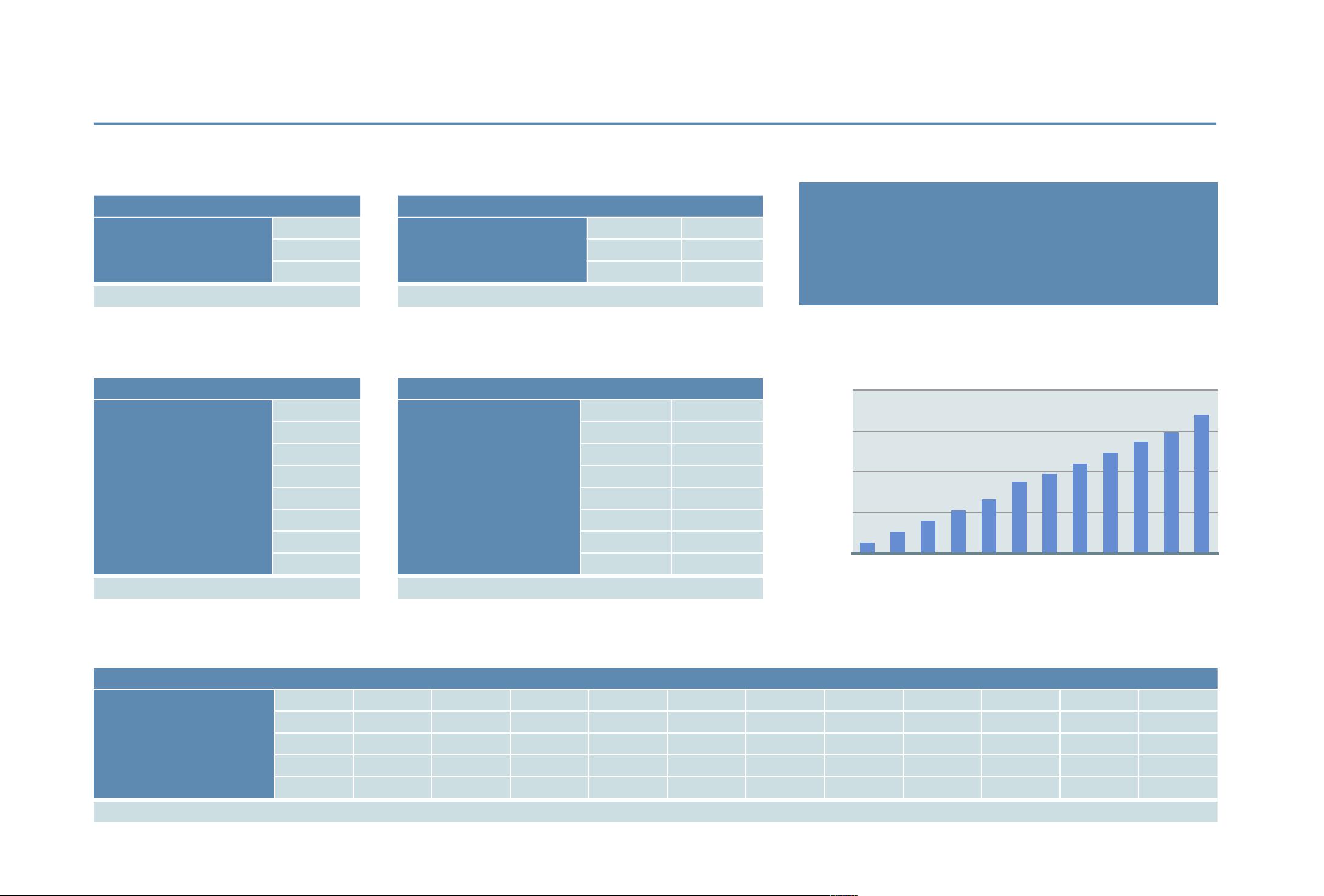

Monthly Net Income

Income Type

Amount

Monthly Net Income

Other Monthly Income

$4,500

$2,500

Available Cash

$7,000

Monthly Expenses

Expense

Costs

Mortgage

Taxes

Car Payment

Car Insurance

Home Owners Insurance

Cable Bill

Gas/Electric

Monthly Prescription

$2,300

$600

$350

$60

$127

$120

$88

$50

Total Monthly Expenses

$3,695

Annual Budget by Month

Income and Expenses

January

February

March

April

May

June

July

August

September

October

November

December

Previous month’s balance

Available cash

Additional income

Monthly expenses

Planned expenses

$3,305

$6,610

$9,915

$13,220

$16,525

$21,830

$24,255

$27,560

$30,865

$34,170

$37,025

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$7,000

$0

$0

$0

$0

$0

$2,000

$0

$0

$0

$0

$0

$3,000

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$3,695

$0

$0

$0

$0

$0

$0

$880

$0

$0

$0

$450

$900

Savings

$3,305

$6,610

$9,915

$13,220

$16,525

$21,830

$24,255

$27,560

$30,865

$34,170

$37,025

$42,430

Additional Income

Details

Month

Amount

Mid Year Bonus

Year End Bonus

June

$2,000

December

$3,000

January

Total Additional Income

$5,000

Planned Expenses

Expenditure

Month

Amount

November vacation

Home for the holidays

Gifts for family

Family vacation

November

$450

December

$600

December

$300

July

$880

January

January

January

January

Total Planned Expenses

$2,230

$0

$12,500

$25,000

$37,500

$50,000

January

February

March

April

May

June

July

August

September

October

November

December

Savings

1.

Enter your income

information in the two

income tables.

2.

Enter your expenses.

Use the Monthly

Expenses table for

recurring expenses.

3.

Enter a starting

balance in the

January column on

the Annual Budget

table.

Personal Budget