Oce of The Board of Investment

555 Vibhavadi-Rangsit Road, Chatuchak,

Bangkok, Thailand 10900

Tel: +66 (0) 2553 8111

Fax: +66 (0) 2553 8315

Website: www.boi.go.th

Email: head@boi.go.th

EN Jan 2020

COST OF DOING BUSINESS

COST OF DOING BUSINES IN THAILAND 2020

IN THAILAND 2020

Thailand Board of Investment

www.boi.go.th

T

h

i

s

c

o

m

p

l

i

m

e

n

t

a

r

y

b

o

o

k

i

s

n

o

t

f

o

r

s

a

l

e

.

F

o

r

i

n

q

u

i

r

y

,

p

l

e

a

s

e

c

o

n

t

a

c

t

T

h

a

i

l

a

n

d

B

o

a

r

d

o

f

I

n

v

e

s

t

m

e

n

t

.

EN Jan 2020

CONTENTS

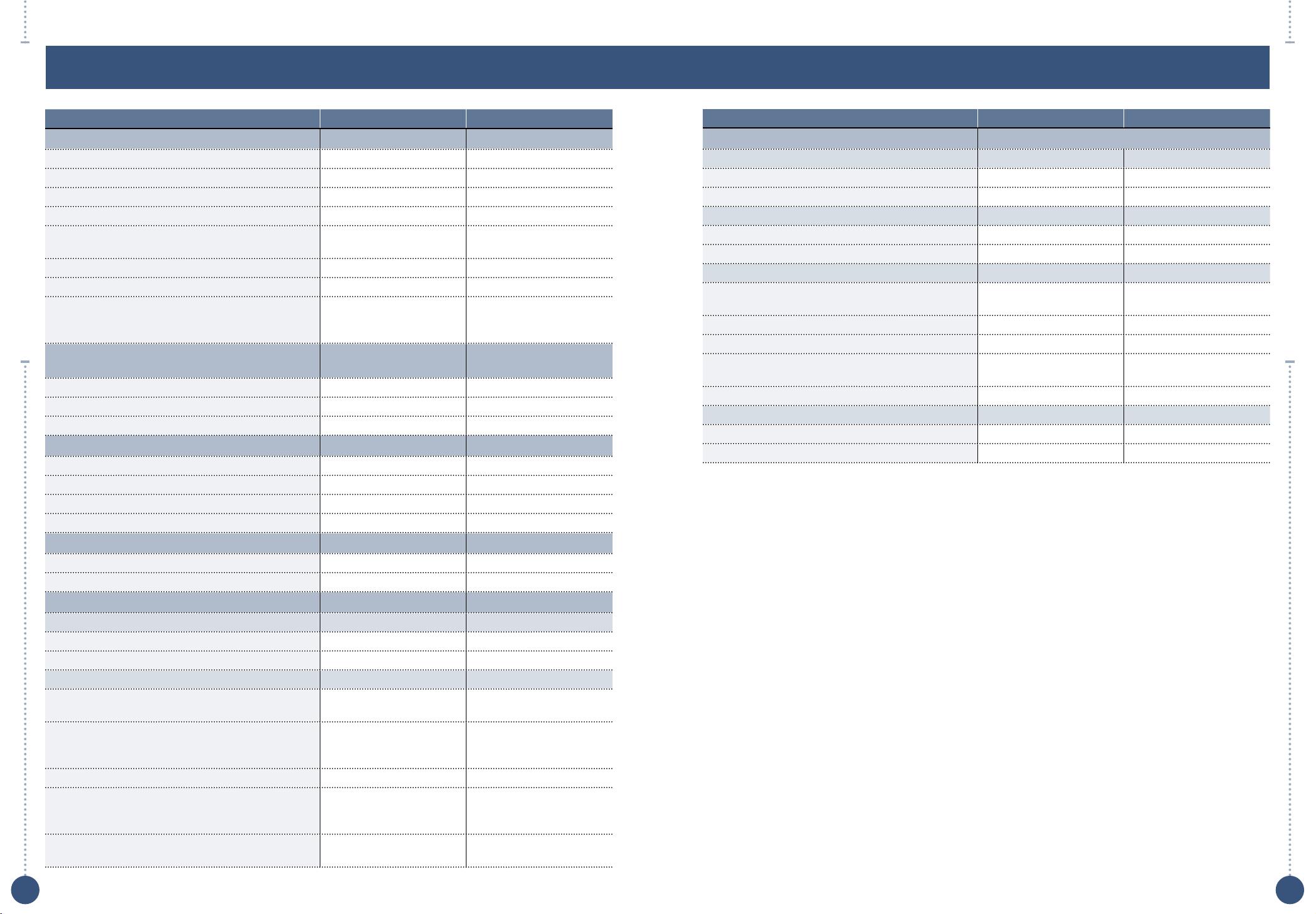

TYPICAL COSTS OF STARTING AND OPERATING A BUSINESS 4

TAX RATES AND DOUBLE TAXATION AGREEMENTS 6

Tax Rates 6

Excise Tax 7

LABOR COST 11

Oce Position 11

Engineering & Technical Positions 13

IT Positions 13

Industrial Positions 15

Translation Cost 16

Overtime Regulations 16

Severance Payment Entitlements 17

Minimum Wage 17

OFFICE OCCUPANCY COSTS IN ASIA PACIFIC 18

RENTAL FACTORY INDUSTRY 19

UTILITY COSTS 19

Water Rates for Regional Area 19

Electricity Taris 19

TRANSPORTATION COSTS INCLUDING

FUEL COSTS AND FREIGHT RATES 26

Retail Oil Prices 26

Retail LPG Prices 27

Shipping Cargo Rates from Bangkok 27

Cost of Express Postal Service from Bangkok 28

Air Cargo Rates from Bangkok 29

Rail Transportation Costs 30

COMMUNICATION COSTS 31

International Telephone Rates 31

Fixed Line Service 37

Y-Tel 1234 Rates 38

International Telephone Rates (ISD 007 / 008) 38

International Private Leased Circuit (Half Circuit) 44

TOT Satellite Package 44

Monthly Internet Rates 45

Internet - IPstar 46

Data Center Rental Cost 47

INDUSTRIAL ESTATES AND FACILITIES 48

MISC. COSTS AND INFORMATION 88

Grade-A Serviced Apartment in Downtown Area, Q1 2019 88

Apartment Achieved Rents by Area and Grade, Q1 2019 88

International School Fee Structures 88

Thai Graduates by Major 93

Foreign Students in Thai Higher Education Institutions 93

Vehicles: Domestic Sales 93

Sea Ports in Thailand 94

International Airports in Thailand 98

CONTACT US 100

Regional Oces 100

Overseas Oces 101

2 3

[

COST OF DOING BUSINESS IN THAILAND 2020

]

[

COST OF DOING BUSINESS IN THAILAND 2020

]

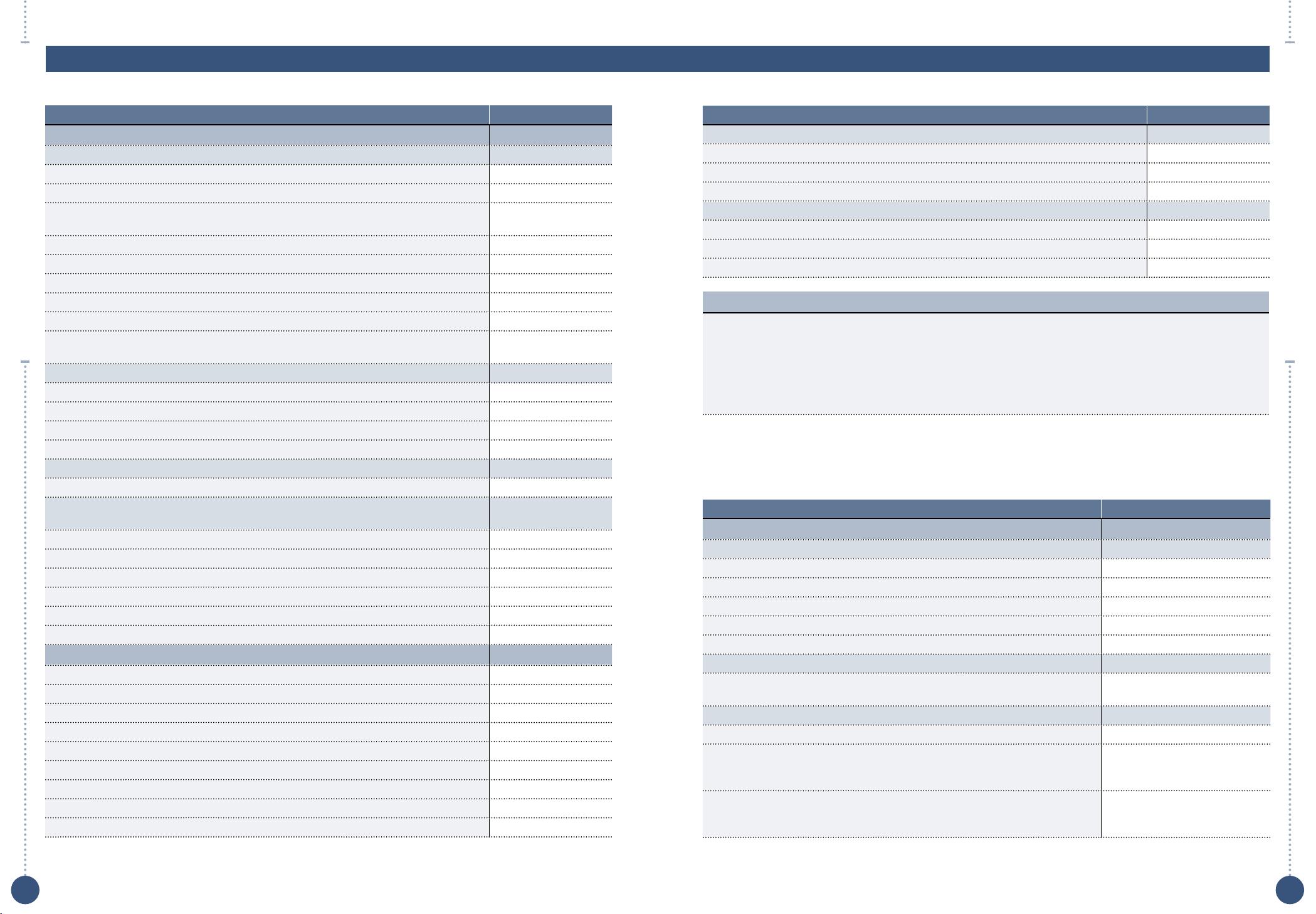

Baht US$

5. Construction Cost

(9) (1) (2)

Per square meter

Industrial Building

Standard low-rise factory 15,000 - 19,000 456.96 - 578.82

Electrical power systems

(3)

5,670 172.73

Oce (construction)

(4)

High quality 30,000 - 35,000 913.93 - 1,066.25

Medium quality 25,000 - 30,000 761.61 - 913.93

Oce Fit Out (oces or factory oce)

Air conditioning

(external to communal system)

4,567 139.13

Electrical fit out (workstations) 1,940 59.10

Furniture fit out (medium quality) 3,517 107.14

Other fit out cost

(flooring cover, curtains, etc.)

682 20.78

Glass partition wall (individual oces) 5,775 175.93

Car Park

Multi-storey 12,000 - 15,000 365.57 - 456.96

Basement 16,000 - 20,000 487.43 - 609.29

Note:

(1) The costs are average square metre costs only and not based on any specific drawings/designs. The costs are

to be used as a rough guide to the probable cost of a building. Budget costs outside the above may be

encountered when searching other avenues.

(2) The costs exclude site clearing, formation and external works, financial and legal expenses, consultants’ fees

and land costs.

(3) The cost Includes Transformer, Main DB and Sub DB for general factory & oce electrics only, but excludes

production equipment/machinery power.

(4) The cost includes communial air conditioning, general electrics, and sanitary.

Sources:

(5) Ministry of Labour, as of September 2019: www.mol.go.th

Immigration Bureau, as of September 2019: www.immigration.go.th

(6) Tilleke & Gibbins International Ltd., as of September 2019: www.tillekeandgibbins.com

(7) Department of Business Development, as of September 2019: www.dbd.go.th

(8) CBRE (Thailand) Co., Ltd, as of September 2019: www.cbre.com

(9) Tractus Asia Ltd, updated as of September 2019: www.tractus-asia.com

TYPICAL COSTS OF STARTING AND

OPERATING A BUSINESS

Note: All US$ conversions are calculated at an exchange rate of US$1 = 30.65 Baht

Baht US$

1. Visas (government fee)

(5)

Work permit (process time 1-10 days)

– Expired within 3 months 750 24.47

– Expired between 3 to 6 months 1,500 48.94

– Expired between 6 to 12 months 3,000 97.88

– Expired more than 1 year Increase at the rate as

it is stated above

Increase at the rate as

it is stated above

Three-month Visa (single entries) 2,000 65.25

One-year Visa (multiple entries) 5,000 163.13

Re-entry permit (process time 1 day)

– Single entry

– Multiple entry

1,000

3,800

32.63

123.98

1. a. Visas (typical fee charged by

a law firm to process)

(6)

Work permit (process time 1-10 days) 30,000 - 35,000 1,305.06 - 1,794.45

Visa extension (process time 1-30 days) 35,000 - 45,000 1,141.92 - 1,468.19

Re-entry permit (process time 1 day) 8,000 261.01

2. Registration (government fee)

(7)

Company registration 5,000 - 250,000 163.13 - 8,156.61

List 2 Alien business license 40,000 - 500,000 1,305.06 - 16,313.21

List 3 Alien business license 20,000 - 250,000 652.53 - 8,156.61

Factory license 100,000 3,262.64

3. Accounting

(6)

Tax returns and VAT 40,000 yearly 1,305.06

Review/draft contracts, agreements 50,000 minimum 1,631.32

4. Oce Achieved Rents (per month)

(8)

Oce Rent

Regular oce in Bangkok area (CBD) 700 per square meter 22.84 per square meter

Oce Grade A in Bangkok area (CBD) 980 per square meter 31.97 per square meter

Other Expenses

Electrical 5 - 6

per kilowatt per hour

0.15 - 0.18

per kilowatt per hour

Air conditioning (water cooled package unit)

40 - 50

per square meter

per month

1.22 - 1.52

per square meter

per month

Air conditioning (central chiller system) No expense No expense

Air conditioning (after hour) 2 - 3

per square meter

per hour

0.06 - 0.09

per square meter

per hour

Decorating 15,000 - 20,000

per square meter

456.96 - 609.29

per square meter

4 5

[

COST OF DOING BUSINESS IN THAILAND 2020

]

[

COST OF DOING BUSINESS IN THAILAND 2020

]

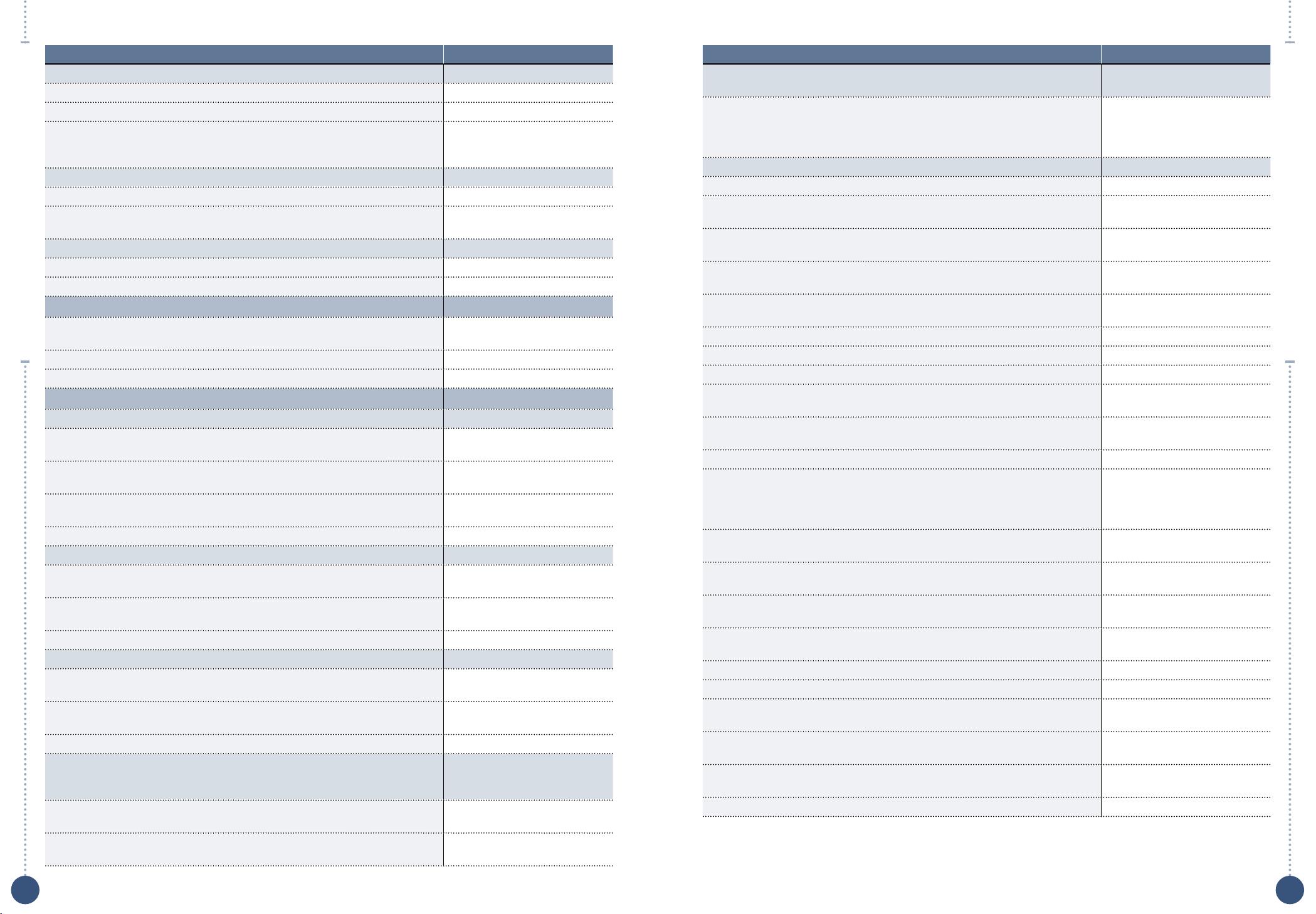

Rate

Withholding Tax from Bank Deposits

– A. For individuals 15%

– B. For companies 1%

– C. For foundations 10%

Value Added Tax

Level of taxable income (Baht)

– No more than 1,800,000 Exempted

– Over 1,800,000 7%

Double Taxation Agreements Exist with the Following Countries

Armenia, Australia, Austria, Bahrain, Bangladesh, Belarus, Belgium, Bulgaria, Cambodia, Canada,

Chile, China, Chinese Taipei, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany,

Great Britain and Northern Ireland, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy,

Japan, Kuwait, Laos, Luxembourg, Malaysia, Mauritius, Myanmar, Nepal, The Netherlands,

New Zealand, Norway, Oman, Pakistan, The Philippines, Poland, Romania, Russia, Seychelles,

Singapore, Slovenia, South Africa, South Korea, Spain, Silence, Sweden, Switzerland, Tajikistan,

Turkey, Ukraine, United Arab Emirates, United States of America, Uzbekistan and Vietnam

Source: Revenue Department, as of September 2019: www.rd.go.th

EXCISE TAX

Note: These are only examples, for the full list please visit www.excise.go.th

Product Tax Rate

Petroleum and Petroleum Products

Gasoline and Similar Products

– Unleaded gasoline 6.500 Baht per liter

– Gasoline other than unleaded gasoline 6.500 Baht per liter

– Gasohol E10 5.850 Baht per liter

– Gasohol E20 5.200 Baht per liter

– Gasohol E85 0.975 Baht per liter

Kerosene and Similar Lighting Oil

– Kerosene and similar lighting oil Fuel oil for a jet airplane that

is not aircraft

4.726 Baht per liter

Fuel Oil for Jet Plane

– Fuel oil for a jet airplane that is not aircraft 4.726 Baht per liter

– Fuel oil for jet airplanes for domestic aircraft per regulations,

procedures, and conditions as specified by the Director

General

4.726 Baht per liter

– Fuel oil for jet airplanes for international aircraft per

regulations, procedures, and conditions as specified by the

Director General

Exempted

TAX RATES AND DOUBLE TAXATION AGREEMENTS

TAX RATES

Rate

Corporate Income Tax

A. Tax on Net Corporate Profits

1. Ordinary company

– For the accounting period starting on or after the 1

st

January 2015 20%

2. Small company (paid up capital not exceeding 5 million Baht and

revenue not exceeding 30 million Baht)

– Net profit not exceeding 300,000 Baht Exempted

– Net profit over 300,000 Baht but not exceeding 3 million Baht 15%

– Net profit exceeding 3 million Baht 20%

Note: For the accounting periods starting on or after the 1

st

January 2015

3. Regional Operating Headquarters (ROH) 10%

4. Bank deriving profits from Bangkok International Banking Facilities

(BIBF)

10%

B. Tax on Gross Receipts

1. Association and foundation

– For income under Section 40 (8) 2%

– Otherwise 10%

2. Foreign company engaging in international transportation (Section 67) 3%

C. Remittance Tax

– Foreign company disposing profits out of Thailand 10%

D. Foreign Company Not Conducting Business in Thailand but Receiving

Income from Thailand

1. Dividends 10%

2. Interests 15%

3. Professional fees 15%

4. Rents from hiring property 15%

5. Royalties from goodwill, copyright and other rights 15%

6. Service fees 15%

Personal Income Tax

Level of taxable income (Baht) Marginal Tax Rate

– 1 - 150,000 Exempted

– 150,001 - 300,000 5%

– 300,001 - 500,000 10%

– 500,001 - 750,000 15%

– 750,001 - 1,000,000 20%

– 1,000,001 - 2,000,000 25%

– 2,000,001 - 5,000,000 30%

– More than 5,000,001 35%

6 7

[

COST OF DOING BUSINESS IN THAILAND 2020

]

[

COST OF DOING BUSINESS IN THAILAND 2020

]

Product Tax Rate

Passenger Car or Public Transport Vehicle with Seating Not

Exceeding 10 Seats

– Passenger car or public transport vehicle with seating not

exceeding 10 seats used as an ambulance of a government

agency,hospital, or charitable organization as per terms,

conditions, and numbers specified by the Ministry of Finance

Exempted

Eco Car with Seating Not Exceeding 10 Seats

– Hybrid Electric Vehicle

(1)

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission not exceeding 100 g/km (3)

8%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 100 g/km but not exceeding 150 g/km

16%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 150 g/km but not exceeding 200 g/km

21%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 200 g/km

26%

– With cylindrical volume exceeding 3,000 cc 40%

– Electric powered vehicle 8%

– Fuel cell powered vehicle 8%

– Economy Car Meeting International Standards (from 1

st

October 2009 onwards)

(1)

– Gasoline engine with cylindrical volume not exceeding

1,300 cc

14%

– Diesel engine with cylindrical volume not exceeding 1,400 cc

14%

– Passenger Car or Public Transport Vehicle with Seating Not

Exceeding 10 Seats Using Alternative Energy with Cylindrical

Volume Not Exceeding 3,000 Cc as Specified by The Ministry

of Finance

(2)

– Using No Less Than 85% Ethanol Mix with Gasoline

Available Generally Petrol Stations

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission not exceeding 150 g/km

(3)

20%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 150 g/km but not exceeding 200 g/km

25%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 200 g/km

30%

– With cylindrical volume exceeding 3,000 cc 40%

– Being Capable of Operating on Natural gas

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission not exceeding 150 g/km

(3)

20%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 150 g/km but not exceeding 200 g/km

25%

– With cylindrical volume not exceeding 3,000 cc and CO

2

emission exceeding 200 g/km

30%

– With cylindrical volume exceeding 3,000 cc 40%

Product Tax Rate

Diesel and Other Similar Types Of Oil

– Diesel with sulphuric content exceeding 0.005% by weight 6.440 Baht per liter

– Diesel with sulphuric content not exceeding 0.005% by weight 6.440 Baht per liter

– Diesel with Methyl Esters biodiesel containing fatty acid not

less than 4% as per regulations, procedures and conditions as

specified by the Director General

6.440 Baht per liter

(from May 15, 2019 onward)

Natural Gas Liquid (NGL) and Similar Products

– NGL and similar products 5.85 Baht per liter

– NGL and similar products to be used during the refining

process at a refinery

Exempted

Liquid Petroleum Gas (LPG), Propane and Similar Products

– LPG and similar products 2.17 Baht per kg

– Liquid propane and similar products 2.17 Baht per kg

Electrical Appliances

– Air-conditioning, with or without a humidity control unit, with a

capacity not exceeding 72,000 BTU/ hour

(1) For use in vehicle Exempted

(2) Others from (1) Exempted

Automobiles

Passenger Car

(1)

– With a cylinder volume not exceeding 3,000 cc and CO

2

emission not exceeding 150 g/km

(3)

25%

– With a cylinder volume not exceeding 3,000 cc and CO

2

emission exceeding 150 g/km but not exceeding 200 g/km

30%

– With a cylinder volume not exceeding 3,000 cc and CO

2

emission exceeding 200 g/km

35%

– With cylindrical volume exceeding 3,000 cc 40%

Pick-up Passenger Vehicle (PPV)

(2)

– With cylindrical volume not exceeding 3,250 cc and CO

2

emission not exceeding 200 g/km

(3)

20%

– With cylindrical volume not exceeding 3,250 cc and CO

2

emission exceeding 200 g/km

25%

– With cylindrical volume exceeding 3,250 cc 40%

Double Cab Vehicle

(2)

– With cylindrical volume not exceeding 3,250 cc and CO

2

emission not exceeding 200 g/km

10%

– With cylindrical volume not exceeding 3,250 cc and CO

2

emission exceeding 200 g/km

13%

– With cylindrical volume exceeding 3,250 cc 40%

Passenger Car (that is made from a pick-up truck or chassis with

the wind shield of a pick-up truck or modified from a pick-up

truck)

(2)

– Manufactured or modified by industrial entrepreneurs with

cylindrical volume not exceeding 3,250 cc

2.5%

– Manufactured or modified by industrial entrepreneurs with

cylindrical volume exceeding 3,250 cc

40%

8 9

[

COST OF DOING BUSINESS IN THAILAND 2020

]

[

COST OF DOING BUSINESS IN THAILAND 2020

]