Equity Research

22 April 2021

U.S. Equity Strategy

Continued EPS surprise vs pervasive

overvaluations: Who wins?

The streak of strong positive EPS surprises is likely to continue,

but elevated valuations have now become pervasive; sentiment

is too optimistic; and a potential change in corporate taxation is

an overhang. We raise our SPX FY21E EPS to $190 and our 2021

price target to $4,400 but caution that further upside is unlikely.

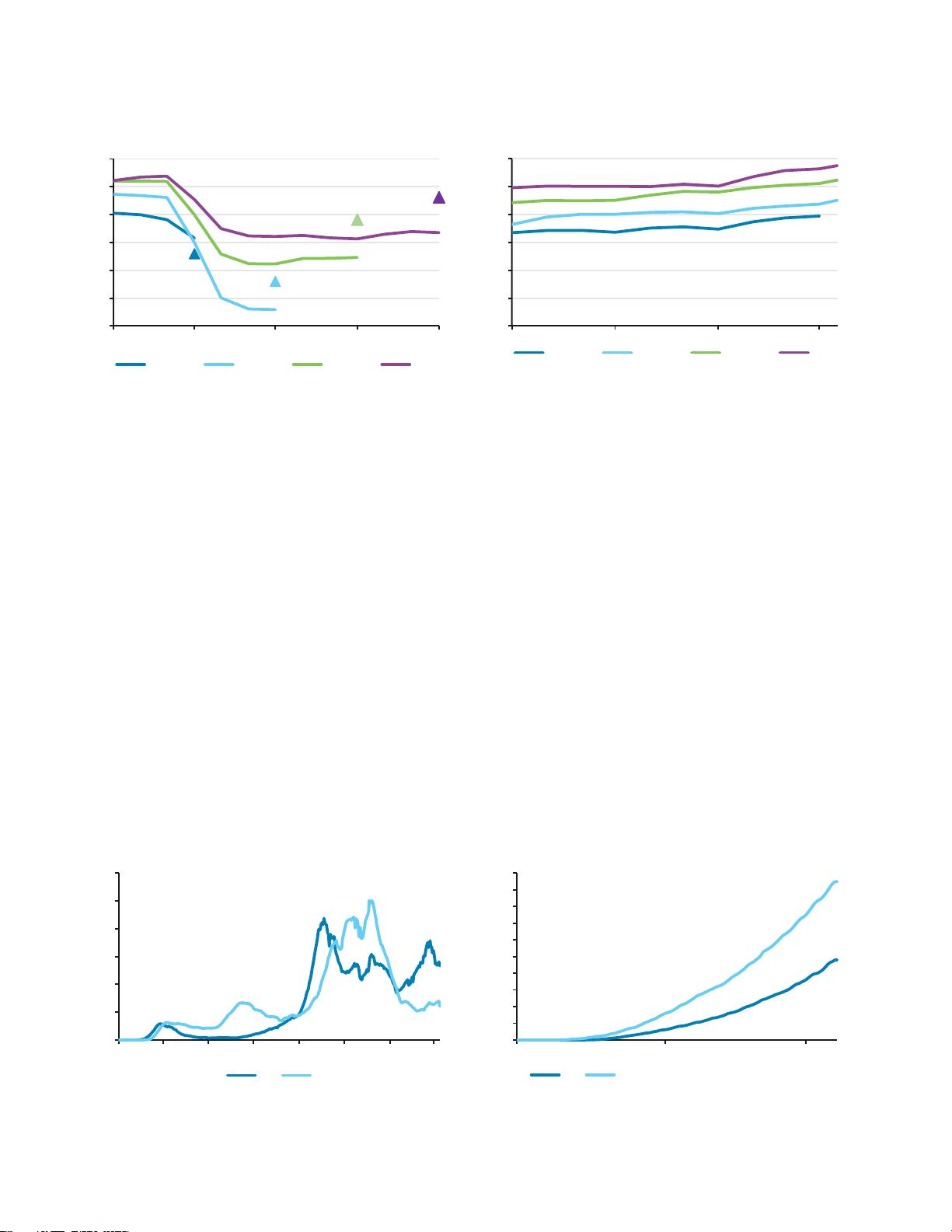

Consensus is not incorporating recent EPS surprises. Although S&P 500 earnings have

surprised three times in a row, consensus has not incorporated these into future earnings. Each

successive beat has been viewed as a one-o event and has had only a modest eect on

earnings projections, eectively lowering QoQ growth forecasts. We construct a simple “surprise

catch-up” model that applies pre-earnings announcement QoQ growth forecasts to actual EPS

and show that it would have done a remarkably good job in forecasting 20Q3 and 20Q4 earnings

and would have been equally eective during the 2009 recovery from the credit crisis. Our

model currently forecasts CY21 earnings of $195 versus the current consensus expectation of

$176. This is not that far from our top-down model forecast of $190, which relies solely on

economic forecasts, but much below our bottom-up model, which starts with consensus.

Hence, we raise our SPX FY21 EPS forecast to $190 from $173.

We expected SPX valuation to contract, but not enough to oset higher EPS growth.

Current SPX valuations look highly elevated and are facing several notable headwinds that

should cause a contraction to more reasonable levels by EOY 2021. These include: 1) the rise in

valuations for many cyclical sectors, beyond just the names with medium-term positive

exposure to Covid-19, 2) overly optimistic retail sentiment, as seen in strong fund flows, strong

readings in the AII Bull-Bear indicators, high levels of call buying by retail investors, and

increasing hedge fund beta, 3) an overhang from a potential corporate tax hike, which could

impact SPX EPS by as much as ~8% in FY2022, and 4) strong indications that we are well into the

early/middle expansion phase of the business cycle, which is usually a period of valuation

contraction. Given these significant headwinds, we expect the SPX P/E to decline from

28.8x currently to 23.1x by the end of 2021. Our target FY21 P/E of 23.1x combined with a

target EPS of $190 results in an SPX 2021 price target of $4,400.

We upgrade Financials to OW and downgrade Hardware & Semis ex FANMAG to MW. Our

multi-pronged approach to sector allocation marries our valuation framework with our

“surprise catch-up” model, the allocations for our optimal business cycle stage basket, impact

from potential enactment of President Biden’s fiscal plan, and industry-specific factors for each

sector. We upgrade Financials to OW as our “surprise catch-up” model indicates higher FY21 EPS

Barclays Capital Inc. and/or one of its ailiates does and seeks to do business with companies

covered in its research reports. As a result, investors should be aware that the firm may have a

conflict of interest that could aect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision.

Please see analyst certifications and important disclosures beginning on page 23 .

FOCUS

Macro Strategy

U.S. Equity Strategy

Maneesh S. Deshpande

+1 212 526 2953

maneesh.deshpande@barclays.com

BCI, US

Elias Krauklis

+1 212 526 9376

elias.krauklis@barclays.com

BCI, US

Japinder Chawla, CFA

+1 212 526 2771

japinder.chawla@barclays.com

BCI, US

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功