18 February 2019

Property

China Property

Property

Property

Forecast Change

Asia

China

Industry

China Property

Date

18 February 2019

Deutsche Bank

Research

Preview: Overall strong results with

good dividend payout

Overall strong FY18F results with ~30% earnings growth

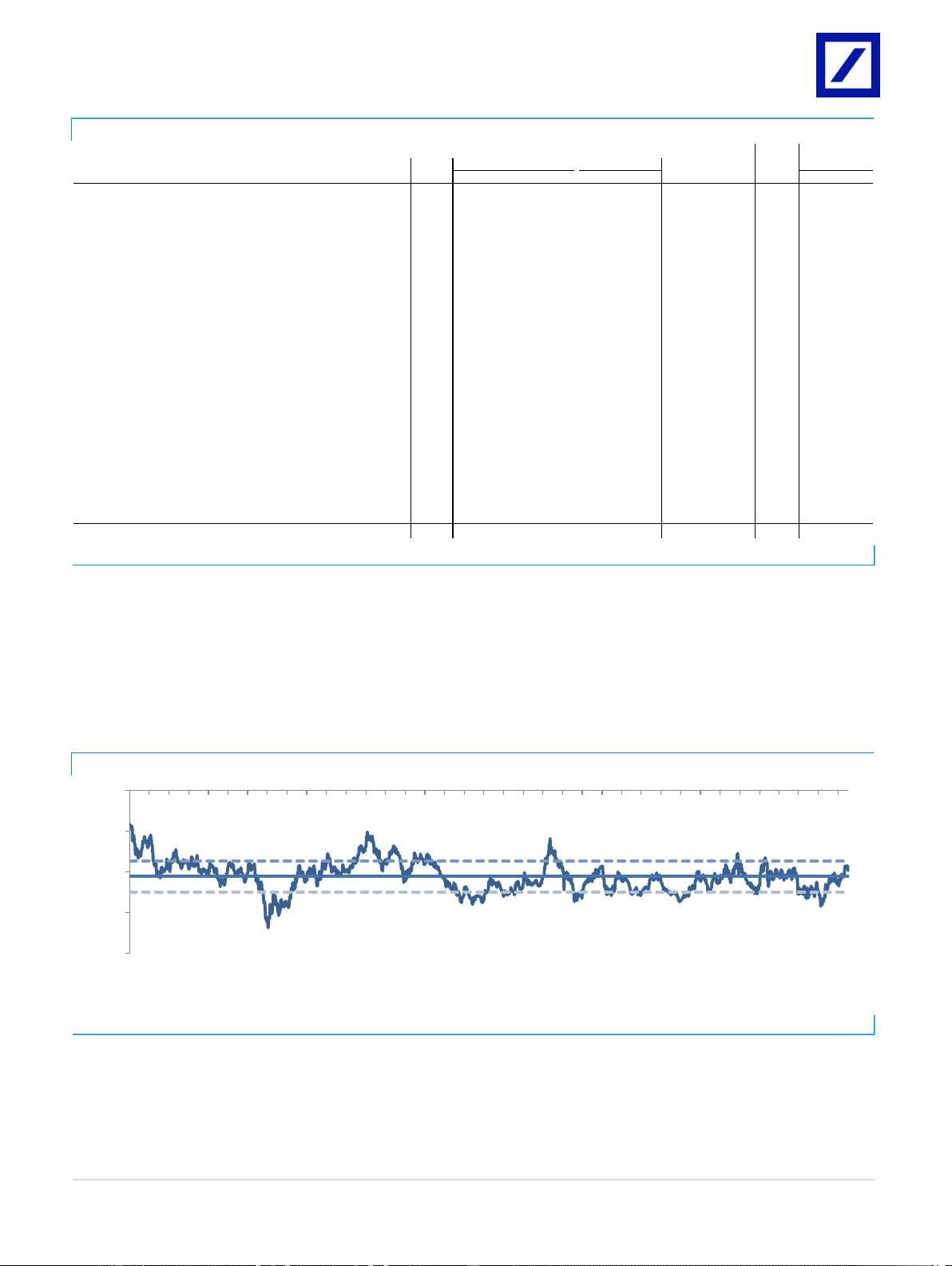

Overall, we expect strong FY18 results for the developers we cover (Fig 1): 1)

~30% earnings growth on average due to strong sales in the past two years;

2) gross margin staying high at ~33% (vs. 32.9% in FY17) due to ASP rally in

2016-17; 3) stable dividend payout ratio (~6% yield); albeit with 4) higher average

borrowing cost to ~6% (vs. 5.6%/5.3% in 1H18/FY17) and higher net gearing due

to tighter credit/slower sales in 2H18. Our FY18-20 earnings forecasts are largely

in line with Bloomberg consensus, but we are more bullish on Sunac and Future

Land on their 2018 earnings. Also, we think developers on the whole will continue

to give high-teen sales growth guidance (5-15% for large-caps and >20% for mid/

small-caps) for 2019 despite an overall weaker physical market.

Who might beat and who might miss?

Within our coverage, we expect more than half to report strong results (>30%

earnings growth), and one-third to report decent results (Figure 1). In particular,

Sunac, Future Land, Logan, Evergrande, Aoyuan and Gemdale should deliver

>40% earnings growth due to their strong sales and margin expansion, while

Country Garden, Longfor, CIFI, China Jinmao, GZ R&F, and Times should deliver

30-35% earnings growth. Our FY18F earnings on Sunac and Future Land are 11%

and 8% above consensus, while Vanke, CR Land and KWG might report slightly

weaker-than-consensus earnings growth.

Figure 1: Top picks

Source: Deutsche Bank

What are the potential surprises?

We think there could be positive surprises on dividends with Future Land and

Longfor possibly raising their payout ratios, while Logan might continue to declare

a special dividend. Also, overall gross margin should remain high, particularly for

COLI, CR Land, Logan, GZ R&F, Agile and China Jinmao. In terms of downside

surprises, the net gearing ratio of Agile, Greentown and Aoyuan could increase

due to aggressive landbanking or slow sales.

This report includes changes to target prices and forecasts for several

companies under coverage; please see the table at right and discussion

following Figure 7.

Jeffrey Gao, CFA

Research Analyst

+852-2203 6256

Stephen Cheung, CFA

Research Analyst

+852-2203 6182

Foo Leung

Research Associate

+852-2203 6239

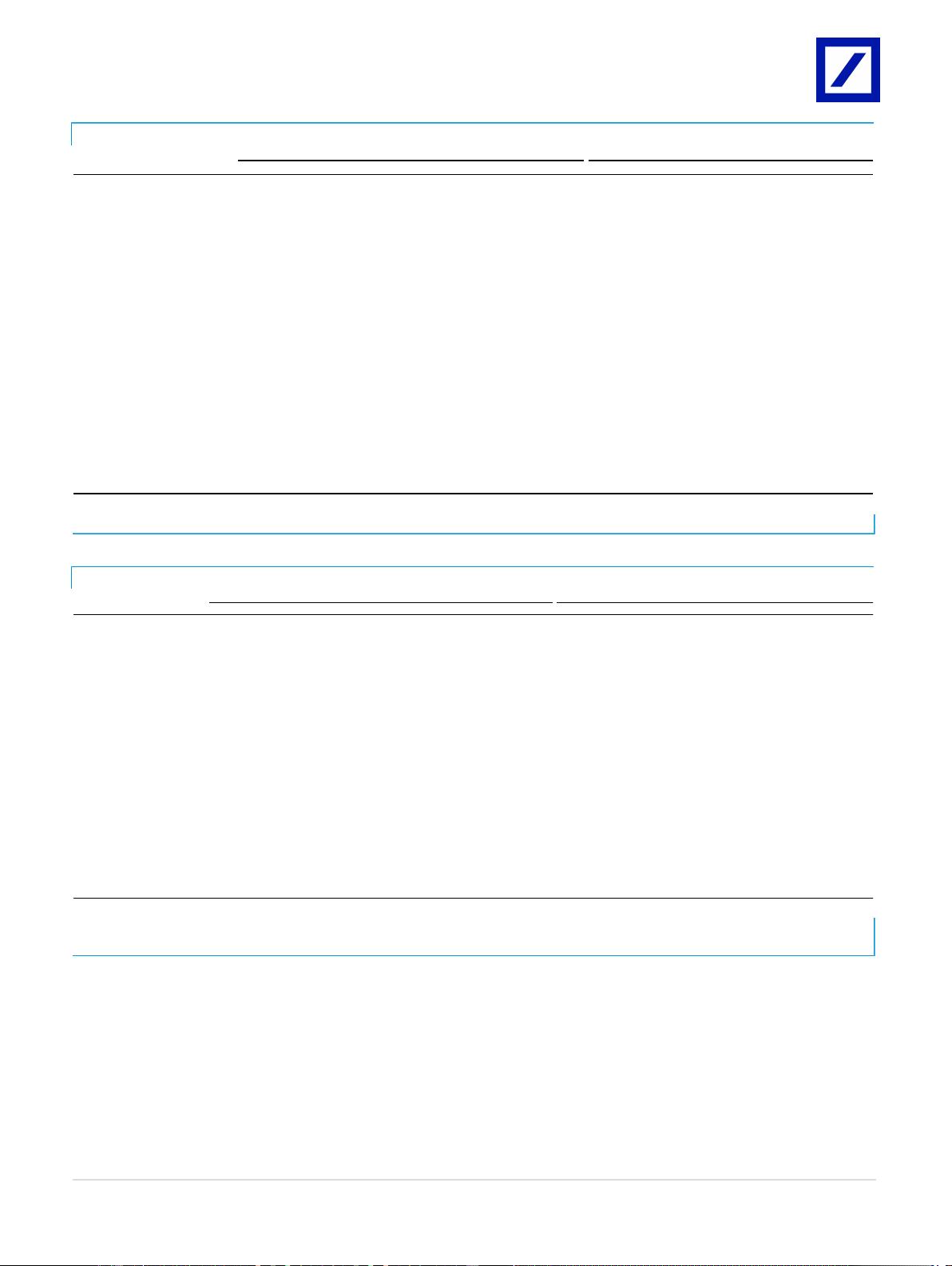

Key Changes

Company Target Price Rating

1813.HK 12.23 to 11.69 -

3380.HK 11.43 to 12.30 -

1109.HK 34.77 to 35.84 -

2007.HK 16.97 to 17.19 -

3883.HK 7.99 to 8.97 -

2202.HK 30.64 to 31.31 -

000002.SZ 27.23 to 27.22 -

Source: Deutsche Bank

Deutsche Bank AG/Hong Kong

Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be

aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider

this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS

ARE LOCATED IN APPENDIX 1. MCI (P) 091/04/2018. THE CONTENT MAY NOT BE DISTRIBUTED IN THE PEOPLE'S

REPUBLIC OF CHINA ("THE PRC") (EXCEPT IN COMPLIANCE WITH THE APPLICABLE LAWS AND REGULATIONS OF

PRC), EXCLUDING SPECIAL ADMINISTRATIVE REGIONS OF HONG KONG AND MACAU.

Distributed on: 17/02/2019 21:00:12 GMT

7T2se3r0Ot6kwoPa

我的内容管理

展开

我的内容管理

展开

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

前往需求广场,查看用户热搜

前往需求广场,查看用户热搜

信息提交成功

信息提交成功