAIMER HERE

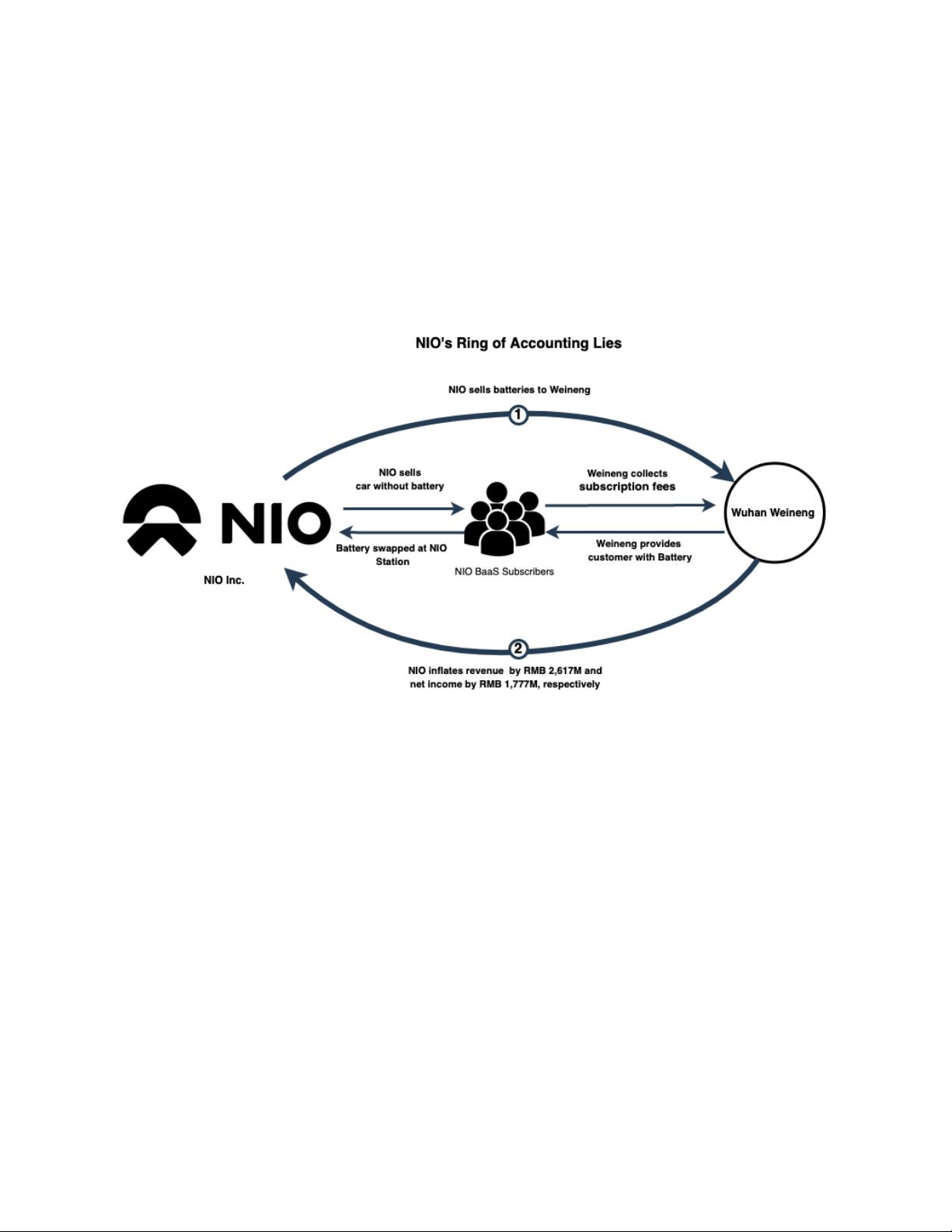

• Today, we reveal what we consider an audacious scheme by NYSE-listed NIO. Reminiscent of the

Philidor-Valeant relationship, NIO is likely using an unconsolidated related party to exaggerate

revenue and profitability.

• Presumably, with these stellar operating results in mind, retail investors have bid NIO’s shares up

>450% since 2020, making it one of China’s most valuable EV companies.

• Allow us to introduce you to Wuhan Weineng (“Weineng”), the convenient difference-maker helping

NIO exceed lofty growth and profitability estimates on The Street. Despite being formed by NIO and

a consortium of investors in late 2020, this unconsolidated related party has already generated

billions in revenue for NIO.

• While this rapid growth is impressive on the surface, our investigation has found Weineng might be

to NIO what Philidor was to Valeant. Just as Philidor aided Valeant in habitually making numbers,

NIO has curiously exceeded estimates since establishing Weineng.

• We believe sales to Weineng have inflated NIO’s revenue and net income by ~10% and 95%,

respectively. Specifically, we find that at least 60% of its FY2021 earnings beat seems attributable

to Weineng.

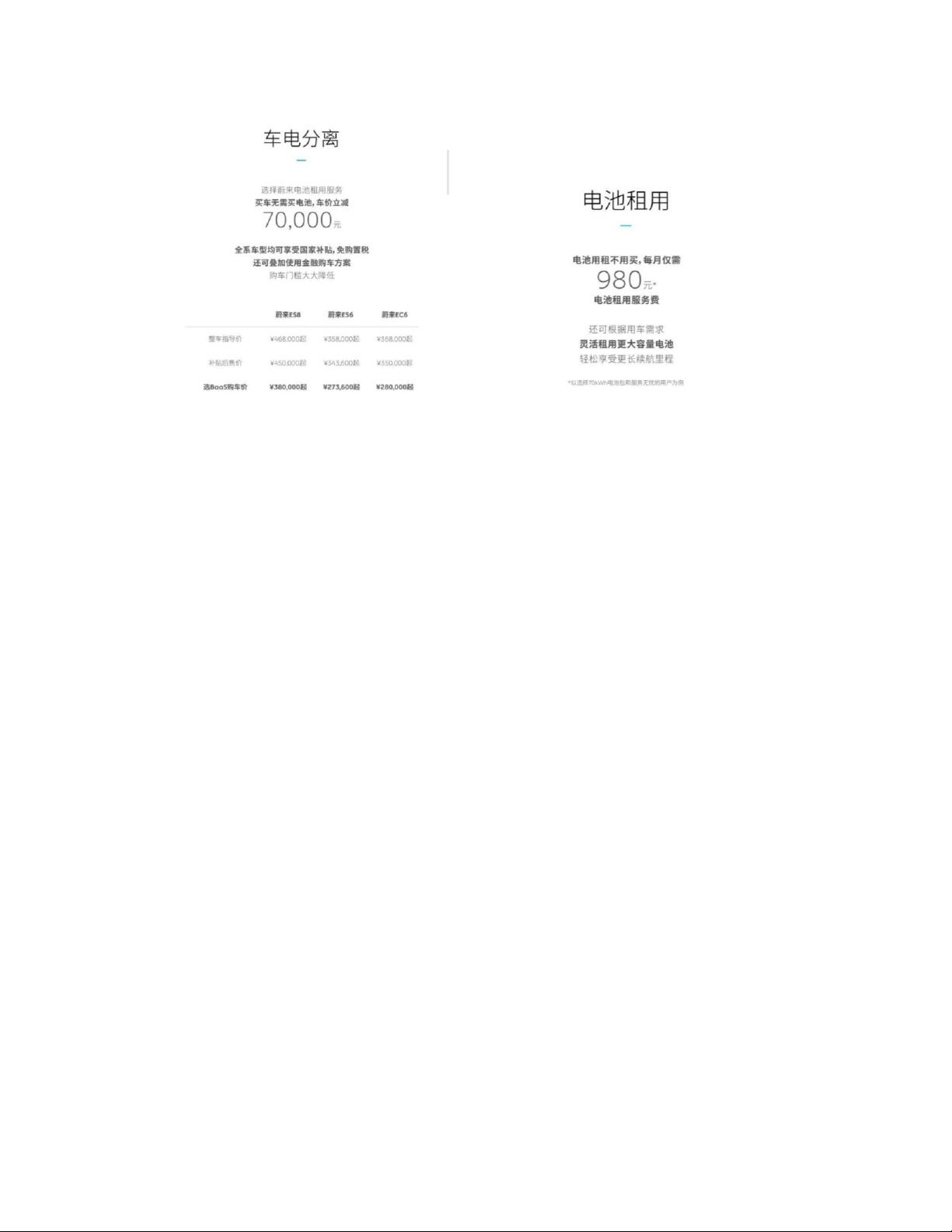

• By transferring the burden of collecting monthly subscriptions to Weineng, NIO has accelerated its

revenue growth. Instead of recognizing revenue over the life of the subscription (~7 years), Weineng

allows NIO to recognize revenue from the batteries they sell immediately. Through this

arrangement, we think NIO has juiced its numbers by pulling forward 7 years of revenue.

• Considering Weineng’s recent disclosure of 19,000 battery subscriptions, we questioned why

Weineng held 40,053 batteries as inventory on September 30, 2021. After careful investigation, we

believe NIO flooded Weineng with up to extra 21,053 batteries (worth ~1,147M RMB) to boost its

numbers. For Q4 2021, this number only gets worse and we estimate NIO oversupplied up to

another 15,200 batteries. The effect of this action on NIO’s bottom line is enormous.

• Of course, it would take a willing potential accomplice to pull off such a scheme… While NIO

represents limited control over Weineng, we identified notable conflicts of interest between the

two parties: Weineng’s top two executives currently double as NIO’s Vice President and Battery

Operating Executive Manager.

• NIO’s Chairman and CEO, Bin Li, is closely tied to Joy Capital and Erhai Liu, parties central to the

Luckin Coffee Fraud. While he has been hailed as the “Elon Musk of China”, Li’s past ventures have

seen their stocks collapse and been taken private at a fraction of their peak valuations.

• In January 2019, Bin Li transferred 50M shares to the “NIO Users Trust”, an opaque BVI entity

purportedly established to provide NIO Users with more influence over the Company’s governance.

In an apparent violation of these “Users” trust, Li pledged these shares to UBS to secure a personal

loan. With NIO’s stock declining 50+% since the pledge, we believe shareholders are unknowingly

exposed to the risk of a margin call against the Users Trust shares.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功