| ©2022 by COMAP, Inc. | www.comap.com | www.mathmodels.org| info@comap.com |

2022 MCM

Problem C: Trading Strategies

Background

Market traders buy and sell volatile assets frequently, with a goal to maximize their total return.

There is usually a commission for each purchase and sale. Two such assets are gold and bitcoin.

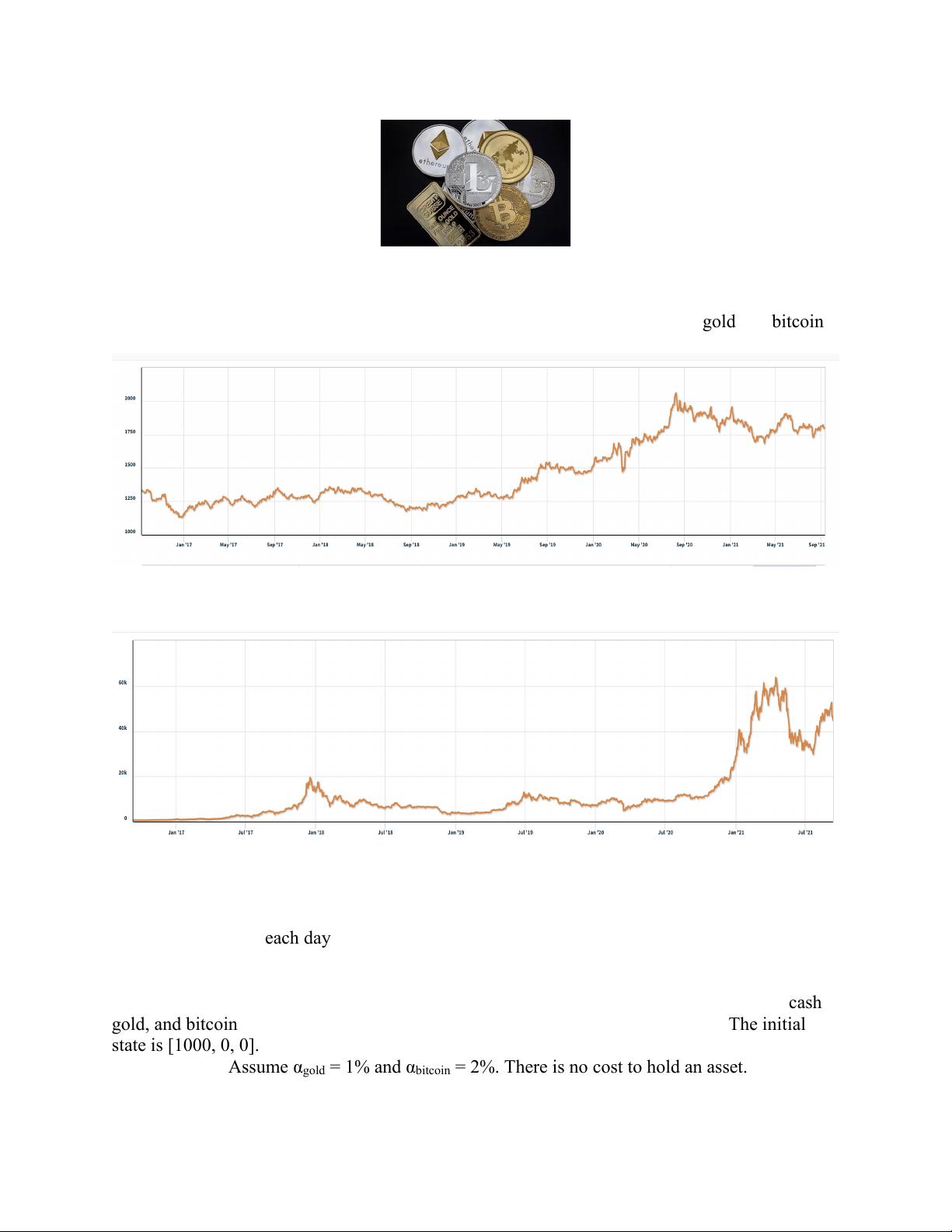

Figure 1: Gold daily prices, U.S. dollars per troy ounce. Source: London Bullion Market

Association, 9/11/2021

Figure 2: Bitcoin daily prices, U.S. dollars per bitcoin. Source: NASDAQ, 9/11/2021

Requirement

You have been asked by a trader to develop a model that uses only the past stream of daily prices

to date to determine each day if the trader should buy, hold, or sell their assets in their portfolio.

You will start with $1000 on 9/11/2016. You will use the five-year trading period, from

9/11/2016 to 9/10/2021. On each trading day, the trader will have a portfolio consisting of cash,

gold, and bitcoin [C, G, B] in U.S. dollars, troy ounces, and bitcoins, respectively. The initial

state is [1000, 0, 0]. The commission for each transaction (purchase or sale) costs α% of the

amount traded. Assume α

gold

= 1% and α

bitcoin

= 2%. There is no cost to hold an asset.

评论0