1

Luckin Coffee: Fraud + Fundamentally Broken Business

Executive Summary

When Luckin Coffee (NASDAQ: LK) (“Luckin” or the “Company”) went public in May 2019, it was a fundamentally broken

business that was attempting to instill the culture of drinking coffee into Chinese consumers through cut-throat discounts and free

giveaway coffee. Right after its USD 645 million IPO, the Company had evolved into a fraud by fabricating financial and operating

numbers starting in 3

rd

quarter 2019. It delivered a set of results that showcased a dramatic business inflection point and sent its

stock price up over 160% in a little over 2 months. Not surprisingly, it wasted no time to successfully raise another USD 1.1 billion

(including secondary placement) in January 2020. Luckin knows exactly what investors are looking for, how to position itself as a

growth stock with a fantastic story, and what key metrics to manipulate to maximize investor confidence. This report consists of

two parts: the fraud and the fundamentally broken business, where we separately demonstrate how Luckin faked its numbers

and why its business model is inherently flawed.

Part One: The Fraud

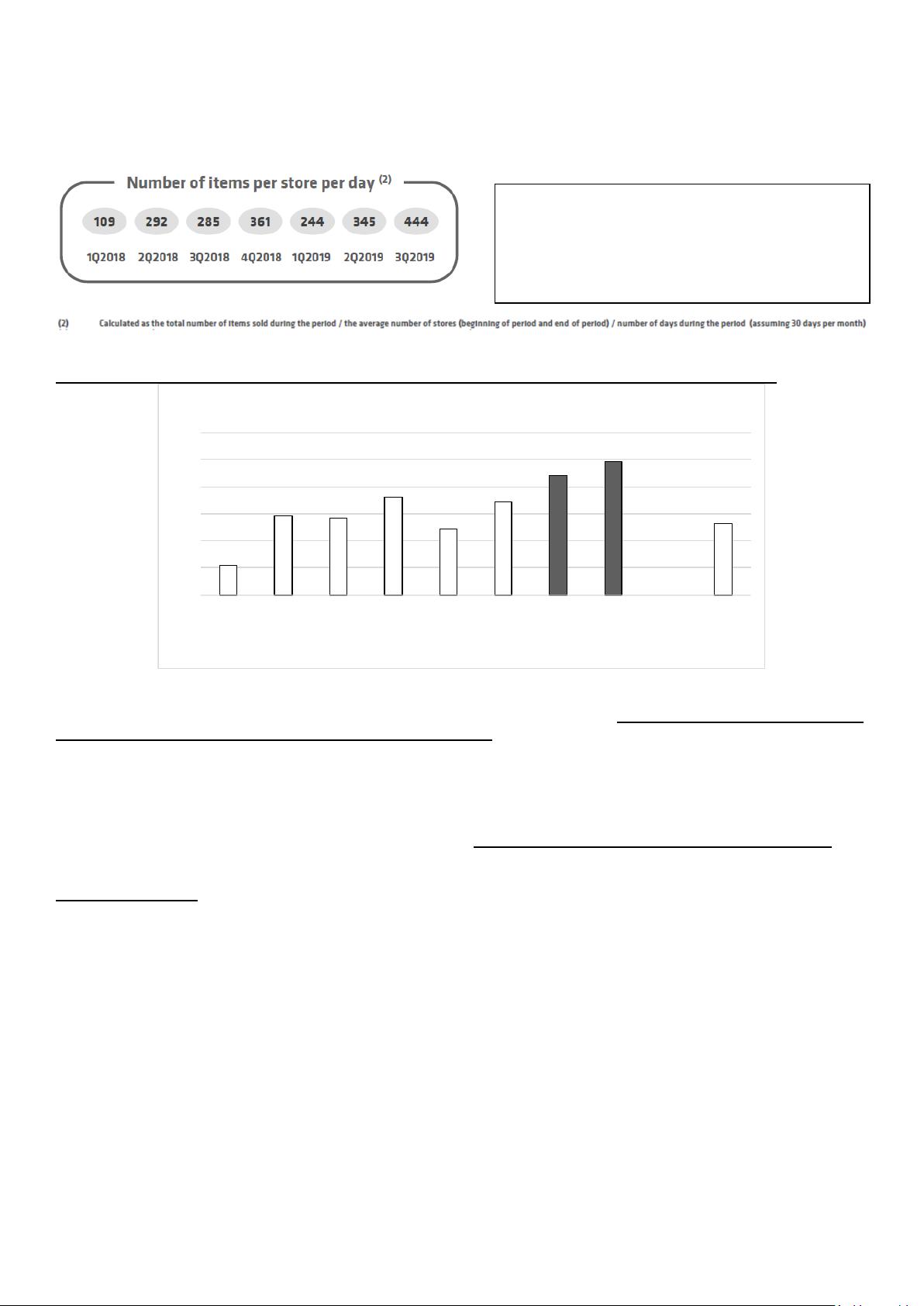

Smoking Gun Evidence #1: Number of items per store per day was inflated by at least 69% in 2019 3Q and 88% in 2019 4Q,

supported by 11,260 hours of store traffic video. We mobilized 92 full-time and 1,418 part-time staff on the ground to run

surveillance and record store traffic for 981 store-days covering 100% of the operating hours. Store selection was based on

distribution by city and location type, the same as Luckin’s total directly-operated store portfolio.

Smoking Gun Evidence #2: Luckin’s “Items per order” has declined from 1.38 in 2019 2Q to 1.14 in 2019 4Q.

Smoking Gun Evidence #3: We gathered 25,843 customer receipts and found that Luckin inflated its net selling price per item by

at least RMB 1.23 or 12.3% to artificially sustain the business model. In the real case, the store level loss is high at 24.7%-28%.

Excluding free products, actual selling price was 46% of listed price, instead of 55% claimed by management.

Smoking Gun Evidence #4: Third party media tracking showed that Luckin overstated its 2019 3Q advertising expenses by over

150%, especially its spending on Focus Media. It’s possible that Luckin recycled its overstated advertising expense back to inflate

revenue and store-level profit.

Smoking Gun Evidence #5: Luckin’s revenue contribution from “other products” was only about 6% in 2019 3Q, representing

nearly 400% inflation, as shown by 25,843 customer receipts and its reported VAT numbers.

Red Flag #1: Luckin’s management has cashed out on 49% of their stock holdings (or 24% of total shares outstanding) through

stock pledges, exposing investors to the risk of margin call induced price plunges.

Red Flag #2: CAR Inc (HKEX: 699 HK) (“CAR”) déjà vu: Luckin’s Chairman Charles Zhengyao Lu and the same group of

closely-connected private equity investors walked away with USD 1.6 billion from CAR while minority shareholders took heavy

losses.

Red Flag #3: Through acquisition of Borgward, Luckin’s Chairman Charles Zhengyao Lu transferred RMB 137 million from

UCAR (838006 CH) to his related party, Baiyin Wang. UCAR, Borgward, and Baiyin Wang are on the hook to pay BAIC-Foton

Motors RMB 5.95 billion over the next 12 months. Now Baiyin Wang owns a recently founded coffee machine vendor located

next door to Luckin’s Headquarter.

Red Flag #4: Luckin recently raised USD 865 million through a follow-on offering and a convertible bond offering to develop its

“unmanned retail” strategy, which is more likely a convenient way for management to siphon large amount of cash from the

company.

Red Flag #5: Luckin’s independent board member, Sean Shao, is/was on the board of some very questionable Chinese companies

listed in the US that have incurred significant losses on their public investors.

Red Flag #6: Luckin’s co-founder & Chief Marketing Officer, Fei Yang, was once sentenced to 18 months’ imprisonment for

crime of illegal business operations when he was the co-founder and general manager of Beijing Koubei Interactive Marketing &

Planning Co.,Ltd. (“iWOM”). Afterwards, iWOM became a related party with Beijing QWOM Technology Co., Ltd. (“QWOM”),

which is now an affiliate of CAR and is doing related party transactions with Luckin.

weixin_387439682020-05-07可以,很高清很齐全的资料。谢谢了

weixin_387439682020-05-07可以,很高清很齐全的资料。谢谢了 我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功