Table

I

Historical Excess Returns, January 1975-August 1991*

Germany France Japan UK

US.

Canada Australia

Total Mean Excess Return

Currencies

-20.8

3.2 23.3 13.4

12.6

3.0

Bonds 15.3 -2.3 42.3 21.4 -4.9 -22.8 -13.1

Equities 112.9 117.0 223.0 291.3 130.1 16.7 107.8

Annualized Mean Excess Return

Currencies

-1.4

0.2

1.3

0.8

0.7

0.2

Bonds

0.9

-0.1

2.1

1.2

-0.3 -1.5 -0.8

Equities 4.7

4.8

7.3

8.6

5.2 0.9 4.5

Annualized Standard Deviation

Currencies

12.1

11.7 12.3 11.9 4.7 10.3

Bonds

4.5 4.5 6.5 9.9

6.8 7.8

5.5

Equities 18.3

22.2

17.8 24.7 16.1 18.3 21.9

*

Bond and equity returns

in

U.S. dollars, currency hedged and

in

excess

of the London

interbank

offered rate (LIBOR); returns on currencies are

in

excess of

the

one-month forward rates.

on

cn

0

U

LL

cca

z

30

rium provides

the appropriate

neutral reference.

Most of

the

time

investors have

views-

feelings

that some assets or cur-

rencies are

overvalued

or under-

valued at

current market

prices.

An asset allocation model

can

help them

to apply those

views to

their

advantage. But it

is unrealis-

tic

to

expect

an investor

to be

able

to state exact expected

ex-

cess returns for every

asset

and

currency.

The

equilibrium,

how-

ever,

can provide the

investor

an

appropriate

point

of

reference.

Suppose,

for

example,

that an

in-

vestor has

no views.

How then,

can

he

define

his

optimal

portfo-

lio? Answering

this question

dem-

onstrates

the usefulness of

the

equilibrium

risk

premium.

In

considering

this question,

and

others

throughout

this

article,

we

use historical

data on

global eq-

uities,

bonds

and currencies.

We

use

a

seven-country

model

with

monthly

returns

for the United

States, Japan,

Germany, France,

the

United

Kingdom,

Canada

and

Australia

from January

1975

through

August 1991.4

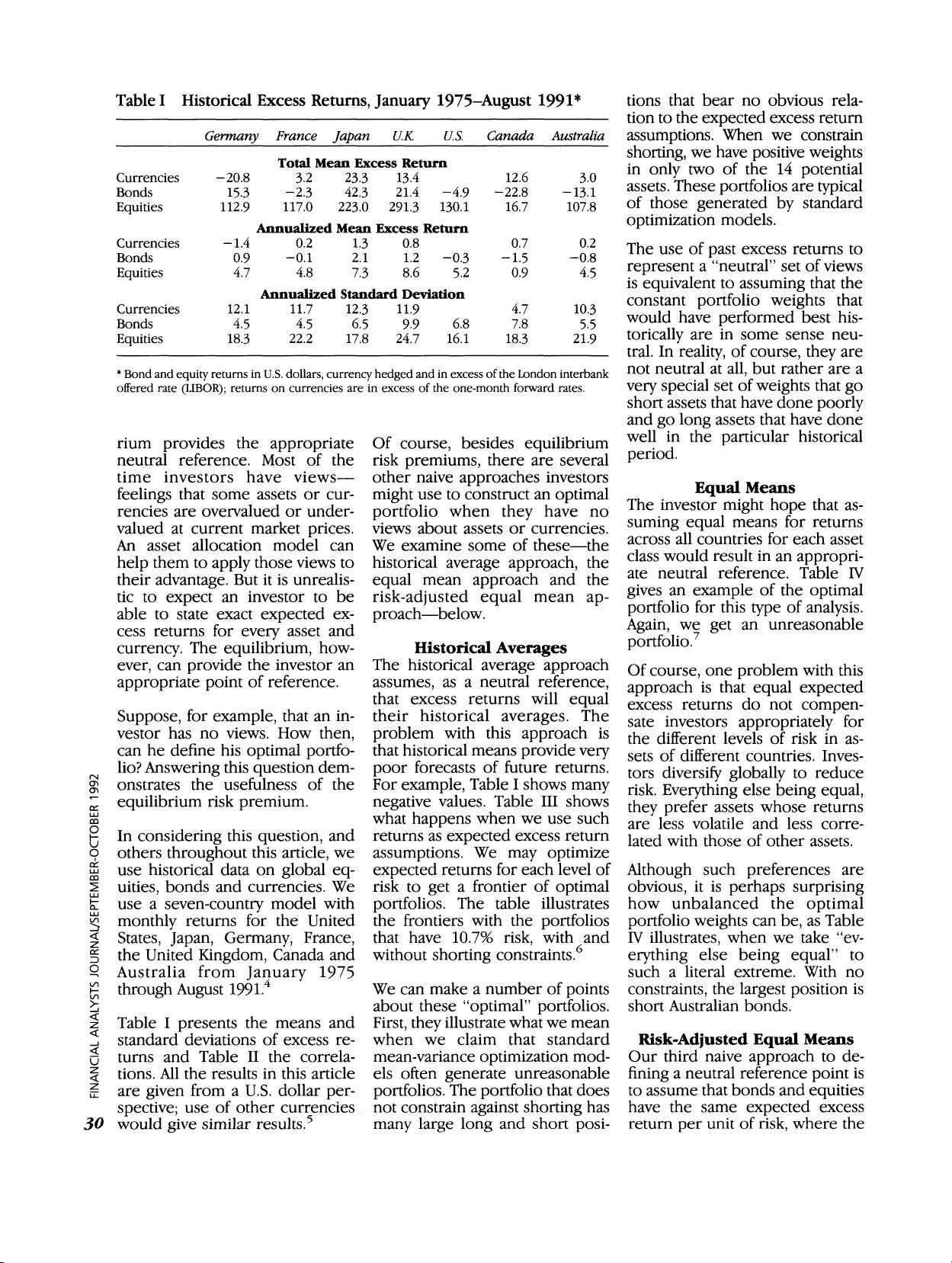

Table

I

presents

the

means and

standard

deviations of excess

re-

turns and Table

II

the correla-

tions.

All

the results

in

this article

are

given

from

a U.S. dollar

per-

spective;

use of other currencies

would

give

similar results.5

Of

course,

besides

equilibrium

risk

premiums, there are several

other

naive approaches investors

might use

to

construct an

optimal

portfolio

when they have no

views

about assets or currencies.

We

examine some

of

these-the

historical

average approach, the

equal

mean

approach

and the

risk-adjusted equal mean ap-

proach-below.

Historical Averages

The

historical average approach

assumes,

as a neutral

reference,

that excess returns

will

equal

their

historical averages. The

problem

with this approach is

that historical means

provide very

poor

forecasts of future returns.

For

example,

Table

I

shows

many

negative

values. Table

III

shows

what happens when

we

use

such

returns as

expected

excess return

assumptions.

We

may optimize

expected returns

for each level of

risk to

get

a frontier

of

optimal

portfolios.

The table illustrates

the frontiers with the

portfolios

that have

10.7%

risk,

with and

without

shorting

constraints.6

We can make a number

of

points

about

these

"optimal" portfolios.

First, they

illustrate what we

mean

when

we

claim

that

standard

mean-variance

optimization mod-

els often

generate

unreasonable

portfolios.

The

portfolio

that does

not

constrain

against shorting

has

many large

long

and short

posi-

tions that

bear no

obvious rela-

tion to the

expected

excess return

assumptions.

When we constrain

shorting,

we have

positive weights

in only two of the 14 potential

assets.

These

portfolios

are

typical

of

those generated by standard

optimization

models.

The use of past excess returns to

represent a "neutral" set of views

is equivalent to assuming that the

constant portfolio weights that

would have performed best his-

torically are

in

some sense

neu-

tral.

In

reality, of course, they are

not neutral at all, but rather are a

very special set of weights that go

short assets that have done

poorly

and go long assets that

have

done

well

in

the particular historical

period.

Equal

Means

The investor might hope that as-

suming equal

means for

returns

across

all

countries for each

asset

class would result

in

an

appropri-

ate neutral reference. Table

IV

gives an example

of

the optimal

portfolio

for this

type

of

analysis.

Again,

we

get

an unreasonable

portfolio.7

Of

course,

one

problem

with

this

approach

is

that

equal expected

excess returns do not

compen-

sate investors

appropriately

for

the different levels

of risk in

as-

sets of different countries. Inves-

tors

diversify globally

to reduce

risk. Everything

else

being equal,

they prefer

assets whose

returns

are less volatile and less corre-

lated with

those of

other assets.

Although

such

preferences

are

obvious,

it

is

perhaps surprising

how unbalanced the

optimal

portfolio weights

can

be,

as Table

IV

illustrates,

when we

take

"ev-

erything

else

being equal"

to

such

a literal extreme. With no

constraints,

the

largest position

is

short Australian bonds.

Risk-Adjusted Equal

Means

Our third naive

approach

to de-

fining a neutral reference point is

to assume that bonds and equities

have the same expected excess

return per unit of risk, where

the

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功