2019 Data Center Sector Demand Remains

Strong Despite Lowered DLR FY19 Outlook

■ See our 2019 Outlook – For an in depth view of our 2019 projections and

coverage, see our "2019 Outlook – The Cloud Has Four Walls (2019

Edition)," covering both communications equipment & infrastructure.

■ 2019 Views on Communications Infrastructure: - We have summarized

our views for 2019 in the body of this note for INXN, EQIX, SWCH, CONE,

DLR, COR, and QTS in the pages that follow. We recently introduced

coverage of INXN with an Outperform rating and $70 Target Price. See our

INXN initiation report, “Positioned in a European Rising Tide,” for more

details on our view. Interest rates will be an increasing concern for the data

center operators through 2019, but we see evidence of continuing strong

demand that will enable fundamental strength for the companies that are

best-positioned, such as INXN and EQIX.

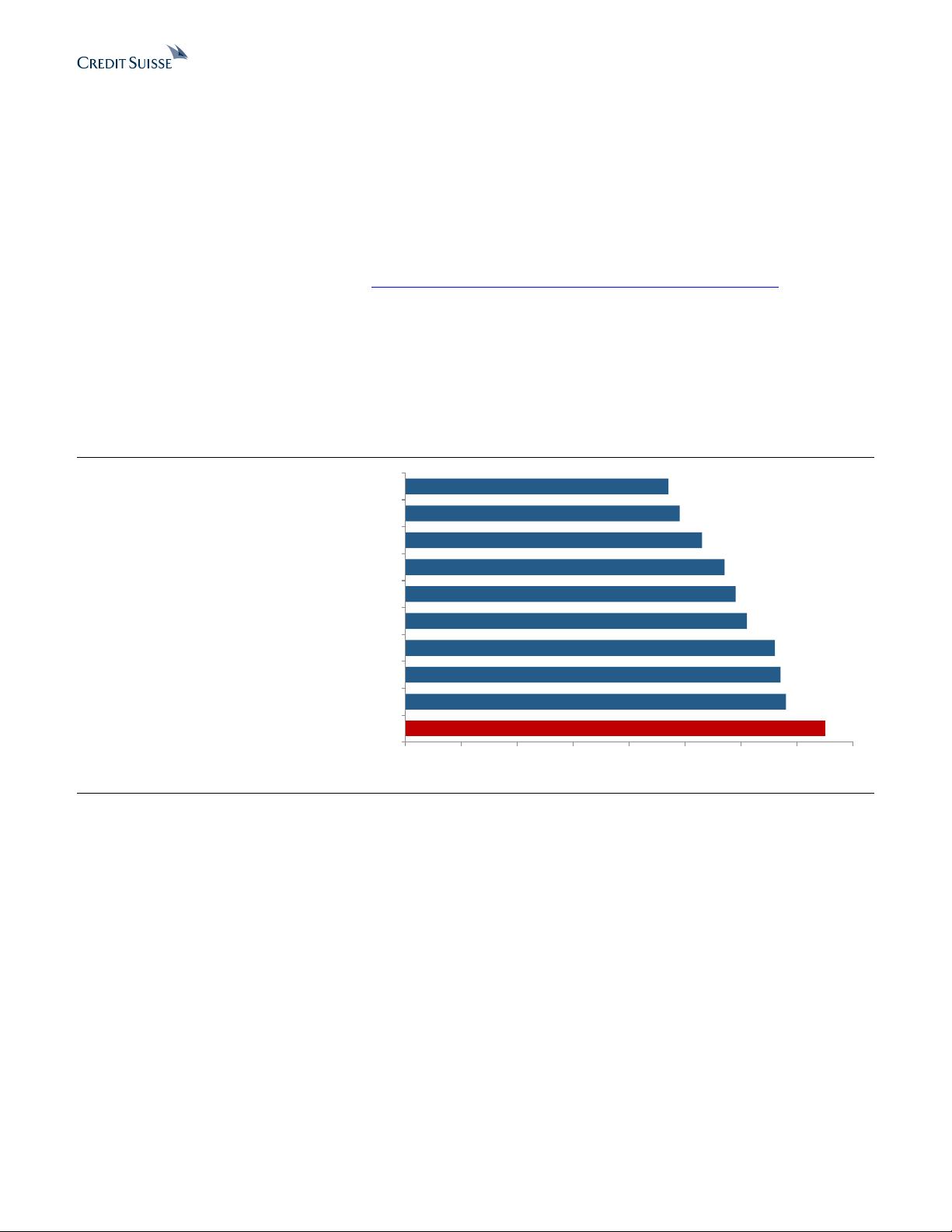

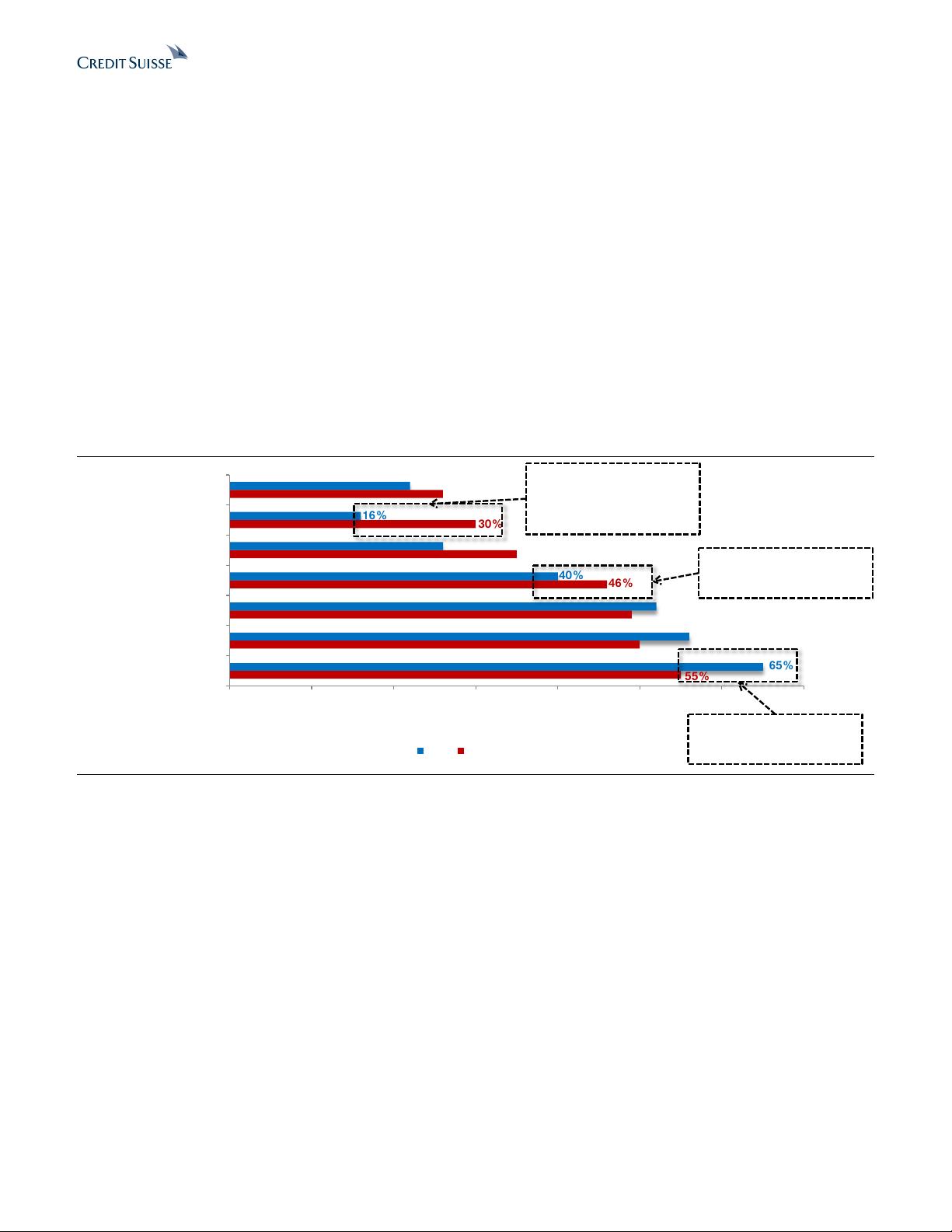

■ Reliance on Colocation is Strengthening Across the Technology

Industry: Highlighted in our outlook, we identify increasing evidence that

global colocation demand and reliance on the data center infrastructure

asset class are only increasing based on two comprehensive industry

surveys from global IT spending decision-makers. These surveys highlight

increasing IT budget spending on colocation, a greater proportion of IT

racks going into colocation, on premise data centers falling out of favor,

and outsourced wholesale capacity increasing, all of which are positive

signals for the industry overall.

■ Digital Realty (DLR) Issued Initial 2019 Guidance Below Street

Expectations: DLR has released their 2019 guidance along with updated

2018 guidance to account for accounting adjustments. These updates

reflect lowered expectations in light of greater than anticipated impacts

from lease accounting changes (ASC 842). In light of the updated

guidance, we adjust our 2018/2019 Core FFO to $6.65/$6.70 from

$6.66/$6.76, respectively, and maintain our 2020E at $7.04.

■ InterXion Initiation – Positioned in a European Rising Tide: We

recently released our initiation report for INXN, “Positioned in a European

Rising Tide.” We observe the growing influence of EQIX and DLR on the

European colocation and interconnection markets, which has the potential

to drive up prices and shift trends toward charging for interconnection on a

greater scale. The European market typically has not treated

interconnection the same way as the American and Asian markets have in

which it is a vital growth segment for data center operators. If EQIX and

DLR can successfully shift trends towards the more American model in

Europe, INXN stands to benefit tremendously as it already has seen

success without reliance from a large interconnection revenue segment.

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功