没有合适的资源?快使用搜索试试~ 我知道了~

JP 摩根-美股-航空行业-美国航空与航空租赁:上半年全线走软-329-27页.pdf

试读

27页

需积分: 0 0 下载量 3 浏览量

更新于2023-07-28

收藏 527KB PDF 举报

【文章摘要】

这篇报告由JP摩根发布,主要分析了美国航空行业的状况,特别是针对美国航空(American Airlines)和航空租赁公司在2019年上半年的表现。报告指出,整个航空行业在上半年出现疲软,主要航空公司如美国航空、达美航空(Delta Air Lines)、联合大陆控股(United Continental Holdings)、西南航空(Southwest Airlines)、阿拉斯加航空集团(Alaska Air Group)、捷蓝航空(JetBlue Airways)以及精神航空(Spirit Airlines)等公司的市场表现均受到影响。报告还提供了这些公司的股票评级、目标价格和市场资本化等关键数据,并对1H(上半年)的业绩进行了预期调整,考虑了燃油成本上升、单位收入(RASM)下降以及波音737 MAX停飞等因素的影响。

【详细知识点】

1. **航空业市场分析**:报告揭示了2019年上半年美国航空业的整体疲软,这可能受到多重因素的影响,包括但不限于经济波动、市场竞争加剧、燃油价格波动和特定机型的安全问题(如波音737 MAX停飞)。

2. **股票评级和价格目标**:JP摩根给出了对各大航空公司股票的评级和目标价格。例如,美国航空被评“OW”(市场表现不佳),目标价格为43美元;达美航空也被评为“OW”,目标价格为62美元。这些评级和目标价格是基于公司财务状况、行业前景、市场表现和分析师预测的综合评估。

3. **市场资本化**:报告列出了各航空公司的市值,反映了它们在市场中的相对规模和影响力。例如,达美航空的市值最高,为34,368.56百万美元,而捷蓝航空的市值相对较小,为5,078.09百万美元。

4. **业绩预期调整**:由于燃油成本上升、收入增长放缓以及波音737 MAX停飞的影响,JP摩根降低了对航空公司1H的业绩预测。这种预期调整通常会在季度或年度业绩发布前进行,以反映最新的市场情况。

5. **股价反应**:报告指出,尽管业绩预期降低,但某些航空公司的股价表现相对稳定,比如西南航空正式开启预发布季节后,股价并未大幅下滑。这表明投资者可能已经提前预期到了业绩的调整,市场对此已有一定消化。

6. **投资决策因素**:投资者在做投资决策时,应考虑多个因素,包括JP摩根的报告,但也要意识到可能存在利益冲突,因为金融机构可能同时与研究报告覆盖的公司有业务往来。

7. **行业影响因素**:除了内部运营和财务表现,航空公司还受到外部因素的影响,如政策法规、燃油价格波动、市场竞争、航线审批以及技术安全问题等。波音737 MAX停飞事件就是一个例子,它不仅影响了相关航空公司,也引发了全球对飞行安全的关注。

8. **公司策略应对**:航空公司在面对市场疲软时,可能会采取各种策略来应对,如降低成本、调整航线网络、提高服务质量或寻求新的收入来源。

总结,该报告提供了对美国航空行业现状的深入洞察,强调了当前面临的挑战和未来可能的发展趋势,对投资者和业界人士理解行业动态具有重要参考价值。

www.jpmorganmarkets.com

North America Equity Research

29 March 2019

Equity Ratings and Price Targets

Mkt Cap

Rating

Price Target

Company

Ticker

($

mn)

Price ($)

Cur

Prev

Cur

End

Date

Prev

End

Date

American Airlines

AAL US

14,388.88

30.90

OW

n/c

43.00

Dec

-

19

n/c

n/c

Delta Air Lines, Inc.

DAL US

34,368.56

50.32

OW

n/c

62.00

Dec

-

19

n/c

n/c

United Continental Holdings, Inc.

UAL US

21,748.62

78.60

OW

n/c

101.00

Dec

-

19

n/c

n/c

Southwest Airlines Co.

LUV US

28,907.85

50.45

UW

n/c

52.00

Dec

-

19

n/c

n/c

Alaska Air Group, Inc.

ALK US

6,835.91

55.17

N

n/c

71.00

Dec

-

19

n/c

n/c

JetBlue Airways Corp.

JBLU US

5,078.09

16.18

N

n/c

19.00

Dec

-

19

n/c

n/c

Spirit Airlines

SAVE US

3,541.15

51.75

OW

n/c

78.00

Dec

-

19

n/c

n/c

Source: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 28 Mar 19.

US Airlines

Estimates housekeeping; 1H softened across the

board

Airlines & Aircraft Leasing/Equity

Jamie Baker

AC

(1-212) 622-6713

jamie.baker@jpmorgan.com

Bloomberg JPMA BAKER <GO>

J.P. Morgan Securities LLC

Karan Puri

(91-22) 6157-3327

karan.puri@jpmchase.com

J.P. Morgan India Private Limited

See

page 24 for analyst certification and important disclosures, including non

-

US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aw

are that

the firm may have a con

flict of interest that could affect the objectivity of this report. Investors should consider this report as only a single

factor in making their investment decision.

Our 1H estimates are reduced across the board on a combination of slightly higher

fuel, slightly lower RASM, and MAX groundings (where applicable). Frankly, we

doubt this serves as the first (or last) such exercise investors will witness in this regard

as we head into the customary pre-earnings housekeeping cycle. In fact, shares have

held up comparatively well since Southwest formally kicked off the pre-release season

this week, suggesting to us that stocks were already discounting a potential downward

revision exercise (Delta comes next, on Tuesday, Spirit the week after). Accordingly,

with several names having corrected close to 10% from their March highs (vs. SPX -

1%), with estimates tempering, and an appreciable uptick in inbound investor inquiries

(after a period of near-radio silence), aggregate risk/reward appears to be improving as

we head into the upcoming earnings season.

Nothing proprietary, just housekeeping – Higher fuel and slightly softer Q1

RASM (plus some MAX/labor noise at LUV) lay at the root of today’s changes. Few

should be surprised, as these themes have been well articulated by most

managements throughout the March conference season. Nor do our estimates

establish new lows outside of AAL & UAL (for now).

Nothing particularly actionable, either – In the case of Delta, we expect

Tuesday’s revised guide to remain within existing parameters (i.e. the $0.70 to $0.90

range), but at the lower end. We similarly expect AAL/UAL outcomes at the softer

end of guided ranges, though not by a degree expected to prompt managements to

disclose prior to earnings. ALK, JBLU & LUV have already weighed in, LUV most

recently.

For Spirit, we believe the damage is done – SAVE has underperformed the market

by 9.5% since the eve of the JPM ATI conference earlier, slightly worse than other

names. We would attribute this to a) UAL commentary at said event, and b)

subsequent cautious commentary from SAVE since that time. While incremental

demand softness appears coincident with MAX groundings (which should be largely

irrelevant to non-MAX operators, though in Spirit's case we can envision how its

more elastic passenger audience might have been spooked), it may reflect little more

than poor Easter-shift estimates by management. On the other hand, it could be

related to the increased price competition cited by UAL management. Too early to

tell, and frankly we may never know for certain. But given SAVE’s otherwise-steep

and peer-leading correction, we believe the near-term damage has potentially been

done.

2

North America

Equity Research

29 March 2019

Jamie Baker

(1-212) 622-6713

jamie.baker@jpmorgan.com

As noted, the setup into actual earnings seems to be improving – Market lagging

equity performance over the past month. Diminished consensus forecasts (with a bit

more likely to come, in our view). But a reasonable bounce already underway

following Southwest’s guide down and an appreciable uptick in inbound investor

phone calls expressing interest in the space over the past seven days (compared to

near-radio silence prior). To us, it appears that aggregate risk/reward has improved

and some are already taking notice. Whether this leads us to aggressively pound the

table going into earnings (kicking off on April 10th with Delta earnings and Spirit's

Q1 update) has yet to be determined, though Delta's Tuesday guide may help

solidify our view in this regard.

3

North America

Equity Research

29 March 2019

Jamie Baker

(1-212) 622-6713

jamie.baker@jpmorgan.com

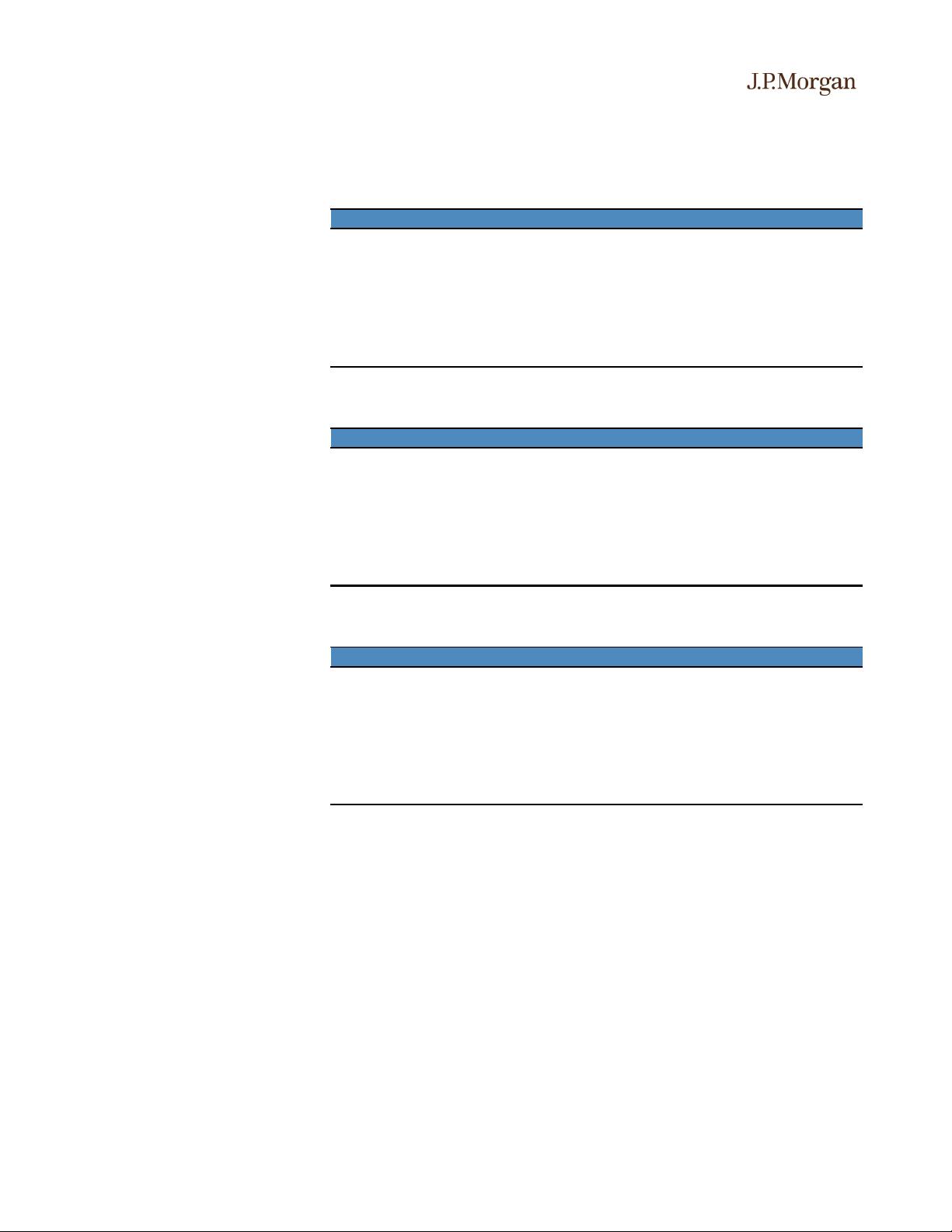

Table 1: Our Q1 estimates range in magnitude, and establish new lows for AAL/UAL…

Source: JP Morgan estimates

Table 2: …whereas our 2019 forecasts don’t appear particularly unique…

Source: JP Morgan estimates

Table 3: ...and for now our 2020 estimates emerge unscathed.

Source: JP Morgan estimates

Q1:19e New Old % change Consensus

AAL $0.45 $0.60 -25% $0.60

ALK ($0.02) ($0.02) 0% $0.08

DAL $0.76 $0.88 -14% $0.81

JBLU $0.09 $0.09 0% $0.15

LUV $0.60 $0.85 -29% $0.65

SAVE $0.78 $0.90 -12% $0.89

UAL $0.85 $0.99 -14% $0.97

2019e New Old % change Consensus

AAL $6.26 $6.51 -4% $5.96

ALK $6.49 $6.56 -1% $6.26

DAL $6.77 $6.98 -3% $6.48

JBLU $1.89 $2.00 -6% $1.95

LUV $4.73 $5.21 -9% $4.82

SAVE $6.87 $7.08 -3% $6.51

UAL $11.15 $11.41 -2% $11.31

2020e New Old % change Consensus

AAL $6.54 $6.54 0% $6.24

ALK $7.50 $7.50 0% $7.07

DAL $7.76 $7.76 0% $6.97

JBLU $2.24 $2.24 0% $2.31

LUV $5.44 $5.44 0% $5.34

SAVE $7.85 $7.85 0% $6.98

UAL $12.60 $12.60 0% $12.22

4

North America

Equity Research

29 March 2019

Jamie Baker

(1-212) 622-6713

jamie.baker@jpmorgan.com

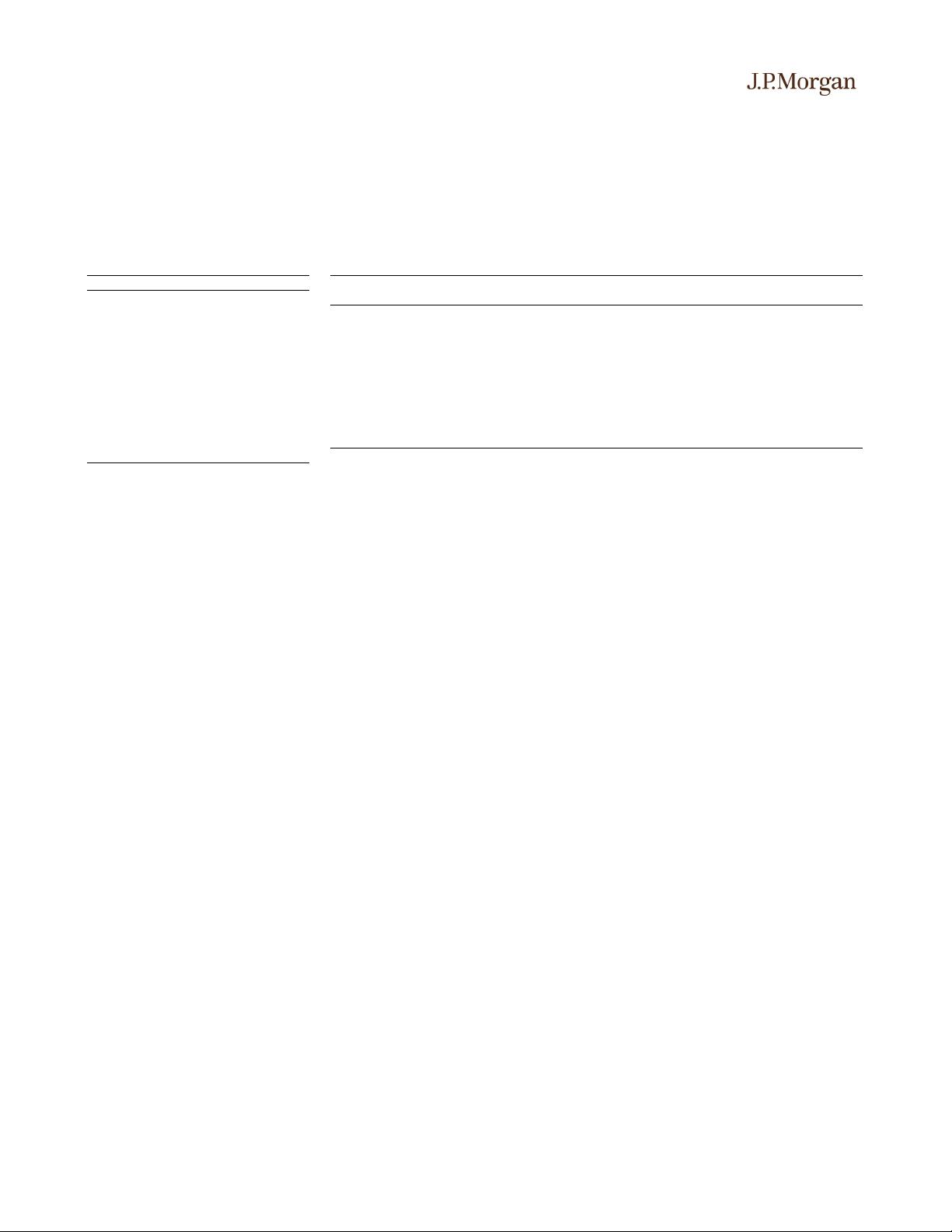

American Airlines

Overweight

Company Data

Shares O/S (mn) 466

52-week range ($) 53.08-28.81

Market cap ($ mn) 14,388.88

Market cap ($ mn) 14,388.88

Exchange rate 1.00

Free float(%) 89.0%

3M - Avg daily vol (mn) 8.05

3M - Avg daily val ($

mn)

269.3

Volatility (90 Day) 47

Index S&P 500

BBG BUY|HOLD|SELL 14|8|0

New American Group (AAL;AAL US)

Year-end Dec ($)

FY17A

FY18A

FY19E

(Prev)

FY19E

(Curr)

FY20E

FY21E

Revenue ($ mn) 42,623 44,541 46,694 46,590 48,422 -

Adj. EBITDAR ($ mn) 7,865 6,554 7,699 7,546 7,550 -

EBITDAR Margin 18.5% 14.7% 16.5% 16.2% 15.6% -

Adj. net income ($ mn) 2,592 2,118 2,933 2,817 2,831 -

Adj. EPS ($) 5.27 4.55 6.51 6.26 6.54 -

BBG EPS ($) 4.89 4.51 - 5.98 6.24 6.73

Reported EPS ($) 5.27 4.55 6.51 6.26 6.54 -

DPS ($) - - - - - -

Dividend yield - - - - - -

Adj. P/E 5.9 6.8 4.7 4.9 4.7 -

Source: Company data, Bloomberg, J.P. Morgan estimates.

Investment Thesis, Valuation and Risks

New American Group (Overweight; Price Target: $43.00)

Investment Thesis

Despite the industry’s revenue momentum in 2018, American shares have been a

noteworthy laggard, the worst performing stock at -38% in 2018. Fundamentally, we

believe American’s 2019 capacity growth plan of ~3% endorses a pattern of capacity

restraint that we believe will help set 2018 results as a margin support level. But we

acknowledge investor frustration with American – while Delta delivers industry-

leading margins and new revenue initiatives, and while United’s turnaround plan

appears to be working and winning over investors’ confidence – American’s revenue

story has been third-best and its Basic Economy execution hit-or-miss. The primary

rationale we see for owning AAL shares is the valuation dislocation relative to peers.

Despite projected margin deficiency on a relative basis to United and Delta, we don’t

believe American shares should trade at a nearly 2.5x discount to United on our 2019

estimates (and a ~2.0x discount to Delta). Indeed, American shares recently triggered

our proprietary Down 30 in 30 rule, and we believe sentiment is bottoming out. We

do not necessarily believe the company’s balance sheet strategy is prudent in what

feels like a late-cycle environment, but we do not envision any liquidity/solvency

concerns despite some investor concerns. In other words, at this valuation level, we

believe investors are more than compensated for lower margins and a riskier balance

sheet. Accordingly, we rate American shares Overweight.

Valuation

Our AAL Dec 2019 price target is $43.00, predicated on our company-specific

forward P/E multiple assumption. We are applying a 6.5x P/E multiple to our 2020

estimates to arrive at our price target. For context, we assume higher multiples at

both Delta and United (8.0x for both) reflect American’s enhanced balance sheet risk

and lower projected margin profile. AAL shares have experienced a ~2.5x P/E

valuation contraction since the autumn 2018 peak when measured on a consensus

2019 basis, and we believe this is a function of investor concern on American’s

leverage as well as slowing industry revenue momentum on account of cheaper fuel.

5

North America

Equity Research

29 March 2019

Jamie Baker

(1-212) 622-6713

jamie.baker@jpmorgan.com

Risks to Rating and Price Target

To the downside: if jet fuel prices rapidly move higher and American is unable to

recoup higher input costs through stronger fares; if United’s growth plans in Chicago

erode American’s profitability in its hub; if the Latin American region, where

American has outsized exposure, suffers from further macroeconomic headwinds.

剩余26页未读,继续阅读

资源推荐

资源评论

120 浏览量

124 浏览量

2023-07-24 上传

2023-07-26 上传

185 浏览量

167 浏览量

151 浏览量

130 浏览量

2023-02-10 上传

资源评论

dunming_6725413

- 粉丝: 20

- 资源: 6947

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功