market equilibrium estimate of the expected re turn

(see Walters 2013). One limitation of this approach is

that it downweights the forecasting information that

is available in the CA PM estimate and ignores the

possibility that systematic errors such as forecast bias

can potentially be estimated a nd removed. A nat ural

approach to address the acknowledged limitations of

theCAPMisexploredinKrishnanandMains(2005),

which includes additional factors in the equilibrium

model. Similar c oncerns about misspecification arise

in the context of the expert model, where much of the

focusiscenteredaroundhowconfidence levels for

experts can be chosen (see, e.g., Walters 2011,where

several methods are discussed).

In this paper, we propose a substantial general-

ization of the traditional model that accounts for

its shortcomings directly. Specifically, we propose a

Bayesian graph ical model t hat acco unts for syst em-

atic biases and unmodeled factors/dynamics in both

the expert and e quilibrium models and show how it

can be estimated in a Bayesian framework using a

history of expert forecasts and realized returns. We

characterize the optimal mean-variance portfolio in

terms of the mean and variance of returns under the

posterior and show how it can be estimated using

Gibbs sampling. We also show that this estimate is

consistent, asymptotically normal, and converges at

rate 1/

m

√

(where m is the number of Gibbs samples),

generalizing analogous results for sample average

approximation ( Shapiro et al. 2014)tothecasewhen

samples are dependent and there is a risk function

in the objective. Empi rical tests with simulated and

historical data are also provided.

As we have noted, much of the literature on the

Black–Litterman m odel stays close to the original

framework, and relatively little has been done to

address its shortcomings by generalizing the model,

which is one contribution of this paper. One nota-

bleexceptionisthepaperbyBertsimasetal.(2012),

which combines forecasts from the equilibrium model

and experts using ideas from inverse optimization.

The advantage of their framework is that it allows for

nonstandard expert opinions (e.g., on volatility) and

the use of risk measures such as conditional value at

risk (CVaR). It can also handle uncertainty about the

covariance matrix using ideas from robust optimi-

zation. W e note, however, that it does not address

concerns about misspecification in either the equi-

librium or expert models (and hence the forecast of

asset returns that is generated by combining these

models). Our paper is different in that we develop

equilibrium and view m odels with both learnable

bias and unresolvable estimation uncertainty using

probabilistic and Bayesian techniques and s how how

sampling methods can be used to compute optimal port-

folios. Although we focus on mean-variance optimization,

we believe that mean-CVaR problems can be addressed

by combining the posterior sampling methods used i n

this paper with the data-driven method from Rockafellar

and Urya sev (2000). In summary, both papers address

different limitations of the classical Black–Litterman

model with different tools.

The remainder of this paper is as follows: Section 2

covers the bac kground of the Black –Litterman model

and its graphical representation. Section 3 introduces

the generalized Black–Litterman model (GBL) and the

associated Bayesian graphical model. Section 4 dis-

cusses the problem of estimation and shows how

Gibbs sampling can be used to calibrate the model

and generate samples from the updated posterior

distribution of re turn s. The op timal por tfolio is char-

acterized in terms of the mean and variance of returns

of the posterior distribution in S e c ti o n 5 and can be

estimated using Gibbs sampling. We show that this

estimate is consistent and asymptotically normal and

converges a t rate 1/

m

√

(the number of Gibbs sam-

ples). Empirical tests on simulated and real data are

provided in Section 6. W e conclude in Section 7.

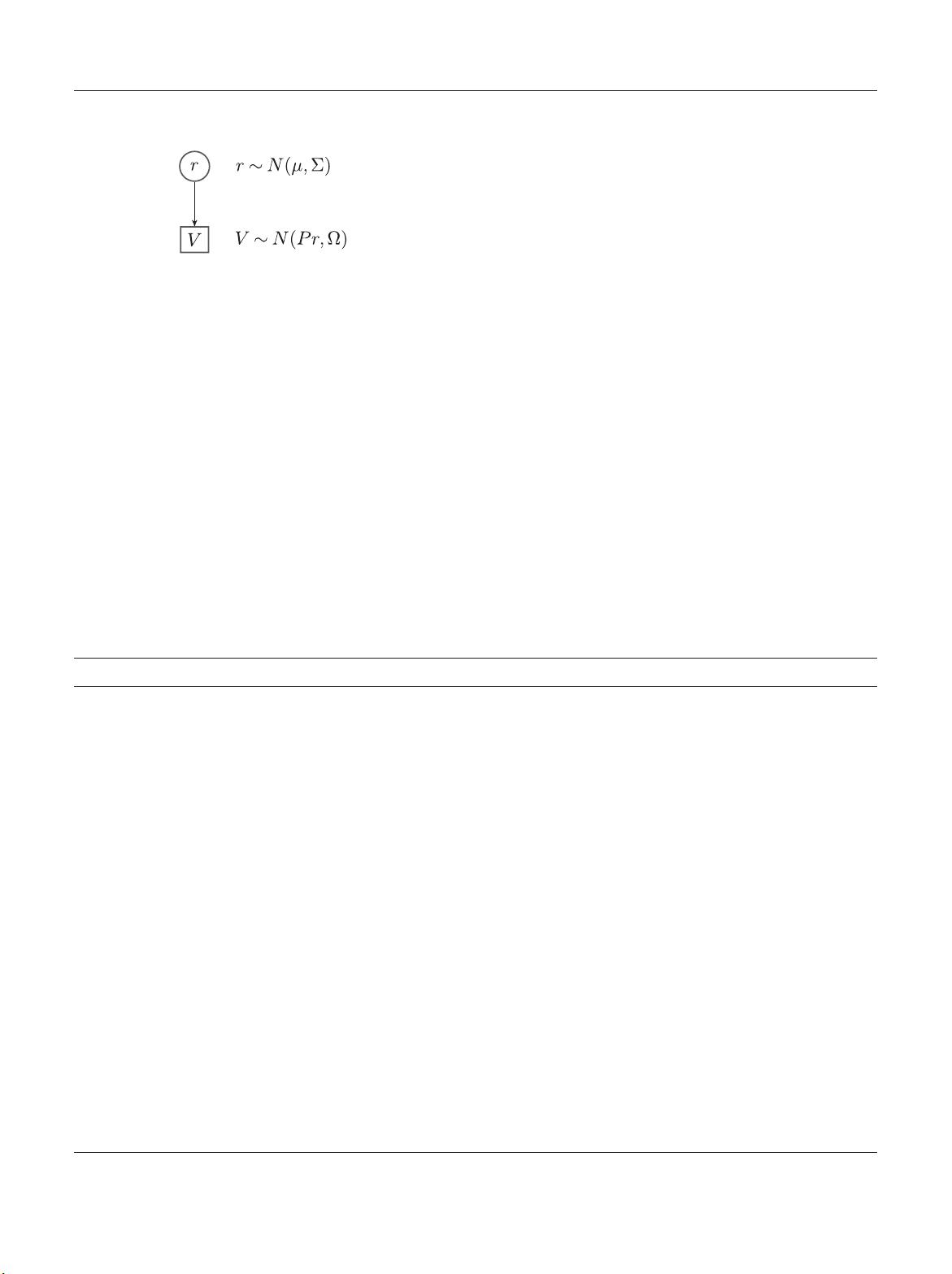

2. The Black–Litterman Model

The Black –Litterman model estimates future returns

by combining a backward-looking equilibrium model

with forward-looking expert views. We brieflysum-

marize the Bayesian perspective of the classical model

(see also Qian and Gorman 2001)andprovideagraph-

ical representation of this model.

2.1. Description

A central concern in a portfolio choice problem is

modeling the distribution of asset returns. The clas-

sical Black–Litterman model constructs this distribu-

tion by combining a backward-looki ng equilibrium

model with forward-looking expert views where the

following sequence of events is assumed: (i) at the

start of the investment period, the investor specifies a

“prior” distribution for the vector of asset returns that

is calibrated using a backward-looking equilibrium

model, (ii) the investor receives expert views which

are modeled as noisy observations of the future asset

returns, (iii) expert views are combined with the

equilibrium model using Bayes’ rule to generate an

updated return distribution, (iv) a portfolio allocation

is made on the basis of the updated distribution, a nd

(v) asset returns are realize d.

2.1.1. Equilibrium Model and Prior Distribution for

Returns.

Our financial market c onsists of N risky

assets and a risk-free a sset. Let r denote t he N-

dimensional vector of returns for the risky assets. We

assume without loss of generality that t he risk-free

rate is zero. (If the risk-free rate is nonzero, simply

replace r with the vector of excess returns and our

Chen and Lim: A Generalized Black– Litterman Model

2 Operations Research, Articles in Advance, pp. 1–30, © 2020 The Author(s)

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功