24 June 2019

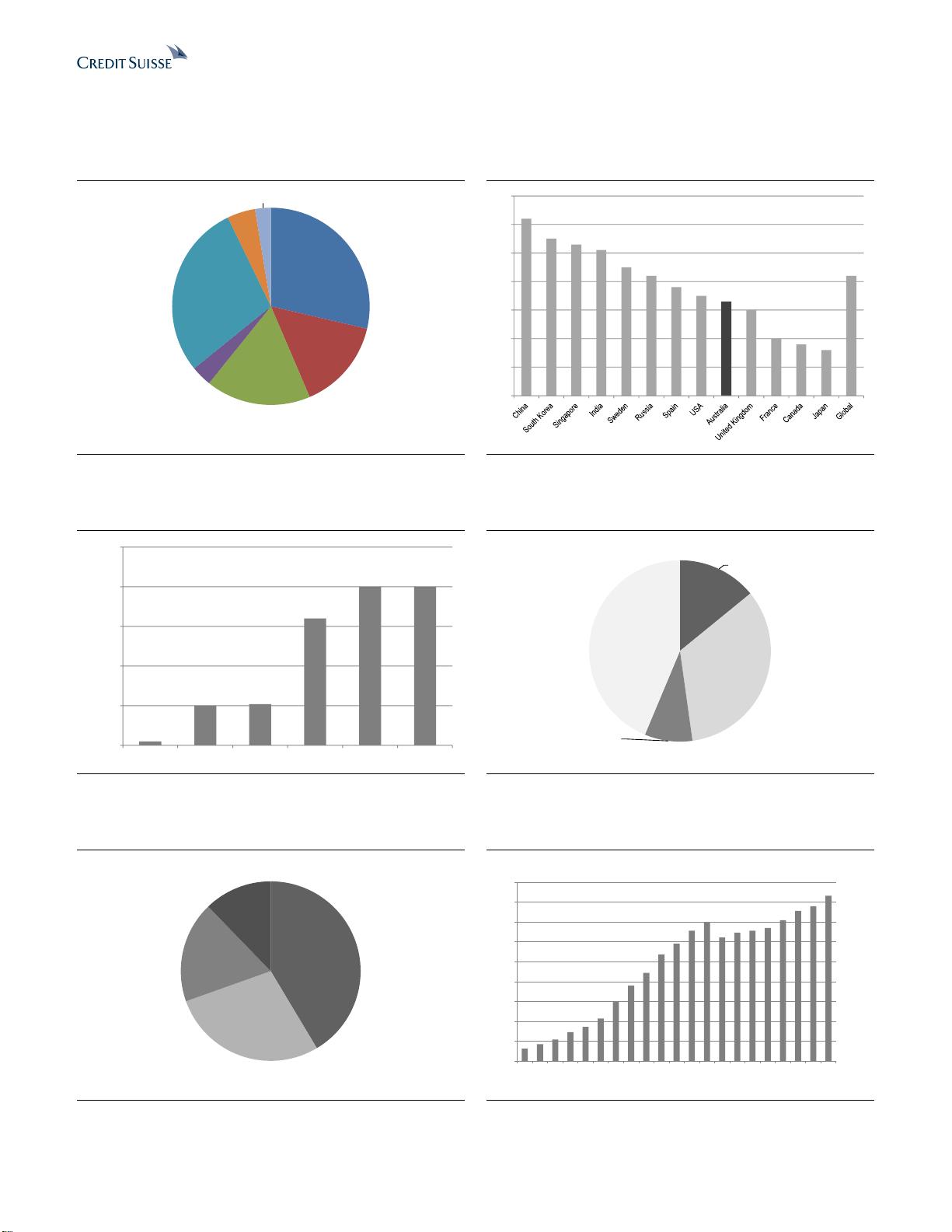

Commercial Banks 3

The rise of the neobanks

What is a neobank?

A ‘neobank’ is a 100% digital bank that communicates and provides services to clients

exclusively through an application or online.

UK Case Study: 5 years ahead

Neobanks are yet to disrupt the traditional banking industry when it comes to vanilla

banking products, the incumbents still maintain the majority of the market share.

Australia’s neobanks

There are a number of neobanks targeting different markets that have recently obtained

licenses from APRA. They are aiming to be operational in the next year.

Regulation of neobanks

There are different avenues neobanks can pursue when obtaining their banking license

from APRA. They can take the RADI approach, similar to getting your P-plates, apply for a

full banking license straight away or piggyback off another bank’s license.

Open banking - catalyst for change?

This allows customers to access their information from a number of institutions. This can

empower other institutions to better help them with tailored, fast and accurate insights.

The millennial impact or ‘Nomads’

‘Nomads’ have a greater preference for digital channels and are not loyal to a single

brand.

How neobanks fund themselves

When a neobank first establishes itself, its main source of funding will be from equity

investors. As their operations grow they will start to look at funding up the capital structure.

Neobanks vs Fintech

Even though they are not neobanks, fintech companies still provide a threat to traditional

and major banks in Australia.

Profit Pool Analysis

We estimate that in the retail and SME segments there is an addressable market of

roughly $57bn of revenue generated by the major banks.

How are the majors responding?

Traditional banks are trying to use technology to “provide customised solutions, complete

solutions, and seamless solutions” in order to offer the same service as the neobanks.

Should the majors be threatened?

They have been investing in their own technology and are fully operational with their own

loyal customer bases. In order for the neobanks to truly pose a threat to the majors they

will need to offer a fundamentally different service and value-add that the majors currently

don’t.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功