Some things are easier to forecast than others. The time of the sunrise tomorrow morning can be forecast very precisely. On the other hand, tomorrow’s

lotto numbers cannot be forecast with any accuracy. The predictability of an event or a quantity depends on several factors including:

1. how well we understand the factors that contribute to it;

2. how much data are available;

3. whether the forecasts can affect the thing we are trying to forecast.

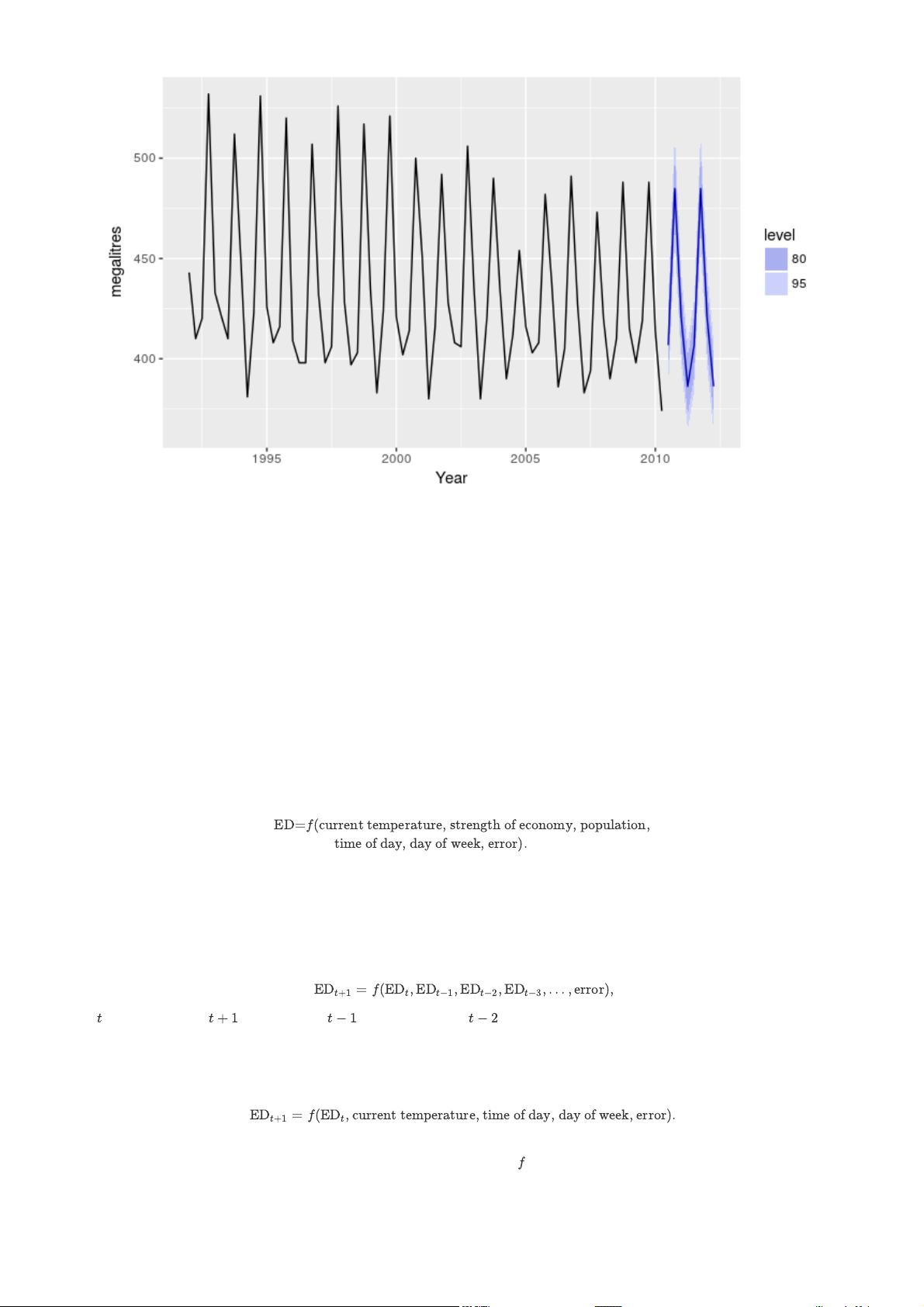

For example, forecasts of electricity demand can be highly accurate because all three conditions are usually satisfied. We have a good idea of the

contributing factors: electricity demand is driven largely by temperatures, with smaller effects for calendar variation such as holidays, and economic

conditions. Provided there is a sufficient history of data on electricity demand and weather conditions, and we have the skills to develop a good model

linking electricity demand and the key driver variables, the forecasts can be remarkably accurate.

On the other hand, when forecasting currency exchange rates, only one of the conditions is satisfied: there is plenty of available data. However, we have a

very limited understanding of the factors that affect exchange rates, and forecasts of the exchange rate have a direct effect on the rates themselves. If

there are well-publicized forecasts that the exchange rate will increase, then people will immediately adjust the price they are willing to pay and so the

forecasts are self-fulfilling. In a sense, the exchange rates become their own forecasts. This is an example of the “efficient market hypothesis”.

Consequently, forecasting whether the exchange rate will rise or fall tomorrow is about as predictable as forecasting whether a tossed coin will come down

as a head or a tail. In both situations, you will be correct about 50% of the time, whatever you forecast. In situations like this, forecasters need to be aware

of their own limitations, and not claim more than is possible.

Often in forecasting, a key step is knowing when something can be forecast accurately, and when forecasts will be no better than tossing a coin. Good

forecasts capture the genuine patterns and relationships which exist in the historical data, but do not replicate past events that will not occur again. In this

book, we will learn how to tell the difference between a random fluctuation in the past data that should be ignored, and a genuine pattern that should be

modelled and extrapolated.

Many people wrongly assume that forecasts are not possible in a changing environment. Every environment is changing, and a good forecasting model

captures the way in which things are changing. Forecasts rarely assume that the environment is unchanging. What is normally assumed is that the way in

which the environment is changing will continue into the future. That is, a highly volatile environment will continue to be highly volatile; a business with

fluctuating sales will continue to have fluctuating sales; and an economy that has gone through booms and busts will continue to go through booms and

busts. A forecasting model is intended to capture the way things move, not just where things are. As Abraham Lincoln said, “If we could first know where

we are and whither we are tending, we could better judge what to do and how to do it”.

Forecasting situations vary widely in their time horizons, factors determining actual outcomes, types of data patterns, and many other aspects.

Forecasting methods can be very simple, such as using the most recent observation as a forecast (which is called the “naïve method”), or highly complex,

such as neural nets and econometric systems of simultaneous equations. Sometimes, there will be no data available at all. For example, we may wish to

forecast the sales of a new product in its first year, but there are obviously no data to work with. In situations like this, we use judgmental forecasting,

discussed in Chapter 4. The choice of method depends on what data are available and the predictability of the quantity to be forecast.

1.2 Forecasting, planning and goals

Forecasting is a common statistical task in business, where it helps to inform decisions about the scheduling of production, transportation and personnel,

and provides a guide to long-term strategic planning. However, business forecasting is often done poorly, and is frequently confused with planning and

goals. They are three different things.

Forecasting

is about predicting the future as accurately as possible, given all of the information available, including historical data and knowledge of any future

events that might impact the forecasts.

Goals

are what you would like to have happen. Goals should be linked to forecasts and plans, but this does not always occur. Too often, goals are set

without any plan for how to achieve them, and no forecasts for whether they are realistic.

Planning

is a response to forecasts and goals. Planning involves determining the appropriate actions that are required to make your forecasts match your

goals.

Forecasting should be an integral part of the decision-making activities of management, as it can play an important role in many areas of a company.

Modern organizations require short-term, medium-term and long-term forecasts, depending on the specific application.

Short-term forecasts

are needed for the scheduling of personnel, production and transportation. As part of the scheduling process, forecasts of demand are often also

required.

Medium-term forecasts

are needed to determine future resource requirements, in order to purchase raw materials, hire personnel, or buy machinery and equipment.

Long-term forecasts

are used in strategic planning. Such decisions must take account of market opportunities, environmental factors and internal resources.

rakish20142018-04-01这本书适于预测分析学者参考。

rakish20142018-04-01这本书适于预测分析学者参考。 lordcat2022-08-11应该是全的,图文pdf,非印刷排版,只有章书签。

lordcat2022-08-11应该是全的,图文pdf,非印刷排版,只有章书签。 我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功