North America Credit Research

02 May 2019

Strategy

US High Grade Strategy & CDS Research

US High Grade Strategy & Credit

Derivatives Research

Eric Beinstein

AC

(1-212) 834-4211

eric.beinstein@jpmorgan.com

Paul Glezer

(1-212) 270-8185

paul.x.glezer@jpmorgan.com

Pavan D Talreja

(1-212) 834-2051

pavan.talreja@jpmchase.com

Sheila Xie

(1-212) 834-3036

sheila.xie@jpmorgan.com

J.P. Morgan Securities LLC

certification and important disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aw

firm may have a conflict of interest that could affect the objectivity of thi

s report. Investors should consider this report as only a single factor in

making their investment decision.

www.jpmorganmarkets.com

High Grade Strategy

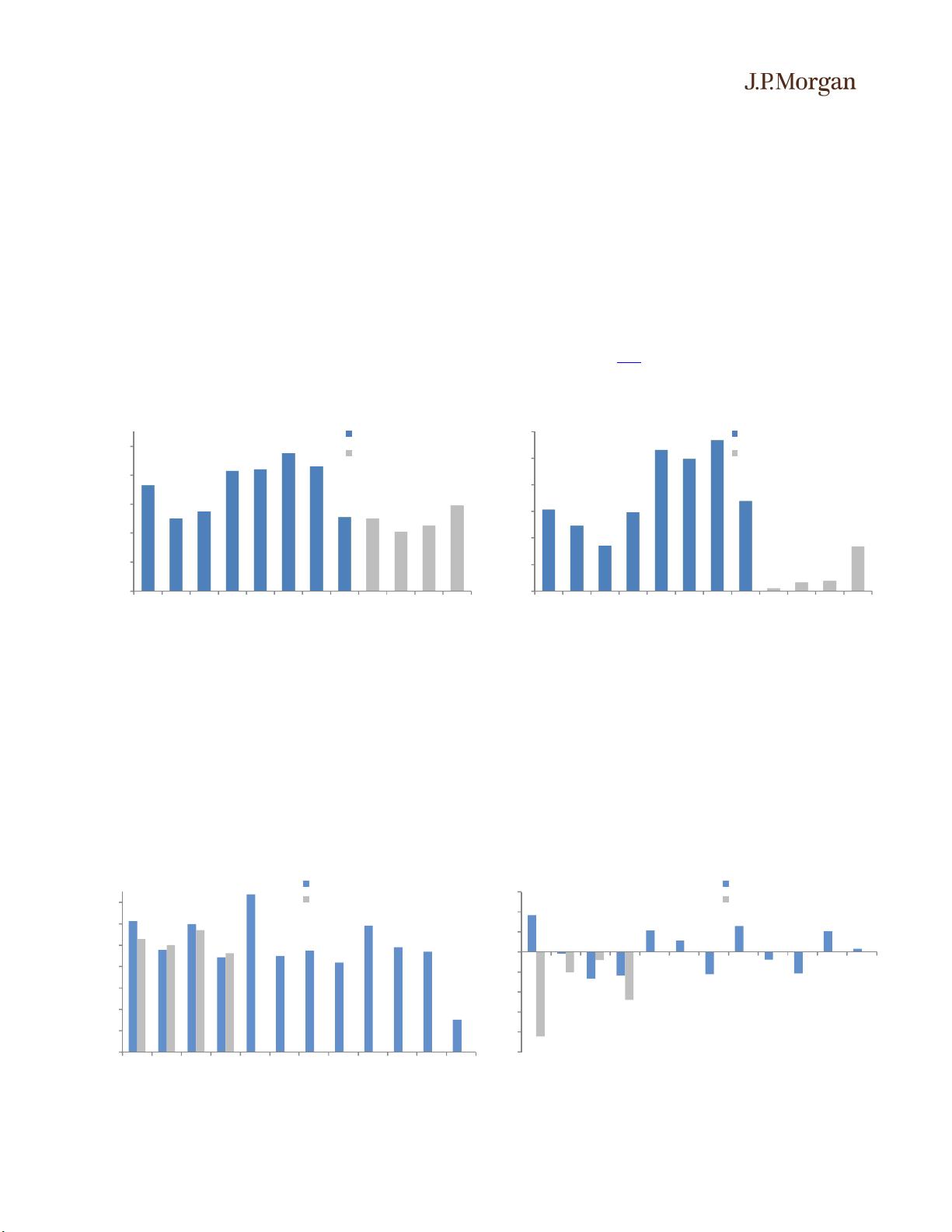

High Grade bond spreads rallied 12bp in the first half of April to 139bp and

remained there for the past two weeks. Last month was positive news on US

growth as GDP came in at 3.2% compared with much weaker estimates earlier in

the quarter. Corporate earnings also have come in better than expected (though

not strong) with EPS growth of 0.5% y/y on the quarter so far, compared

with -2.0% expected at the start of earnings season in early April. Supply was in

line with expectations at $92bn last month and is down 6% y/y. This has brought

net supply down by 18% y/y. The slowdown in supply has been driven by

Financials, and they have outperformed Financials partly on the back of this. The

cost of FX hedges for Euro and Yen-based investors has risen recently, but not for

Taiwan based investors. Based on TRACE data overseas demand for USD credit

is running near the 2018 level, following a strong Jan-Feb. The 20s30s spread

curve suggests that 20yr bonds remain cheap – despite the message given by

analyzing 20s30s benchmark curves.

Credit Derivatives

CDX HY has outperformed most credit and equity indices since its roll last month.

CDX.HY index is trading rich versus HY bonds, iTraxx Crossover and the Russell

2000. However, CDX.IG and CDX.HY are trading in line. Trading activity has

picked up significantly in the CDX.IG 3y and 10y indices. CDX.IG 10y index is

one of the three most traded linear instruments in HG credit after CDX.IG 5y

index and LQD. The CDX.IG S31 senior mezzanine tranche has underperformed

while the junior mezzanine tranche has outperformed in the recent rally. This

provides attractive relative value opportunities to position for a mild index selloff.

Additionally, the CDX.IG senior mezzanine tranche appears as a more attractive

long than the CDX.IG index. We discuss an option trade to position for CDX

indices trading range bound over the coming weeks without taking risk in a large

selloff.

Trade Tracker

Since our last publication, our Trade Tracker is up $7,715. Over the last twelve

months, performance is up by $720,174 (+4.3% ROI / +19.8% IRR).

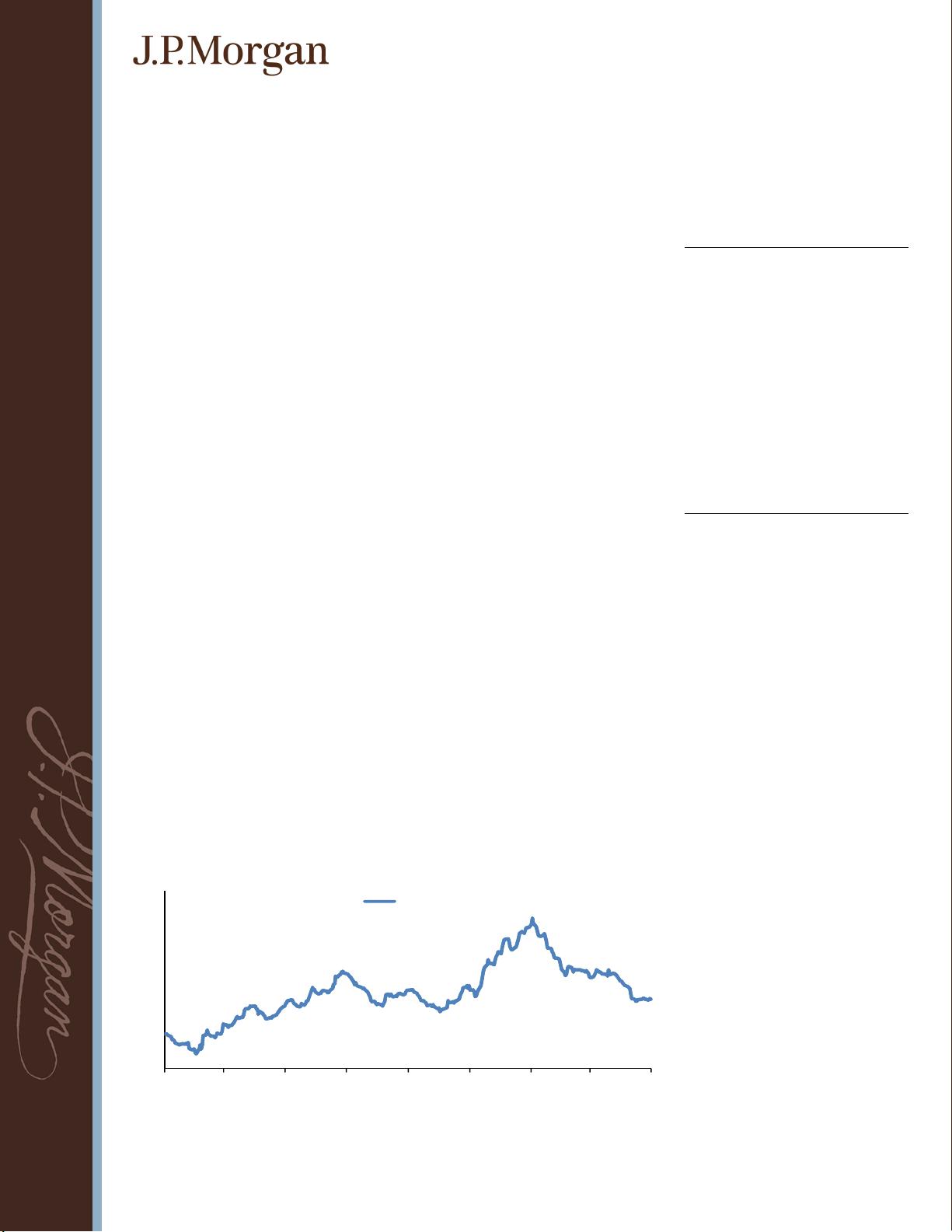

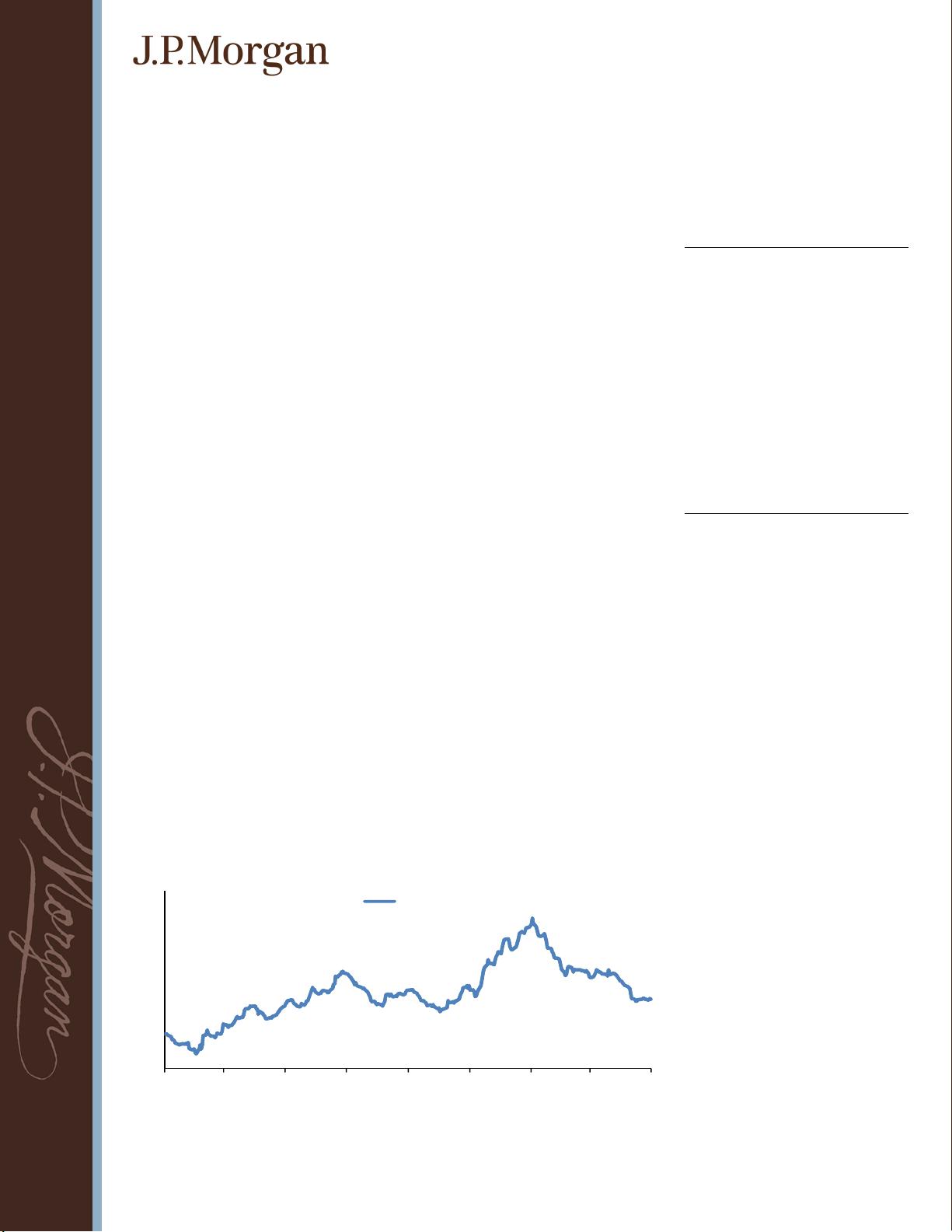

Chart of the week: HG bond spreads rallied 12bp earlier last month and remained flat since then

Source: J.P. Morgan

100

120

140

160

180

Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19

JULI Spread

bp

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功