没有合适的资源?快使用搜索试试~ 我知道了~

【UBS-2024研报】Global Strategy _CTAs Positioning and Flows.pdf

0 下载量 55 浏览量

2024-11-26

20:41:51

上传

评论

收藏 5.52MB PDF 举报

温馨提示

行业研究报告、行业调查报告、研报

资源推荐

资源详情

资源评论

ab

Global Strategy

CTAs' Positioning and Flows - Biweekly Update

!

"#$#!

• Despite the S&P making new all-time highs, CTAs have quietly been reducing their

equity exposure (by $15/20bln, ie. ~20%). They notably sold the UK FTSE and European

indices, which have been trading in ranges since May, and now appear close to their

breaking points. Declining realized volatilities will be helpful near-term, masking the

anticipated decline in signalling.

• CTAs are back being net short duration. Their overall level of conviction is at 30%, and

we will need higher yields for CTAs to increase their shorts from here. US and Australia

continue to be the most-at-risk bond markets.

• In Credit, CTAs keep harvesting carry. They are max long the asset class.

• In FX, since October 1st, CTAs have bought $275/300bln of USD, switching from very

short to very long (now at 82%le). The frenzy dollar buying might come to an end, as we

forecast limited flows for the remaining of November. While the EUR, CHF, SEK and GBP

may still face some (mild) CTAs selling pressure in the coming two weeks, commodities

currencies may benefit from some profit taking.

• Limited activity from CTAs in the commodity space since our last update. This is about

to change, as our model anticipates strong selling in Metals, especially in Precious, and

active buying in Energy and Agriculturals.

%&'( )$

a) Equities: bullish most markets, especially US. Bearish Latam indices, Kospi2 & CAC

b) Bonds: bullish Korea & Japan, neutral Canada & EU, bearish US, Australia & UK

c) Credit: bullish across the board

d) Currencies: bullish USD & EMEA FX, neutral GBP, bearish Commo & Latam FX

e) Commodities: bullish Precious, neutral Industrials, bearish Energy & Agriculturals

Potential trades in couple of charts

Levels to watch on S&P 500

Levels to watch on UST 10y

What our CTA model says about FX?

What our CTA model says about Equities?

What our CTA model says about Rates?

What our CTA model says about Credit?

What our CTA model says about Commodities?

*& %"+! , '&

-1.00

-0.75

-0.50

-0.25

0.00

0.25

0.50

0.75

1.00

US10Y EU10Y SPX SX5E MESA

(EM Eq)

XIN9I EUR MXN CNH CdxHY Crude Gold

Signal (t)

Exp. Signal (t+2w)

Signal value [-1,+1]

Source: UBS, Bloomberg

*& % ! -! # . /

+01,'

-10

-5

0

5

10

15

US10Y EU10Y SPX SX5E MESA

(EM Eq)

XIN9I EUR MXN CNH CdxHY Crude Gold

Position (t, %ADV) Expected Flows (t, t+2w, %ADV)

(%ADV)

CDX HY: +31% ADV

Source: UBS, Bloomberg

This report has been prepared by UBS Europe SE. ++23 " %4"5*5%+"56 + 4(54 5 %26 (4 $ 789:;<78=

78>?@ABC7?8?8CDE;B8C7CBC7FEEGEB@9DEF7EHI;J:7GDE<JK(L $JE=78?8IB=EMN

O

Global

2-

Strategist

nicolas.le-roux@ubs.com

+33-14-888 5000

LL#,

Strategist

bhanu.baweja@ubs.com

+44-20-7568 6833

PQ

Analyst

paul-j.winter@ubs.com

+61-2-9324 2080

RO

Strategist

james.malcolm@ubs.com

+44-20-7568 8924

O'

Strategist

manik.narain@ubs.com

+44-20-7568 3635

O%

Strategist

mike.cloherty@ubs.com

+1-203-719 4281

O#O$%*+

Strategist

matthew.mish@ubs.com

+1-203-719 1242

*#

Strategist

gerry.fowler@ubs.com

+44-20-7567 5490

R%S

Strategist

julien.conzano@ubs.com

+44-20-7567 2067

O-#$%*+

Strategist

maxwell.grinacoff@ubs.com

+1-212-713 3892

12 November 2024 ab 2

Global Strategy UBS Research

P"

Potential 'Going with the momentum' Trades:

Equities: bullish SIMSCI, OMX, NKY and US small & mid caps, bearish IBOV and

KOSPI2

FX: bullish TRY and IDR, bearish SEK, EUR, INR, PLN, CNH and CHF

Rates (bond futures): bullish Korea 10y, EU 2y, bearish Australia 10y and US

duration across the curve

Rates (front-end futures): bearish US 1y & 2y, Australia 2y and UK 1y & 2y

Credit: bullish across the board

Commodities: bullish Soybean Oil, Lme Tin and Lean Hogs, bearish Cattle Feeder

and Lme Lead

*M&O&today vs forecast

-1.00

-0.80

-0.60

-0.40

-0.20

0.00

0.20

0.40

0.60

0.80

1.00

SIMSCI

RTY

NKY

IBOV

TRY

SEK

INR

EUR

KR10Y

US5Y

SFR8

IR8

CdxHY

Soybean

Oil

Cattle

Feeder

Signal (t)

Exp. Signal (t+2w)

Signal value [-1,+1]

Source: UBS, Bloomberg

*& % ! -! # . /

+01

-30

-20

-10

0

10

20

30

40

SIMSCI

RTY

NKY

IBOV

TRY

SEK

INR

EUR

KR10Y

US5Y

SFR8

IR8

CdxHY

Soybean

Oil

Cattle

Feeder

Position (t, %ADV)

Expected Flows (t, t+2w, %ADV)

(%ADV)

SIMSCI: +62% ADV

Source: UBS, Bloomberg

.-!-1-!#

*T&O&today vs expected change

CHF

CNH

EUR

IDR

INR

PLN

SEK

TRY

IBOV

KOSPI2

MID

NKY

OMX

RTY

SIMSCI

US2YFut

EU2YFut

AD10YFut

KR10YFut

SFR4

SFR8

SFI4

SFI8

IR8

LmeLead

LmeTin

SoybeanOil

LeanHogs

CattleFeeder

-0.6

-0.5

-0.4

-0.3

-0.2

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

-1.0 -0.8 -0.6 -0.4 -0.2 0.0 0.2 0.4 0.6 0.8 1.0

Expected change in signal (t, t+2w)

Current signal (t)

FX EQ Rates Credit Commo

Potential assets to sell

based on CTA signal

Potential assets to buy

based on CTA signal

Source: UBS, Bloomberg.

The securities and futures products described herein may not be eligible for sale in all

jurisdictions or to certain categories of investors. Options, derivative products and

futures are not suitable for all investors, and trading in these instruments is considered

risky. Past performance is not necessarily indicative of future results.

U#U

'#%"+

-!

!

"!#

%"+

12 November 2024 ab 3

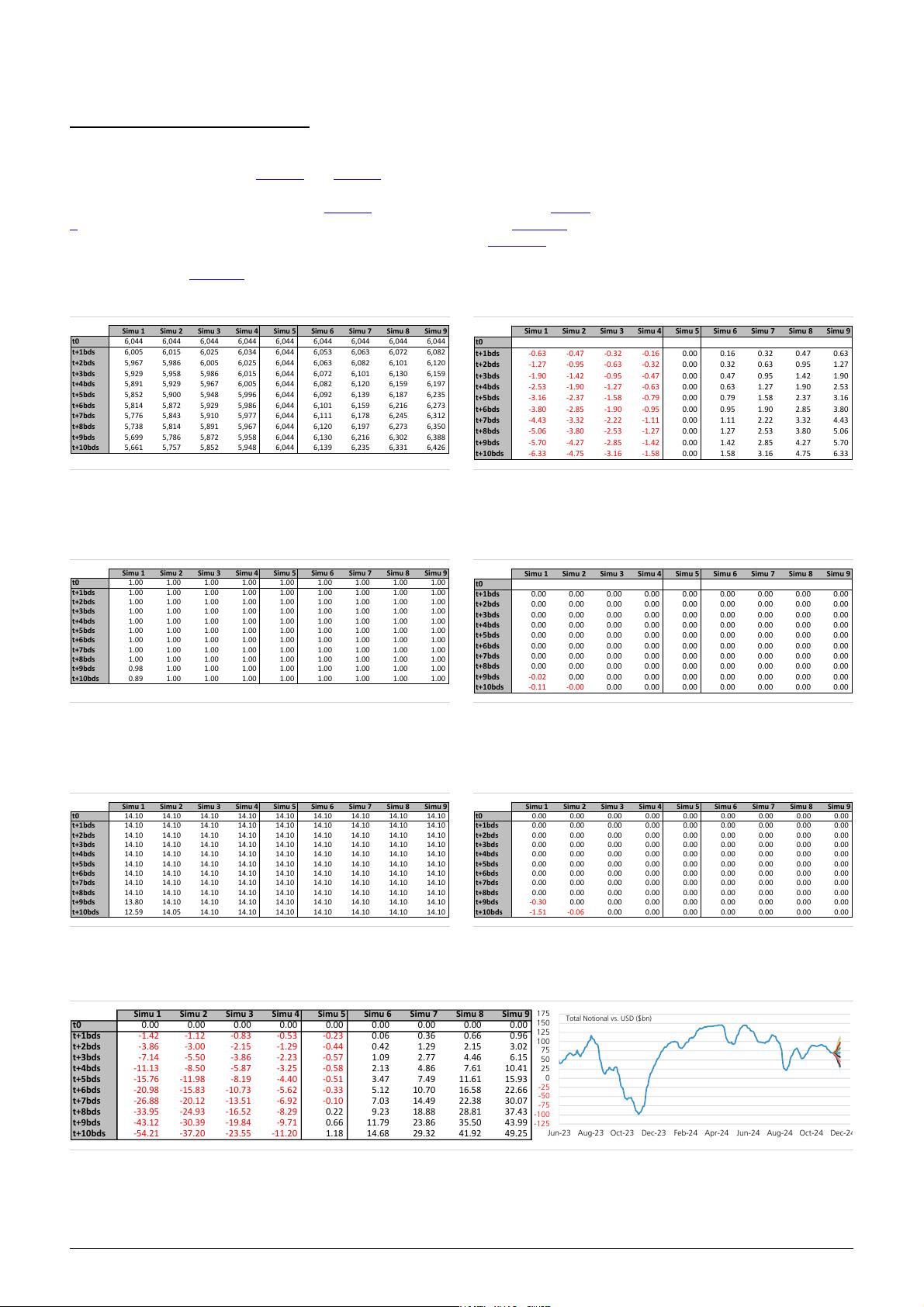

2# VPT

How to read the simulation tables below:

If we take the example of simulation 1, it indicates the S&P would sell off linearly from

6044 to 5661 (-6.33% sell-off, Figure 6S&P Simulated Prices and Figure 7S&P Simulated Changes (%)) over the next two weeks. After 9

business days, the S&P should be at 5699 (-5.70%) and, as a result, the signal would

move from +1.00 at t0 to +0.98 at t+9bds (Figure 8S&P Expected Signal, in response to simulated prices), i.e. a -0.02 change in signal (Figure

9 S&P Expected Change in Signal, in response to simulated prices). CTAs' position in S&P would decrease from $+14.10bln to $+13.80bln (Figure 10S&P Expected Position ($bln), in response to simulated prices) in

response to the simulated prices, i.e. a selling flow of $-0.30bln (Figure 11 S&P Expected Flows ($bln), in response to simulated prices).

Extrapolating the S&P change in signal to all equity indices, we would get a total equity

flow of $-43.12bln (Figure 12Total Equities Expected Flows ($bln), using S&P as a proxy, in response to simulated pricesFigure 12).

*W& VP P

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 6,044 6,044 6,044 6,0 44 6,044 6,044 6,044 6,044 6,044

t+1bds 6,005 6,015 6,025 6,034 6,044 6,053 6,063 6,072 6,082

t+2bds 5,967 5,986 6,005 6,025 6,044 6,063 6,082 6,101 6,120

t+3bds 5,929 5,958 5,986 6,015 6,044 6,072 6,101 6,130 6,159

t+4bds 5,891 5,929 5,967 6,005 6,044 6,082 6,120 6,159 6,197

t+5bds 5,852 5,900 5,948 5,996 6,044 6,092 6,139 6,187 6,235

t+6bds 5,814 5,872 5,929 5,986 6,044 6,101 6,159 6,216 6,273

t+7bds 5,776 5,843 5,910 5,977 6,044 6,111 6,178 6,245 6,312

t+8bds 5,738 5,814 5,891 5,967 6,044 6,120 6,197 6,273 6,350

t+9bds 5,699 5,786 5,872 5,958 6,044 6,130 6,216 6,302 6,388

t+10bds 5,661 5,757 5,852 5,948 6,044 6,139 6,235 6,331 6,426

Source: UBS, Bloomberg

*X& VP %./1

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0

t+1bds -0.63 -0.47 -0.32 -0.16 0.00 0.16 0.32 0.47 0.63

t+2bds -1.27 -0.95 -0.63 -0.32 0.00 0.32 0.63 0.95 1.27

t+3bds -1.90 -1.42 -0.95 -0.47 0.00 0.47 0.95 1.42 1.90

t+4bds -2.53 -1.90 -1.27 -0.63 0.00 0.63 1.27 1.90 2.53

t+5bds -3.16 -2.37 -1.58 -0.79 0.00 0.79 1.58 2.37 3.16

t+6bds -3.80 -2.85 -1.90 -0.95 0.00 0.95 1.90 2.85 3.80

t+7bds -4.43 -3.32 -2.22 -1.11 0.00 1.11 2.22 3.32 4.43

t+8bds -5.06 -3.80 -2.53 -1.27 0.00 1.27 2.53 3.80 5.06

t+9bds -5.70 -4.27 -2.85 -1.42 0.00 1.42 2.85 4.27 5.70

t+10bds -6.33 -4.75 -3.16 -1.58 0.00 1.58 3.16 4.75 6.33

Source: UBS, Bloomberg

* Y& VP 4-! $ !

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+1bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+2bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+3bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+4bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+5bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+6bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+7bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+8bds 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+9bds 0.98 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

t+10bds 0.89 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

Source: UBS, Bloomberg

*Z& VP 4-!% $ !

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0

t+1bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+2bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+3bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+4bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+5bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+6bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+7bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+8bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+9bds -0.02 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+10bds -0.11 -0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Source: UBS, Bloomberg

* & VP 4-! P .)1$ !

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+1bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+2bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+3bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+4bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+5bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+6bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+7bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+8bds 14.10 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+9bds 13.80 14 .10 14.10 14.10 14.10 14.10 14.10 14.10 14.10

t+10bds 12.59 14 .05 14.10 14.10 14.10 14.10 14.10 14.10 14.10

Source: UBS, Bloomberg

* & VP 4-! *# .)1$ !

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+1bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+2bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+3bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+4bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+5bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+6bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+7bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+8bds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+9bds -0.30 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+10bds -1.51 -0.06 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Source: UBS, Bloomberg

*&"4[4-!*#.)1$ VP!-$!!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+1bds -1.42 -1.12 -0.83 -0.53 -0.23 0.06 0.36 0.66 0.96

t+2bds -3.86 -3.00 -2.15 -1.29 -0.44 0.42 1.29 2.15 3.02

t+3bds -7.14 -5.50 -3.86 -2.23 -0.57 1.09 2.77 4.46 6.15

t+4bds -11.13 -8.50 -5.87 -3.25 -0.58 2.13 4.86 7.61 10.41

t+5bds -15.76 -11.98 -8.19 -4.40 -0.51 3.47 7.49 11.61 15.93

t+6bds -20.98 -15.83 -10.73 -5.62 -0.33 5.12 10.70 16.58 22.66

t+7bds -26.88 -20.12 -13.51 -6.92 -0.10 7.03 14.49 22.38 30.07

t+8bds -33.95 -24.93 -16.52 -8.29 0.22 9.23 18.88 28.81 37.43

t+9bds -43.12 -30.39 -19.84 -9.71 0.66 11.79 23.86 35.50 43.99

t+10bds -54.21 -37.20 -23.55 -11.20 1.18 14.68 29.32 41.92 49.25

-125

-100

-75

-50

-25

0

25

50

75

100

125

150

175

Jun-23 Aug-23 Oct-23 Dec-23 Feb-24 Apr-24 Jun-24 Aug-24 Oct-24 Dec-24

Total Notional vs. USD ($bn)

Source: UBS, Bloomberg

12 November 2024 ab 4

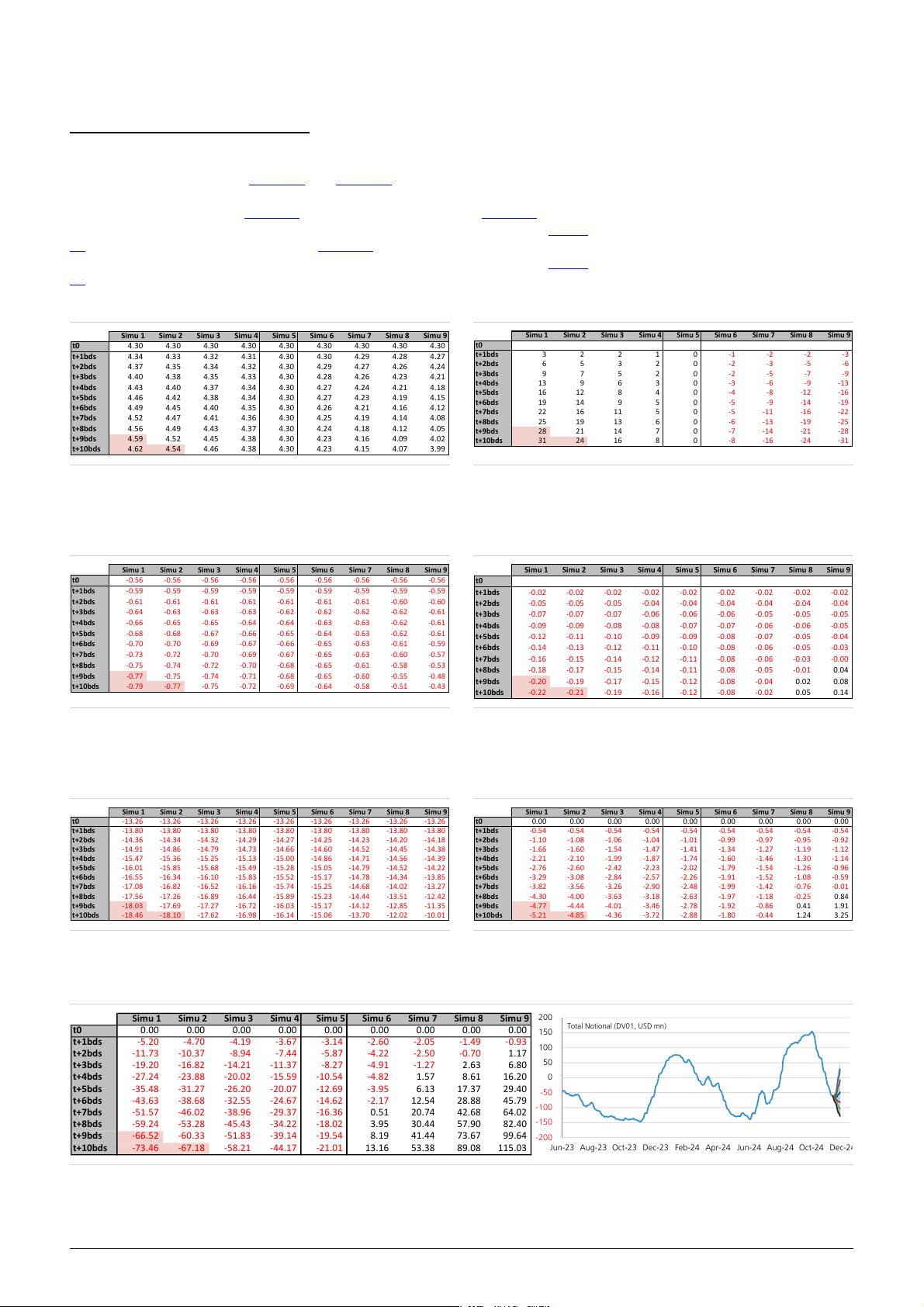

2#( "."31

How to read the simulation tables below:

If we take the example of simulation 1, it shows the UST 10y would sell off linearly from

4.30 to 4.62 (+31bps sell-off, Figure 13UST 10y Simulated Yields and Figure 14UST 10y Simulated Changes (bps)) over the next 2 weeks. After 7

business days, UST 10y should be at 4.52 (+22bps) and as a result, the signal would

increase from -0.56 to -0.73 (Figure 15UST 10y Expected Signal, in response to simulated yields), i.e. a -0.16 change in signal (Figure 16UST 10y Expected Change in Signal, in response to simulated yields). CTAs'

position in UST 10y would increase from $-13.26 DV01mn to $-17.08 DV01mn (Figure

17UST 10y Expected Position ($DV01 mn), in response to simulated yields), i.e. a selling flow of $-3.82 DV01mn (Figure 18UST 10y Expected Flows ($DV01 mn), in response to simulated yields). Extrapolating the UST 10y change

in signal to all bond futures, we get a total bond future flow of $-51.57 DV01mn (Figure

19Total Bond Future Expected Flows ($DV01 mn), in response to simulated yields).

*M&( " 3

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 4.30 4.30 4.30 4.30 4.30 4.30 4.30 4.30 4.30

t+1bds 4.34 4.33 4.32 4.31 4.30 4.30 4.29 4.28 4.27

t+2bds 4.37 4.35 4.34 4.32 4.30 4.29 4.27 4.26 4.24

t+3bds 4.40 4.38 4.35 4.33 4.30 4.28 4.26 4.23 4.21

t+4bds 4.43 4.40 4.37 4.34 4.30 4.27 4.24 4.21 4.18

t+5bds 4.46 4.42 4.38 4.34 4.30 4.27 4.23 4.19 4.15

t+6bds 4.49 4.45 4.40 4.35 4.30 4.26 4.21 4.16 4.12

t+7bds 4.52 4.47 4.41 4.36 4.30 4.25 4.19 4.14 4.08

t+8bds 4.56 4.49 4.43 4.37 4.30 4.24 4.18 4.12 4.05

t+9bds 4.59 4.52 4.45 4.38 4.30 4.23 4.16 4.09 4.02

t+10bds 4.62 4.54 4.46 4.38 4.30 4.23 4.15 4.07 3.99

Source: UBS, Bloomberg

*&( " %.!1

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0

t+1bds 3 2 2 1 0 -1 -2 -2 -3

t+2bds 6 5 3 2 0 -2 -3 -5 -6

t+3bds 9 7 5 2 0 -2 -5 -7 -9

t+4bds 13 9 6 3 0 -3 -6 -9 -13

t+5bds 16 12 8 4 0 -4 -8 -12 -16

t+6bds 19 14 9 5 0 -5 -9 -14 -19

t+7bds 22 16 11 5 0 -5 -11 -16 -22

t+8bds 25 19 13 6 0 -6 -13 -19 -25

t+9bds 28 21 14 7 0 -7 -14 -21 -28

t+10bds 31 24 16 8 0 -8 -16 -24 -31

Source: UBS, Bloomberg

* T& ( " 4-! $ !

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 -0.56 -0.56 -0.56 -0.56 -0.56 -0.56 -0.56 -0.56 -0.56

t+1bds -0.59 -0.59 -0.59 -0.59 -0.59 -0.59 -0.59 -0.59 -0.59

t+2bds -0.61 -0.61 -0.61 -0.61 -0.61 -0.61 -0.61 -0.60 -0.60

t+3bds -0.64 -0.63 -0.63 -0.63 -0.62 -0.62 -0.62 -0.62 -0.61

t+4bds -0.66 -0.65 -0.65 -0.64 -0.64 -0.63 -0.63 -0.62 -0.61

t+5bds -0.68 -0.68 -0.67 -0.66 -0.65 -0.64 -0.63 -0.62 -0.61

t+6bds -0.70 -0.70 -0.69 -0.67 -0.66 -0.65 -0.63 -0.61 -0.59

t+7bds -0.73 -0.72 -0.70 -0.69 -0.67 -0.65 -0.63 -0.60 -0.57

t+8bds -0.75 -0.74 -0.72 -0.70 -0.68 -0.65 -0.61 -0.58 -0.53

t+9bds -0.77 -0.75 -0.74 -0.71 -0.68 -0.65 -0.60 -0.55 -0.48

t+10bds -0.79 -0.77 -0.75 -0.72 -0.69 -0.64 -0.58 -0.51 -0.43

Source: UBS, Bloomberg

*W&( "4-!% $!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0

t+1bds -0.02 -0.02 -0.02 -0.02 -0.02 -0.02 -0.02 -0.02 -0.02

t+2bds -0.05 -0.05 -0.05 -0.04 -0.04 -0.04 -0.04 -0.04 -0.04

t+3bds -0.07 -0.07 -0.07 -0.06 -0.06 -0.06 -0.05 -0.05 -0.05

t+4bds -0.09 -0.09 -0.08 -0.08 -0.07 -0.07 -0.06 -0.06 -0.05

t+5bds -0.12 -0.11 -0.10 -0.09 -0.09 -0.08 -0.07 -0.05 -0.04

t+6bds -0.14 -0.13 -0.12 -0.11 -0.10 -0.08 -0.06 -0.05 -0.03

t+7bds -0.16 -0.15 -0.14 -0.12 -0.11 -0.08 -0.06 -0.03 -0.00

t+8bds -0.18 -0.17 -0.15 -0.14 -0.11 -0.08 -0.05 -0.01 0.04

t+9bds -0.20 -0.19 -0.17 -0.15 -0.12 -0.08 -0.04 0.02 0.08

t+10bds -0.22 -0.21 -0.19 -0.16 -0.12 -0.08 -0.02 0.05 0.14

Source: UBS, Bloomberg

* X& ( " 4-! P .)0 1$

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 -13.26 -13.26 -13.26 -13.26 -13.26 -13.26 -13.26 -13.26 -13.26

t+1bds -13.80 -13.80 -13.80 -13.80 -13.80 -13.80 -13.80 -13.80 -13.80

t+2bds -14.36 -14.34 -14.32 -14.29 -14.27 -14.25 -14.23 -14.20 -14.18

t+3bds -14.91 -14.86 -14.79 -14.73 -14.66 -14.60 -14.52 -14.45 -14.38

t+4bds -15.47 -15.36 -15.25 -15.13 -15.00 -14.86 -14.71 -14.56 -14.39

t+5bds -16.01 -15.85 -15.68 -15.49 -15.28 -15.05 -14.79 -14.52 -14.22

t+6bds -16.55 -16.34 -16.10 -15.83 -15.52 -15.17 -14.78 -14.34 -13.85

t+7bds -17.08 -16.82 -16.52 -16.16 -15.74 -15.25 -14.68 -14.02 -13.27

t+8bds -17.56 -17.26 -16.89 -16.44 -15.89 -15.23 -14.44 -13.51 -12.42

t+9bds -18.03 -17.69 -17.27 -16.72 -16.03 -15.17 -14.12 -12.85 -11.35

t+10bds -18.46 -18.10 -17.62 -16.98 -16.14 -15.06 -13.70 -12.02 -10.01

Source: UBS, Bloomberg

* Y& ( " 4-! *# .)0 1$

!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+1bds -0.54 -0.54 -0.54 -0.54 -0.54 -0.54 -0.54 -0.54 -0.54

t+2bds -1.10 -1.08 -1.06 -1.04 -1.01 -0.99 -0.97 -0.95 -0.92

t+3bds -1.66 -1.60 -1.54 -1.47 -1.41 -1.34 -1.27 -1.19 -1.12

t+4bds -2.21 -2.10 -1.99 -1.87 -1.74 -1.60 -1.46 -1.30 -1.14

t+5bds -2.76 -2.60 -2.42 -2.23 -2.02 -1.79 -1.54 -1.26 -0.96

t+6bds -3.29 -3.08 -2.84 -2.57 -2.26 -1.91 -1.52 -1.08 -0.59

t+7bds -3.82 -3.56 -3.26 -2.90 -2.48 -1.99 -1.42 -0.76 -0.01

t+8bds -4.30 -4.00 -3.63 -3.18 -2.63 -1.97 -1.18 -0.25 0.84

t+9bds -4.77 -4.44 -4.01 -3.46 -2.78 -1.92 -0.86 0.41 1.91

t+10bds -5.21 -4.85 -4.36 -3.72 -2.88 -1.80 -0.44 1.24 3.25

Source: UBS, Bloomberg

*Z&"L*4-!*#.)01$!

Simu 1 Simu 2 Simu 3 Simu 4 Simu 5 Simu 6 Simu 7 Simu 8 Simu 9

t0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

t+1bds -5.20 -4.70 -4.19 -3.67 -3.14 -2.60 -2.05 -1.49 -0.93

t+2bds -11.73 -10.37 -8.94 -7.44 -5.87 -4.22 -2.50 -0.70 1.17

t+3bds -19.20 -16.82 -14.21 -11.37 -8.27 -4.91 -1.27 2.63 6.80

t+4bds -27.24 -23.88 -20.02 -15.59 -10.54 -4.82 1.57 8.61 16.20

t+5bds -35.48 -31.27 -26.20 -20.07 -12.69 -3.95 6.13 17.37 29.40

t+6bds -43.63 -38.68 -32.55 -24.67 -14.62 -2.17 12.54 28.88 45.79

t+7bds -51.57 -46.02 -38.96 -29.37 -16.36 0.51 20.74 42.68 64.02

t+8bds -59.24 -53.28 -45.43 -34.22 -18.02 3.95 30.44 57.90 82.40

t+9bds -66.52 -60.33 -51.83 -39.14 -19.54 8.19 41.44 73.67 99.64

t+10bds -73.46 -67.18 -58.21 -44.17 -21.01 13.16 53.38 89.08 115.03

-200

-150

-100

-50

0

50

100

150

200

Jun-23 Aug-23 Oct-23 Dec-23 Feb-24 Apr-24 Jun-24 Aug-24 Oct-24 Dec-24

Total Notional (DV01, USD mn)

Source: UBS, Bloomberg

12 November 2024 ab 5

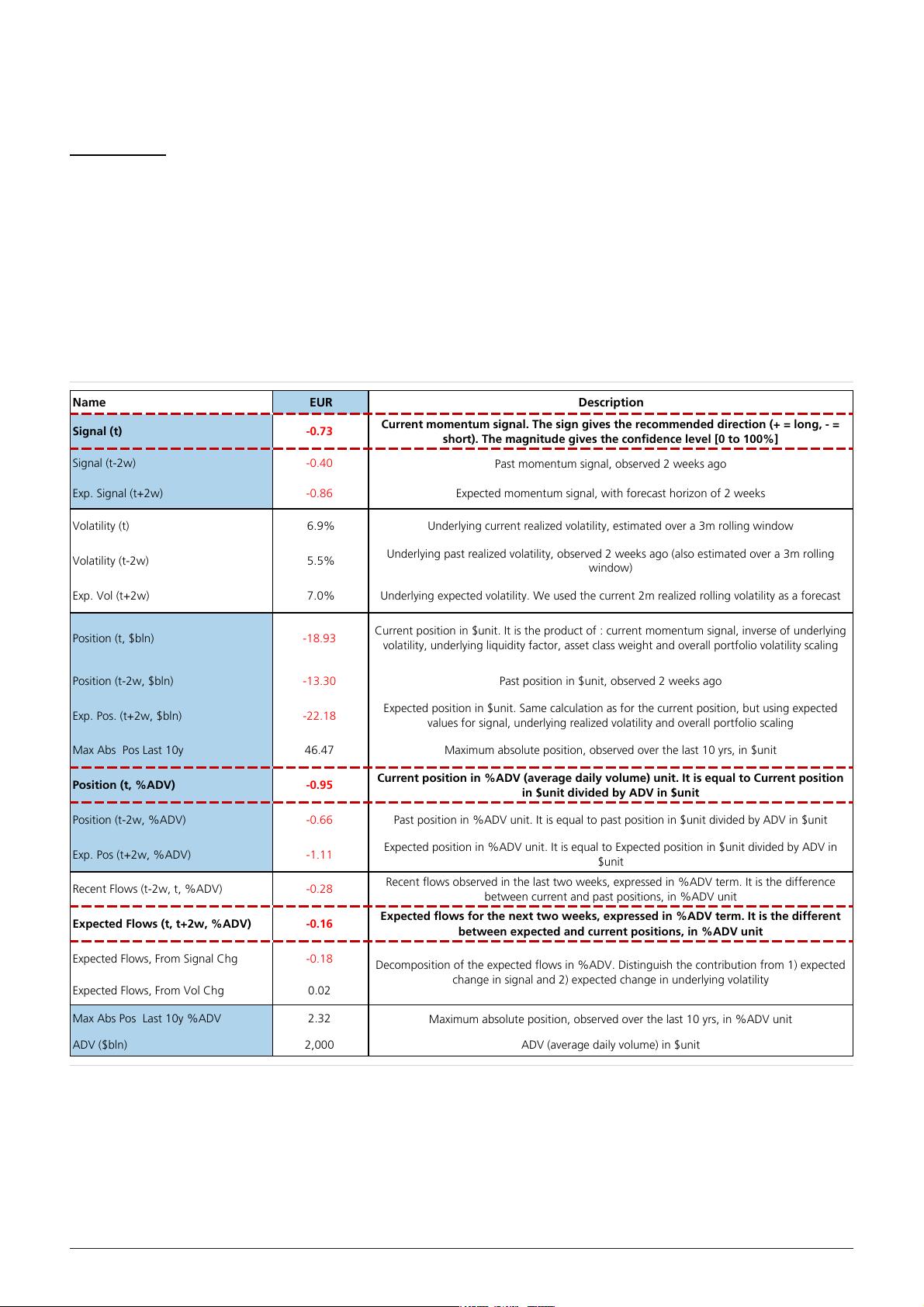

Q%"+U!*\

%$!-!#

Main takeaways:

Since October 1st, CTAs have bought $275/300bln of USD, switching from very

short to very long (now at 82%le)

The frenzy dollar buying might come to an end, though. We foresee limited flows

for the remaining of November

While the EUR, CHF, SEK and GBP may still face some (mild) CTAs selling pressures

in the near term, commodities currencies may benefit from some profit taking

'Contrarian' trades: bullish ILS, Latam FX and NOK, bearish MYR , THB and ZAR

'Go with momentum' trades: bullish TRY and IDR, bearish SEK, EUR, INR, PLN,

CNH and CHF

*&'!#'- example of EUR/$

Name EUR Description

Signal (t) -0.73

Current momentum signal. The sign gives the recommended direction (+ = long, - =

short). The magnitude gives the confidence level [0 to 100%]

Signal (t-2w) -0.40

Past momentum signal, observed 2 weeks ago

Exp. Signal (t+2w) -0.86

Expected momentum signal, with forecast horizon of 2 weeks

Volatility (t) 6.9%

Underlying current realized volatility, estimated over a 3m rolling window

Volatility (t-2w) 5.5%

Underlying past realized volatility, observed 2 weeks ago (also estimated over a 3m rolling

window)

Exp. Vol (t+2w) 7.0%

Underlying expected volatility. We used the current 2m realized rolling volatility as a forecast

Position (t, $bln) -18.93

Current position in $unit. It is the product of : current momentum signal, inverse of underlying

volatility, underlying liquidity factor, asset class weight and overall portfolio volatility scaling

Position (t-2w, $bln) -13.30

Past position in $unit, observed 2 weeks ago

Exp. Pos. (t+2w, $bln) -22.18

Expected position in $unit. Same calculation as for the current position, but using expected

values for signal, underlying realized volatility and overall portfolio scaling

Max Abs Pos Last 10y 46.47

Maximum absolute position, observed over the last 10 yrs, in $unit

Position (t, %ADV) -0.95

Current position in %ADV (average daily volume) unit. It is equal to Current position

in $unit divided by ADV in $unit

Position (t-2w, %ADV) -0.66

Past position in %ADV unit. It is equal to past position in $unit divided by ADV in $unit

Exp. Pos (t+2w, %ADV) -1.11

Expected position in %ADV unit. It is equal to Expected position in $unit divided by ADV in

$unit

Recent Flows (t-2w, t, %ADV) -0.28

Recent flows observed in the last two weeks, expressed in %ADV term. It is the difference

between current and past positions, in %ADV unit

Expected Flows (t, t+2w, %ADV) -0.16

Expected flows for the next two weeks, expressed in %ADV term. It is the different

between expected and current positions, in %ADV unit

Expected Flows, From Signal Chg -0.18

Expected Flows, From Vol Chg 0.02

Max Abs Pos Last 10y %ADV 2.32

Maximum absolute position, observed over the last 10 yrs, in %ADV unit

ADV ($bln) 2,000

ADV (average daily volume) in $unit

Decomposition of the expected flows in %ADV. Distinguish the contribution from 1) expected

change in signal and 2) expected change in underlying volatility

Source: UBS, Bloomberg

剩余32页未读,继续阅读

资源评论

soso1968

- 粉丝: 3321

- 资源: 1万+

上传资源 快速赚钱

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜最新资源

- 基于UDS协议的Bootloader 采用autosar架构的标准,DCM集成uds协议,nxpS32K,tc275,tc233,tc234,nxp148,tc1782,NXP5746,NXP5748

- 开绕组电机的控制策略,SVPWM仿真的双闭环控制,控制效果优良,具有快速响应性能,对开绕组电机的控制策略,故障容错,共模电压电流抑制都有所了解 同步电机开绕组与异步电机开绕组都有

- 宝马股票价格数据,BMW股票价格数据 (1996 - 2024)

- genad-hGridSample-test.hbm.png

- VSG模型仿真,和单台同步机的联合仿真模型 在负荷扰动下进行了验证 有详细的技术报告,包括所有参数的设置原理 可将vsg接入3机9节点

- comsol一维管道流模型,集非等温管道流模块、浓物质传递模块和化学反应模块为一体,三物理场耦合,本模拟以甲烷气体为例进行模拟仿真,涉及了GRI-3.0最为核心的Z40反应和其余的附加反应,反应结果真

- 蛋白质数据集,生物信息学蛋白质数据集,物理性质和功能分类的合成蛋白质数据集

- sgdgcxkdshloxdjsalcxhksdgcxdsyjt

- HC32L196串口中断发送数据

- AI时代下的汽车-分析报告

- Turbo编译码实现 通信专业 信道编码译码识别 接turbo码译码算法仿真 译码算法logmap sova

- 加载富文本框鼠标右键菜单翻译文件

- django南京某高校校园外卖点餐系统-j2k3o(源码+数据库+论文+PPT+包调试+一对一指导)

- msys2-x86-64-20230318.exe

- HP DL380 Gen9 BIOS/BMC 固件及bmc中文语言包/升级教程

- 单相九电平级联NPC逆变器模块,输入250V直流,输出交流幅值1000V,电阻负载 PLECS平台搭建,MATLAB simulink也可实现

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功